CREDIT CARDS

Understanding Balance Transfer Cards

What you'll learn: Send debt on its way with a balance transfer credit card and savvy payoff plan.

Expected Read Time: 14 minutes

Understanding Balance Transfer Cards

Maybe you splurged on a new smart fridge, just enrolled your little one in daycare, or had unexpected car repairs that have thrown your budget off track. Now, you’re facing what feels like a mountain of debt. You’re chipping away at the principal each month, but it feels like you’re barely making a dent.

The interest alone is a beast.

Then, you hear about balance transfers — a chance to move your high-interest debt to a new card with a tempting 0% introductory annual percentage rate (APR).

You’ve got questions. Is this your ticket to financial freedom or are you about to step into a debtor’s quicksand? How does a balance transfer compare to taking out a personal loan?

We’re here to walk you through all the details so you can decide if a balance transfer credit card is right for you.

What Is a Balance Transfer?

Taking advantage of a balance transfer can be like hitting the reset button on high-interest debt, giving you an opportunity to pay it down more efficiently. All it takes is moving that debt from your existing card to a new one.

While mostly used for credit card debt, balance transfers can also be used to pay down balances on personal loans, auto loans, or home equity lines of credit (HELOCs) if the lender allows it.

How Balance Transfers Work

A credit card balance transfer does two things:

- First, it consolidates your scattered high-interest debt into a single account, making monthly payments a lot simpler.

- Second, it reduces the burden of high-interest rates, replacing them with a low or 0% APR, usually for a defined period. The result? You end up paying less on your debt over time.

Benefits of Using Balance Transfer Cards

Let’s walk through a scenario to bring the benefits of a balance transfer to life.

You have three credit card bills:

- Card A has a $3,000 balance and 24% APR

- Card B has a 2,500 balance and 22% APR

- Card C has a 1,500 balance and 20% APR

Your monthly payments on your $7,000 balance are barely touching the principal and interest is piling up. Luckily, you’ve been approved for a new credit card with a 0% intro APR for 15 months. It has a balance transfer fee of 3%.

What positive changes can you anticipate with transferring your debts to the card?

- Interest on hold For 15 months, all payments you make go toward your principal, giving you a window of interest-free calm. Imagine that wasn’t the case — say you were to pay off card A’s balance over the same 15 months but with the regular APR. That’s just over $1,000 in interest charges for one card.

How we did the math: First, we used a credit card payoff calculator to calculate how much interest you’d pay on each card if you paid them off over 15 months at their current interest rates:

Card A: A balance of $3,000 at 24% APR would require a payment of $233 to pay it off in 15 months. You would pay a total of $502 in interest.

Card B: A balance of $2,500 at 22% APR would require a payment of $192. You would pay a total of $382 in interest.

Card C: A balance of $1,500 a 20% APR would require the payment of $113. You would pay a total of $207 in interest.

Your total interest would be $502 + $382 + $207 = $1,091

- Potential interest savings: A 3% fee on a balance of $7,000 results in a transfer fee of 0.03 × $7,000 = $210. If you pay off your entire balance on the transfer card after 15 months, your net interest savings would be the difference between the foregone interest and the balance transfer fee, which would be $1091 – $210 = $881.

- Accelerated debt payoff: With a minimum monthly payment of $467, you could be credit-card-debt-free by the time the 15 months are up. if interest were in the picture, that might not be as feasible.

How we did the math: 0% interest means that we can just divide the total debt by the number of months: $7,000 ÷ 15 months = $467/month.

- Potential credit score boost: Once you consolidate your debt, you’ll no longer be using a high percentage of the available credit on various cards. This could be good for your credit utilization ratio, which factors into your overall credit score.

- Sound financial planning: The no-to-low interest grace period will give you time to create (or refine) your budget and establish healthy money habits — and maybe even build your emergency fund.

Low Introductory APR

APR is essentially the total cost of borrowing money for a year, expressed as a percentage. The APR you chalk up on your credit card balance is essentially the interest rate. For mortgages and some other types of loans, however, APR often factors in both the interest rate and any other fees, giving you a clearer picture of what you’ll pay annually.

Since they are listed separately, paying attention to credit card APRs and fees is essential when you’re applying for any credit card, but especially for balance transfer credit cards, as it will help you avoid unexpected costs down the line.

Make sure you understand if the low or 0% APR on your new balance transfer card only applies to the amount you’re moving over, or if it also applies to other new balances. If your balance transfer offer comes with a card that you already possess, know that it won’t apply to any existing balance at the time you accept the offer. So, you will need to continue to pay that down, along with the newly transferred balance. In this case, it’s like scoring a special, limited-time discount when you sign up for a monthly subscription service.

After Your Introductory APR Ends

When the introductory APR (also called standard or regular APR) comes around, any remaining balance will be charged the standard or regular APR. you’ll incur just like a subscription box going back to its regular price, plus any add-ons.

As of 2024, the national average APR for all credit cards is nearly 25%, and about 23% after the intro period for 0% APR balance transfer cards. Remember, these are just averages — you may be able to find better deals. It all depends on what your credit looks like.

Pro tip: Need to pay for a bill, buy a gift for a loved one, or snag an item from your wish list? Don’t go swiping your new card unless you can confirm that the 0% APR promotion applies to purchases made during the intro period. It sometimes doesn’t.

Variable APRs

Some card issuers use a variable APR, which means it can change based on market conditions, your creditworthiness, or prime rates. Prime rates are the interest rates that banks charge their most creditworthy customers, and it’s often used as a benchmark for other interest rates. So, when the prime rate goes up or down, your credit card’s post-introductory APR might change too.

Also be aware of any penalty APRs, which can be triggered by late payments or other violations of the cardholder agreement. Some lenders may apply penalty rates as high as 29.99%.

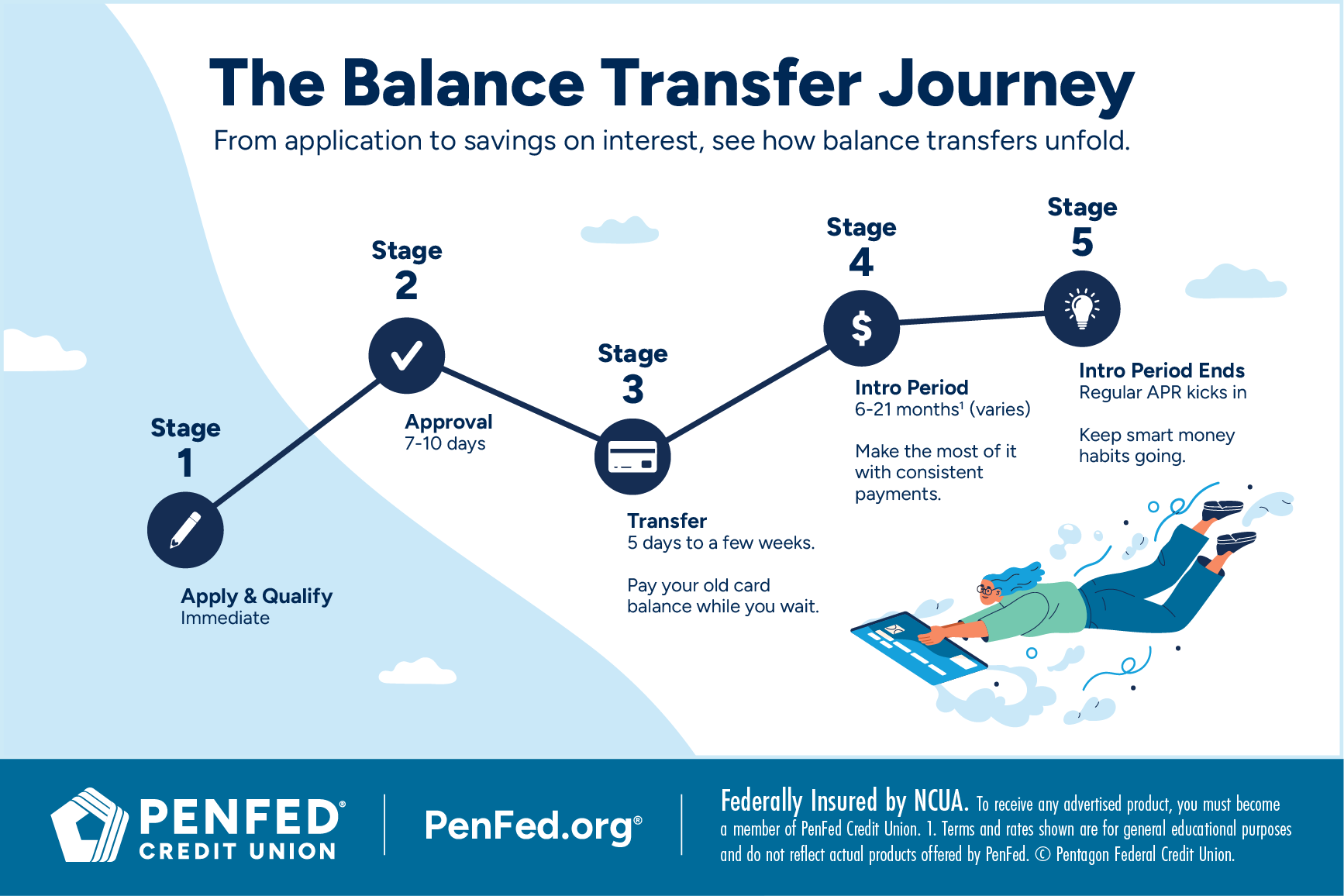

How to Complete a Balance Transfer

You’ve been thinking about a balance transfer, maybe even browsing some offers. Things are looking promising, then you hit a wall of fine print and numbers. It’s enough to make your eyes glaze over. While overwhelming, the actual how-to of a balance transfer is fairly straightforward and similar across lenders.

Here’s a step-by-step of how to secure your balance transfer card.

Steps to Perform a Balance Transfer

- Check your credit score: Your score is your VIP pass to the best deals. It determines the types of cards and offers you’ll be eligible for. You can usually snag a free peek of your score through your bank, credit union, or current credit card issuer, or go with a full report from any of the three major credit bureaus. Pore through and fix any errors. If your score isn’t high enough to land the offer you want, take some time to work on it. Lenders usually reserve the best offers for borrowers with a FICO score of 690 or higher.

- Research balance transfer credit card options: Don’t jump at the first card you see. Have your old credit card statements handy and get to crunching the numbers. The goal is to save on interest with either an unbeatable introductory APR, low transfer fees, or a long enough term to give you some breathing room. Use a free online balance transfer calculator or a card-specific balance transfer calculator from a trusted financial institution to help you find the card that will do that for you.

- Apply for the one: The process of applying for a balance transfer card is the same as applying for any other credit card, so it’s essential to master the strategies that will increase your chances of qualifying. Some lenders will let you request a balance transfer as part of the application process, while others require you to request a transfer after you’ve been approved.

- Request your balance transfer: You’ll need the account numbers, exact amounts, and issuer information for the balances you plan to move. Continue paying off your old credit card(s) until your transfer is complete.

- Begin paying your new card: Verify the balance went through smoothly. Your old card(s) should show a zero (or lower) balance, and your new card should reflect the total transferred amount plus any transfer fees. It could take anywhere from five days to a few weeks before your balance transfer is complete. Set up alerts to track changes to your credit accounts.

If at any point terms and conditions become too much to digest or decipher, get a second pair of qualified eyes.

Common Mistakes to Avoid During the Process

While you may be going interest-free for a couple of months, there are still potential pitfalls to look for with balance transfers. Avoid these first-timer mistakes so you can make the most of your transfer:

- Neglecting terms and conditions: Ignoring the terms and conditions is like trying to build furniture without reading the instructions. You might end up with a wobbly mess. Pay attention to key details like transfer fees, term length, and the standard APR. Ranging from 2-5% of the total transferred amount, balance transfer fees are not something to ignore. Treat any fees like shipping costs, factoring them into the overall price.

- Overestimating the credit limit: You can do the work to get your credit score in tip top shape, but lenders call the shots when it comes to credit limits. When you’re transferring debt, you’ll want to find a card that allows you to move all or most of your debt. Don’t panic if that’s not an option. There are other ways to combine and crush your debt,.

- Assuming issuer flexibility: You can’t move debt between two cards from the same creditor. For example, if you have a balance on a Chase card, you’ll need to look elsewhere —

- Missing the transfer deadline: Transfer windows vary from one lender to another. Make a note of this detail in the research phase and set up an alert upon approval, so you don’t lose out on the introductory offer.

- Going beyond the introductory period: The 0% (or low) APR period is like a get-it-now sale. You have to act before it’s gone. Going beyond the designated number of months sticks you with a high-interest rate that might be the same as the one you tried to avoid in the first place.

- Paying less than you can afford: While low introductory APR offers take away some of the stress of repayments, you have to be strategic. The required minimum payment on an intro offer is not designed to pay off your balance at the end of the intro period. If you only pay that minimum, your remaining balance when the period ends will be subject to a higher rate of interest. Don’t lose sight of the bigger picture — the one where your debt is behind you. If you can shell out even more than the amount required to pay off your balance before the intro APR ends, go for it.

- Making late payments: A low APR doesn’t absolve you of late fees. Automate payments to stay in the clear.

- Accumulating additional debt: Swiping your old credit card defeats the purpose of a transfer and can get you into a deeper hole. Stick to your payment plan and budget.

A low APR doesn’t absolve you of late fees. Automate payments to stay in the clear.

Choosing the Best Balance Transfer Credit Card

The balance transfer credit card ads keep popping up, catching you halfway through your social scroll. You take it as a sign to start comparing offers, but where should you start and what’s most important? We’ll answer these questions in the next few sections.

Comparing Balance Transfer Offers

Low APRs and long introductory periods are the major selling points of balance transfer cards, making them key considerations when you’re narrowing down your options. However, there are some additional card features and factors to keep in mind.

- Regular APR: Your debt may go away after the introductory period, but the card sticks around. So, when you’re comparing offers, look beyond the now. Consider cards with a standard APR that makes sense for your future spending habits. Some balance transfer cards have higher-than-normal APRs that can take you right back to square one. See if you can find a card with an APR that sits around or is less than the national average APR for credit cards.

- Annual fees: Some cards charge an annual fee, like a recurring subscription. If you don’t mind them, then great. But if not, go back to the drawing board.

- Rewards and perks: It’s less common to find cards that offers rewards on transferred balances, but if you do, it’s a great way to earn cashback or travel points. You can also customize your search to include cards that reserve rewards for new purchases. Keep in mind that rewards cards can be more expensive than other types of credit cards. Some people earn enough rewards to offset this extra cost, but you’ll need to know how to maximize your rewards points to do that. You’ll also need to manage your debt carefully to avoid the pressures of high interest and slow progress toward your money goals.

- Customer service: What happens if something goes wrong with the transfer, or you lose your card? How easy is it to get someone on the phone to help? Quality customer service can make a real difference.

When you’re comparing offers, consider cards with a standard APR that makes sense for your future spending habits.

What to Look for With Balance Transfer Fees

Transfer fees are almost always a part of the balance transfer deal. Here are some factors that make some fees different from others:

- Percentages: As mentioned, most balance transfer fees are calculated as a percentage of the amount you’re transferring. While a 2-5% charge might seem small, it can add up quickly for larger balances. For example, a 3% fee on a $5,000 transfer is $150. Ask yourself: Are the interest savings worth the upfront cost? To answer that, calculate how much time it would take for the savings to offset the fee.

- Fixed fees: Some cards have minimum or flat fee amounts. This might be most useful for those transferring very large balances. Consider this: A card with a $10 minimum fee might not be ideal for a $200 transfer but might make sense for a higher amount.

- Promotional waivers: Keep an eye out for cards that waive balance transfer fees as part of the promo offer. You can’t go wrong with that.

A consolidated account lowers your credit utilization ratio.

Top Recommendations Based on Consumer Needs

There’s a whole world of balance transfer cards out there, and every issuer claims theirs is the best. You can also find several roundups of popular balance transfer cards online, but these lists tend to go out of date quickly.

Instead, focus on what truly matters — matching your needs to the right type of card.

- If you have a large balance to transfer, then the best card for you will be one with a high credit limit.

- If you’re laser-focused on minimizing upfront costs, then the best card for you is the one with the lowest possible balance transfer fee, or even better, one that waives it altogether.

- If you value peace of mind, then the best card for you will be one from a reputable lender with excellent customer service.

- If you’re in a tight spot because of an emergency and need time to get back on your feet, then the best card for you is one with a longer introductory period (upwards of 18 months).

- Life happens. If you’re not sure you’ll be able to pay off your balance before the introductory APR window closes, then the best card for you is one with a reasonable standard APR.

How Does a Balance Transfer Card Impact Your Credit?

Sure, you want to get rid of your debt, but you don’t want to jeopardize the thing that gets you a line of credit in the first place.

Balance transfers can boost your credit score or knock off a few points. It all depends on time. In the short term (the weeks following account opening), it will drop. Here’s why: As part of the approval process for your new card, you’ll undergo a hard credit inquiry, which could cost you up to 10 points. A new credit card account also affects the average age of your accounts — the lower that is, the greater the likelihood of losing a few points.

But if we’re talking long-term (months down the line), you can anticipate the opposite. A consolidated account lowers your credit utilization ratio, which you’ll want to keep between 10% and 30%.

Pro tip: Once you open your new balance transfer credit card, keep your old card account(s) open. Closing accounts can hurt your credit score.

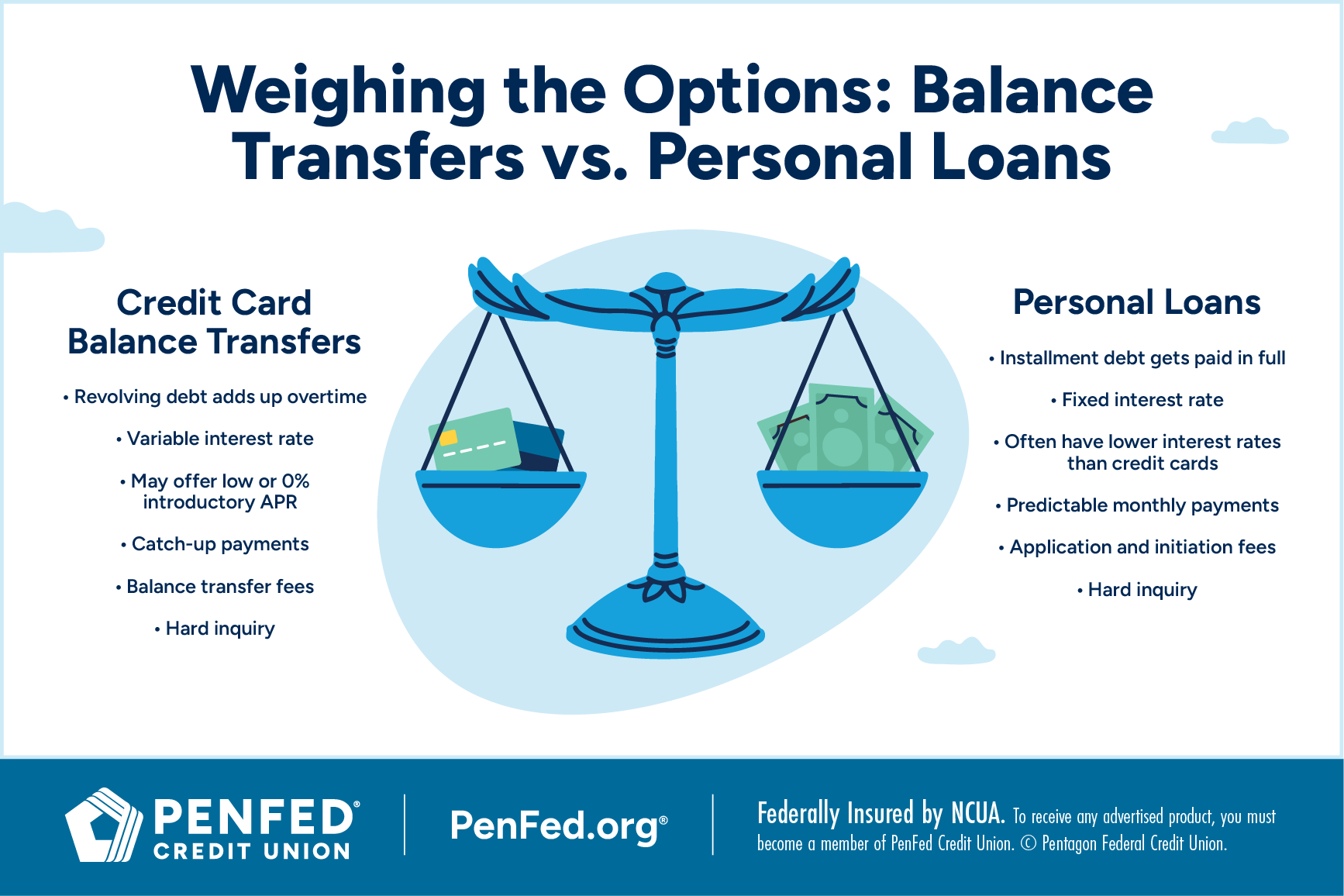

Balance Transfer or Personal Loan: Which Is Better?

One common alternative to a credit card balance transfer is a personal loan, but how does it stack up against the former? Compare features between the two using the information below.

Let’s think it through with a scenario: Imagine you’ve got $10,000 in credit card debt between two cards, both with APRs hovering around 22%.

You’ve tightened your budget to free up an extra $500 a month to put toward debt. You also recently received a bonus at work and are expecting a payout from a small side hustle you’ve been building over the past few months.

Your two options for low-interest debt repayment are:

- A personal loan with a 12% fixed interest rate and 24-month term.

- A balance transfer card offering a 0% introductory APR for 21 months, with a 3% balance transfer fee.

You realize you can realistically pay off the entire $10,000 within 21 months if you keep to your plan, making the balance transfer the clear winner for you.

Factors that influenced the decision:

- Sticking to your personal goal: While the personal loan offers monthly payments of $471, you’ve committed to $500. That extra $29 per month accelerates your payoff, allowing you to eliminate the balance a little bit faster than the personal loan’s fixed schedule.

- A funding boost: The work bonus and side hustle earnings provide a lump sum to kickstart repayment that would help with the payoff schedule for either scenario, but favors the balance transfer option.

How we did the math: We used a debt payoff calculator and credit card payoff calculator, respectively, plus a little arithmetic:

$471 personal loan payment: A balance of $10,000 at 12% APR would require a payment of approximately $471 to pay it off in 24 months.

$500 credit card balance transfer payment:

A balance of $10,000 at 0% APR and a balance transfer fee of 0.03 × $10,000 = $300 yields a total of $10,300.

With a payment of approximately $500, that could be paid off 21 months: $10,300 ÷ $500/month = 20.6 months, which rounds up to 21.

- Fees vs. interest savings: We used the calculators mentioned above to figure out the interest on the current card and personal loan. Even with a balance transfer fee of 3%, the interest savings make sense. :

Current card: With the regular 22% APR, you would pay approximately $4,428 in interest over 21 months.

Personal loan: With a 12% interest rate you would pay about $1,298 in interest over 24 months.

Balance transfer card: A 3% transfer fee on $10,000 means you’d pay Ultimately, the $300 transfer fee lets you keep more money in your pocket than paying interest on either of the first two options, as long as you pay off the balance in 21 months.

- Payment flexibility: While personal loans offer predictable payments, you may not be able to get around the strict schedule. An attempt to speed up repayments could stick you with an early payment penalty. That’s not the case with balance transfers.

When a personal loan might be better:

- Longer repayment needs: If you needed more than 21 months to pay off the debt, the 24-month personal loan would be the way to go.

- Large debt: If you have a very large amount of debt — say twice the amount in the scenario — a personal loan could be a better option. There are no transfer limits, and you could get an interest rate that’s lower than the average standard APR for balance transfer credit cards.

Pro tip: Find creditors that allow you to check rates without a hard pull of your credit report.

Once you open your new balance transfer credit card, keep your old card account(s) open.

Frequently Asked Questions

Ready to choose your card? These questions can help you seal the deal.

A balance transfer can be a smart and convenient way to tackle high-interest debt, but it’s not a one-size-fits-all solution. We’ve discussed the key factors to consider, like transfer fees and APRs. Do some or all of the benefits make sense for your current situation? Do a deep dive, then decide.

Apart from securing the card that suits your needs, having a solid plan and budget is the way to make the most of your balance transfer. Know your payoff timeline, always make on-time payments, and if you can increase payments some months, then do that. Be sure to keep this guide handy in case you have questions along the way.

You can’t move debt between cards from the same lender, but you can transfer it to your lowest APR card from a different issuer. Some issuers require credit approval for a balance transfer to an existing card. If not, you may be able to avoid a hard credit inquiry by going this route, and the average age of your accounts will stay the same. However, taking this route will increase the credit utilization ratio for that transfer credit card, potentially bringing down your credit score.

Credit score is the umbrella term for any number that sums up your creditworthiness. Your FICO score on the other hand, is a specific type of credit score created by the Fair Isaac Corporation — and it’s the one lenders love to see. It encompasses your payment history, how much you owe, credit age, any new credit, and your credit mix.

As of March 2025, the average APR for a personal loan sits at 12.37%.

The Takeaway

Remember, a balance transfer is just one part of a savvy plan to take control of your finances. Review your budget, check your spending, and prioritize paying down your balance. And just like that, you’ll be one step closer to a debt-free future!

Go Debt-Free with the PenFed Gold Visa® Card

Give up high interest and get to your goals faster with 0% APR for 15 months.