Does Applying for a Credit Card Hurt Your Credit Score?

What you'll learn: See how your score changes with a new card.

EXPECTED READ TIME: 10 MINUTES

That shiny new credit card offer just landed in your mailbox, promising sweet rewards and a lower interest rate than your current card has. You start to imagine the possibilities. You can finally tackle the bathroom renovation you mapped out months ago or book that sun-soaked getaway you've been dreaming of.

But then, you stop to wonder: "Will applying for this card increase my score or undo the work I've put into getting it to where it is?" It's a valid concern. Your credit score is like your financial report card. It's your golden ticket to a great rate on a car loan and a metric that tells your landlord you'll be a financially responsible tenant.

Here's the truth: Applying for a credit card, loan, or other line of credit can knock a few points off your score. But that's a natural part of dealing with credit. Let's look at how exactly credit card applications impact your score — separating fact from fiction — so you can decide how a credit card fits into your overall financial plan.

Differences Between Soft and Hard Inquiries

To fully understand the impact of a credit card application, we first need to define the different types of credit inquiries. Not all credit report checks are created equal.

Soft Inquiries

Imagine you're browsing online for car insurance quotes. To give you an estimate, the insurance company might check your credit. This type of check is called a soft inquiry. Soft inquiries occur when a business takes a glance at your credit report for administrative purposes or pre-approved offers, like the one in your mailbox. When you check your report, that's a soft inquiry too. Soft inquiries are only visible to you. Even better, they have zero impact on your credit score, so there's no need to worry if you have more than one.

Hard Inquiries

Now, let's say you're sold on the mail offer and decide to apply for that new card. As part of the application process, the credit card issuer will contact one or more of the three national credit bureaus (Equifax, Experian, and TransUnion) to request a copy of your credit report. This is known as a hard inquiry or hard pull. This type of inquiry happens when you formally apply for a line of credit, loan, or credit card limit increase, or complete a rental application.

During this inquiry, the lender takes an in-depth look at your credit report, focusing on factors like payment history and balances. This helps them decide whether to approve your request. Unlike soft inquiries, hard inquiries are visible to lenders and companies that have permission to access your report.

Soft inquiries are only visible to you. Even better, they have zero impact on your credit score.

Pro tip: Want to take a peek at your report before a lender gets to it? Good news — it's free! By law, you can request a copy of your credit report every 12 months from each of the major credit bureaus. You can access those same reports once a week, also free of charge. Just make sure you're not requesting more than one copy at a time from a single credit reporting agency.

Why Hard Credit Checks Matter

Applying for a credit line signals to lenders that you are taking on more debt, which might make it harder to pay your bills on time or meet other financial obligations. It's like adding a new task to an extensive to-do list — you may get to it or not.

In other words, lenders consider you a bigger credit risk. As a result, your score takes a hit. But only until you prove that you can use new credit wisely.

Impact of a Hard Inquiry on Your Credit Score

So, you've applied for a credit card and got a "yes." Now, there's a hard inquiry on file. You probably have a bunch of questions regarding what comes next.

How much is your score going to drop? Does it depend on the amount you're applying for? What are the chances of rebounding? Are you seeing the same thing as potential lenders?

Let's find out.

Deciphering Your Score

Make sure you understand the score categories from the two credit scoring companies — FICO and VantageScore. That way, you'll know exactly where you stand. Both companies use a scoring range of 300 to 850.

FICO considers scores above 800 exceptional, those between 740 and 799 very good, and those ranging from 670 to 739 good. Scores of 580 to 669 are fair. Anything below 580 is poor. VantageScore uses similar ranges.

If you're interested, you could also research credit score averages. From there, you can take a closer look at your new score.

The Initial Hit

The impact from a single application is usually nowhere near enough to tank your score and change your credit rating from "excellent" to "poor." Think a five-point decrease (or less) to your FICO score. However, that number could climb as high as 10 points based on a variety of factors, including:

- Credit repayment history: A record of making on-time payments can help minimize the impact of hard inquiries.

- Credit utilization: This is the relationship between the amount of credit you're using and your total credit limit. Lenders generally prefer borrowers who keep their total credit usage at or below 30%.

- Age of credit accounts: Generally speaking, hard pulls have less of an effect on your credit score if you have older credit accounts that you've kept in good standing.

- Recent hard inquiries: A low number of hard inquiries in a short timeframe is good for your credit score.

Now, here's some reassuring news. A higher credit ask doesn't result in more points getting knocked off your score. So, whether you're applying for a credit line of $1,000 or $10,000, that's one less thing to worry about.

The impact from a single application is usually not enough to tank your rating from “excellent” to “poor.”

Recovery and Timeline for Credit Score Restoration

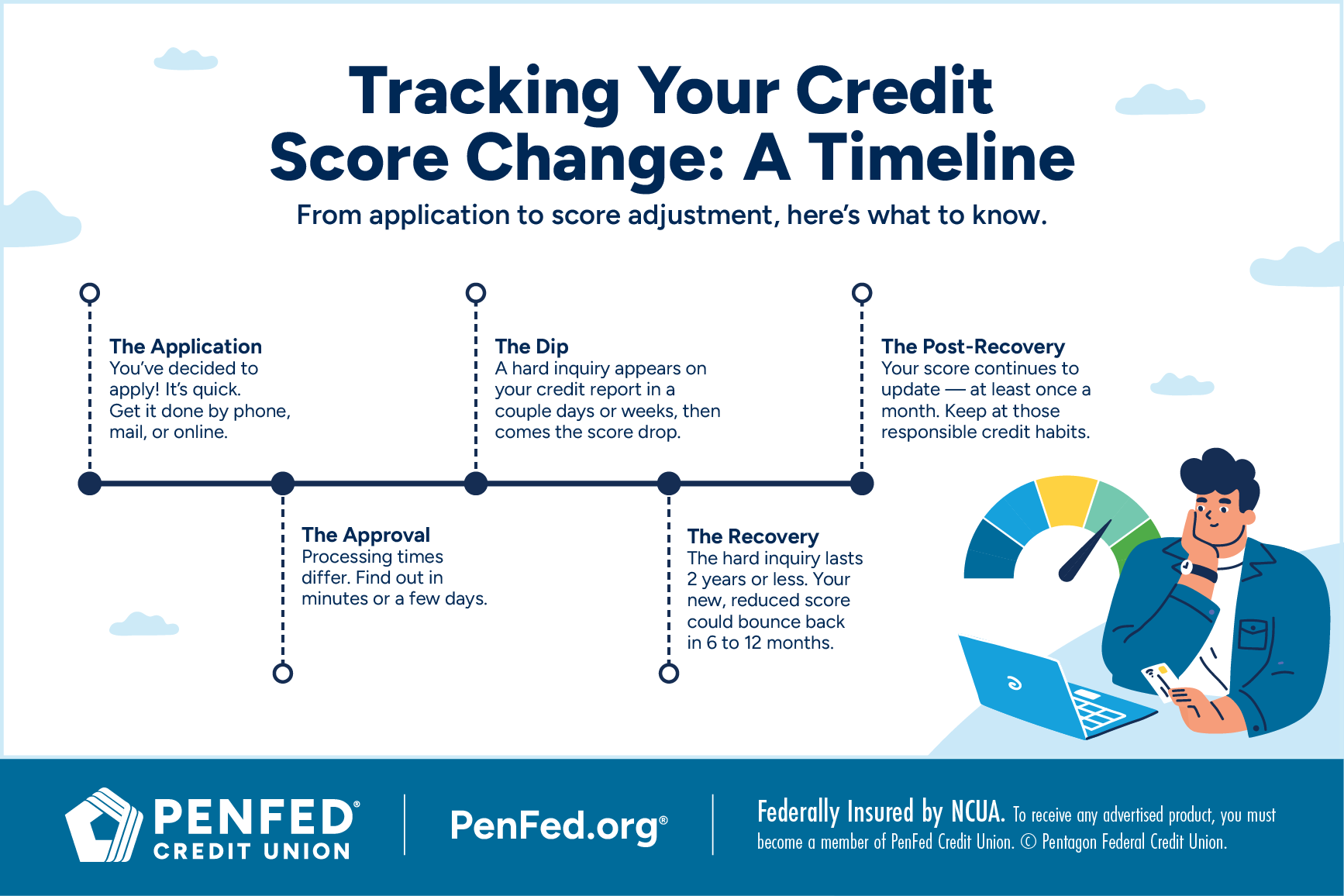

Hard inquiries show up on your report a couple of days or weeks after your application and stay for a while — up to two years, to be precise.

But the effect could fade sooner.

Your score may start to readjust in 12 months or less, provided you stay current on your payments and don't take on additional debt.

Other Timelines to Consider

What about what to expect when it comes to growing your credit? If you're just starting out, it will take about six months to establish a FICO score and about a month for your VantageScore credit score. The timeframe for building a good credit score varies based on how you use and manage your credit accounts, but you should think in terms of years.

While income isn’t used to calculate your credit score, it affects your ability to repay.

Does Getting Denied for a Credit Card Hurt Your Credit?

Getting turned down for a credit card isn't the end of the world. While the hard inquiry will still show up on your report, the denial itself won't hurt your score. What's more important is why you were denied.

By law, any lender who rejects your application for credit must provide an explanation within 60 days. Common reasons include:

- History of late payments: The fastest way to disqualify yourself for new credit is to make a habit of missing payments on existing loans or credit cards.

- Low credit score: Each lender has its own criteria for approving or denying credit card applications, but a credit score below 660 will make it harder to qualify.

- Little (or no) credit history: Many credit card companies won't approve your credit application if you haven't proven that you can manage debt well over an extended period.

- Insufficient income: While income isn't used to calculate your credit score, it affects your ability to repay, which no doubt factors into a lender's decision.

- High debt: If you already have a large amount of debt, lenders will be less inclined to approve you for additional credit because you're at a higher risk of missing payments.

Be sure to review your credit report following a denial. Go in with the goal to spot and fix any errors.

Strategies for Mitigating Negative Impacts on Your Credit Score

You've taken a personal finance class, automated bill pay, evened out your debt-to-income ratio, and maintained low card balances — all in an effort to improve your credit score. And it's paid off. Your score is right where you want it to be. How do you keep it minimally scathed knowing there's a rewards credit card you're eyeing or a necessary car upgrade on the horizon, for which you'll need a loan?

Here are 10 practical tips to help you make informed decisions about credit applications and boost your score after a hard inquiry.

- Know what makes up your credit score: While each credit scoring company uses a formula of its own to come up with your three-digit score, knowing the general importance of different factors lets you home in on where it counts. Here are some factors both companies consider.

- Payment history: Your payment history is the heavyweight champion. When it comes to both scoring systems, consistently paying your credit card bills on time is the most impactful thing you can do.

- Credit utilization: The amount you owe on your credit cards in relation to your total credit limit accounts for 30% of your FICO score and 20% of your VantageScore credit score. If you have a high credit utilization on one card, you can improve your credit utilization ratio by strategically transferring a portion of that balance to a card with more available credit. This is called a balance transfer. Plus, there's the opportunity to save on interest with a low-to-no APR intro offer on the new card.

- Credit age and mix: These two factors measure longevity and versatility. FICO weighs them separately, with age representing 15% of your score and mix accounting for 10%. VantageScore, on the other hand, combines them. They make up to 21% of this score. The longer you've had your accounts and the more types of credit accounts you have, the better.

- Focus on your needs: In many ways, having multiple credit cards and using them judiciously is a good thing. The average American has four. Having a few options allows you to diversify your credit mix, provides payment flexibility, and offers rewards for every dollar you spend. That doesn't mean you should apply for numerous cards at once. Before you hit "submit," ask yourself why you really need that card. Are you looking for better rewards or a lower interest rate? Having a clear purpose will help you narrow down your list, avoiding unnecessary applications in a short period of time.

- Leverage pre-approval tools: Many lenders offer pre-approval tools that let you gauge your approval odds — no hard pull involved. Plus, mortgage, auto loan, and balance transfer calculators are great for comparing and estimating upfront and monthly costs.

- Get smart about rate shopping: When you're looking for a mortgage or car loan, lenders know you'll likely compare rates. That's why credit scoring systems treat multiple hard inquiries for the same type of loan within a short window (typically 14 to 45 days) as a single inquiry. So, shop around for those big-ticket items within that timeframe.

- Time and prioritize applications: If you know you'll be applying for a big loan soon, it might be a good idea to hold off on applying for new credit cards unless you absolutely need one. This keeps your recent hard inquiries to a minimum. Financial experts generally recommend a six-month wait between credit applications. Depending on your circumstances and credit history, a longer break might do your score some good.

- Use dedicated funds: What if you could avoid the hard inquiry altogether? Before considering a loan or new credit card for planned expenses, take stock of the resources you have. Remember the education sinking fund you set up a year ago? What about the employer-matched flexible spending account (FSA) or the health savings account (HSA) in your name? Or maybe, you just received your tax refund, first side hustle check, or annual workplace bonus? Instead of going for new credit, review your budget to see how you can direct extra income or savings toward immediate (and qualifying) needs.

- Negotiate payment plans: Proactivity can pay off. If you anticipate difficulty making a minimum payment, contact the creditor to discuss alternate payment arrangements. This might prevent a negative mark, like a missed payment, from showing up on your credit report and lowering your score. Handling these negotiations on your own instead of handing them over to a debt settlement company could also save you from headaches down the road.

- Keep old, unused card accounts open: Unless there's a high annual fee you can't justify, keep your old credit card open — even when you get the new one. Cards with a zero balance can increase your available credit and improve your credit utilization ratio. Some companies may require you to make a purchase every so many months or year or two in order to keep card accounts open. You can do this without impacting your credit score by making a small purchase and then paying off the purchase immediately. Just keep an eye on any infrequently-used cards to make sure there's no fraudulent activity going on.

- Consider alternative credit-building strategies: Store credit cards, secured cards, and credit builder loans are great options for people who are just getting started on their credit journey or those hoping to make a comeback after multiple defaults. You can also enlist the help of a financially savvy friend or family member. Make use of their good credit standing by becoming an authorized user on their credit card account.

- Target lenders like you would cards: Maybe you have a credit card with great perks. Those perks are what got you in the first place. Similarly, there are benefits to choosing specific lenders. If your score limits your options, go for creditors with a history of lending to people in your score category.

The Takeaway

Applying for credit has become second nature for many. The ripple effects of a single application extend beyond the day your new card arrives.

Whether you're a credit card first-timer or a veteran juggling a diverse credit mix, do yourself and your score a solid by using your plastic money strategically. The key is to create healthy habits early on and stick with them for the long haul. Resist the temptation to open a new credit card every time you hear about a great promotion.

The long-term benefits will almost certainly exceed any short-term perk you enjoy.

Do More With a PenFed Credit Card

Pay bills, grow your credit, and unlock rewards big and small.