FINANCE

What Is a Credit Freeze and How Does It Work?

EXPECTED READ TIME:7 MINUTES

Aside from drinks, frozen goods, and certain perishable items, you probably don't make a habit of icing your assets. When it comes to your credit, however, there are times when "freezing" everything can be a downright cool thing to do.

Here's all you need to know about credit freezes and several tips to ensure you use this security tool wisely if you choose to put your credit report on ice.

What Is a Credit Freeze

A credit freeze is a federally mandated security measure, also known as a security freeze, that allows you to legally restrict credit bureaus from sharing your credit report with any third parties.

In fact, once you put a credit freeze in place, only a select few entities can access your report until you lift it (aka, unfreeze or thaw). They include:

- Creditors of accounts you currently have

- Certain government agencies

- Credit-monitoring companies that you've hired

When your credit report is frozen, financial institutions and other lenders won't issue loans or extend lines of credit because they can't review your credit history to determine if you're likely to repay the money you borrow.

This, in turn, makes it far more difficult for identity thieves to open new accounts in your name.

When your credit report is frozen, financial institutions and other lenders won't issue loans or extend lines of credit.

How to Freeze Your Credit

You can freeze and unfreeze your credit as often as you'd like, free of charge. A credit freeze won't affect your credit score, regardless of how many times you apply and remove it, but it does require a bit of legwork.

Start by visiting the websites of the nation's three main credit bureaus individually or calling each directly. (Yes, you need to reach out to them separately.)

- Equifax: 888-298-0045

- Experian: 888-397-3742

- TransUnion: 888-909-8872

The process varies slightly with each agency, but you'll generally be asked or prompted to provide your Social Security number, date of birth, and other identifying personal information. You may also receive a PIN or password to use when unfreezing your report.

The credit reporting company must freeze your credit file within one business day if your request is made online or over the phone.

By law, the credit reporting company must freeze your credit file within one business day if your request is made online or over the phone (three days if made by mail). The bureau is also required to notify you in writing within five business days after the credit freeze is placed.

Once activated, a credit freeze secures your credit file until you lift it. Even so, it's a good idea to continue monitoring your credit periodically throughout the freeze. A credit freeze only prevents thieves from opening new accounts in your name, it doesn’t prevent them from making fraudulent purchases using your existing accounts.

It's a good idea to continue monitoring your credit periodically throughout the freeze.

How to Unfreeze Your Credit

Much like setting up a credit freeze, the easiest and fastest way to remove a freeze is to go online or call each credit bureau directly. Again, you'll have to contact Equifax, Experian, and TransUnion individually.

The steps are slightly different among the agencies (TransUnion requires you to set up an account, while Experian and Equifax simply require a PIN or password), but the process is fairly straightforward. In fact, the most difficult aspect of unfreezing your credit might be deciding between a temporary or permanent thaw.

The most difficult aspect of unfreezing your credit might be deciding between a temporary or permanent thaw.

What Is a Temporary Credit Thaw?

Temporary credit thaws are ideal when you're applying for a loan, trying to rent an apartment or house, or applying for a job that requires a background check.

You can specify the length of time you want to unfreeze your report — days, weeks, or months — and even request a one-time thaw at a single credit bureau if you know which agency the potential lender, landlord, or employer plans to use when pulling your credit history.

What Is a Permanent Credit Thaw?

Permanent credit thaws, on the other hand, make sense when you no longer need or want to restrict access to your credit report. If you choose this option, you can always refreeze your credit whenever you want at no cost or negative impact to your credit score.

Whether temporarily or permanently, credit bureaus must lift a freeze within one hour when a request is made electronically or by phone. Mail-in requests can take up to three business days from the date they were received to be processed.

Credit bureaus must lift a freeze within one hour when a request is made electronically or by phone.

When to Freeze Your Credit

Remember the Equifax data breach of 2017 when cybercriminals hijacked the personal information of approximately 143 million customers, more than 200,000 of which had their credit card data exposed?

That's a perfect example of when you should use a credit freeze. It might even be considered a no-brainer. That said, you shouldn't wait for headline-grabbing cyber incidents before placing a freeze on your credit.

You shouldn't wait for headline-grabbing cyber incidents before placing a freeze on your credit.

If you're a victim of identity theft or suspect your personal information (Social Security number, birth date, address, driver's license number) has been compromised, you should initiate a credit freeze.

The same applies if your credit card number has been taken, your mail has been tampered with or stolen, or your bank or credit monitoring service alerts you of a potential security issue.

Increasingly, consumers are using credit freezes as proactive measures to stave off potential threats. A credit freeze can't prevent your identity or personal information from being stolen, but it can help limit financial damage in the event of identity theft or a data compromise.

A credit freeze can't prevent your identity or personal information from being stolen, but it can help limit financial damage.

Should I Freeze My Child’s Credit?

Most minors don’t have a credit report, which actually makes them good targets for identity thieves. A thief who opens fraudulent accounts in a child’s name could go undetected for years.

To freeze your child’s credit, you’ll need the same documents required to freeze your own credit, plus your child’s Social Security number and birth certificate or equivalent document (foster care certification, adoption paperwork, or power of attorney).

You can only freeze your child’s credit until the age of 16. After that, they can freeze their own credit.

Just like with adults, freezing a child’s credit is only one part of protecting their identity. It’s important to know signs of identity theft and take steps to protect yourself and your dependents. And if you do discover suspicious activity on your child’s credit report, it’s important to take action quickly.

You can only freeze your child’s credit until the age of 16. After that, they can freeze their own credit.

Pros and Cons of Freezing Credit

Should you or shouldn't you place a freeze on your credit? It's a simple question that has no simple answer, other than "it depends."

More specifically, it depends on who you ask.

Some view credit freezes as the single most important thing you can — in fact, should — do to prevent identity thieves from opening fraudulent credit accounts in your name. Others consider a credit freeze to be a drastic step that should only be taken if your identity is stolen, or your personal data is compromised in a security breach.

Regardless of your personal beliefs, there are some advantages and disadvantages to credit freezes that you should always keep top of mind.

| Pros | Cons |

|---|---|

| Free to freeze and unfreeze | Have to contact each credit bureau separately |

| Won't impact your credit score | Doesn't guarantee fraud protection |

| Adds protection against identity theft | Need to unfreeze before getting a new loan or credit card |

| Offers peace of mind |

Credit Locks vs. Credit Freezes

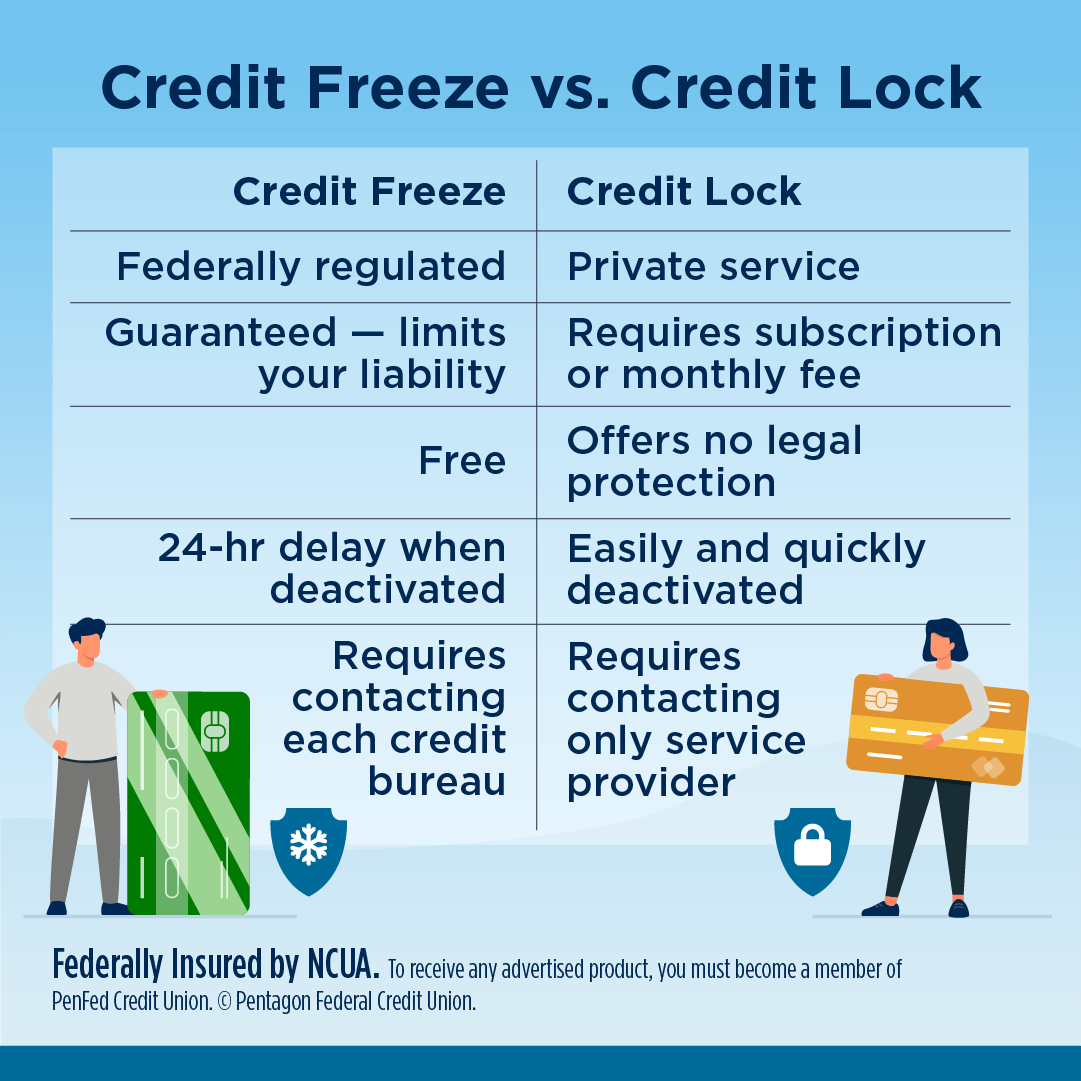

The names are similar and often used interchangeably, and both restrict access to your credit file. However, there are several key differences between credit locks and credit freezes.

For starters, a credit freeze is a federally regulated and guaranteed safeguard that must be provided without charge to anyone who requests one.

And because they're covered by law, if something goes wrong — for instance, if a credit account is somehow fraudulently opened in your name anyway — credit freezes will help to shield you from financial liability.

A credit lock, meanwhile, is an optional service offered by numerous private companies and credit monitoring firms, as well as the three main credit bureaus.

Credit locks usually require a monthly fee or subscription.

Credit locks usually require a monthly fee or subscription, and they're governed only by the contract between the issuing company and the consumer, which means there's no legal protection or clear-cut burden of liability if fraudulent activity occurs.

Generally speaking, it's easier to activate and deactivate a credit lock than to apply and remove a credit freeze. You can typically switch a lock on or off via the issuing company's website or with a mobile app using just your username and password.

Plus, unlike the delay of 24 hours when you freeze your credit and one hour when you thaw it, you can arm and disarm a credit lock instantaneously.

Generally speaking, it's easier to activate and deactivate a credit lock than to apply and remove a credit freeze.

The Takeaway

Deciding whether to ice your credit report temporarily or indefinitely is obviously a far weightier consideration than choosing between cooking something immediately or tossing it in the freezer until a later date.

When viewed through an all-encompassing prism of preservation, however, both credit freezes and coolers of any size are valuable devices that maintain the integrity of an investment. Short term or long, that should offer plenty of food for thought.

Explore Credit Card Options at PenFed

Discover the diverse offering of products, services, and support available to our members.