FINANCE

Understanding Credit Scores

What You’ll Learn:

Credit scores measure creditworthiness. See how the three-digit number works.

EXPECTED READ TIME: 14 MINUTES

Ever been on vacation and had to get through a conversation in a language you don’t speak? Or maybe, your furniture set arrived without a manual. That’s what dealing with credit scores without the proper know-how can feel like — confusing, stressful, and like you’re missing something important.

But it doesn’t have to be this way.

We’ll look at what makes up credit scores, why they really matter, and how to make them work for you.

What Is a Credit Score?

A credit score is a three-digit number between 300 and 850 that tells lenders how well you handle debt.

It’s basically your financial report card.

Let’s say you have a five-year track record of paying your credit card bills on time and keeping your balances low. That’s like acing your classes. However, if you’ve missed a couple of payments and maxed out your cards, you could end up with a lower-than-average grade.

What Is a Good Credit Score?

Generally, a score of 670 on the 300 to 850 scale is considered good. Anything above 800 is even better.

The Importance of a Good Credit Score

It’s more than just a number. A good credit score is like VIP ticket that gets you into a members-only event.

It can come in handy when you’re trying to secure a mortgage for your dream home. Or maybe, you’re looking to snag a deal on a new car loan and land the lowest possible auto insurance premium.

The higher your score, the more attractive you are to potential lenders — and that means better rates and bigger borrowing power.

Focus on your score category and maintaining healthy money habits, but don’t ignore large discrepancies of 50 points or higher.

Types of Credit Scores

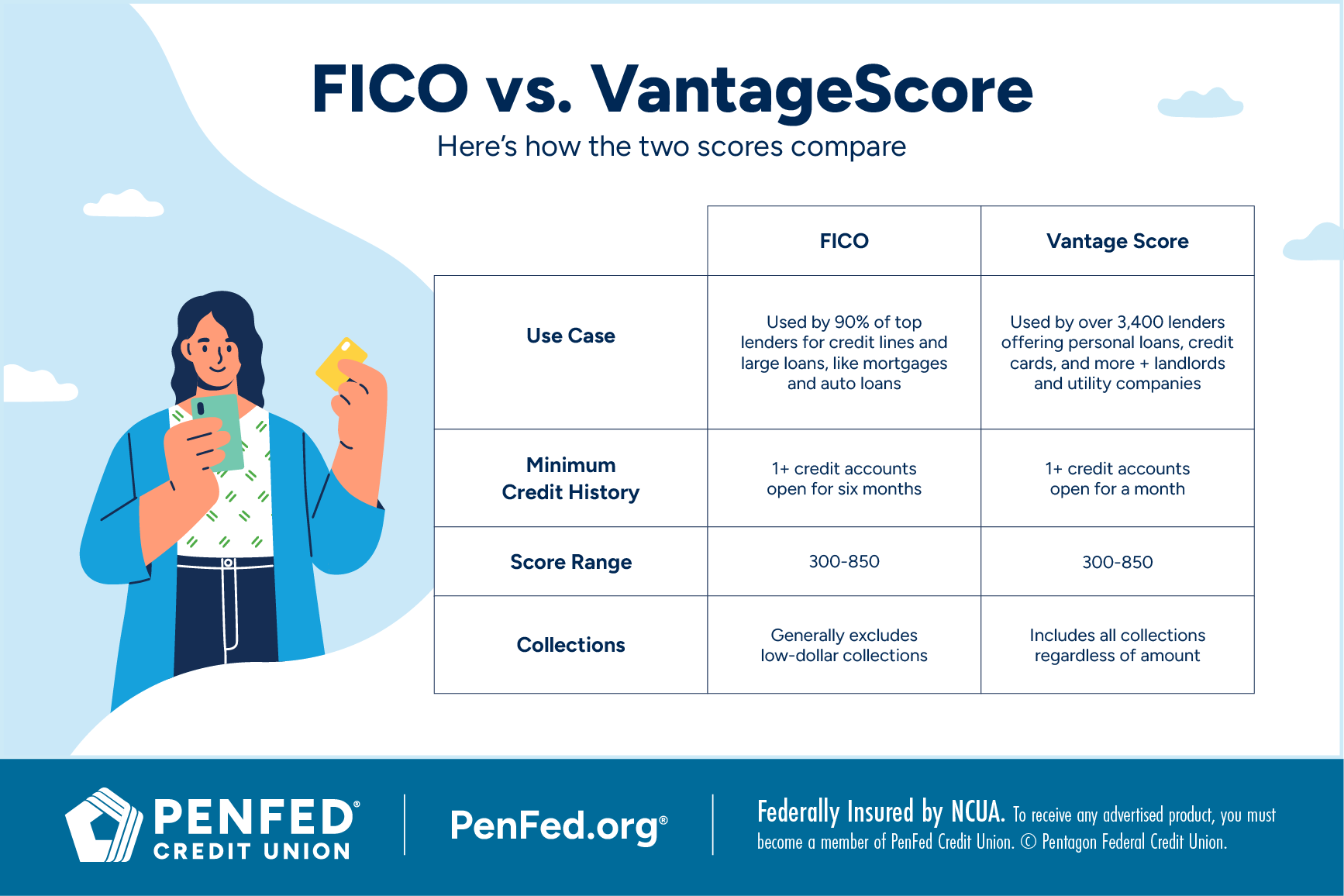

You’ve likely heard of FICO® and VantageScore®. These are the two most common types of credit scores, each named after the company that created it.

Think of them as different scorecards for the same game. Each one uses a unique formula to figure out how likely you are to pay back the money you borrow.

Now, let’s get clear on what sets them apart.

FICO scores are the OG of credit scores — the ones lenders have been using for 30 plus years. VantageScore hasn’t been around as long, but it’s quickly gaining traction thanks to its wide-net approach. Plus, it’s backed by the three major credit bureaus: Equifax, Experian, and TransUnion.

There are two VantageScore scoring models — VantageScore 3.0 and VantageScore 4.0. Both consider a wider range of financial activity than FICO, allowing people with a “thin file” to apply for lines of credit and grow their scores. That’s good news if you’re hoping to get your first credit card at 18 or you’re new to the country.

Even with this advantage, the final decision lies with the lender. If you have concerns or questions about your situation, you can get in touch with them.

Pro tip: Your FICO and VantageScore credit scores might not be the same. That’s normal. Don’t obsess over minor differences. Instead, focus on your score category and maintaining healthy money habits. However, don’t ignore large discrepancies of 50 points or higher. They may indicate errors, which you should seek to correct.

Industry-Specific Scores

In addition to general FICO and VantageScore credit scores, lenders rely on specialized scores for specific loans.

Here are a few of them:

Auto industry scores: Auto lenders often turn to FICO® Auto Scores, which take into account your auto loan history and other relevant factors. These scores range from 250 to 900.

Mortgage industry scores: Similarly, mortgage lenders often use a specialized version of your FICO score. It ranges from 300 to 850. Lenders will consider any real-estate debts you have.

Credit-based insurance scores: Each insurance lender has its own way of calculating your credit-based insurance score, but it all boils down to your credit history.

Retailers, online lending platforms, telecommunications companies, and utility providers also use custom scoring models. Developed by in-house statisticians or external experts, these models factor account histories and other financial information the lender has on file.

While your general FICO and VantageScore ratings are important, understanding industry and custom scores can give you an edge when applying for specific loans, insurance, or services.

Retailers, online lending platforms, telecommunications companies, and utility providers also use custom scoring models.

Credit Report vs. Credit Score

Although the terms are often used interchangeably, your credit report and credit score serve different purposes.

Your credit report is raw data, while your score is an interpretation of that data.

Let’s dive deeper.

Compiled by each of the three major credit bureaus, your credit report is a comprehensive record of your borrowing and repayment history.

On it, you will find:

Personal information: Your name, address, Social Security number (SSN), and birthdate.

Credit accounts: A list of your credit cards, loans, and other credit lines with corresponding account numbers, balances, credit limits, and payment history.

Public records: Information about bankruptcies, foreclosures, tax liens, and vehicle repossessions.

Inquiries: A list of companies that have requested your credit report.

Miscellaneous: This includes collections and charge-offs.

Your credit score, on the other hand, summarizes your creditworthiness based on the information in your report.

How Credit Scores are Calculated

Now, let’s go behind the scenes. How do credit scoring companies turn your financial history into that three-digit number? Like a numerical grade in school, your credit score is calculated using an algorithm that incorporates select data.

Here’s what that looks like for FICO:

Payment history (35%): This is the biggest slice of the pie. Do you pay off your balances on time? Lenders want to know.

Amounts owed (30%): Next up, they look at the total amount of debt to your name.

Length of credit history (15%): The longer you’ve been managing credit, the better. It shows you’re a pro.

New credit (10%): Opening too many new accounts at once or in a short period of time triggers multiple hard inquiries. Slow and steady wins the race.

Credit mix (10%): A variety of accounts is always good to have.

VantageScore 3.0 is more commonly used than its successor, VantageScore 4.0.

Both VantageScore scoring models weigh the same six factors, but differently. VantageScore 3.0 is more commonly used than its successor, VantageScore 4.0. Here’s how model 3.0 calculates your score:

Payment history (40%): Just like FICO, your payment history matters most.

Credit age and mix (21%): This a measure of longevity and versatility.

Credit utilization (20%): The trick here is to keep your balances low compared to your available credit.

Balances (11%): The total amount of debt you’re juggling comes in fourth.

Recent credit (5%): This includes your newest credit card and loan accounts. Too many of them is a red flag.

Available credit (3%): Lenders like to see that you have some wiggle room.

VantageScore 4.0 gives more weight to payment history (41%) and recent credit (11%), and less to balances (6%), available credit (2%), and credit age and mix (20%).

Another big difference between VantageScore 4.0 and 3.0 lies in their approaches to trended data. Leveraging the power of machine learning, VantageScore 4.0 takes a deeper dive into your credit history, analyzing patterns of payment behavior overtime. So, if you’ve been cleaning up your act, VantageScore 4.0 will show that off more accurately than 3.0. That’s why 4.0 is poised to become more widely adopted in the coming years.

You can request a free copy of your credit report every 12 months from each of the major credit bureaus.

How to Check Your Credit Score

You have the right to know where you stand — the law says so. Let’s go over some of the ways to keep track of your score.

Monitoring and Evaluating Your Credit Score

You can request a free copy of your credit report every 12 months from each of the major credit bureaus. If you’re gearing up for a big buy and want to check your report more frequently, that’s possible. Each reporting agency allows you to access your report once a week, for free. Many banks, credit card issuers, credit unions, and personal finance platforms also offer complimentary credit score monitoring.

Keep in mind, however, that your credit score doesn't appear on your credit report. What you’ll see, is all the data used to determine your FICO and VantageScore credit scores.

Credit Report Errors

Having that information is just the start. Protecting your credit score against fraud is crucial. Identity theft can tank your score faster than it took to get it in good shape. In 2024, the Federal Trade Commission received over 1.1 million reports of identity theft.

Watch out for these potential red flags:

New accounts you don’t recognize: Did you get a welcome email for a credit card you didn’t apply for? It could mean someone got a hold of your SSN, giving them free range to mess with your credit.

Unfamiliar inquires: See a company you don’t recognize checking your report? That could mean someone’s applying for credit in your name. Get in touch with the credit bureaus and ask for a credit freeze.

Changes in credit limits or balances: Did your credit limit or balance mysteriously increase? These could be signs of fraud or an error, which is usually accompanied by a sudden drop in your score.

Identity theft aside, pay attention to these details:

Incorrect personal information: See an incorrect address? Is your name misspelled? Are there late payments that shouldn’t be there? Small errors can cause problems down the line.

Public records you don’t recognize: Do you see a bankruptcy you didn’t file or tax lien you know nothing about? These could damage your score. Find out how they made it into your report and get rid of them.

Regularly checking your credit reports and scores is like reviewing your bank statements. Don’t wait until something doesn’t add up — catch errors while they’re still a simple fix.

We have an action plan to help you do that. You can also use these helpful resources:

Consumer Financial Protection Bureau (CFPB): Provides credit monitoring resources and complaint filing.

National Consumer Law Center (NCLC): Offers legal information, advocacy, and the latest news on all things credit.

Credit counseling services: These organizations can help with credit management. Make sure they’re certified.

Don’t wait until something doesn’t add up — catch errors while they’re still a simple fix.

Credit Score Ranges and Ratings

Even though FICO or VantageScore use the same 300 to 850 scale, your scores won’t match up perfectly. Similar to how two specialists might interpret the same X-ray a little differently, these scoring models weigh factors in distinct ways. The credit bureaus’ reporting timelines also influence the differences in scores. Most importantly, FICO and VantageScore use slightly different ranges and terminology.

Credit Score Ranges

|

Score Classification (FICO/VantageScore) |

FICO Score Range |

VantageScore Range |

|---|---|---|

|

Exceptional/Excellent |

800-850 |

781-850 |

|

Very Good/ Good |

740-799 |

661-780 |

|

Good/Fair |

670-739 |

601-660 |

|

Fair/Poor |

580-669 |

500-600 |

|

Poor/Very Poor |

300-579 |

300-499 |

What They Mean

- Excellent/Exceptional: This category represents some degree of credit success. People in this range have low credit card balances, a good utilization rate, and a long history on-time payments. They'll typically get lower interest rates on mortgages, credit cards, and loans, because they're considered low risks for defaulting.

- Very Good/Good: Individuals who have a credit score in this range are generally seen as financially responsible. They make most of their payments on time.

- Good/Fair: The average FICO score is in this range. Individuals with good or fair credit will likely get decent interest rates, though certain lenders may be a little hesitant.

- Fair/Poor: Borrowers in this category have some dings to their credit history, but no major delinquencies. They can still qualify for credit, but at less attractive rates.

- Poor/Very Poor: Individuals with a poor or very poor credit score have significant damage to their credit history caused by multiple defaults or a bankruptcy. They'll may need to repair their credit score before obtaining new credit.

Average Credit Scores

As of 2024, the average FICO score is 715. According to 2024 VantageScore data, the average score for its most recent model (4.0) sits a bit lower than FICO's, at 702.

These averages shift with age. Individuals aged 60 and above tend to have the highest average FICO score, ranging from 745 to 760. On the flip side, those between the ages of 18 and 27 have the lowest average, around 681. Age-based VantageScore averages show the same trend.

Now, if you’re thinking ‘I’m way off from that,’ don’t worry. Averages are just a rough guide. What really matters is that your score gets you the loan, rate, or rental you need.

How to Improve Your Credit Score

Improving your credit score is like training for a marathon. It takes time, dedication, and consistent effort. We’ve discussed fixing credit report errors, limiting new credit applications, and paying attention to score ranges. Here are some additional tips to help you increase and maintain your score.

- Perfect your payment history: Your payment history is the single most important factor in determining both your FICO and VantageScore credit scores. Set up calendar reminders, track payments with a personal finance app, and automate your bills to keep your payment history pristine. It may be a good idea to pay off any loan balances ahead of schedule. This allows you to save on interest. Just make sure there are no early payment penalties.

- Keep utilization low: Aim to keep your credit utilization below 30%. And if you have a history of responsible credit use, consider requesting a credit limit increase. This can lower your utilization rate and boost your score.

- Don’t close old credit cards: Your score takes a hit when you close old credit card accounts. First, the average age of your credit accounts decreases. Your credit utilization will also drop. Best practice is to keep your old card accounts open, with small balances and regular payments. But if your card is too expensive to keep, then you might prefer to deal with the temporary credit score drop. You can always work your way back up.

- Know the difference between good and bad debt: Depending on your personal goals and where you are in your credit building journey, certain types of debt could favor or fail you. An example of good debt is a loan for higher education. Maxing out your credit card for a shopping spree is considered bad debt. Choose wisely and aim for a balanced mix of revolving and installment credit.

An example of good debt is a loan for higher education. Maxing out your credit card for a shopping spree is considered bad debt.

Strategies for a Balanced Credit Mix

Building your credit from the ground up? Consider these diversification strategies:

Consider a secured loan or credit card: Weigh the pros and cons of a secured loan or credit card. One major perk is the lenient approval requirements.

Add a retail credit card: Retail credit cards can be helpful for building credit, but be cautious of high interest rates.

Assign each card a purpose: No need to go overboard. Start with two to three cards — one for everyday purchases, one for emergencies, and one for rewards.

Get a credit-builder loan: These loans are meant to help you establish payment history. Instead of getting cash up front, the creditor holds onto the total loan amount while you make payments. You get the money back when the term is up.

Become an authorized user: Ask a friend or family member with excellent credit if they wouldn’t mind having you as an authorized user on their credit card account. The advantage? Their positive payment history could rub off on yours.

And remember, be patient. Building good credit takes time.

Making Informed Financial Decisions with Credit Scores

Now that you know more about credit scores, how can you use your score(s) to your advantage? There are several benefits beyond securing a mortgage, auto loan, or personal loan, like:

The Rental Edge

Whether you’re considering a one-bedroom apartment, high-end downtown rental, or corporate space, landlords will want to know your score. A good score tells them you’re a financially responsible tenant. Try using it to negotiate better rental terms, such as a lower security deposit.

The Service Rate Edge

Utility companies, wireless network operators, and other service providers may want to see your report and score. A good score could mean lower monthly payments or protect you from hefty deposits. A bad score could make setup a little challenging.

The New Opportunity Edge

Need a credit card for your new tech business or applying for a top-secret government position? A background check might include a peek at your credit report. Business lenders as well as government and finance industry employers especially value responsible financial behavior.

The Private Student Loan Edge

Making your way to your dream college and need some help covering tuition? Most federal student loans don’t require a credit score for approval. That’s different for private student loans. Many private student loan lenders favor borrowers with a FICO score of 670 or more. Your debt-to-income ratio also matters. Nailing both can give you an advantage.

Most federal student loans don’t require a credit score for approval.

Preparing for Auto Loans and Mortgages

If you’re dreaming of a new set of wheels or house keys, we’ve got some tips for you too.

- Research potential lenders: Most lenders offering conventional mortgages look for a minimum FICO score of 620, while auto lenders prefer borrowers with a score close to 661. Higher scores can get you better interest rates, so don’t be afraid to negotiate if you’re in the very good or excellent categories. Shopping around before auto loan pre-approval lets you know which lender has the best offer. It’ll also limit unnecessary hard credit pulls. The same goes for mortgage pre-qualification. Remember, lenders want your business. If they won’t budge, be prepared to walk away. Conversely, if your score doesn’t give you much leverage, target lenders known for accommodating people in your score range.

- Talk to a financial or credit advisor: These professionals can help you create a plan to boost your score.

- Plan for post-purchase credit maintenance: Don’t let your credit score slide once you get a loan. Continue with regular credit report checks and on-time payments.

Common Questions About Credit Scores

Between scoring models, averages, and credit score myths, you may have some outstanding questions. We’ll help you gain more clarity.

While a score of 850 is achievable, it’s rare. Less than 2% of Americans have a perfect score. Don’t get discouraged if you’re not one of them. There are a variety of lenders and lines of credit for individuals with average scores. While limited, there are also options for those who are just starting off or repairing their credit.

No, it won’t. Checking your score is like a soft inquiry. You should do it often. The more you know, the better.

Technically, there's no such thing as a starting credit score. If you've never used credit, you simply don't have a score. That changes once you open your first line of credit and begin establishing a payment history. Lenders will start sending information to the credit bureaus. At that point, the bureaus create a file containing the data used to determine your initial score.

No. Lenders look at your income to see if you can repay debt, but your score itself is based on your credit history.

Not immediately. Collection accounts will remain on your credit report, just marked as paid.

No, it won’t. Checking your score is like a soft inquiry. You should do it often. The more you know, the better.

Your credit score gets updated when lenders report new information to the credit bureaus. That varies. It could be multiple times a month or quarterly.

Your credit score gets updated when lenders report new information to the credit bureaus. That varies. It could be multiple times a month or quarterly.

A credit freeze locks down your credit report, stopping new lenders from accessing it. This restriction only goes away when you unfreeze your report. A credit lock, on the other hand, requires lenders to verify your identity before opening new accounts. Both are great for preventing identity theft. You can set up and manage a credit freeze over the phone or online.

They can give you personalized tips to improve your score. But they can’t make negative information disappear from your credit report. Remember, the long-term benefits of a good credit score come from proper credit management.

The Takeaway

A good credit score is a long-term investment. It’s not just about today’s loan — it’s about building a foundation for the financial opportunities you’ve always dreamed of. With the right tools, resources, and healthy money habits, you’ll be on your way to getting the credit rating you want.

Do More with a PenFed Credit Card

Pay bills, grow your credit, and unlock rewards big and small.