FINANCE

How to Build Credit Without a Credit Card

EXPECTED READ TIME: 5 MINUTES

Once you build good credit, a world of opportunity opens up, from better interest rates to big purchases like cars and homes. Good credit can even save you money on insurance and housing applications.

And while they can help you build credit, credit cards aren’t the right choice for everyone. Interest charges and fees can make them an expensive option, especially if you’re a young adult just starting out or just a regular adult with a lot of standing debt.

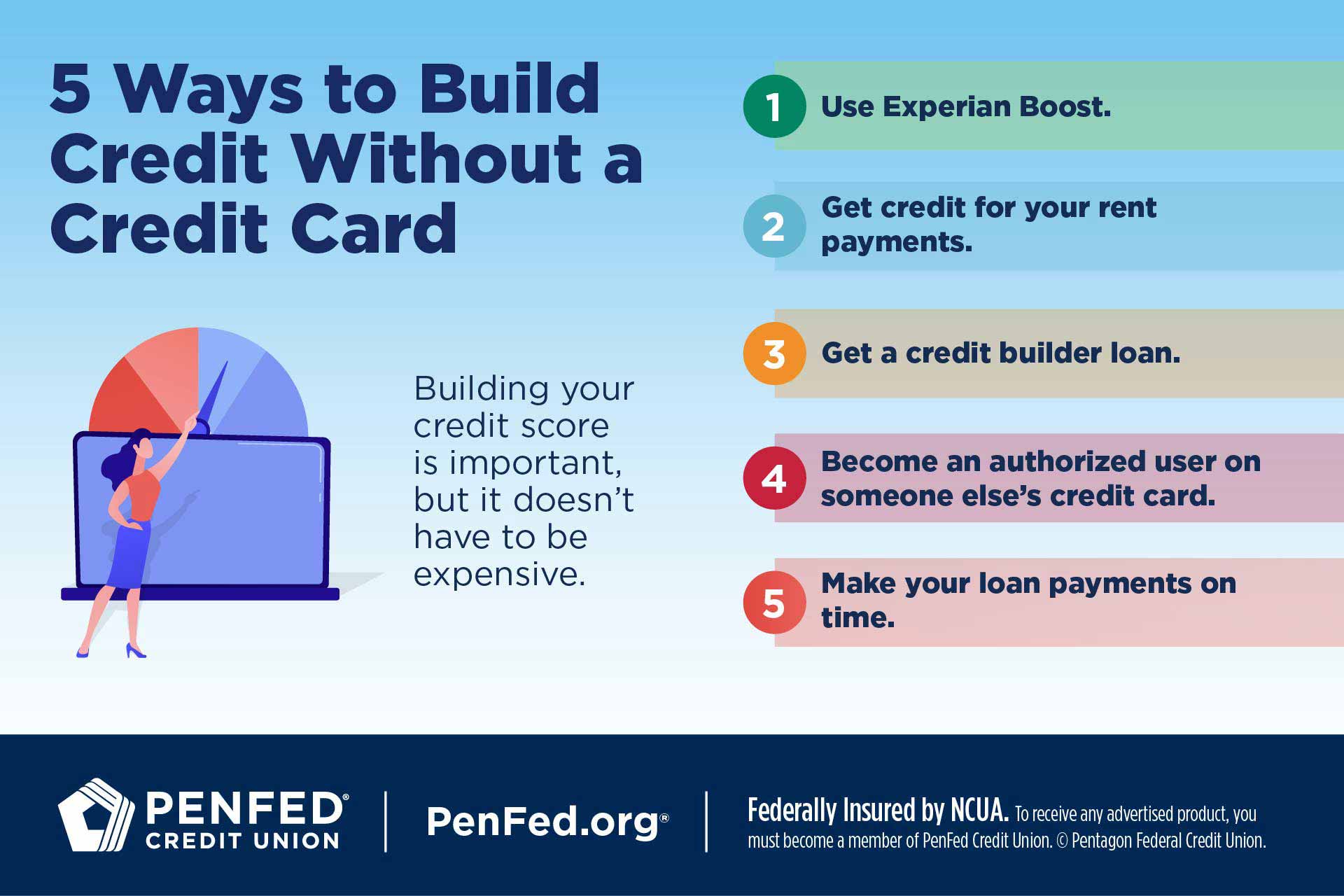

5 Ways to Build Credit Without a Credit Card

Thankfully, there are lots of great options for building your credit that don’t include applying for another credit card.

1. Use Experian Boost

You make lots of regular payments on things like your phone plan, internet, utilities, and other subscription services that don’t count toward your credit score. However, with Experian Boost, you can have these payments reported to your Experian credit report. Simply sign up, link your bank account, and Experian’s tool will comb through your charges, documenting any qualifying payments.

Your rent payments could raise your credit score by more than 40 points if you have a good payment record.

Experian Boost is a free service provided by the well-known credit bureau of the same name. To be eligible, users must have at least one active credit account, such as a credit card or personal loan.

2. Get Credit for Your Rent Payments

Most landlords don’t report rent payments to credit bureaus. This is a shame because reporting your rent payments could raise your credit score by more than 40 points if you have a good payment record.

You can always ask your landlord to use one of the many services that enable landlords to report rent payments. However, some landlords don’t want the hassle or fees that come with these services. Thankfully, you can also report your rent payments yourself using tools like RentBureau, PayYourRent, or eRentPayment. Just be sure to compare prices and make sure whatever tool you use reports your payments to all three credit bureaus.

Your rent payments could raise your credit score by more than 40 points if you have a good payment record.

3. Get a Credit Builder Loan

Taking out a loan will lower your credit score temporarily because opening new lines of credit drops your credit rating. However, the long-term improvement you’ll see from this type of loan will be worth the short-term drop in credit.

What Is a Credit Builder Loan?

Credit builder loans are designed for people with little or no credit history. While they don’t require borrowers to have a good credit score, you will still be evaluated and approved for a credit builder loan. During the approval process, lenders will consider any other debt you have and expect you to provide proof of income.

If you take out a credit builder loan, make sure you can easily afford your payments.

If you take out a credit builder loan, make sure you can easily afford your payments. Missing, late, or partial payments will damage your credit, not improve it. Also, make sure your lender is reporting your payments to all three major credit bureaus to get the maximum benefit.

Make sure your lender is reporting your payments to all three major credit bureaus to get the maximum benefit.

5. Make Your Loan Payments on Time

Making regular, on-time payments is one of the best ways to build credit. In fact, your payment history accounts for 35% of your credit score.

Keeping on top of loans you already have is a good place to start. Paying consistently on your student loans, personal loans, auto loans, and mortgage helps you build a strong payment history, increasing your credit score.

Making regular, on-time payments is one of the best ways to build credit.

How Long Does It Take to Build Credit Without a Credit Card?

Credit bureaus calculate your credit score using a formula. The formula considers factors like your payment history, credit mix, and how much debt you carry to determine how safe it is for lenders to loan you money.

It takes between three and six months of regular credit activity before credit bureaus can calculate a credit score for you. People with more loans will establish credit faster than people with fewer loans because credit bureaus receive information from each line of credit you have open.

However, opening too many lines of credit too quickly can also drop your score, so it’s important to be patient and diligent as you build credit. Once you’ve established a credit history, improving your credit score can be an ongoing part of your financial wellness habits.

The Takeaway

Building your credit score is important, but it doesn’t have to be expensive. If credit cards aren’t right for you, there are other options that can be just as effective. We always suggest making choices that fit with your current financial situation and long-term financial goals.

Learn More About Personal Loan Options at PenFed

Discover the diverse offering of products, services, and support available to our members.