Personal Loan

Personal Loan Basics: The Basics to Borrowing Money

What you'll learn: What a personal loan is and how it works

EXPECTED READ TIME: 9 MINUTES

If you need money, a personal loan is one of the easiest, most common ways to borrow. Getting a personal loan takes some thought and planning, so here's a comprehensive guide to help answer all your personal loan questions.

What We'll Cover

What Is a Personal Loan?

A personal loan is a type of installment loan, which means you borrow a lump-sum amount of money and repay the loan over a set number of monthly payments.

Most personal loans have a fixed interest rate, meaning the rate and the amount you pay each month stays the same throughout the life of your loan. There are options for a variable rate as well, which can change over your loan term.

Generally, personal loans are ideal when you need to pay for one-time expenses and have a basic idea of how much money you need to borrow. A personal line of credit might be a better option if you want a source of money you can draw from as needed.

A personal loan is a type of installment loan, which means you borrow a lump-sum amount of money and repay the loan over a set number of monthly payments.

Types of Personal Loans

Personal loans can be secured or unsecured, although most tend to be unsecured.

Secured Personal Loans

A secured personal loan is money you borrow from a lender that can be used for expenses such as home improvement and renovation projects or car repair costs. You can provide cash assets, such as savings accounts or certificates, or property, such as your home or vehicle, as collateral.

Unsecured Personal Loans

You can apply for an unsecured personal loan through a lender, and you don't have to provide collateral to secure the loan. This type of loan can go toward most expenses, such as consolidating debt or upgrading your home.

Personal loans can be secured or unsecured, although most tend to be unsecured.

How Does a Personal Loan Work?

Once you’re approved by your lender for a personal loan, the lump-sum amount will be deposited into your bank account. Most often, borrowers repay personal loans by making fixed monthly payments over the life of the loan, known as the term.

Terms

Lenders offer different terms, but the length of a personal loan typically ranges from 1 to 10 years.

Interest Rates

You can select a fixed interest rate option for your personal loan, which again, means the rate won't change throughout your loan term. Here are some points to consider:

- The average personal loan interest rate for borrowers with good credit is 12.35%.

- Since unsecured personal loans don't require collateral, their rates tend to be higher than rates for other types of loans.

- A lower monthly payment with a longer term may seem like a better deal, but you'll pay more in interest throughout the life of your loan.

Crunching some numbers with a loan calculator can help you figure out your monthly payment options.

What Can a Personal Loan Be Used For?

One of the greatest benefits of a personal loan is that the money can be used for nearly anything. Here are some of the most common uses:

Debt Consolidation

If you have high-interest debt, such as credit cards, you might take out a debt consolidation personal loan. By combining your debts into a single debt with a new loan, you may be able to lower your monthly payments and the amount of interest you pay throughout your loan term.

See debt consolidation loan details.

Home Improvements

When it comes to home improvements, personal loans are typically used for quick repairs or large home renovation purchases, such as a new furnace, roof, or water heater. Personal loans are ideal in any home improvement scenario in which you need money fast because many lenders distribute funds within a couple days.

See home improvement loan details.

Weddings and Vacations

Life events such as weddings and travel plans are meaningful milestones, but they often come with a hefty price tag. Taking out a personal loan to cover these kinds of costs can help break down big expenses into manageable payments.

Family Planning

There are many ways to grow a family. Personal loans can help you spread out the cost of expanding yours, whether you’re expecting, adopting, or going through IVF.

Personal loans can help you spread out the cost of expanding your family, whether you’re expecting, adopting, or going through IVF.

Medical Bills

It's no secret that many people struggle to cover the cost of medical and dental bills. A personal loan is a simple way to handle those bills over time.

Where Can I Get a Personal Loan?

You can apply for a personal loan through a credit union, bank, or online lender.

Credit Unions

- Not-for-profit and member-owned, credit unions may offer personal loans with lower rates and fees than other lenders.

- Credit unions may be more flexible about approving personal loans for borrowers with fair or poor credit.

- To qualify for a loan, you must become a credit union member.

Banks

- Not all banks offer personal loans, so ask a bank representative about their offerings.

- A bank may provide a larger loan amount.

- You often need good credit to qualify for a personal loan through a bank.

Online Lenders

- Online lenders may be more lenient than some banks when it comes to loan qualifications.

- Online lenders may offer more accommodating payment schedules, waived fees, and a quicker application process.

- You need to be comfortable applying and managing your loan completely online.

To find a loan with the rate and term that work best for you, make sure to shop around so you can compare offerings from different lenders.

Shop around and compare different lenders to find the rate and term that work best for you.

How to Qualify for a Personal Loan

When you apply for a personal loan, lenders consider general qualification factors such as your credit score, credit history, verifiable income, and debt-to-income ratio.

Credit Score

Although qualifications may vary by lender, a credit score of 580 is typically the minimum score you need to qualify for a personal loan. Some institutions have either higher or lower minimums, but keep in mind that having a higher score may also help you get a lower interest rate.

Checking your credit through one of the top three credit bureaus — Equifax, Transunion, and Experian — is free and won't affect your credit score.

Verifiable Income

Providing income verification documents can help assure a lender you'll be able to repay your loan. Common documents to present include:

- Pay stubs (preferably your most current one and a few previous ones as well)

- Bank statements

- Most recent W-2 form

Debt-to-Income (DTI) Ratio

A debt-to-income ratio is calculated by dividing your total monthly debts by your gross monthly income. Lenders use your DTI to gain a better sense of whether you'll be able to make monthly payments to repay your loan.

For example: monthly debts ($1,500) / gross monthly income ($5,000) = 0.3 or 30%

A DTI ratio of 36% is considered good. You can use a debt-to-income ratio calculator to find your DTI.

A debt-to-income ratio is calculated by dividing your total monthly debts by your gross monthly income.

Cosigner

If you don't qualify for a loan because you either have poor credit or little-to-no credit history, you may want to find a cosigner. A cosigner agrees to take legal responsibility for loan repayment if the primary borrower isn't able to make the payments.

Overall, keep in mind that loan qualification factors vary by lender.

Common Personal Loan Fees to Know About

Taking out a loan often requires you to pay certain fees. Personal loan fees may vary by lender, but here are some common ones to be aware of:

Common Personal Loan Fees and Their Costs

Below is a list of typical fees for a personal loan. This data comes from LendEDU and is current as of April 2024.

|

Fee Type |

Industry Average Cost |

|---|---|

|

Application fee |

1-8% |

|

Loan origination/loan processing fee |

1-10% |

|

Prepayment penalty |

1-2% |

|

Late payment fee |

$10-100, or 5% of your monthly payment |

|

Non-sufficient funds (NSF) fee |

Some fees are required, but you may want to talk to your lender to find out which fees may potentially be waived.

Talk to your lender to find out which fees may potentially be waived from your loan.

Personal Loan Alternatives

It’s just as important to compare borrowing options as it is to compare lenders. Different ways of borrowing will impact your finances differently. Here are some alternatives to personal loans you might consider:

Personal Line of Credit

- Revolving credit that you can draw from as needed

- Ideal for short-term expenses

- Borrow only as much as you need, and only pay interest on the amount you borrow

Home Equity Line of Credit (HELOC)

- A secured loan that uses your home as collateral

- Carries a lower interest rate because it’s secured

- Offers larger amounts of money than most personal loans

Credit Card

- Revolving credit you can use as needed

- Carries a higher interest rate than other borrowing methods

- May offer rewards like cash back or points

Payday Loan

- Banned in some states for predatory lending practices

- Carries very high interest, expensive fees, and high penalties

- Must be repaid in 2-4 weeks

- Easy approval

It’s just as important to compare borrowing options as it is to compare lenders.

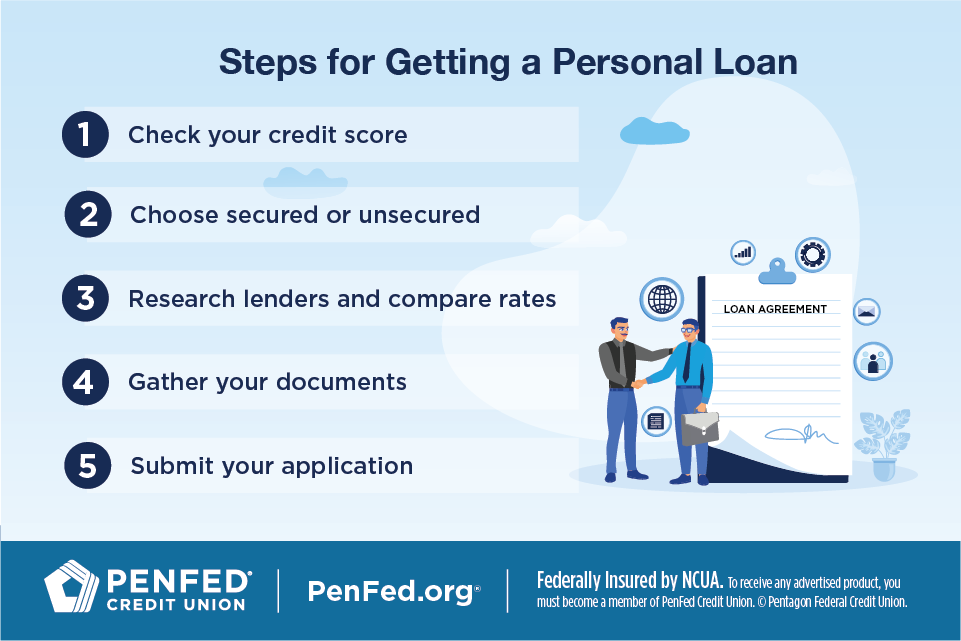

5 Steps to Getting a Personal Loan

Here are five quick steps you can take when applying for a personal loan.

1. Check Your Credit Score

When you apply for a loan, lenders will check your credit score to assess whether you'll be able to pay back the money you borrow.

Here's a breakdown of score ranges:

- 800+: Excellent

- 740-799: Very good

- 670-739: Good

- 580-669: Fair

- Under 580: Subprime

Some lenders will accept a minimum credit score of 580, but qualifying scores will vary by lender. You may want to find a cosigner if you don't have much credit or have a subprime credit score.

You may want to find a cosigner if you don't have much credit or have a subprime credit score.

2. Choose Secured or Unsecured

Decide whether you're most comfortable with a secured loan, which must be backed by collateral, or an unsecured loan. Lenders consider unsecured loans to be riskier, so their interest rates are typically higher than those for secured loans.

3. Research Lenders and Compare Rates

Take the time to research lenders and find the best rates and terms for your situation. Read online reviews to make sure the lenders you’re considering are reliable and upfront with fees. Explore your options by researching different types of lenders, including:

- Credit unions

- Banks

- Online lenders

Then run different rates and terms through a loan calculator to estimate your payments so you can decide what works best for you.

When you've finished your research and you're ready to apply, have verification documents on hand.

4. Gather Your Documents

When you've finished your research and you're ready to apply, having verification documents on hand will make the application process smoother for you. Common documents include:

- Proof of employment (pay stubs, bank statements)

- Driver's license

- Proof of residence

- Social Security number

- W-2 forms

5. Submit Your Application

Review the loan terms and conditions, and if you're on board with everything, apply! If you're officially approved, you'll need to accept the terms and you'll receive your funds within a week.

Note that applying for a loan requires a hard credit inquiry, which may affect your credit score. Thankfully, making on-time payments can help you build back your credit.

The Takeaway

There are plenty of options for borrowing money, and a personal loan is a great choice if you have a general idea of your costs and like the consistency of fixed payments. Now you have the tools to choose the personal loan you need to achieve your goals!

Learn More About Personal Loans from PenFed

Discover the diverse offering of products, services, and support available to our members.