YOUTH FINANCE

For Parents: Teaching Your Kids to Have a Healthy Relationship With Money

What you'll learn: Tips and advice to help children build a healthy financial future.

Expected Read Time: 14 minutes

Think about your last trip to the store with your kid. Perhaps they pointed to a sugar-dusted treat, their favorite cartoon character in plush form, a bike with all the bells and whistles, or the sleek VR headset making its rounds on TikTok — their eyes wide open with desire.

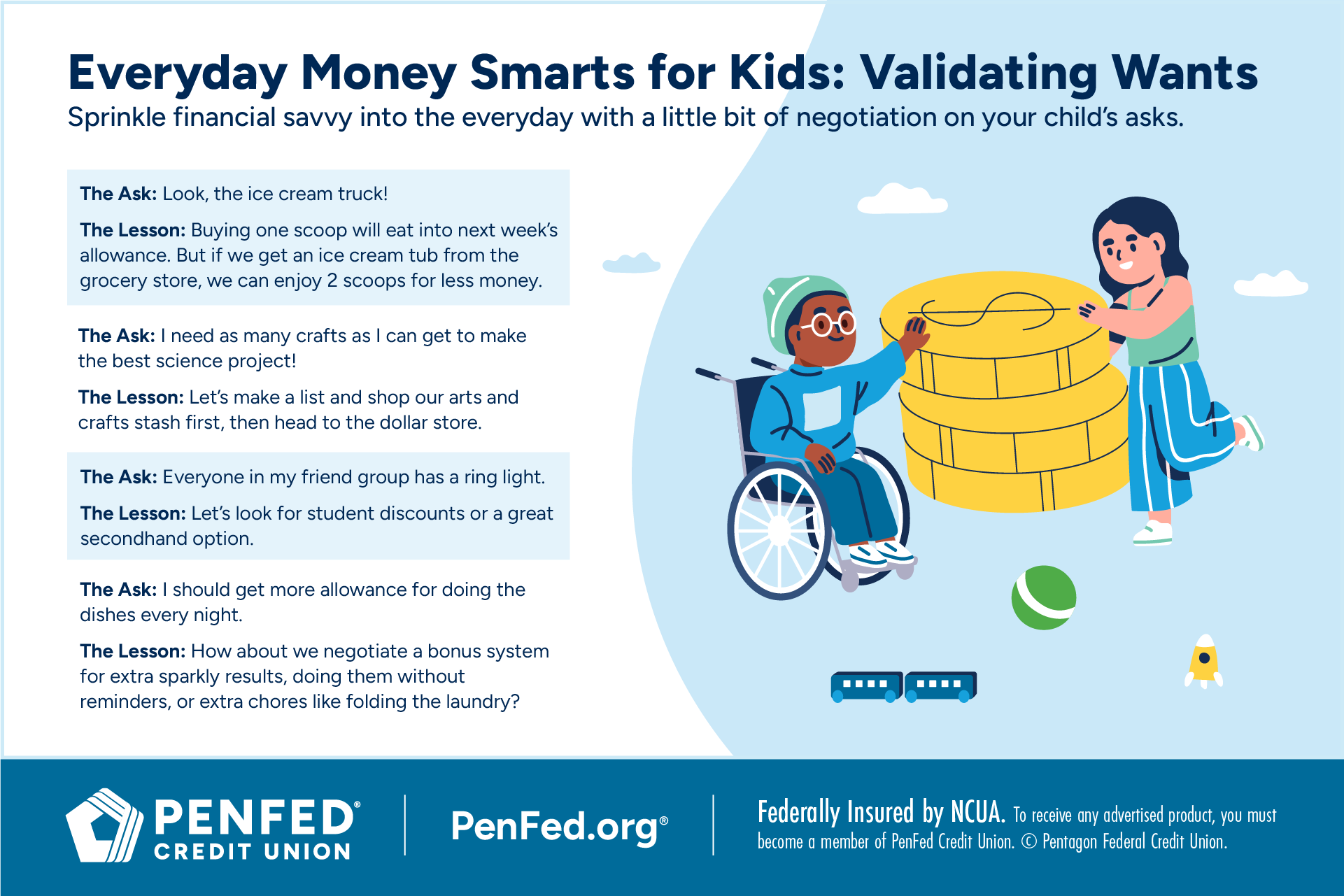

These moments present a powerful opportunity to begin shaping their understanding of wants versus needs, and while a “not today” gets you off the hook, it doesn’t exactly help them internalize the concept of financial trade-offs.

These everyday experiences can become the building blocks for a lifetime of sound financial decisions, but it takes a little more than counting coins. It’s about the bigger picture. You want your kids to have a healthy relationship with money that not only keeps them financially secure, but also emotionally stable.

If you’re a new parent or looking to refresh your approach, you’re in the right place. This comprehensive guide will show you how to turn those weekly pizza nights, chore-filled weekends, and charity events into money lessons that stick.

The Importance of Open Conversations About Finances

Take a moment to reflect on your childhood.

How often did your family discuss money? Was it a grown-ups-only topic? Did it feel like an unsolvable mystery?

You’re not alone. According to a 2024 Fidelity survey, 56% of American adults said their parents never discussed money with them. More than 80% of people in this group said they wish that wasn’t the case.

The Psychology Behind It

If you’re here, you probably don’t need convincing — talking family finances with your little ones is as important as teaching them their ABCs, but it still may not come easy to you. Maybe you’re working through financial trauma, can’t figure out how to make the topic age-appropriate, worried your struggles with managing a volatile income might taint their childhood, or don’t know where to fit it in between their extracurricular activities, parent-teacher meetings, and your 40-hour work week.

These are valid reasons, but avoiding the conversation can unintentionally breed anxiety and misconceptions about money — a price you can’t afford to pay. At the age of three, your child has the ability to grasp basic money concepts. By seven, many of their money habits are set in stone. With early and frequent child-friendly money chats, you can replace those misconceptions with understanding and that anxiety with confidence.

Your child’s desires are a normal part of development. When you acknowledge and position those wants within the larger context of a healthy relationship with money, you’ll empower them.

Here's something to remember when you’re having those talks. Your child’s desires are a normal part of development. Children are naturally drawn to novelty, plus their brains are still figuring out the whole impulse thing. That longing for the latest toy or trend isn’t coming from a place of greed. It often stems from a need to fit in, a fascination with the unknown, and the excitement of acquisition.

When you acknowledge this and position those wants within the larger context of having a healthy relationship with money, you empower them to navigate money matters constructively.

Take Stock of Your Money Mantras

Maybe you’re part of the 44% of Americans who did talk about money with their parents. What stuck with you? Do you recall any of these common sayings?

- "Money doesn’t grow on trees.”

- “You have to work hard for your money.”

- “A penny saved is a penny earned.”

- “You have to spend money to make money.”

- “Money doesn’t buy happiness.”

- “Cash is better than credit.”

- “Treat yourself!”

- “The best time to invest was yesterday. The next best time is now.”

The list goes on, encompassing both financially liberal and conservative approaches.

Money mantras shape our financial outlook. Get clear on yours. Replace the mantras that haven’t served you with ones you’d be proud to pass along.

Money mantras shape our financial outlook. Replace the mantras that haven’t served you with ones you’d be proud to pass along.

Put Your Values on Display

Mantras are a great way to introduce the concepts of saving, budgeting, and investing to your child. Here’s how you come up with them:

Step 1: Discuss hard money facts, the economy, and define basic concepts like purchasing power, dividends, and budgeting in a way that they’ll get.

Step 2: Explore shared goals and values. This might include saving for a beach vacation, updating your pet or holiday decor budget, or upping your annual giving back fund.

Step 3: Instead of creating a worksheet on your own that you just hand over to your kids, make it a collaborative project. Encourage creativity! Use a round-robin style brainstorm to allow each family member to add their ideas to the list, even if it sounds silly at first. Ultimately, agency is what makes the process meaningful.

Step 4: Ask follow-up questions and refine the suggestions. Settle on five to 10 money values.

Step 5: Workshop those that don’t make it to the list, so everyone understands the reasoning behind the choices.

Step 6: Make sure the end product is signed by all and placed where they can see it. You could put it on your fridge, in the hallway, or in a frame on their homework desk. This keeps them top of mind.

Much like affirmations you might recite each morning with your little one, practice those money mantras often.

Need help getting started? Here are some suggestions:

- "I am capable of managing money.”

- “Money is a tool that helps me get things done.”

- “I am worthy of financial abundance.”

- “I can achieve financial freedom.”

- “I use money to create good in the world.”

Navigate Your Money Values Without Pressure

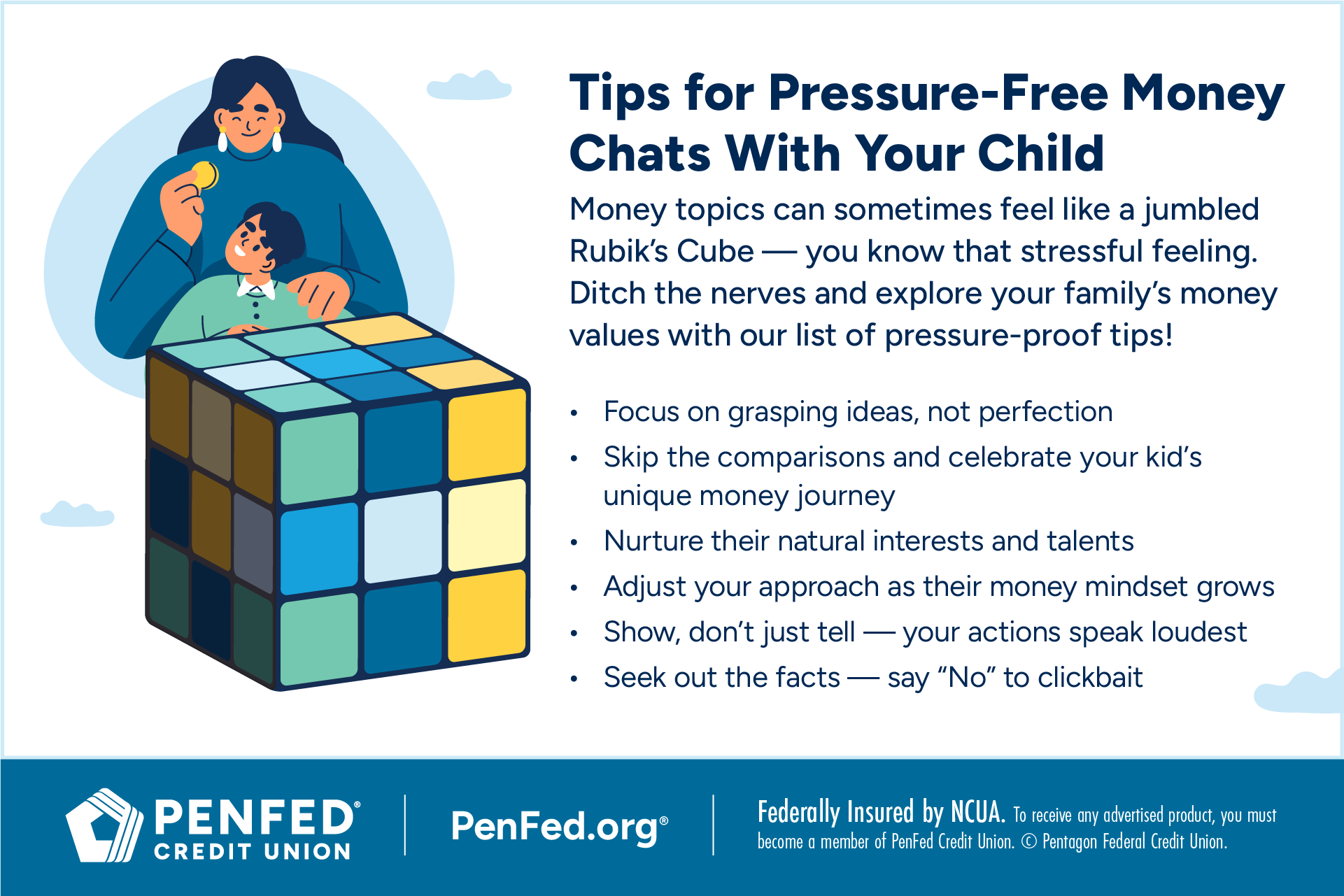

Remember, the whole point of money values or mantras is to empower, not to impose. Here are six tips to keep you on track.

Understanding — not perfection — comes first

Don’t turn mantra recitation into a rigid chore. Strive to keep it organic. The goal is for your kids to understand the underlying ideas at their own pace. Discuss what each mantra means in simple terms, using everyday scenarios and fictional examples. Check your tone — cut out the condescending language and be clear and practical.

Avoid comparisons or judgment

Never compare one child’s mantra or participation to another’s or that of their peers. It’s okay to introduce financial role models, but don’t make them the end-all-be-all. Refrain from criticizing their choices or suggesting they “should” feel a certain way about money.

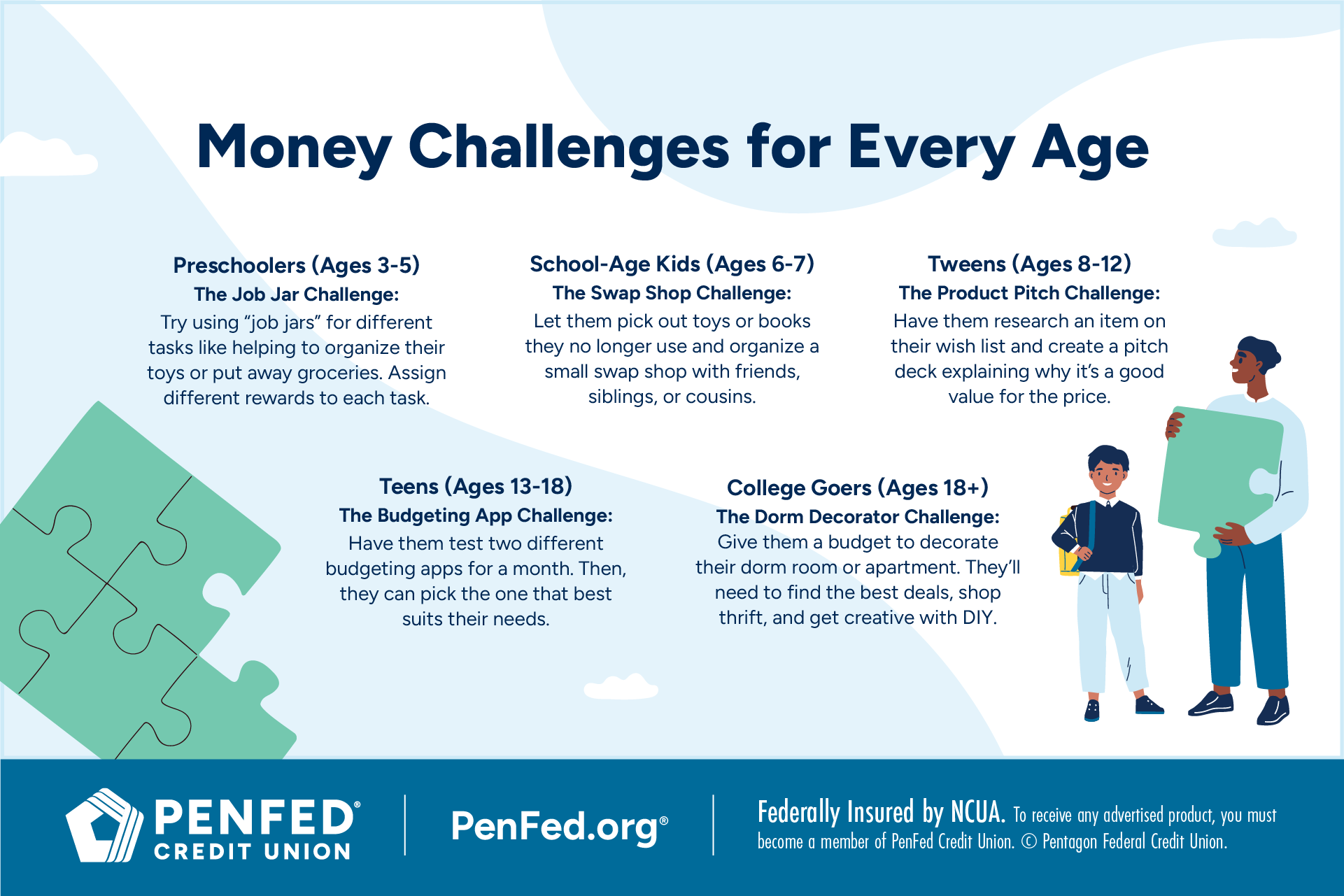

Build on their natural inclination

Some children enjoy tracking every penny, while others are drawn to the bigger picture of saving for a goal. Pay attention to those varying levels of interest and talent as you practice your money values. If your child loves technology, encourage them to use budgeting apps or explore free investment games. For young creatives, suggest ways to monetize their craft, pick budget-friendly tools, and track profit in an easy way.

Children are keen observers. The more you live out your values, the more likely your kids are to follow suit.

Adaptability is key

If your child isn’t feeling it on a particular day, don’t force it. Come back to it another time. As they grow, the mantras that resonate with them as well as their understanding of them may change, and that’s perfectly fine. Adjust your approach.

Be a real-life example

Children are keen observers. The more you live out your values, the more likely they are to follow suit. It’s also important for them to see that you’re learning new things about money. Don’t be afraid to share your money mistakes, from messing up the math on your tax return to choosing the wrong type of credit card. After all, you’re human.

Check and filter your sources

Encourage your high schoolers and college kids to tune into the news with curiosity but also teach them to filter out the worry. If they’ve already started investing, reassure them that changes in the market shouldn’t be cause for panic. Remind them to make their own decisions about the topics they hear and read about. You’ll also want to explore different financial literacy resources, including helpful “finfluencer” tips. Just make sure they can spot who’s real. Together, come up with a vetting checklist.

Of course, you never want to turn your children into anxious mini adults. That’s why honest, low-pressure money talks are important.

Build Trust Through Transparency Around Family Assets

As your children grow older, you may consider sharing more details about the family’s financial landscape. This doesn’t mean divulging every single number or your financial woes. You want to offer age-appropriate insights into topics like taxes, saving for college, credit cards, and managing good debt.

Transparency, when handled thoughtfully, can build trust and provide valuable context for your financial decisions.

Maybe you’re getting ready to buy a new car to accommodate everyone more comfortably. Here’s how transparency comes in — explain to your teen that this is a big expense you’ve been planning for, just like their college fund. If they’re old enough, you can even show them the breakdown of costs and explain financing. They might not remember every detail, but they’ll appreciate feeling included and they’ll learn that there’s more to big purchases than saying, “I’ll take it!”

It’s also helpful to give kids a general idea of the resources that might become available to them in the future. This provides a sense of security and lets them know how they fit into the bigger financial picture.

Understand the Impact of Financial Decisions on Family Harmony

Managing finances can get stressful, and kids can sense that. Of course, you never want to turn your children into anxious mini adults who crunch numbers. That’s why honest, low-pressure money talks are important. They foster empathy and a sense of togetherness. When kids grasp that resources are finite and that a single financial decision can impact those around them, they may be more inclined to appreciate the value of what they have. This can also cause them to be more considerate of family spending.

Practical Advice for Instilling Good Financial Habits

Now, let’s dive into even more actionable tips for cultivating positive financial habits in your children. Think about how you can tailor the following suggestions to your family’s unique circumstances.

Find Age-Appropriate Financial Education for Children

As you seek out the best educational resources for their academic growth, explore age-appropriate books, games, and online tools that introduce financial concepts in an engaging way. For younger children, this could include play money, a toy cash register, a cartoon character piggy bank, money flashcards, and coloring books. For older kids, consider goal-setting workbooks, money management podcasts, expert-recommended personal finance apps, and financial aid one-pagers.

Explore age-appropriate books, games, and online tools that introduce financial concepts.

Go-To Resources

Bookmark and use these helpful money resources:

Teach Smart Financial Decision-Making

Apart from our suggested money challenges, encourage your children to think critically before making purchases. Consider implementing a waiting period for non-essential buys to give them time to reflect.

Smart financial decision-making goes beyond spending. Take advantage of car rides or family dinners to bring up values-aligned prompts that address a broad range of money matters. Keep them casual.

Here are some examples:

- What’s something new you’ve learned about money?

- How did saving for those shoes make you feel?

- Imagine you spent the day building an amazing Lego castle and your buddy wants to give you a limited-edition action figure for it. What would make the trade worth it?

- If you could donate $20 to any cause, what would it be and why?

- How would you feel if everyone in our neighborhood put a bit of their allowance in a giant piggy bank so we could build a playground?

For college kids or recent graduates, share your list of top personal finance questions.

Encourage Budgeting and Saving Practices

Once you start giving your child an allowance or when they get their first job, guide them in creating a simple budget. Help them come up with different spending categories, including essentials like gas and non-essentials like subscriptions. Provide jars, envelopes, or digital tools to allow them to track their progress and celebrate saving milestones.

As they become more comfortable, you can introduce a variety of budgeting techniques and have them choose the one that makes sense for them. The most important thing is to make this a part of everyday life for your kids. Making money management an essential life habit — like brushing their teeth — will make it easier for them to keep up with it as adults.

Set Boundaries and Clear Expectations About Money

Establish clear rules and expectations around money in your household. This might include guidelines for allowances or spending limits. Consistency is key to helping your kids understand and respect those boundaries. For example, if they receive a weekly allowance, be consistent with the amount and timing. If something changes, communicate that early.

Reward Hard Work and Accomplishments

Linking effort with financial reward is a great way to teach your child the value of hard work. We’ve discussed job jars and bonuses for chores well done, but you can also reward them for acing a challenging school project, diligently preparing for a swim meet, hitting their Girl Scout cookies sales target, or getting their first side job.

Understand Family Wealth and Generational Legacy

You’ve watched your thumb-sucking toddler mature into a zest-for-life teenager, ready to buy their first car. Now is a great time to explore more complex financial concepts like net worth, retirement planning, and generational wealth, to further grow their sense of stewardship.

Inspire a Sense of Responsibility and Legacy

With 73% of Americans ranking finances as their number one stressor, discussing generational wealth with your children may seem daunting. But it doesn’t have to be. In fact, if you’ve gotten this far, you’re right on track! Sharing your financial wisdom is a great first step.

Here’s how to make the concept even more accessible for you and your kid. Discuss (and tackle) the small, strategic practices that lead to long-lasting family wealth and community development — one at a time. This can include:

Knowledge/skill sharing: Talk about the value of money-making skills that can be passed down. Maybe your family has great painters, a standout baker, an award-winning writer, or a retired athlete. Gauge your child’s interest in learning these unique skills and potentially making a career of it. If they perk up, then you’ve got the green light. Organize fun learning sessions like cook-offs, writing workshops, or a casual Q&A. You can also enroll them in courses and camps to nurture their newfound interest.

Talk about money-making skills that can be passed down. Maybe your family has great painters, a standout baker, an award-winning writer, or a retired athlete.

Community building: Show them how to build strong connections and contribute positively to their community, so future generations can thrive in the same space. Sure, charitable donations go a long way, but so does supporting local businesses and ethical consumerism.

Smart investing: Whether you’ve chosen to open a certificate account, invest in the stock market, or buy real estate, the important thing is to understand the basics, then pass it on. You can show your college student how to set up a robo-managed portfolio, which includes a diverse mix of index funds and stocks. This is a great option for beginners, and they don’t need hundreds of dollars. A small portion of their paycheck will do. Use investing resources like newsletters and compound interest calculators, which give your young adult an idea of how much their investment could grow. While it’s essential to acknowledge that all investments carry some level of risk, learning about these risks together equips them with strategies for mitigating losses and helps them build confidence.

Sure, charitable donations go a long way, but so does supporting local businesses and ethical consumerism.

Discuss Using a Financial Advisor for Long-Term Planning

Establishing a generational legacy doesn’t mean looking past your immediate needs. It’s an opportunity for you and your kids to keep at those smart, everyday money habits and conversations, but with an eye on a much bigger prize.

An expert can help with long-term planning.

Perhaps you’re already engaging a financial advisor who’s helping with estate planning, or you’re thinking it’s time to get advice on shifting your retirement investment strategy. Share your decision with your older children and explain what led you to it. While they may not be ready to participate in meetings, understanding the process makes it less foreign, and they’ll know they have yet another valuable wealth management tool at their disposal.

Incorporate Philanthropy and Charitable Practices

While it’s possible to have a healthy relationship with money without charitable giving, raising truly well-rounded children means empowering them to be positive contributors to their communities.

Philanthropy isn’t just about donating large sums of money. It’s about cultivating a mindset of generosity. Let’s discuss some ways to do that.

Teach the Value of Giving Back

Start by explaining that there are people and causes that need their support. Discuss different ways to give back, such as donating money, volunteering time, or using their skills to help others. Help them understand that it’s the action that counts, not the size of their donation.

Build a Philanthropic Mindset in Children

Get your child to think about the causes they care about — that way, they’re motivated to invest in them. It might be animal welfare or supporting other children. Help them research different organizations.

Encourage Family Contributions to Charitable Causes

Make giving back a mandatory family engagement. Here are 10 activities to try.

Create a giving back themed vision board: Have each family member create a vision board representing their charitable goals for the year. Get friends, neighbors, and extended family to sponsor some of the goals with cash donations.

Host a fundraiser: Lemonade stand, yard sale, or GoFundMe — you decide. Use the proceeds to help an acquaintance in need or support a local soup kitchen.

Organize a no-spend day: Put your wallets away for 24 hours (or more). Calculate how much the family would normally spend and donate that amount to a cause you all agree on.

Set up a round-up challenge: For a set period, round up every family purchase to the nearest dollar and contribute the total amount to a financial inclusion initiative or international nonprofit.

Create a special tip jar: When your kid earns money from chores, designate a certain percentage to a special tip jar. At the end of a quarter, give the money to your favorite service worker as a token of appreciation.

As a family, choose a small business to support and come up with a budget and a day to make it happen.

Patronize a small business: As a family, choose a small business to support and come up with a budget and a day to make it happen.

Give away a gift card: While grocery shopping, grab a gift card or two and load them up. Hand them over to unhoused individuals.

Celebrate milestones with charitable donations: Celebrating a birthday, moving to a new house, or paid off the family car? Agree to make a charitable donation when the family meets a shared goal or milestone.

Sponsor a financial advising session: Know someone that could use a free financial advising session? Build the cost of that into the family’s annual giving back budget.

Fund financial education: If someone makes a financial mistake (think missed chores, a late credit card payment, or an impulse buy that wasn’t worth it), take a minute to reflect, then turn it into an opportunity for good. The cost of the mistake (or a base amount) can be donated to an organization that helps people avoid similar pitfalls through education.

FAQs

Navigating the world of parenting and money might bring up some doubts. We’re here to help! Let’s explore a couple questions you might have along the way.

It’s natural to be concerned about causing unnecessary anxiety, but dishonesty breaks trust. The key is to make the conversation age-appropriate and focus on positive aspects like saving for goals or the joy of giving back. Frame discussions about making smart choices and planning for the future in an empowering way. Finally, focus on the principles of money management instead of specific figures. If you’ve experienced financial trauma, remember that open communication can help create positive cycles.

It’s never too early to start laying the groundwork. Children as young as three can grasp basic concepts like earning, spending, and saving. Use everyday scenarios to introduce these ideas in a simple and engaging way. With time, gradually introduce more in-depth discussions.

Not necessarily. Help them understand that spending is fine, but saving helps them reach big, exciting goals. It’s all about balance.

Just because you’re doing some learning of your own doesn’t mean you should hold back what you know. Be open about your journey. Show them that financial literacy is a skill that get stronger with new knowledge and experiences.

Keep parental discussions away from the kids. Remind yourselves of the shared goals for your child, like the soft skills you’d like them to have or the type of parent you hope they’ll become. Use that to help you figure out some non-negotiables for teaching them about money.

Calmly discuss what happened and why it’s considered a mistake, focusing on understanding instead of blame and guilt. Look at the consequences, then brainstorm concrete steps to do better.

The Takeaway

Teaching your children to have a healthy relationship with money is one of the most valuable investments you can make in their future. The journey calls for patience, flexibility, open communication, and modeling positive behaviors.

Every conversation, lesson, and shared experience is a step toward a more secure, responsible, and fulfilling financial life for your children.

Looking for more guidance?

Find out how a wealth management professional can help you organize your financial life and set your kids up for success.