FINANCE

Financial Tips for Non-Traditional College Students

What You’ll Learn: Excel in school and at work and manage student debt wisely.

EXPECTED READ TIME: 12 MINUTES

The alarm buzzes. Another day begins. You’re brewing your morning coffee, checking on the kids . . . and putting the final touches on your mid-term project before hitting “Submit.”

Whether you’re changing fields, returning to school after a long break, or planning to be the first in your family to claim the title of doctor, pursuing a degree is a monumental life shift. It’s exciting, but it can also feel like walking a tightrope — with a stack of textbooks in one hand, a pile of bills in the other, family responsibilities on your shoulders, and work deadlines looming.

Can you master this act?

Of course, you can! This guide tells you how. Here’s our roundup of smart money moves to help non-traditional students get through school without letting their finances fall behind.

What Is a Non-Traditional Student?

So, who exactly falls under the non-traditional student umbrella? You might be a non-traditional student if you’re:

- Deciding to attend college years after high school or undergrad

- In a position to complete the advanced degree you started some time ago

- Looking to advance your career or break into a new one

While the reasons for enrolling differ, adult learners have one thing in common — they’re managing multiple responsibilities, such as keeping up with mortgage payments while caring for an ill parent.

That’s why you might prefer flexible enrollment options, such as accelerated degree programs and asynchronous study. It’s an effective way to balance commitments.

Unique Financial Challenges Faced by Non-Traditional Students

More than 84% of American adults who paused their studies or never enrolled in a degree or credential program cited high prices. As mentioned, non-traditional students tend to have obligations that traditional students don’t, which exacerbates the cost factor. You might be struggling with:

- Loss of income: For some, returning to school means reducing work hours or giving up a side hustle. Don’t fret — it’s only temporary. Savings can help with the drop in income.

- Dependents: Many non-traditional students have spouses, children, or other loved ones who need their support.

- Existing debt: Not all adult learners are debt-free at the time of enrollment. Some are in the middle of paying down credit card debt, while others are chipping away at their auto loans. Carrying debt doesn’t mean you can’t go after your academic goals — just make sure it’s the good kind, and keep an eye on that credit score.

- Cost of living adjustments: For international students, the cost of living in a new country, along with fluctuating exchange rates, can make life feel a little shaky. Find out if you’re eligible for employment on-campus and make use of your education and emergency funds.

More than 84% of American adults who paused their studies or never enrolled in a degree or credential program cited high prices.

Funding Options for Non-Traditional Students

Funding your education doesn’t have to be an uphill battle. There are several types of financial aid. Before you take to your trusty search engine, let’s look at some of the common ones.

Scholarships and Grants for Non-Traditional Students

Think of scholarships and grants as free money. These no-strings-attached forms of aid are given to non-traditional students in need as well as those with outstanding accomplishments.

Here’s what you need to know:

Employer tuition reimbursement: They’re more common than you think. Companies put millions of dollars into this benefit, yet just 2% of people take advantage of it. The goal with tuition assistance programs is to help employees gain career-advancing skills. The benefit may cover a portion of your chosen program, or the full thing. Check with your HR department to see if that’s something that’s available to you. Eligibility requirements vary but often include tenure and job relevance.

Professional organizations: From engineering to healthcare, many professional organizations offer scholarships to members pursuing degrees in their field. It’s simple — look for those that align with your current or desired career path.

Nonprofits: National nonprofits often have need- and merit-based scholarships and grants. They may target non-traditional students from specific groups, such as veterans, single parents, persons with disabilities, and minorities. Check with local organizations, too — don’t overlook the opportunities in your backyard. They may be a little less competitive than those offered nationwide.

University-specific aid: Your dream school may have scholarships for non-traditional students. Always check your university’s financial aid website and follow your department’s communication channels for updates.

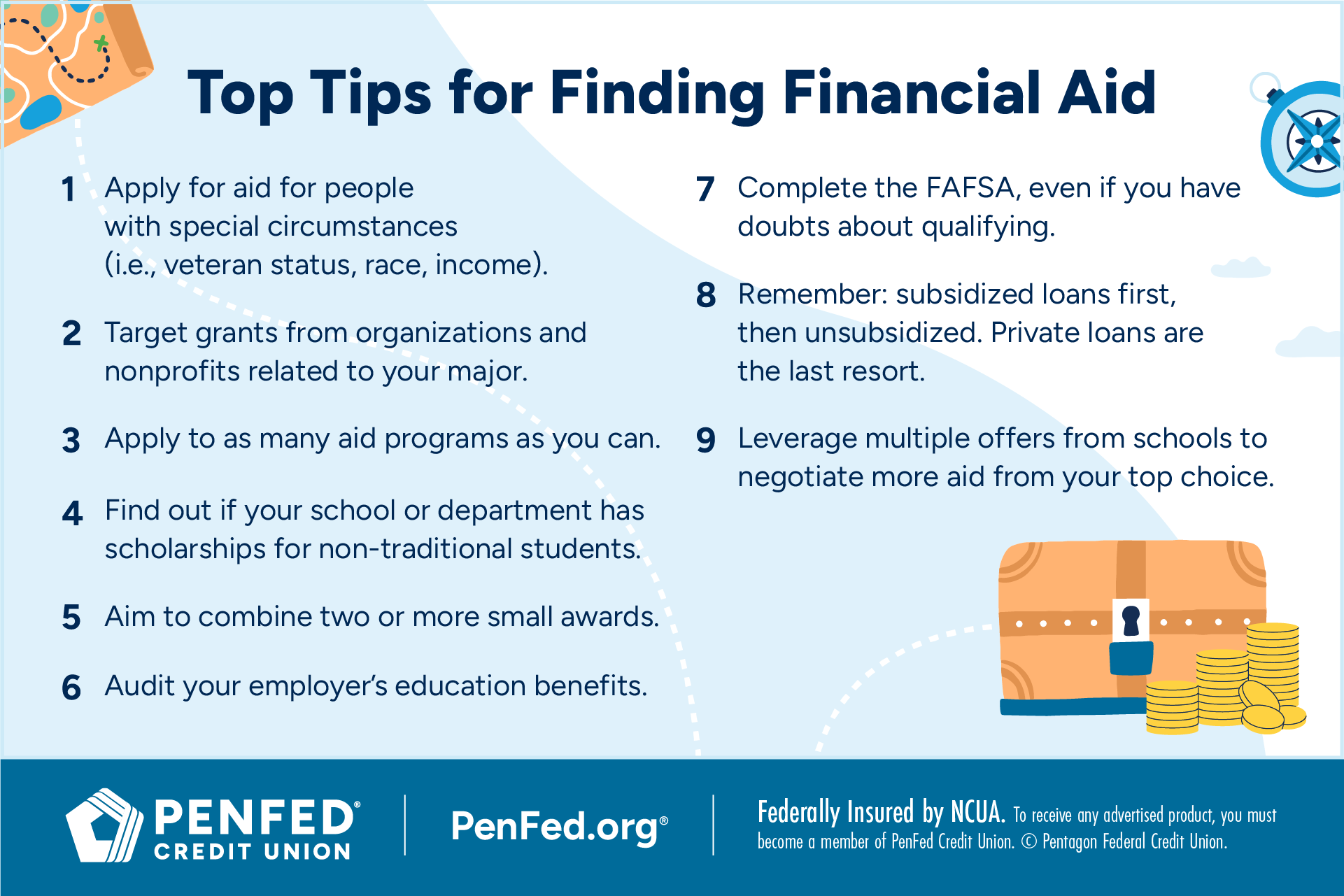

The key to unlocking these opportunities is diligent research and applying for as many as you qualify for. Browse databases and articles, ask other non-traditional students, or try alumni organizations. It’s like fishing — the more lines you cast, the better your chances of a catch.

Companies put millions of dollars into this benefit, yet just 2% of people take advantage of it.

Federal Student Aid and FAFSA Explained

Submitting the Free Application for Federal Student Aid (FAFSA) is a critical step for anyone interested in furthering their education. It helps determine your eligibility for financial aid from a wide range of federal, state, and local sources. This includes subsidized and unsubsidized loans and federal grants like the Pell Grant. More on loans later.

Dependency

Understanding your dependency status on the FAFSA is essential. Unlike younger students, many non-traditional students are way past the stage of being considered a dependent because of their age, marital status, veteran status, or the fact that they have children. Being an “independent student” can impact your eligibility and therefore, how much funding you’ll get.

Employment Through Work-Study Programs

The Federal Work-Study Program provides students with on- and off-campus part-time jobs. It’s especially designed for those who demonstrate a financial need. Although it is funded by the government, select schools administer this benefit as part of a student’s financial aid package.

Work-study employees earn the minimum wage or more. As of 2024, the average annual work-study award is $1,615.

Income aside, the beauty of work-study is that it fits around your academic schedule even if you’re a full-time student. Employers are typically flexible and understand that your studies come first. This isn’t always the case with regular jobs. And if you’re fortunate enough, you may end up with a job in your field. For example, someone with aspirations to become an educator might work as a department tutor.

Student Loans

In the case that you aren’t awarded a scholarship or grant, you’re going to need a plan B. For many students, especially non-traditional ones, loans are that backup. In fact, 30% of U.S. adults have taken out a student loan at some point in their lives.

While you’ll have to pay it back, a loan is still a useful tool to help you reach your goals. The key is paying attention to the fine print because not all loans are created equal.

Types of Student Loans

First, there are federal student loans. They’re quite popular among aspiring students as they come with lower, fixed interest rates, which means you’ll be paying less over the life of the loan. They also offer flexible repayment options (like income-driven repayment plans) compared to private student loans.

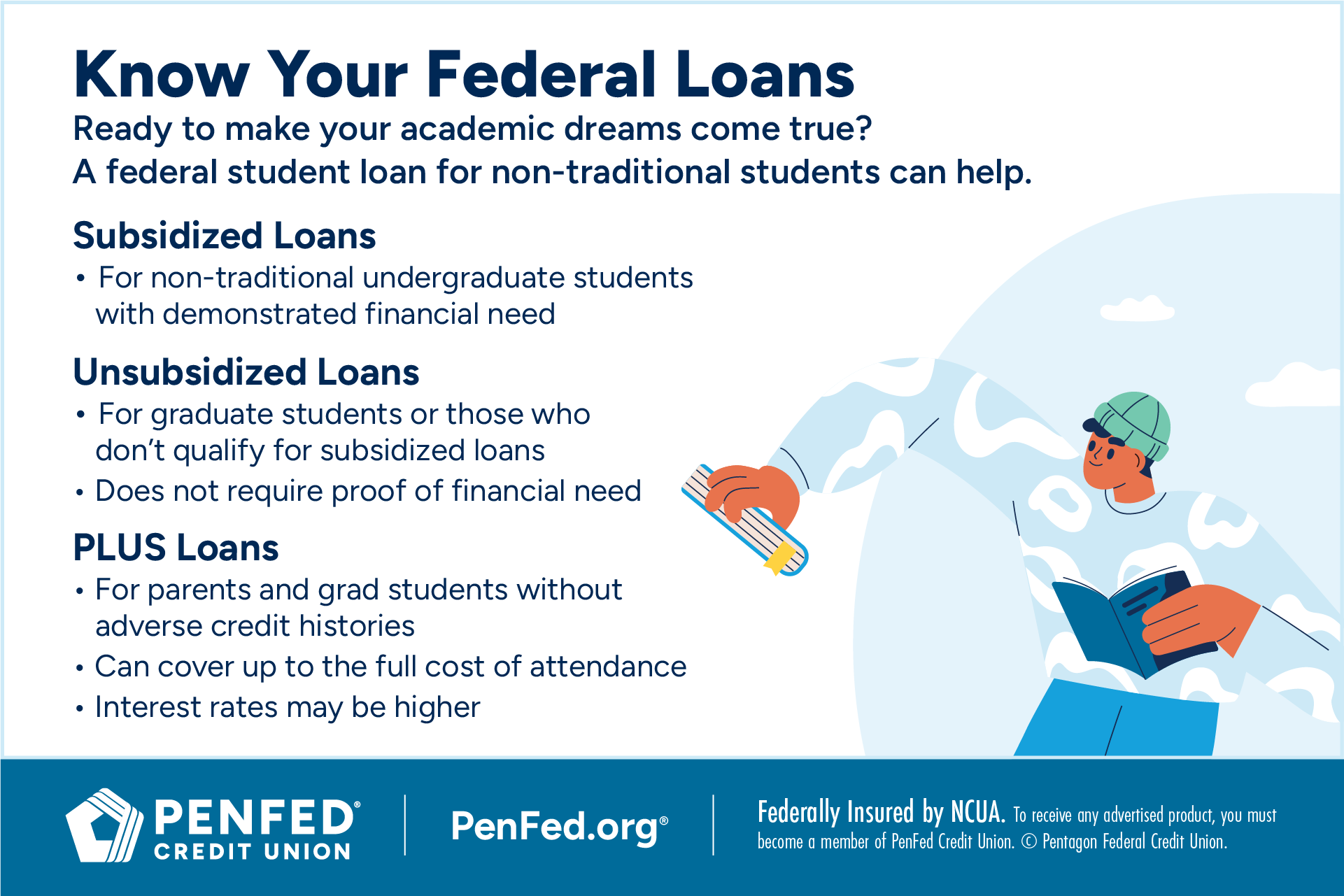

Now, let’s get to know the different types of federal loans: subsidized, unsubsidized, and PLUS loans.

Subsidized Loans

- For non-traditional undergraduate students with demonstrated financial need

Unsubsidized Loans

- For graduate students or those who don’t qualify for subsidized loans

- Does not require proof of financial need

PLUS Loans

- For parents and grad students without adverse credit histories

- Can cover up to the full cost of attendance

- Interest rates may be higher

Then, there are private student loans, which are offered by banks, credit unions, and other lenders. Their higher, sometimes variable, interest rates, limited repayment flexibility, credit requirements, and co-signer requirements make them a less traveled and potentially bumpier road.

Whichever loan you go for, make sure you understand every clause and percentage point.

Whichever loan you go for, make sure you understand every clause and percentage point.

Effective Budgeting Strategies for Financial Wellness

Budgeting as a non-traditional student may sound overwhelming, but it can be done.

Applying the 50/30/20 Rule to Budgeting

The 50/30/20 rule is an effective way to allocate your after-tax dollars by diving them into these three categories:

- 50% for needs

- 30% for wants

- 20% for savings + debt repayment

Thinking About Essentials

Household costs are big budget eaters. That’s why most of your income goes to it. Get even smarter about how you’re handling money for nonessentials:

Lower Housing Costs

Whether you’re renting or own a home, your costs won’t be as low as someone who’s living in a dorm room.

The less you spend on housing costs, the better.

Consider moving into a smaller apartment once your lease is up, refinance your mortgage to a lower rate, or rent out part of your space if need be. It’s also a good time to negotiate renters’ or homeowners’ insurance, so you can put those savings toward your studies.

Plan Out Your Meals

You’ve had a long day after class and work, and you’re on your way home. However, you realize you need to grab takeout since there isn’t much food in your fridge. This isn’t the first time this week or month. Before you know it, your budgeting app is calling you out for spending hundreds of dollars on dining out.

We’ve all been there.

This is where meal planning comes in. Taking one day out of your week to buy in bulk and cook saves you time and money.

Students can usually get a discounted or free public transportation pass.

Consider Public Transportation

If you’re able to forgo your car(s) and take the train or bus, then do it. This lets you avoid the cost of owning a vehicle, from maintenance and repairs to gas prices. Students can usually get a discounted or free public transportation pass. Check with your school’s transportation office or the local public transit authority. You can also carpool with a work colleague, neighbor, or fellow student.

Managing Expenses: Tuition, Books, and More

Tuition is the biggest mountain you’ll have to climb. Here’s what you can do to make the ascent easier.

- Consider community college: Pursing a bachelor’s? Try a two-step approach. Take your general education courses at a community college before transferring to a four-year university. Community colleges are known to offer relatively low tuition rates, so this will help you save money.

- Enroll in an online or hybrid course: Online programs can sometimes be more affordable than traditional, in-person courses. Living at home means no room and board fees, expensive meal plans, or commuting costs. The same goes for hybrid programs.

- Request a payment plan: Don’t let a large tuition bill overwhelm you. Many universities offer installment plans, allowing you to break large sums into smaller, more manageable payments. It’s like paying for a car.

Many publishers offer digital versions of textbooks, sometimes at a lower price than the physical copy.

Then there’s the cost of books, which add up quickly. Here are some tips to keep you resourceful.

Find used textbooks: Check your campus bookstore for used copies first, then cast a wider net online. Browse retailers like Amazon and Chegg.

- Rent them: Why buy when you can rent? Stores like CampusBooks allow you to borrow textbooks for a fraction of the purchase price.

- Purchase e-books: Many publishers offer digital versions of textbooks, sometimes at a lower price than the physical copy.

- Leverage library resources: See if your school or local library has copies of required textbooks.

- Check out open educational resources (OERs): Some professors use free, open-source textbooks and materials, which can save you a bundle.

Student savings don’t stop at pre-loved books. From clothes to baby equipment, embrace the world of thrifting. This is how you stretch your dollars and score amazing finds.

From clothes to baby equipment, embrace the world of thrifting. This is how you stretch your dollars.

Utilizing Student Discounts and Resources

Your student ID card isn’t just for getting into the library or registering for classes. It’s your golden ticket to a world of savings. Many businesses, big and small, offer discounts for students. Here’s when to flash that ID.

Buying technology: Need a new laptop or software? Companies like Apple, Microsoft, and Adobe usually provide discounts on tech essentials. Before adding to your cart, check for student pricing.

Shopping: Keep an eye out for discounts at clothing stores, book shops, cafes, and other retailers. Websites like UNiDAYS and StudentBeans keep a comprehensive list of student offers.

Exploring campus resources: Your university is a goldmine of free or low-cost resources, such as:

- Career support: Get free resume reviews, interview prep, and job search assistance. They’re there to help you land that dream job.

- Tutoring practice: Struggling with a particular subject? Access free academic support — it’s often built into your tuition.

- Counseling services: Mental health support might be available at no charge or a reduced cost. Don’t hesitate to reach out when things get tough.

- Fitness centers: Sweat it out for free! Stay in shape with state-of-the-art sports facilities that save you money on gym memberships.

Beyond financial aid, there are tax credits and deductions to help ease the burden of pursuing higher education.

Saving Money and Planning for the Future

Going after that degree or certificate is a big investment in your future. But like any investment, it requires strategic planning.

Building an Emergency Fund

It might seem counterintuitive to save when you’re spending so much on education, however an emergency fund is nonnegotiable. Life happens and unexpected expenses like car repairs, medical bills, or a volatile income could cause you to go further into debt.

Follow these strategies to build your three- to six-month fund:

Before school

- Save, save, save

- Take on a short-term contract or freelance job and stash away as much of your earnings as possible

- Sell unused items

- Direct unexpected money (think tax refunds, work bonuses, or a gift) to your emergency fund

During school

- Automate your savings, no matter how small

- Pause nonessential subscriptions

- Delay large purchases

- Negotiate a lower rate on your bills, like internet and car insurance

- If you have a health savings account, use it for qualified medical expenses

Exploring Tax Credits and Other Financial Benefits

Thinking twice about going to school because of the cost? Beyond financial aid, there are tax credits and deductions to help ease the burden of pursuing higher education.

- American Opportunity Tax Credit: This credit can be worth up to $2,500 per eligible student per year for the first four years of postsecondary education. Even better — it’s partially refundable, meaning if you owe no tax, you could get up to $1,000 back.

- Lifetime Learning Credit: Undergraduate or graduate — get up to $2,000 per tax return for an unlimited number of years for qualified education expenses.

- Student loan interest deduction: You may be able to deduct the amount of interest you paid in a given year on a qualified student loan — up to $2,500. Find eligibility requirements and up-to-date information on the IRS website.

- Employer-provided educational assistance: Is your employer is helping you with tuition? There’s a tax break for that. Up to $5,250 of that aid can be excluded from your taxable income each year.

Consulting a qualified tax professional or using reliable tax software can help you determine exactly which credits and deductions you qualify for. Don’t leave money on the table that’s rightfully yours!

Part of planning means asking yourself, “What’s the ROI of my degree?”

Financial Planning for Career Changes and Further Education

Part of planning means asking yourself, “What’s the ROI of my degree?” Perhaps, it’s a promotion or shift to higher-paying discipline. To get an idea, research average salaries of professionals with your qualification.

A nice salary bump allows you to do more for your family and pay down those student loans.

Next on your list of things to consider is your repayment strategy. Don’t leave it till the cap toss. Do this:

- Understand your grace period: This is how long you have after graduation before you have to start paying. It’s usually six months for federal loans. Use this precious time wisely. Adjust your family budget if needed.

- Automate payments: This is how you avoid missed payments and protect your credit score.

- Pay extra: If financially feasible, pay a little more each month so you shorten the repayment period and reduce the total interest you pay. Always tackle high-interest loans first.

As you look into the future, build in the costs of potential certifications, licenses, and additional degrees so you can save right.

Our final tip for planning requires you to take stock of the people around you. As they say, your network is your net worth. Connect with professors, classmates, alumni, and industry professionals while you’re in school. These connections can lead to unexpected job opportunities and complimentary mentorship.

Talk to your employer to see if you can work part time or a flex schedule or even take time off during finals week.

Strategies for Balancing Work, Life, and Study

You’ve secured the loan or scholarship and attended your first couple classes — you’re on your way to donning those post-nominal letters on LinkedIn. The future is bright, but monthly bills and work projects are casting a bit of a shadow.

That’s normal.

Crush your grades and financial responsibilities, plus avoid burnout with our simple strategies.

- Adjust your work schedule: Now’s the time to put your negotiation skills to use. Talk to your employer to see if you can work part time or a flex schedule or even take time off during finals week. If you must step away from a full-time role, you can always pick up a ridesharing gig or offer freelancing services.

- Divvy up equally: As much as possible, treat your study and work time with equal importance. Use a planner or digital calendar to schedule both. Instead of drawn-out cramming sessions, boost your efficiency with shorter lessons followed by breaks.

- Batch or delegate errands: Schedule all your non-academic tasks like grocery shopping, appointments, and laundry during the same block of time each week. Better yet, get trusted friends and family to help with school runs and other day-to-day tasks.

- Leverage your commute: Make travel time productive. Listen to recorded lectures, review flashcards, or write an essay outline while on the bus, train, or during a carpool.

- Build in a buffer day: If your schedule allows, set aside one day a week (or even half a day) where you plan nothing. This time can be used for unexpected tasks, catching up, or getting some much-needed rest.

As much as possible, treat your study and work time with equal importance.

The Takeaway

Let’s face it — pursuing any form of higher education is a big step accompanied by a mix of emotions. With careful planning, smart budgeting strategies, good time management, and a go-getter mindset, you’ll quickly realize being a non-traditional student is more than viable.

Invest in Your Future

Get a PenFed loan to fund your studies, from start to finish.