CREDIT CARDS

How to Use a Credit Card to Build Credit

What you'll learn: How to build your credit right, one card at a time.

EXPECTED READ TIME: 11 MINUTES

Picture this: you’re touring houses, and after just a few showings, you find The One. Natural light floods each room and the layout feels right. You’re in love. Maybe you’re relocating for work or just trading up for more space (or better schools) — either way, you’re excited to land on something good.

So, how do you seal the deal?

These big life moments (and even smaller ones) have one thing in common: they require good credit. Landlords check it, mortgage lenders scrutinize it, and auto insurers review it. Credit’s your key to “yes” and one of the best tools for building good credit is sitting right in your wallet.

Let’s look at how a credit card can help you build a solid credit rating to achieve your goals.

Understanding the Basics of Credit

A credit card is the most common entryway into the credit universe. Before getting your hands on that glossy piece of plastic, it’s crucial to grasp the fundamentals of credit.

Let’s home in on credit scores.

Ranging between 300 and 850, your credit score is a numerical snapshot of your borrowing behavior. There are two versions — FICO® and VantageScore®. Both are calculated based on several factors, with payment history and amounts owed being the most significant.

Credit histories and scores take time to grow. While there are some exceptions, most people start building credit when they’re legally able to enter a contract, which is typically at age 18. After your first ever swipe, it takes up to six months for card activity to be reported to the major credit bureaus (Equifax, Experian, TransUnion) and reflected on your credit file.

The longer you’ve been in the game, the more robust and reliable your history gets — as long as you’re doing what's needed to keep your credit on track. It’s like aging a fine wine. And as you acquire and properly manage large credit lines, like a mortgage or auto loan, there’s more chances for a score bump.

If you’re not quite ready for a credit card, you can explore alternative methods for establishing a credit history or take some time to make sure you’re credit card approval ready.

Credit histories and scores take time to grow.

Importance of a Good Credit Score

A good credit score isn’t just a nice to have. It can turn aspirations into realities and save you money in ways you might not even realize.

Imagine you can’t stop thinking about the top-rated hybrid you test drove last month. It’s the ultimate upgrade, offering both efficiency and style. You’ve decided to make it yours. With a strong credit score, you’re more likely to qualify for an auto loan with a lower interest rate, potentially saving you thousands of dollars over the life of that line of credit. On the other hand, a lower score could mean higher rates or even denial. The same goes for auto insurance.

Even utility companies look at your credit history to decide whether to waive your deposit.

For entrepreneurs, credit counts too. While you might eventually set up a separate business credit profile, your personal credit history can be the thing that gets you your first business credit card.

Generally, lenders view a score of 670 as good. Anything above 800 is even better. Whichever financial door you find yourself knocking on, an excellent credit score will always make a difference!

An excellent credit score will always make a difference.

How Credit Cards Affect Your Credit Score

Every time you use your card responsibly — staying below your credit limit and paying your bills on time — you’re sending positive signals to the credit bureaus. However, the reverse is also true. Missed payments and maxing out your card can taint your creditworthiness.

Choosing the Right Credit Card to Build Credit

The time has come to pick a card, but where should you start?

Think of it like choosing your first car. Do you need something basic and reliable or are you looking to hit the open road with all the bells and whistles?

Let’s go through some card options.

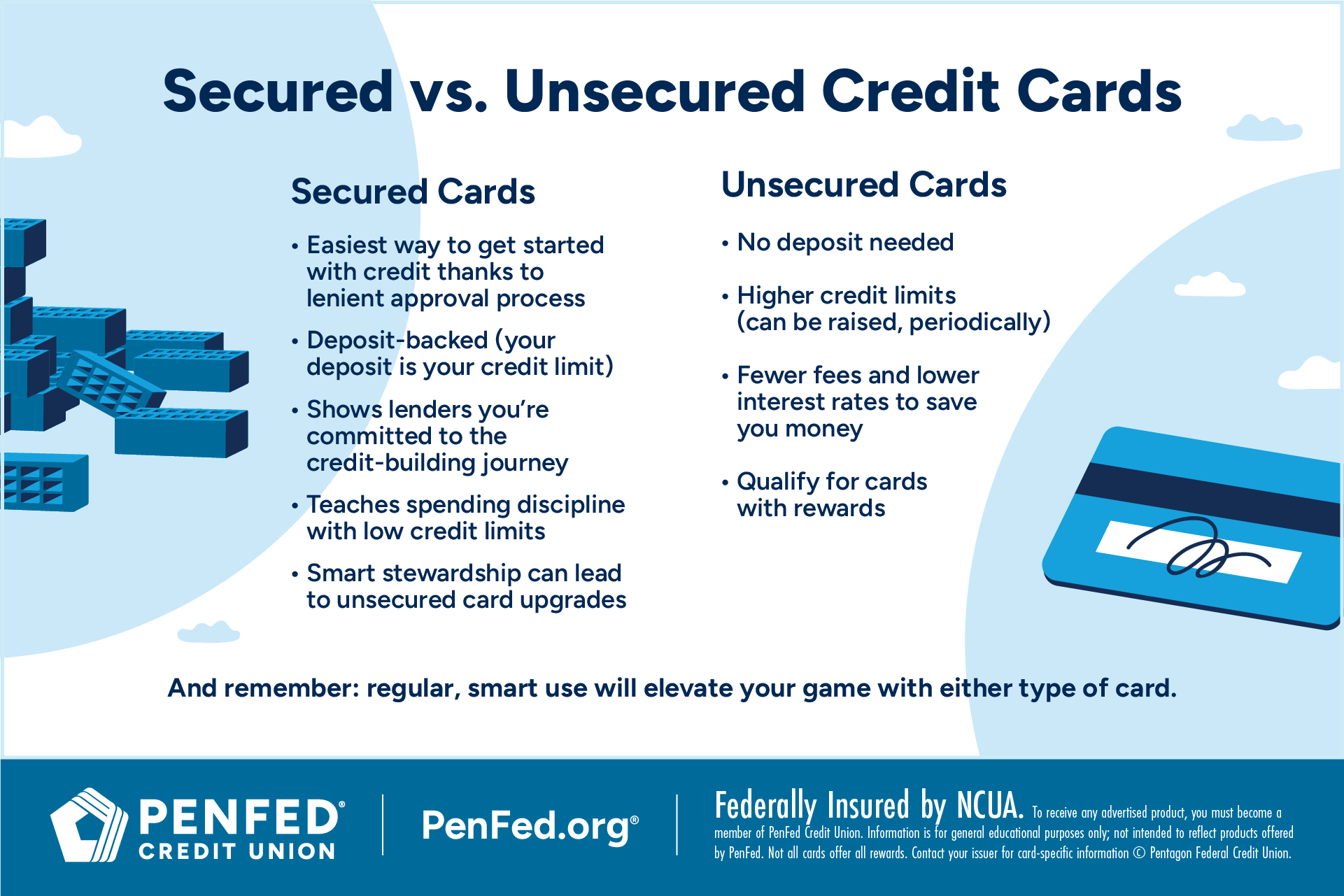

Differences Between Secured and Unsecured Cards

There are two main types of credit cards that banks and credit unions offer: secured and unsecured.

Think back to when you were renting your first apartment. Often, landlords want a little extra assurance that you’ll take care of their space, so they ask for a security deposit. A secured credit card operates similarly. Upon approval, you will need to put down a deposit. That deposit becomes your credit limit and your lender’s collateral. It tells them you’re serious about establishing a credit history.

Often, unsecured cardholders start out as secured cardholders and earn their stripes over a couple of years.

Keep in mind that your deposit doesn’t absolve you of paying monthly balances, just like rent. You’ll get your cash back when you close the account or swap it out for an unsecured card.

An unsecured credit card, on the other hand, doesn’t require this upfront charge. Approval for these cards hinges on your credit profile. Often, unsecured cardholders start out as secured cardholders and earn their stripes over a couple of years. Graduating to an unsecured credit card generally comes with attractive perks and potentially higher credit limits.

Benefits of Secured Credit Cards

Unsecured credit cards are the go-to for most Americans. However, certain types of borrowers can benefit from secured cards. Among them are the “credit curious” or those in need of their first-ever card as well as people looking to replace a missing card. Even some high-income consumers toy with the idea.

So, what’s the selling point?

First, accessibility. Approval odds for a secured credit card are usually higher than for an unsecured card. Once you get the green light, you’ll be on your way to building credit just as you would with an unsecured card. That aside, secured credit cards are designed to breed spending discipline, which is essential to cultivate early in your credit-building journey. You’re less likely to get swipe-happy when you know unpaid balances could lead to your lender seizing your full cash deposit.

While secured cards are generally considered more costly than unsecured ones due to higher interest rates and common card charges, a number of them do waive annual fees and offer some form of rewards. Don’t let these perks distract you from your primary mission to build that credit.

As with any financial decision you make, know the true cost of your desired card. And tap into any educational resources offered by your issuer to help you learn the ropes.

Types of Unsecured Credit Cards

If you’ve decided to go the secured route, you have a couple of options to choose from. They are:

- Student credit cards: Pursuing higher education? Made with students in mind, this type of credit card typically offers lower credit limits and may have more lenient approval requirements, since many applicants are new to credit.

- Store credit cards: Ever been offered a discount at your favorite department store if you sign up for their credit card? A store card might be a fit for you if you want to be rewarded for your loyalty while building your credit. It’s important to be mindful of the potentially high interest rates compared to non-retail credit cards.

- Someone else’s credit card: When you become an authorized user on a close friend or family member’s credit card account, their positive payment history can help you establish and grow your credit footprint. Think of it as riding shotgun with an experienced driver — you get to see how it’s done and benefit from the journey. Just make sure the primary cardholder is financially responsible.

Student credit cards typically offer lower credit limits and may have more lenient approval requirements.

What to Look for in a Credit Card

Secured or not, there are a couple of things to have on your radar when comparing cards. Explore a few of them below.

- Annual fees: First and foremost, keep an eye out for cards with low or, even better, no annual fees. Remember, the goal here is building credit, not racking up unnecessary costs.

- Interest rates: Next, take note of the annual percentage rate (APR). It’s the yearly cost of borrowing money if you carry a balance on your card. Some card issuers boast of low introductory rates, while others stick to variable rates. If you’re playing the credit-building game right by paying your balance in full each month, you’ll sidestep interest charges.

- Credit reporting: This is a big one. Not every secured credit card issuer reports to each of the major credit bureaus. So, if you’re set on getting a secured card, make sure it’s from an issuer that will share your information with all three bureaus. If the issuer reports to only one or two, your efforts to build credit may lag and won’t be as impactful.

- Rewards programs: Cash back, points, or miles — you choose. Finding a card that fits all your credit-building needs and gives you a little something back is a win.

- Customer service and online tools: A credit card issuer with strong customer service and an easy-to-use website and mobile app makes account management smooth. Leverage features like payment reminders, balance alerts, and access to your credit score to avoid costly mistakes.

- Pre-qualification options: See if the card issuer has “pre-qualification” or “pre-approval” tools. This simple offering gives you an idea of whether you’ll be approved without a hard credit check, which temporarily lowers your score.

Here’s something else to keep in mind. When you’re first starting out, you’ll likely have a modest credit limit. With time and good behavior, some lenders will increase that total without your having to ask. And for those with secured cards, the reward could be conversion to an unsecured card.

With time and good behavior, some lenders will increase your limit without your having to ask.

Smart Ways to Use a Credit Card to Build Credit

That gym membership you signed up for at the beginning of the year only makes a difference when you show up regularly, even for a few minutes — same deal with your plastic money. Let’s get into the habits that will get your credit in tip-top shape.

Making On-Time Payments

If there’s one hard-and-fast credit-building rule to heed, it’s this: pay your bills on time every single month. Your payment history is the single most significant slice of your credit pie. One late payment equals a few points off your credit score and a step back in your credit-building journey.

Automate payments or set up calendar reminders to make sure you’re meeting your due dates. Show future lenders you’re a reliable borrower. If you find yourself in a hole, don’t lose hope. Explore debt repayment strategies, like the avalanche and snowball methods, or consider debt consolidation methods such as a balance transfer or HELOC.

Credit Utilization and Its Importance

Another important credit-building factor is something called your credit utilization ratio. Don’t let the technical term throw you off. It’s simply how much of your available credit you’re using. To further simplify the concept, think of your total credit limit as a full tank of gas and your credit utilization ratio as how much fuel you’ve burned. Lenders prefer to see ratios below 30%. Any higher and they may think you're overextending yourself.

After putting in the work to improve your credit score, you may consider a limit increase. This isn’t so you can spend more, but because it improves your credit utilization ratio. If your limit goes from $1,000 to $5,000 and you continue to spend around $200 a month, your utilization drops from 20% to 4%.

Want to know how to calculate your credit utilization ratio? Here’s the math for our example:

|

Before the credit limit increase |

After the credit limit increase |

|---|

Lenders prefer to see ratios below 30%. Any higher and they may think you're overextending yourself.

Additional Strategies

Building credit with a card doesn’t stop at the above methods. Check out these savvy strategies to help you go the distance.

Shift your subscriptions: Think about your recurring subscriptions — streaming services, gym memberships, or even your phone bill. Instead of autopaying them with your debit card or checking account, put one or two of these fixed costs on your credit card. Then, immediately set up an automatic payment from your checking account to your credit card to cover the exact amount, any time before or on the due date.

Make multiple payments: Instead of putting big, tempting purchases (also known as bad debt) on your credit card, use it for small, everyday transactions. Pay those tiny balances off throughout the month. For example, if you charge $5 for Monday morning coffee, pay it off that same week or the next. No need to wait until the due date. You can’t go wrong with regular payment activity.

Use it for emergencies: Let’s say an unexpected bill pops up, like a car repair, appliance breakdown, or emergency room visit. Put it on your credit card. If you’ve got an emergency fund, you can pay off the total balance. If not, make minimum payments until it’s down to $0. This strategy allows you to generate transaction and payment activity, which adds to your credit track record. Always proceed with caution so you don’t end up with too much debt.

Put one or two fixed costs on your credit card. Then, set up an automatic payment from your checking account to your credit card to cover it before the credit card due date.

Tips for Improving Your Credit Score

The pursuit of a good credit score starts with knowledge. Let’s unlock some game-changing insights together.

Regularly Check Your Credit Report

It’s crucial to review your credit report often, just like you would your bank statement. Why? Because errors can sneak in and drag your credit score.

You’re entitled to a free copy from each of the major credit bureaus each year through AnnualCreditReport.com. Your bank or credit union may also offer a credit monitoring service. When reviewing your report, look out for discrepancies such as:

- A misspelled name

- A wrong address

- Incorrect balances or credit limits

- The same debt reported twice

- Accounts in good standing that have been reported as delinquent or closed

Keep Track of Payment History

There’s more to nurturing your overall payment history than just meeting credit card payment deadlines. This means being mindful of all your credit obligations, such as student loans and car loans. A consistent, positive payment record across all your accounts screams reliability to anyone looking at your credit report.

Know how much you owe, chip away at those debts, and communicate with your lender when life throws curveballs. Your balance won’t disappear, but they may provide temporary accommodation to help get you back on track.

Avoid High Balances and Interest Rates

While using your credit card is essential for building credit, it’s equally important to resist the urge to carry high balances. As discussed, a hefty balance compared to your credit limit can hurt your score and stick you with costly interest charges.

There’s a secret weapon to help you avoid that. Most credit card issuers offer a “grace period,” which is the window of time (around 21 days) between your statement closing date and payment due date. If you pay your statement balance in full before the grace period ends, you won’t be charged a dime of interest on new purchases.

Diversify Your Credit

When you get the hang of all things credit card, consider balancing out your revolving and installment credit. This can give your score an extra boost. Lenders like to see that you can manage various kinds of debt, from cards to loans.

Long-Term Strategies for Financial Stability

You’ve mastered the essential strategies for building stellar credit. Good for you! Now, it’s time to direct your attention to other vital pieces of your financial ecosystem. True financial stability means tending to all aspects of your money.

Create a Budget

A budget lets you track every dollar coming in and out of all your accounts, giving you a clear picture of your spending habits. With that, you can come up with a plan to manage current priorities and build your emergency fund.

If you crave simplicity, consider the 50/30/20 budget. Divide your after-tax income into three buckets — 50% for needs, 30% for wants, and 20% for debt repayment and/or savings. Or try the “pay yourself first” budget. The moment your paycheck hits, initiate a funds transfer to your savings or investment accounts. This technique is ideal for anyone who struggles to save consistently or has big, exciting goals like buying a home, planning for retirement, or funding a dream vacation. It turns saving into an effortless habit.

Don’t know where to start or gradually recovering from financial hardship? Enlist the help of an expert to develop a custom long-term plan.

If you crave simplicity, consider the 50/30/20 budget.

Protect Your Identity

You’ve put a lot into getting your credit and finances in order. You want to make sure you’re protecting what you’ve diligently built. Identity fraud cost Americans $43 billion in 2023 alone. Secure your personal information online and offline — use strong, unique passwords and be incredibly cautious about sharing financial details.

Maintain Patience and Consistency While Building Credit

Developing financial resilience doesn’t happen overnight — you’ve got to play the long game. Your most powerful tools are patience, education, and relentlessness. Stay consistent and watch your efforts compound into the results you’ve always dreamed of.

FAQs

Do you have final questions about building credit? Get your answers below.

To supercharge your score, aim to pay your credit card balance in full every month. This blocks interest charges and shows lenders you’ve got a healthy relationship with credit. If paying in full isn’t possible, then focus on keeping your credit utilization low.

Closing any credit card account, especially one you’ve held for a while, can potentially cause a temporary score dip. This is because it reduces your overall available credit and shortens the average age of your credit accounts. However, if you have one to three well-managed, long-standing accounts and feel there’s a card that’s no longer serving you (but costing you), then you may be okay with the temporary score change.

Credit card issuers typically report your payment activity to the credit bureaus about once a month, shortly after your statement closing date. If you’re completely new to credit, your first score will be available within or at six months. From there, you may see improvements from month to month, but only if you’re practicing good credit habits.

When you’re building credit, quality trumps quantity. There isn’t a magic number, but managing one to three cards is viable for many people. Taking on too many cards too quickly results in a score drop. It also means you’ll have to juggle multiple due dates and could end up overspending without realizing it.

The Takeaway

Whether you’re just starting out or eager to rebuild, remember that the best thing about credit is that you can do something about it. Follow our roundup of tips and strategies, and you’ll be on track to summit the score of your dreams!

Credit-Building Made Easy

Find a PenFed credit card that fits your lifestyle and goals and build credit the smart way.