CREDIT CARDS

Which Rewards Credit Card Is Right for Me?

What you'll learn: Learn to choose and use a rewards credit card like a pro.

EXPECTED READ TIME: 15 MINUTES

Think back to the last time you used your plastic money. Maybe it was for the cup of coffee you grabbed on your way to work, the groceries for a cozy weekend in, or last month’s electric bill. Or maybe, you topped up on gas ahead of a road trip. Now, think of those routine spends not just as expenses, but as tiny steps toward something bigger like a sun-kissed escape, an all-paid dinner in the city, or a brand new entertainment system….

Cue the rewards credit card!

Rewards cards are savvy tools designed help you build credit and fuel your aspirations — the big, the small, and the in-between. It’s also your card issuer’s way of incentivizing you to use their product, so make sure you always understand the rewards program’s terms and conditions.

The world of rewards is vast, with each card promising to enhance your spending power. This guide will help you get past the flashy marketing. We’ll look at different types of rewards and show you how to assess your spending habits so you can find the card that’s right for you.

What Is a Rewards Credit Card?

A rewards card is a credit card that incentivizes your spending (and encourages loyalty) by giving you something back for every dollar you charge. That “something” typically comes in the form of points, cash back, or airline miles. Essentially, it’s a way to make your plastic money work harder for you. It’s no wonder nearly three in four Americans have some form of rewards card.

How To Get a Rewards Card

You’re already envisioning the possibilities. So, how do you get your hands on a rewards card? The process of getting a rewards card is no different from that for a regular credit card.

Start with an assessment of your credit score and credit report. This tells you what your potential card issuer will see when they perform a hard pull. The higher your score, the better. However, if you’re not quite where you want to be, there are ways to turn that score up.

Next, go exploring. Sift through the array of options from credit unions, banks, or other reputable card issuers. Once you’ve found the one, it’s time to complete the application. In a few minutes or days, you’ll get the red or green light.

Ways to Earn Rewards

Now, let’s talk about the exciting part — how those rewards stack up. As mentioned, it all comes down to your everyday spending. With most rewards credit cards, you’ll earn a consistent stream of points or cash back on virtually every purchase you make. Let’s go into bonus points now (we’ll address “cash back” a little later).

Bonus Points

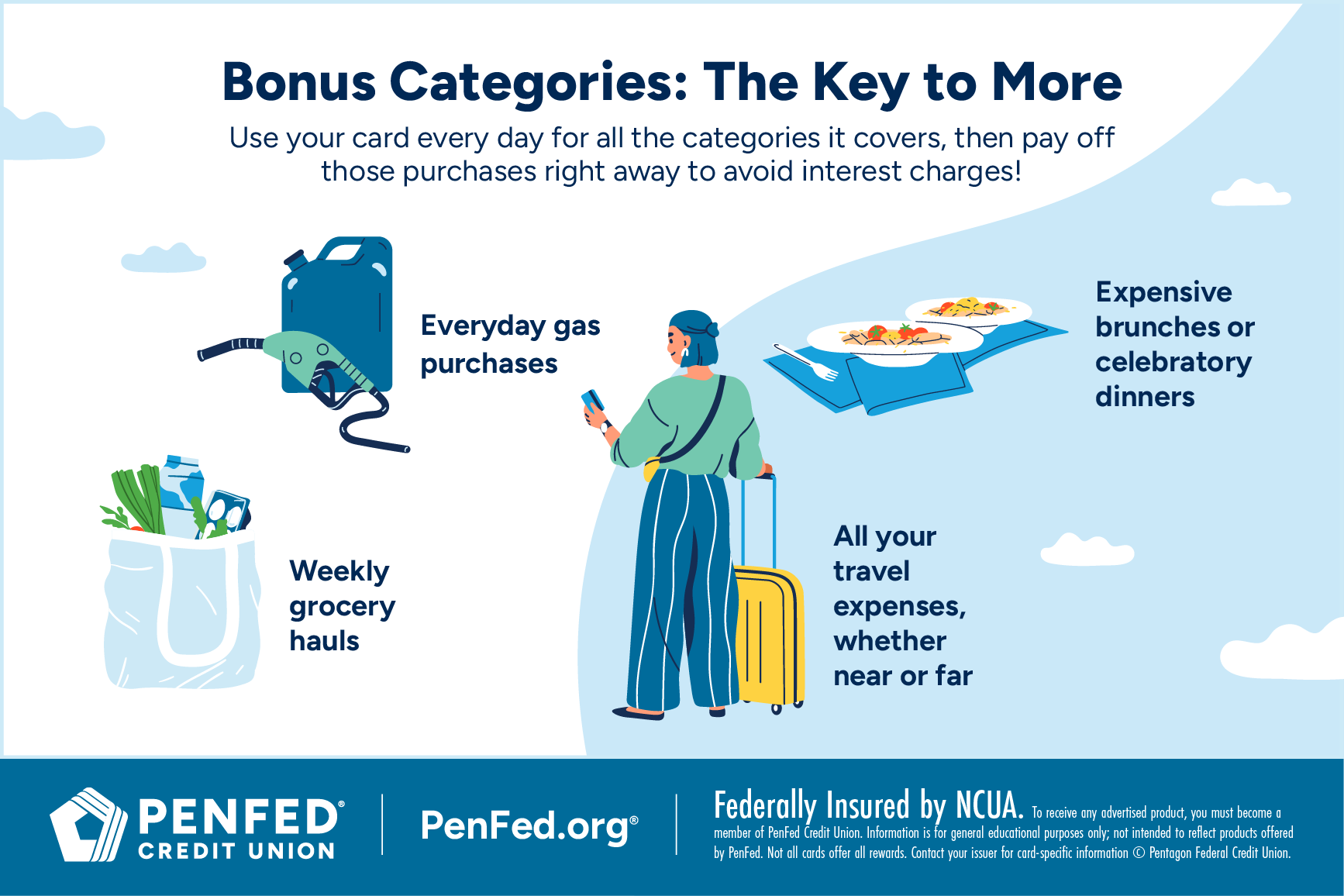

Many cards offer bonus points when you spend in specific categories. This is what we call a bonus category or points multiplier. Bonus categories usually align with your regular expenses, making it easy to boost your earnings. Here are the most common ones:

- Grocery shopping: Get extra points just by shopping for the essentials that keep your kitchen stocked and family fed.

- Car refuels: With cards offering more points or cash back at the pump, filling up your gas tank pays off (CHARGING).

- Dining out: Enjoying a meal at your favorite diner or trying a new eatery? Make those delicious moments even better with a card that offers bonus points at restaurants.

- Travel: Booking flights and hotels can unlock a higher tier of rewards.

Some card companies team up with big name retailers or services to reward you for being a loyal shopper.

- There’s more! Some card companies team up with big name retailers or services to reward you for being a loyal shopper. It’s like getting VIP treatment at your go-to spots.

- Upgrade your current card to a higher tier

- Transfer your balance to a new card

- Sign up for special programs or products like credit monitoring.

Benefits of Rewards Cards

Using your rewards card responsibly goes a long way. The everyday earnings allow you to pay down your card balance, try out new experiences, and more — all while building your credit.

Do more with your card!

Types of Rewards Credit Cards

The beauty of rewards programs lies in their variety. There’s a program for almost every spending style and financial goal. We’ve briefly touched on the different types of rewards. Now, let’s peel back another layer and look at the details of each one.

Cash Back Credit Cards

Here’s how these cards work — spend money and get a percentage back (usually between 1% and 5%). Some cards stick to a flat rate, like 2% cash back on everything you buy, while others offer tiered earnings based on the spending categories we discussed. So, for instance, a card might offer 3% cash back on gas and groceries and 1% on all other purchases. Now, let’s say you spend $500 a month on groceries and $200 on gas. With this card, you would earn $21 in cash back each month just for those categories. Over a year, that’s $252!

How we did the math:

(500 × 0.03) + (200 × 0.03) = $21 monthly cash back

21 × 12 = $252 yearly cash back

So, what can you do with that pocketed cash? Use it to pay a portion of your credit card balance, deposit it in your checking account or emergency fund, or do some online shopping. You earned it!

Wondering whether your cash back card has a spending cap or revolving categories? You’ll find the specifics in the terms and conditions.

Points Credit Cards

Spend a dollar, get a point — that’s the points card in a nutshell. While most people are familiar with this 1:1 structure, dollar-to-point ratios can vary between cards and issuers. Just like cash back credit cards, many points-based rewards programs allow you to earn even more points on specific spending categories. As an example, you might have a card that allows you to earn 4X points for every dollar spent on travel and 1.5X points for every dollar spent on groceries.

Be sure to read the fine print. That’s how you’ll know whether the multiplier (1.5X, 4X, etc.) is a standard card feature or limited time offer, and if it’s tied to a spending limit.

If you’re considering a points card, there’s one major thing to keep in mind. Just because you earn a point for every dollar you spend doesn’t mean that each point is automatically worth that. Points have their own unique value system determined by card issuers. They assign a specific monetary value to a certain number of points.

Just because you earn a point for every dollar you spend, doesn’t mean that each point is automatically worth that.

Let’s say you own a card where you get a point for every dollar you spend. Per card policy, every 10,000 points can be redeemed for $100 statement credit or cash back. That means the value of a single point is $0.01.

How we did the math:

100 ÷ 10,000 = $0.01

While a statement credit is better than nothing, this option doesn’t always give you the most bang for your points. To boost the purchasing power of your points, consider multipliers and alternative redemption options.

Ready to redeem? Try:

Transferring your points to a partner loyalty program

Booking a flight, hotel, or car rental and travel in style

Exchanging your points for gift cards to your favorite retailers, restaurants, or entertainment spots

Contributing to something meaningful by donating your points to a charity of your choice

Using your points to score merchandise (think electronics, household goods, and more) from a predetermined group of businesses

You can typically redeem those hard-earned points at any time, but sometimes, your issuer has a say (after a certain date or meeting a minimum redemption threshold).

Travel Rewards Credit Cards

These cards were made for frequent travelers. They allow you to earn points or miles that you can use to cover a range of travel expenses. The goal is to make travel smoother and affordable.

There are three main types of travel rewards cards — airline credit cards, hotel credit cards, and regular travel credit cards. Here’s how they compare.

A Closer Look at Travel Rewards Credit Cards

|

|

Airline Credit Cards |

Hotel Credit Cards |

Regular Travel Credit Cards |

|---|---|---|---|

|

Issuer |

Airline |

Hotel |

Banks and credit unions |

|

Earning Structure |

Miles/points, may offer bonus miles |

Points, may offer bonus points |

Points, may offer multipliers on travel and dining |

|

Redemption Options |

Free flights, upgrades, sometimes merchandise or gift cards |

Free stays, room upgrades, sometimes merchandise or gift cards |

Flights, hotels, car rentals, cruises, vacation packages. Redeemable via issuer’s portal or by transferring to partner loyalty programs. May also offer cash back |

|

Key Perks |

Free checked bags, priority boarding, in-flight WiFi and entertainment discounts |

Free stays, room upgrades, late checkout |

Travel insurance, baggage delay reimbursement, airport lounge access, no foreign transaction fees |

|

Peace of Mind Perks |

May include some form of travel insurance |

May include some form of travel insurance |

Offer robust travel and purchase protections |

|

Flexibility |

Miles/points must be used to book flights and upgrades with a specific airline and/or partner airlines |

Points must be used to book stays with a specific hotel or hotel chain |

Can use points to book flights with several airlines and stays at multiple hotels |

|

Annual Fees |

$0 to hundreds of dollars for elite cardholders |

$0 to hundreds of dollars for elite cardholders |

$0 to hundreds of dollars for elite cardholders |

|

Best For |

Frequent flyers of a specific airline |

Returning guests, business travelers |

People who value flexibility across travel brands and want several redemption options |

Disclaimer: Specific card rewards vary. Does not reflect actual product offerings from PenFed.

Similar to the value for points rewards cards, the actual value you get from each travel point or mile depends on the issuer’s point-to-dollar conversion and how you choose to redeem it. For example, 25,000 airline miles might get you a $300 flight, making each mile worth 1.2 cents.

How we did the math:

300 ÷ 25,000 = $0.012

Specialty and Co-Branded Credit Cards

When credit card issuers or networks join forces with retailers and other businesses, you get a co-branded credit card. Co-branded and specialty cards offer rewards and benefits tailored to specific interests, industries, and spending habits.

We’ve just gone over airline and hotel credit cards. Those are types of co-branded cards. It’s important to note that a store credit card is not the same as a co-branded card. The former limits spending to a single retailer, while the latter doesn’t.

And now, for types of specialty cards. A business credit card can be considered a specialty card if it offers the cardholder rewards for business spending, like cash back.

Interest charges from carried-over balances can quickly eat away at any rewards you might earn, so pay your card off every month.

How To Choose the Best Rewards Card for You

Now, it’s time to cut through the noise and get to the card that’s right for you. First, let’s home in on your spending habits and money goals.

Evaluating Your Financial Goals and Spending Habits

Do you typically pay off your credit card balance in full each month? If so, great. You’re in prime position to truly benefit from a rewards card. If not, it might be wise to get your existing bills and debts under control before adding another piece of plastic to the mix.

Here’s why — credit card issuers charge interest if you carry a balance from one billing cycle to the next. That interest can quickly eat away at any rewards you might earn.

Consider this example. You’re carrying a balance with a 24% annual percentage rate (APR) a month past the end of the grace period. This means the interest applied to your balance is 2%. If your rewards are less than that, you’re essentially losing money.

Here's how we did the math:

APR: 24%

Monthly Interest Rate = APR ÷ 12 months = 24 ÷ 12 = 2%

But there’s good news. Let’s say your card has a lower interest rate and higher rewards percentage. That higher rewards percentage could outweigh the interest if you occasionally carry a small balance for a short period of time. You’ve got to be strategic. To see pure profit, you’ll need to carefully track your expenses and commit to paying off the full balance as quickly as possible.

You can identify your primary spending categories by reviewing your bank and credit card statements or using a budgeting app or spreadsheet.

Next, set those goals! Ask yourself what’s important to you and what you hope to achieve with your rewards.

You can identify your primary spending categories by reviewing your bank and credit card statements or using a budgeting app or spreadsheet.

Compare Rewards Structures and Rates

When it comes to structures and rates, these are the questions you should be looking to answer:

- What is the standard rewards rate for all purchases?

- Are there any spending caps?

- What is the true value of your points or miles?

Consider Fees and Potential Costs

With any credit card, you need to be mindful of fees. Think about what you’re willing to commit to. As you narrow down your options, ask yourself:

- Can you afford the card’s annual fee?

- Would you have to pay foreign transaction fees if you travel internationally?

- What is the annual percentage rate (APR)?

Importance of Sign-Up Bonuses and Redemption Options

Many rewards cards give you a substantial bonus if you meet a spending requirement within a specific timeframe. This helps you accelerate your rewards game. Here’s how to determine if a card with a sign-up bonus is for you:

- Is the card’s sign-up bonus enough to get you a discount on that large, planned purchase?

- Based on your spending habits, will you be able to meet the spending requirement for the sign-up bonus before the offer expires?

Research redemption values for travel cards and read reviews before applying.

Maximizing Rewards and Benefits

So, you’ve found your match. Choosing the right card is just the beginning. The real magic happens when you use it strategically. Here are some tips to help you make the most of each swipe and tap.

For cash back rewards cards: Consider setting up automatic redemptions to ensure you’re consistently benefitting.

For points rewards cards: If available, add card offers to your account.

For travel rewards cards: Research redemption values and read reviews before applying for the card.

How to Manage Your Account to Avoid Common Pitfalls

Like with any other credit card, responsible usage should be your top priority. Practice these habits and you’ll get the most out of your rewards card while maintaining a good credit score.

- Pay your total balance: Aim to pay off your statement balance in full each month to avoid interest charges.

- Avoid late payments: Missing your minimum payment can lead to past due fees and damage your credit score. Set up automatic payments.

- Keep your credit utilization low: It’s tempting to go on spending spree when you get perks for each dollar you charge. But not all debt is good debt. And you want to keep your credit utilization at or below 30%. Any higher, and you could be harming your score.

FAQs

We’ve covered a lot about credit card rewards, but you may have a few lingering questions. We have the answers.

While the decision is up to you, it’s always best to go with a number that makes sense for your current financial situation and goals. If you can afford it and have made a habit of good money management, then it might make sense to have multiple — for example, one for everyday spending and rewards and another for emergencies. Note, the average American has between three and four cards. No need to hit this average if it pushes your credit utilization ratio out of control. Also be mindful of the 2/3/4 rule, enforced by many credit card issuers. It prevents you from applying for more than two new credit cards within a two-month rolling period, three cards within a 12-month rolling period, and four cards within a 24-month rolling period.

While some cards cater to those with fair credit, the most enticing ones tend to go to those with a solid credit track record and a good to excellent credit score (670 and above). Issuers want to know that you’ll be a reliable borrower.

While some cards cater to those with fair credit, the most enticing ones tend to go to those with a solid credit track record and a good to excellent credit score (670 and above). Issuers want to know that you’ll be a reliable borrower.

As of April 2025, the average rewards credit card interest rate is 24.14%.

Absolutely! Many card issuers offer bonus points or cash back for spreading the word and referring people.

Card issuers don’t typically provide a fixed value forever, but if they’re making changes, they’ll give you a heads up.

It depends on the card. But most cards allow you to keep your rewards as long as your account stays open and is in good standing.

You’ll likely lose them, so It’s best to plan ahead and redeem your rewards before closing the account.

Generally, the answer is no. As with a department store sale, discounts and special promotions only apply during a specific period of time.

The Takeaway

Before you dive headfirst into the exciting world of rewards, use this guide as your reality check. Remember the criteria for choosing a credit card. Determine what you qualify for, assess and adjust your spending habits, know what to expect in terms of fees and redemption options, and map out your plan to maximize your rewards. With all of these checked off, watch those regular outlays transform to meaningful returns.

Find the Right Credit Card for You

See the card options and rewards you could earn with PenFed.