Finance

Techniques for Managing and Stabilizing Volatile Income

What you'll learn: Stabilize your finances with our expert guide on managing a volatile income.

Expected Read Time: 15 minutes

One month, you're celebrating a successful project and anticipating a long-awaited raise. The next, you're staring at severance agreement and wondering how you'll cover your household bills.

Sounds familiar?

In an economy where side hustles are becoming main jobs and full-time roles are getting swapped for contract hires, a volatile income is more common than you think. Whether you're a freelancer, contractor, multi-jobber, entrepreneur, or recent graduate navigating the modern job market, managing fluctuating pay can feel like a constant tightrope walk.

But it doesn't have to be.

With the right strategies and personalized support from a trusted financial institution, you can regain some stability and avoid financial trauma, even if your paycheck isn't what it used to be.

We'll show you how.

What Is Income Volatility?

Income volatility refers to how much an individual's or household's income changes over time. It's not just about earning less. It has more to do with the unpredictable nature of those earnings. And while volatile incomes aren't exactly bad news, they can make it hard to manage daily expenses and save for the future.

Income volatility refers to how much an individual's or household's income changes over time.

Common Causes of Income Volatility

Income volatility isn't random. It happens for a variety of reasons, including:

Economic Fluctuations

The economy is like a seesaw. It changes with global events, new government administrations, and more. On a not-so-good cycle, it squeezes both businesses and consumers. While a volatile economy can affect earning potential, purchasing power, and your overall standard of living, it doesn't necessarily mean stock market conditions will sway.

Changes in Government Policy

Changes to tax laws and social programs can affect your take-home pay. For example, an update to federal tax brackets could decrease your income, while fewer unemployment benefits could make life harder for job seekers.

Mass Layoffs

The job market can sometimes feel like a game of musical chairs. Companies — both public and private — are constantly merging, restructuring, and downsizing. Just this year, major tech companies like Microsoft, Google, Amazon, and Meta have either announced or carried out job cuts. This trend isn't limited to the tech industry. As of February 2025, the unemployment rate sits at 4.1%. That's 7.1 million Americans with no job.

Commission and Bonus Uncertainty

Maybe your work is commission-based, like that of a real estate agent or car salesperson. Or maybe, you're at a company that offers bonuses and profit-sharing plans. In both cases, your income is tied to performance.

Gig Inconsistency

As of 2023, 38% of the American workforce were involved in some form of freelance work. The gig economy makes it possible to find flexible work, but not without risks. Imagine you're a freelance writer landing a lucrative project one month, only to find yourself in a dry spell the next. This feast-or-famine cycle can also be a challenge for contractors.

Treat your income like a personal stock — one that fluctuates based on your efforts, job market trends, and the cost of living.

Business Ownership

Starting a business takes a lot of bravery. Apart from the willingness to embrace risks, you have to think about operational costs, competition, and managing a host of social channels. Unfortunately, not every small business breaks even — in fact, one in five of them fail in their first year. The holiday rush of Q4 might bring you record profits, but that Q2 lull might be another story.

Seasonal Employment and Changing Hours

Depending on your industry, you may be in demand one season and not in the next. This is common for those in the tourism, retail, and agriculture sectors. Even if they have a year-round role, hours can vary from week to week.

Automation

Technology is fast changing our world. It's creating new opportunities, pushing professionals to pick up new skills, and in some cases, replacing jobs. Let's say you're a factory worker whose job gets replaced by a robot. You may need to train for a new role, which could mean making less money during the transition.

Health Emergencies and Caregiving

Life throws curveballs and sometimes those curveballs target your health or the health of a loved one. As of 2022, 41% of Americans reported having medical debt. A new diagnosis or injury could lead to growing medical bills and time away from work to recover or provide care.

To map your income over time, use a spreadsheet or a charting tool to create a line graph. Assign income to one axis and time to the other.

How Do You Measure Income Volatility?

Think of how investors measure volatility. They look for big price swings in a matter of days or weeks, assess a stock's overall risk compared to the market, and follow the events causing price jumps.

They get very specific. You have to do the same.

Treat your income like a personal stock — one that fluctuates based on your efforts, job market trends, and the cost of living among other factors.

Tracking your income helps you understand its volatility.

Here are the steps to get the job done:

- Map your income over time

How to do it: Use a spreadsheet or a charting tool to create a line graph. Assign income to one axis and time to the other. Go as far back as needed — maybe the last three years.

Why it matters: This method helps you identify any major swings.

- Pinpoint your income sources

How to do it: Break down your income sources using a table or spreadsheet. Does your money come from a 9-to-5, weekend tutoring, affiliate marketing, or dividend-paying stocks? Include them all.

Why it matters: This will give you an idea of the most and least volatile income sources.

- Analyze any bonus and/or commission structures

How to do it: Review your company's bonus and commission policies and highlight the metrics that influence these payments.

Why it matters: This allows you to anticipate potential fluctuations in your bonus or commission.

- Look at the big picture

How to do it: Read the news, learn about the latest innovations, and track trends in your field.

Why it matters: This is how you identify external influences.

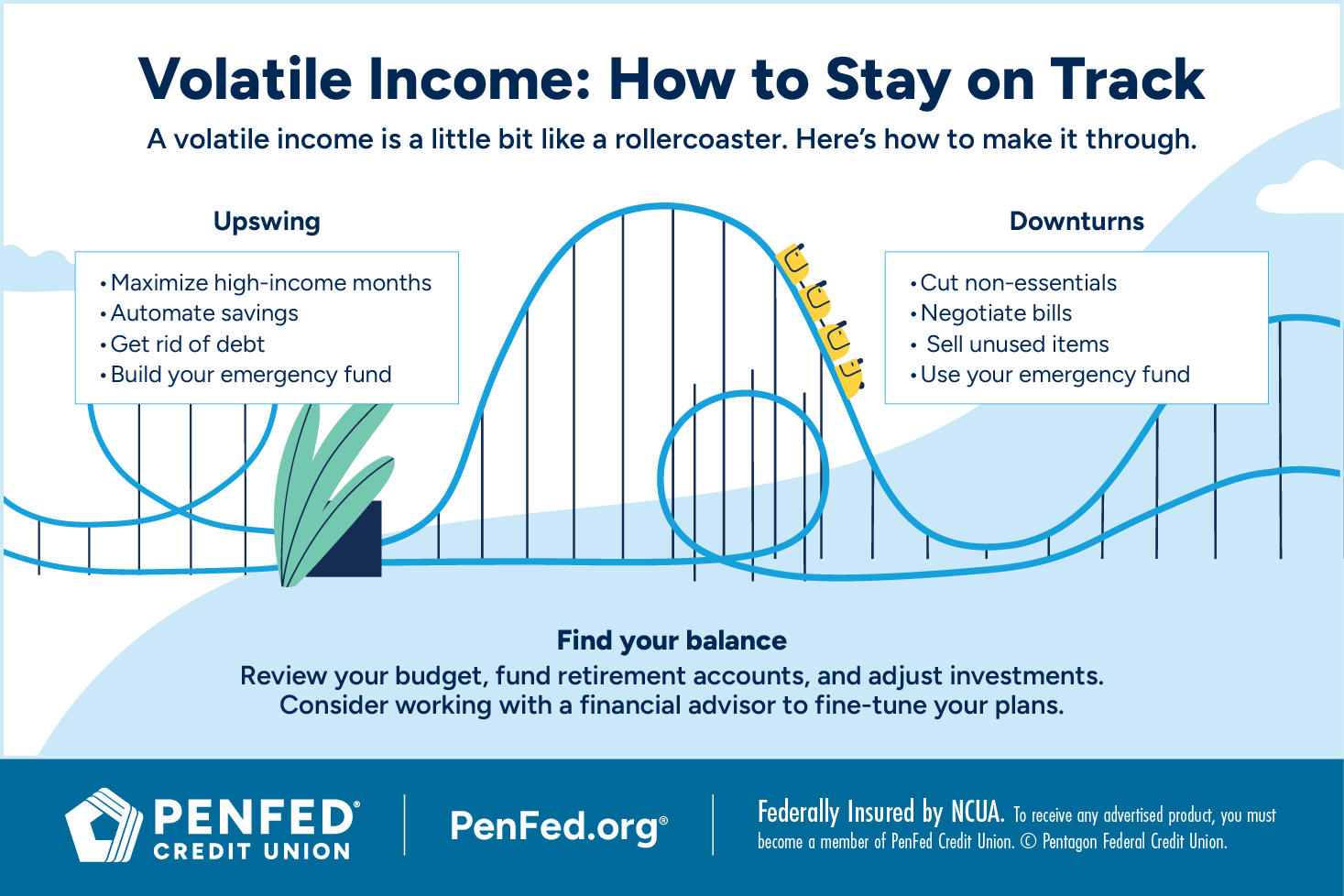

Strategies to Manage Volatile Income

Once you know where you stand, it's time to find a strategy that works for you.

Budgeting

Budgeting is knowing and deciding where your money goes. You can use an app to help you track your monthly spending or do it on your own.

Maybe you're paying for subscriptions you don't use. Your budget will tell you. Prioritize essential expenses like housing, utilities, and food. Then, allocate a portion of your income to savings and debt payments.

Make a note of due dates, and don't assume you've got the best deal on all your bills. It's always a good idea to shop around for a cheaper phone plan or more affordable car insurance. The same goes for grocery shopping and buying gas. And if you want to hit the pause button on costly but necessary services like child or pet care, try asking your close friends and family for help.

Pro tip: Say yes to loud budgeting.

Common Budgeting Tactics

- 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Envelope system: Divide your money into envelopes labeled with different spending categories like entertainment, transportation, and health.

- Zero-based budget: Subtract all your expenses from your income. The goal isn't to necessarily end up with a zero balance at the end of the month, but to assign every dollar a job.

If your income is extremely volatile, create a budget based on the lowest paycheck you've received or expect to get. This will allow you to cover necessary expenses during lean times. Any extra money that comes in during higher-earning months can go to your emergency fund if it's not where it's supposed to be.

If your income is extremely volatile, create a budget based on the lowest paycheck you've received or expect to get.

Creating a Financial Buffer

A budget is a map, while a buffer allows you to go the distance. Here are seven ways to build your buffer:

1. Establish an emergency fund

Try to have three to six months' worth of living expenses stashed in a high-yield savings account. If and when the unexpected strikes, you'll have something to fall back on.

2. Get a Health Savings Account (HSA)

If you have a high-deductible health plan, then an HSA is a natural fit. HSAs are great for planned and unplanned healthcare costs, as long as they're qualified. Plus, they offer a triple-tax benefit — contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

3. Take advantage of Roth IRA flexibility

While primarily for retirement, your Roth IRA can give you some wiggle room if you need it. You can withdraw contributions from a Roth IRA at any time without penalties or taxes.

4. Try a no-spend challenge

Skip the daily coffee runs and smartphone upgrade. Put an end to unnecessary spending habits with a no-spend challenge. It doesn't have to last forever — figure out what works for your current situation.

5. Declutter and put it up for sale

Take a look around your home. Are there unused items collecting dust? Do you have any vintage pieces or collectibles you don't mind giving up? Selling clothes, furniture, and appliances on sites like Depop, Poshmark, and eBay can help you fund your buffer.

6. Start a side hustle

What's something you're good at or passionate about? Make some extra cash with your skillset.

7. Make use of cash back rewards

Maximize your credit card rewards. Cash back is like free money that you can use to offset some of your daily expenses.

Cash back from a credit card is like free money that you can use to offset some of your daily expenses.

Risk Management Techniques

When your income is unpredictable, having a solid risk management plan is essential for building resilience and moving closer to your financial goals.

Diversifying Income Streams

Let's compare income streams to the game of basketball. If you only rely on your star player, you'll be in trouble when they get injured or if they have an off game. But if you have a bench of strong supporting players, you'll be better prepared for each tournament.

So, what can you do to diversify your income? Here are some ideas:

- Freelancing or consulting: Are you good at writing, translation, coding, or agile project management? Offer your services on online work marketplaces like Upwork, Fiverr, or LinkedIn.

- Part-time work: Apply for a flexible, part-time role in your preferred industry. If you're not set on a particular industry, consider rideshare driving and virtual assistant jobs.

- Online courses and tutoring: Share your expertise with those who are new to your field with an online course. You can sell your course content on sites like Udemy, Teachable, and Skillshare. You can also tutor students learning English for the first time or those who find subjects like math and science challenging.

- Affiliate marketing and content creation: Partner with the brands you love and promote their products or services on your YouTube channel, Instagram account, or WordPress blog. Build your audience with intention, and cash in with ads and sponsorships.

- Rental income: Rent out your spare room, second townhome, car, or parking space on platforms like Airbnb, VRBO, SpotHero, and Turo.

- Digital products: Design and sell digital resume templates, stock photos and B-roll footage, and software online.

- E-commerce: Open an online store and use dropshipping to fulfill customer orders or sell your unique creations on sites like Etsy and Shopify.

- Online surveys and market research: Sign up to participate in paid online surveys or market research studies.

Passive Income

Who doesn't want to make money in their sleep, on vacation, or while they're waiting for their next full-time job? You're probably familiar with the term "passive income" but you're not convinced there's actually a viable strategy to boosting your earnings with little effort.

The truth is, there are many. In addition to the above ideas, here are other ways to start earning passive income:

- Dividend-paying stocks: Invest in companies that share their profits with shareholders and have a history of increasing payouts. Think of it this way: you get money just for owning a piece of the company.

Disclaimer: Dividend payments are at the discretion of the company's board of directors, who might choose to re-invest earnings.

- Real estate investing: Maybe you own a quaint apartment at the beach. The monthly rent can help you cover the mortgage and grow your savings. If you don't own a property, there are real estate investment trusts (REITs). A REIT is a company that owns and operates a range of income-producing real estate properties. They work similarly to dividend-paying stocks, except they're required by law to distribute at least 90% of their annual income to shareholders. So, why not get in on it? Open a brokerage account, fund it, buy as many shares of the REIT you want, determine the dividend payment schedule, and keep an eye out for those payments.

Disclaimer: As a landlord, be prepared to bear most of the maintenance costs and deal with occupancy issues. And as a REIT investor, pay attention to market volatility and the REIT itself. A lower share price might lead to higher dividends, but it could signal Issues with the REIT.

Even if you land a high-paying gig, resist the urge to upgrade your lifestyle. Instead, prioritize saving and paying off debt.

Debt Management

When it comes to debt and volatile income, there are two things you want to master — avoiding debt and paying it off. It's tempting to tap and swipe your credit card when your income gets a little thin. But small charges can add up, making it hard for you to catch up.

Try these strategies to help you better manage your debt.

Avoiding Debt

- Live below your means: This one is pretty obvious, and maybe even easier said than done. Don't spend money you don't have. Even if you land a high-paying gig, resist the urge to upgrade your lifestyle. Instead, prioritize saving and paying more than the minimum payment on your credit card(s). Get an accountability partner to help keep you on track.

- Practice the 30-day rule: Remember the no-spend challenge? This is a variation of that. Before making any non-essential purchases, wait 30 days. This gives you time to consider whether you really need the item(s).

- Don't apply for new lines of credit: Extra credit might sound good when you've gone a month without a gig. Don't apply for a new credit card unless you absolutely need it. You can get yourself into a deeper hole with additional lines of credit.

If you're struggling to make payments, reach out to your creditors — don't wait for them to contact you.

Paying Off Debt

Even with the best preventive measures, debt can still creep up on you. Here's what to do if it does:

- Prioritize high-interest debt: Focus on paying credit card debt or loans with high interest rates.

- Communicate with creditors: If you're struggling to make payments, reach out to your creditors — don't wait for them to contact you. They may be willing to work with you to come up with a special payment plan. Your financial institution could also help if they offer money management services.

- Consolidate debt: If you have several debts with varying annual percentage rates (APRs), it might be a good idea to consolidate them into a single loan with a low interest rate.

Debt Repayment Strategies

- Debt avalanche: This method focuses on paying high-interest debts before anything else. This will you save money in the long run.

- Debt snowball: This method targets your smallest debts first, so you can have quick wins and stay motivated.

Savings and Investment Strategies

Just because your income is volatile doesn't mean you should push saving and investing to the back burner. Everyone's circumstances are different. You might have to step away for a bit and come back to it in a few months. As they say in finance: "The best time to start investing was yesterday — the second-best time is now."

As they say in finance: "The best time to start investing was yesterday — the second-best time is now."

Long-Term Investment Vehicles

Long-term investments are exactly that. It often takes several years for them to mature and pay off. We've discussed dividend-paying stocks, which you can hold onto for as long as you want. Now, let's explore some other options for securing your financial future even when the present feels shaky. It's not as daunting as you may think.

- Diversified index funds and exchange-traded funds (ETFs): Instead of picking individual stocks that can be risky, go for broad market index funds or ETFs (like VOO or SPY). They'll give you exposure to some of the largest U.S. companies, plus they're generally low cost which means you may not have to wait to earn more before investing.

- Fractional real estate investing: Traditional real estate investing can be expensive. If you're on a tight budget, consider platforms like Fundrise that offer fractional ownership. As with any investment, there are potential losses, so do your research. Either way, you won't have to deal with large upfront costs or spend time managing properties.

- Bonds: The federal government offers I bonds, which provide stability when the market dips and inflation hits. While you can redeem your bond after a year, it's intended to earn interest over a 30-year period. All you need to get started is $25. Of course, you can contribute more if you have it.

- Certificate accounts: Open a certificate if you want to deposit a set amount of money for a fixed term, ranging from a few months to years. Your credit union might offer them.

Pro tip: Make sure you have access to some liquid investments in case of an emergency.

Retirement Planning and Volatile Income

Retirement might feel like a far-off dream when your income fluctuates — or if there's a recession. But saving for the future is not impossible. There are many ways to go about it.

Opening a Retirement Account

Don't let the lack of an employer-sponsored 401(k) plan hold you back. You can open any of these accounts with most brokerage firms:

- Roth IRA

You can contribute after-tax dollars, meaning your withdrawals in retirement are tax-free. It's ideal for those who don't mind making contributions that aren't tax-deductible or expect to be in a higher tax bracket in retirement. You pay taxes now when your tax rate is lower and withdraw your money tax-free when your tax rate is higher.

- Simplified Employee Pension IRA (SEP IRA)

These accounts are best for self-employed individuals and business owners looking for a convenient way to manage and maximize their retirement savings, while also contributing to their employees' retirement. They function just like traditional IRAs but have a unique set of steps to get them up and running.

- Solo 401(k)

If you're a business owner and don't have employees, a solo 401(k) offers several benefits. The contribution limit for 2025 is $70,000 — about 10 times the Roth IRA contribution limit.

You can also open a traditional IRA and contribute after-tax dollars without an employer, but you'll have to file Form 8606.

Get all the information you need from the IRS website or speak to a tax advisor.

Pro tip: Make sure you have access to some liquid investments in case of an emergency.

Other Considerations

It's easy to lose track of 401(k)s from previous employers when you're in the thick of job hunting. This is your reminder to locate your old accounts and consider rolling them over to an IRA. This can help you consolidate and manage your retirement savings.

Maybe you don't have an old 401(k) account, but you do have an HSA. After age 65, you can withdraw funds for any purpose — not just medical expenses — and without penalty. However, you'll have to pay income tax on non-medical withdrawals.

Professional Advice and Resources

From finance experts to helpful online tools, there's a wide range of resources to help you see through the fog of a volatile income.

The Role of Financial Advisors

A financial advisor can provide clarity, direction, and personalized support, but how do you know when it's the right time to ask for their help?

- If you're struggling to create a budget that works for your volatile income even after trying various methods.

- If you're facing a major financial decision like startin g a business.

- If you want a second opinion on your current financial strategies.

- If you're dealing with a medical emergency that's eating into your savings.

- If you'd like to open a brokerage account or HSA and you're unsure about the best options or where to start.

- If you have a bit of money saved from higher-income months and you're wondering what to do with it.

And if you're self-employed and can't figure out how to estimate taxes, deductions, and credits, a tax professional can help a lot.

While financial advisors can help you turn things around, their expertise often comes with a fee, so you'll want to weigh the costs and benefits. If you decide it's the solution for you, begin the search. Ask for recommendations — and if you're a member of a credit union, reach out to their wealth management team.

If you're self-employed and can't figure out how to estimate taxes, deductions, and credits, a tax professional can help a lot.

Tools and Resources for Financial Planning

Use this checklist to help you stay on top of things.

Your Volatile Income Management Checklist

A: Income Tracking Systems

[ ] Google Sheets or Excel spreadsheets for detailed income and expense tracking

[ ] Freelancer tracking apps like Bonsai or FreshBooks for project-based income

B: Budgeting and Forecasting Tools

[ ] Budgeting apps like YNAB with customizable categories

[ ] Worst-case scenario budget template for low-income months

[ ] Mobile banking tagging/categorization feature for automated tracking

[ ] Cash flow forecasting tools like Float and Cashly to predict future income and expenses

C: Savings and Investment Tools & Resources

[ ] High-yield savings account for your emergency fund

[ ] Automated transfer setup for consistent savings

[ ] Brokerage account for diversified investments

[ ] Retirement calculator to project your future needs

[ ] Financial independence, retire early (FIRE) resources

D: Debt Management Resources

[ ] Debt tracking spreadsheet or app like Tally

[ ] Credit score monitoring service like Credit Karma or TransUnion

[ ] Debt consolidation calculator

E: Financial Education Resources

[ ] Personal finance blogs and websites from experts and credible financial institutions

[ ] Online personal finance courses

F: Communication and Collaboration Tools

[ ] Shared budgeting apps for couples or families

[ ] Calendar reminders for bill payments and monthly/quarterly audits

[ ] Contact information of creditors and service providers

Community and Support Networks

Managing a volatile income doesn't have to be a solo journey. Growing your very own financial village can help you get through the ups and downs. And while you're at it, you may find a new, stable opportunity.

- Join an online community or forum: Connect with others facing similar money challenges. Share experiences, exchange tips, get inspiration, and prioritize accountability.

- Find a local support group: Research personal finance and entrepreneurship groups in your area.

- Get a mentor: Find someone who has experience with managing a volatile income or can give you sound investment advice. It could be your neighbor who used to work in the financial industry or a family member with a diverse investment portfolio.

- Go to a networking event: Attend industry events or meetups to connect with potential clients and collaborators.

- Get active on LinkedIn: Engage in thought leadership conversations on LinkedIn by commenting on others' posts and writing some of your own to help you get noticed. You can even turn your experiences with a volatile income into lessons learned to help others.

- Gather references: Don't be afraid to ask for references from past clients, employers, or colleagues.

- Master informational interviews: Reach out to people in your field for informational interviews.

- Pitch your services: Come up with a compelling pitch to highlight your unique skills, and then practice it.

- Update your digital portfolio: Regularly update your website with new and award-winning work samples.

- Take advantage of skill bartering: Exchange skills or services with people in your network. This can help you save money.

Attend industry events or meetups to connect with potential clients and collaborators.

Managing Finances During Economic Instability

A volatile income is one thing, but economic instability is another. While the strategies to stay afloat in both situations are similar, there are some additional things to keep in mind.

Adapting to Market Changes

The market will never stop evolving. Your financial approach shouldn't either. Instead of trying to predict the unpredictable, focus on building agility and flexibility.

- Review your portfolio often: Automating your investments can be helpful, but make sure you're looking over your portfolio to ensure it aligns with your risk tolerance and current market conditions.

- Keep learning: Economic shifts bring new opportunities and knowledge. Learn about emerging trends and technologies by reading the news or taking an online course.

- Adopt an opportunity mindset: Some stocks become undervalued when the market is down. That may be a good time to invest in quality assets, but do so with lots of caution and research.

Practice a combination of everything we've discussed and remember to give yourself grace.

Risk Mitigation Strategies

We've looked at several risk mitigation strategies, such as diversifying income streams and building an emergency fund. Here are a few additional points to consider:

- Stress test your finances: Imagine various worst-case scenarios like prolonged job loss or emergency surgery. How would your finances hold up? The answer to this question can help you come up with a contingency plan.

- Review insurance coverage: It's always good idea to be insured — more so during economic instability. Review your health, life, and disability insurance policies to make sure you have the coverage you need.

The Takeaway

True financial health isn't just about numbers. It's about striking a balance between smart money management, resilience, and your overall well-being — and it's possible even with a volatile income. Practice a combination of everything we've discussed and remember to give yourself grace. After all, there's no way to know for sure if the economy will surge or favor you — and a volatile income won't last forever.

We Have the Answers to Your Financial Questions.

PenFed empowers you to navigate life's uncertainties with tailored financial solutions.