CREDIT CARDS

How Credit Cards and Credit Card Interest Actually Work

What you'll learn: Don’t let credit card interest hold you back. See how you can conquer it.

EXPECTED READ TIME: 14 MINUTES

Imagine the VR headset you’ve been researching is finally on sale. With a few clicks and the secure entry of your card details, it’ll be on its way to you. That’s the convenience of a credit card. But what’s really going on when you pay with a credit card? And how does interest work?

Knowing how your credit card really works and how to navigate the world of interest is like reading the manual for your new buy. The more you know about its features, the more likely you are to use it efficiently.

We’ll show you how to make the most of your plastic money, with a look at the inner workings of credit cards, debt repayment, and tips to keep interest in check.

Credit Card Basics

From everyday essentials and special treats to emergency expenses and cash advances, credit cards offer instant purchasing power plus the ability to pay balances over time. Once you’ve put in the work to boost your credit score and applied for your ideal credit card, what comes next?

When a bank or credit union gives you the thumbs up on your application, you gain instant access to a pool of funds. You can tap into this pool whenever you want, but it does have a cap, known as your credit limit. This limit — whether $5,000 or $25,000, or somewhere in between — depends on factors like your income, and credit history, as well as other information included on your application.

When you sign and activate that credit card, you’re promising to pay back what you spend, plus interest and any fees outlined in the terms and conditions.

More on those fees later. Now, let’s delve a little deeper into credit card basics with a behind-the-scenes look at transactions.

Credit cards offer instant purchasing power plus the ability to pay balances over time.

What Happens When You Use a Credit Card?

Using your credit card to book a vacation or grab early morning coffee? Each time you pay with plastic, you trigger a chain reaction of digital interactions between various companies.

Here’s how credit card transactions play out:

- Swipe, tap, or click: You present your card at the register or enter the details online. This tells the merchant you want to use your line of credit.

- Inquiry: The merchant’s payment terminal or website communicates with its bank to seek approval for the transaction from your credit card network. All of this is done through a secure network.

- The green (or red) light: The credit card network passes the request on to your credit card issuer, who then assesses it. Do you have enough available credit? Is the transaction suspicious? Based on their findings, the transaction is either approved or declined.

- Transfer of funds: If approved, the credit card issuer pays the merchant on your behalf. You now owe that amount to the issuer.

Multiply this process by the 147.5 million credit card transactions that occur in the U.S. every day — that’s how deeply ingrained credit cards are in daily life.

Understanding Your Monthly Bill

Believe it or not, the above steps are just the beginning of the credit card saga. The second phase puts you in the driver’s seat.

When your billing cycle (typically 28 to 31 days) ends, your card issuer sends you a statement showing all transactions placed on your card during that period. It’ll also include your previous and new balances. You’ll see a minimum payment and due date as well. The credit card company determines your minimum payment (up to 5% of your current outstanding balance), which is the smallest amount you pay each cycle to keep your account in good standing.

Paying Off Balances

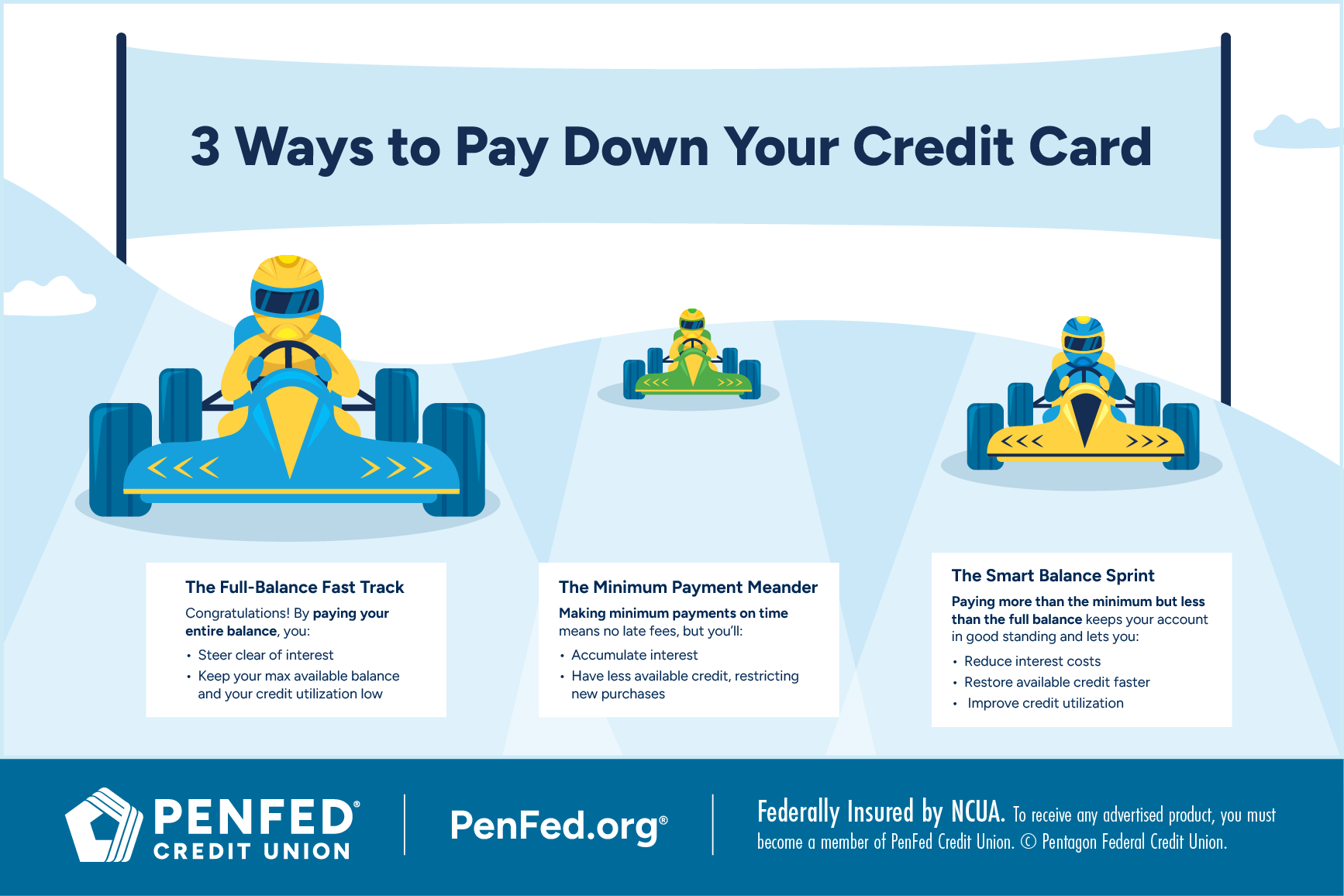

Once you’ve got your statement, you have three options:

- Pay the entire balance

- Make the minimum payment

- Pay an amount in between

Each one directly affects how quickly you shed debt, how much interest makes its way onto your bill, and more importantly, whether your credit score climbs, dips, or stays the same. With the last two options, interest will continue to compound on the balance of any older purchases that remain unpaid.

Always go for the option that’s financially viable for you. And keep in mind, the lower your credit utilization, the better your score.

How Does Credit Card Interest Work?

Now, onto credit card interest. It’s the fee you pay when you carry a balance from one billing cycle to the next — and it’s calculated using an annual percentage rate (APR). All but a few card companies charge interest.

If you settle your credit card balance in full and on time each month, interest rates won’t be a burden. That's because of the grace period on your bill, which typically lasts three weeks. During this time, interest charges don’t apply to new purchases.

If you settle your credit card balance in full and on time each month, interest rates won’t be a burden.

Breaking Down Annual Percentage Rates (APRs)

It’s in the fine print. It’s a term you hear all the time. But its true meaning might still feel a bit hazy. Simply put, APR for credit cards is the yearly cost of borrowing, expressed as a percentage.

Types of APR

Here’s where things get interesting. There are different types of APRs. The first you should know about is fixed APR. This one usually remains the same unless your minimum payment is more than 60 days late or your introductory rate offer expires. Take this example: A 20% fixed APR means you’ll be charged 20% of whatever you owe over a year, provided that balance remains and you don’t make additional purchases.

Then, there’s variable APR. This one changes with the prime rate, which is the interest rate banks charge their most trustworthy customers. Most credit cards feature variable APRs. The issuing company determines this rate by adding a margin to the current prime rate. So, for instance, if the current prime rate is 7.50% and the lender charges a margin of 14.74%, the variable APR for your card would be 22.24%.

Simply put, APR for credit cards is the yearly cost of borrowing, expressed as a percentage.

As you compare credit cards, pay attention to these key figures and consider what you can afford long term.

Comparing Fixed and Variable APRs

|

|

Fixed APR |

Variable APR |

|---|---|---|

|

Interest Rate |

Stays the same, regardless of market fluctuations |

Can change over time, usually linked to the prime rate |

|

Predictability |

Predictable monthly payments |

Payments can fluctuate |

|

Borrower Risk |

Less risk of unexpected charges |

Higher payments if the prime rate rises + makes budgeting less certain |

|

Potential Benefit |

Predictable payments make budgeting easier |

Potential for a lower rate if market rates decrease (not guaranteed) |

So, you’re getting the hang of fixed vs. variable APR, but there are a few more interest rate terms to know. Let’s break them down.

Purchase APR

What it is: Think of this as the standard cost of carrying for anything new you buy with your card and don’t pay off by the due date.

What it means for you: The higher the rate (and more you swipe), the quicker your credit card balance grows.

Balance Transfer APR

What it is: This is the special rate you get for moving debt from one card to another.

What it means for you: While temporary, zero to low balance transfer APRs can help you get rid of debt faster since your monthly payments go only to the principal balance.

Cash Advance APR

What it is: This rate kicks in when you treat your credit card like a debit card and grab cash at the ATM.

What it means for you: This is a costly way to withdraw money, so only opt for it if you’re in a real pinch.

Promotional APR

What it is: This is a limited-time interest rate on new buys or transferred balances.

What it means for you: It’s your opportunity to save, but keep your eye on the clock, as your regular APR will return.

Penalty APR

What it is: This high-interest rate hits when you break the card’s rules.

What it means for you: Know what you’re signing up for. Read the fine print. And make sure you’re making payments on time.

Your average daily balance is a snapshot of how much you owe, on average, each day of your billing cycle.

Average Daily Balances

Now that you know all about APRs, let’s go a step further. How does that yearly percentage morph into the actual dollars and cents on your bill? That’s where average daily balances come in. Your average daily balance is a snapshot of how much you owe, on average, each day of your billing cycle.

How Average Daily Balances Are Calculated

Your card issuer takes your APR and breaks it down to a daily rate, then multiplies it by your average daily balance to figure out your interest due.

Let’s use the 22.24% APR scenario from earlier to illustrate how credit card interest would impact your bill if you rolled a $1,000 balance for new purchases from one 30-day billing period to the next.

Step 1: Divide your APR by the number of days in the year

(0.2224 ÷ 365 = 0.00061 daily rate)

Step 2: Multiply your balance by the daily rate

(1,000 x 0.00061 = $0.61 daily interest charge)

Step 3: Multiply your daily interest charge by the number of days in the billing period

($0.61 x 30 = $18.30 monthly interest charge)

As you can see from the math, $18.30 is what would be tacked to your bill. These charges would continue to compound daily, and month over month, until you repay the entire amount.

Keep in mind that interest also grows daily on the balance from any older purchases that you haven't paid off. Add these figures together, and you can see how quickly interest can spiral out of control and lead to substantial credit card debt.

Why Average Daily Balances Matter

For credit card companies, average daily balances are the gold standard for calculating interest. It paints a clearer picture of your borrowing habits than just looking at the end-of-cycle balance. It also levels the playing field. Someone who spends big early in the cycle doesn’t get the same interest bill as someone with similar spending just before the close.

Pro tip: Keeping your daily balances low throughout the month is how you steer clear of hefty interest charges. Instead of making a large last-minute payment, try sprinkling in smaller ones during the month, being sure to still pay the minimum amount due by that due date . Use an average daily balance calculator to help you plan.

Strategies to Manage and Avoid Credit Card Interest

We’ve covered the main tactics for curbing interest — paying in full (or a little more than the minimum), sticking to due dates, and understanding APR and average daily balances.

Now, let’s get a little more strategic with these nine additional strategies to keep high interest at bay:

- Leverage the grace period: Treat your credit card like a debit card during the grace period. Make purchases as needed. Then, schedule the full payment days before the due date. That’s how you make the most of the no-interest window.

- Set up reminders: Get in that personal finance app and schedule reminders for minimum payments. Go a step further and make a note of any additional payments you plan to make throughout the billing cycle, especially following large purchases. This helps shrink your average daily balance and reduces potential interest even if you can’t pay the full balance by month’s end. While you’re at it, keep track of the dates your credit card issuer reports to the credit bureaus. Understanding reporting cycles allows you to get extra smart about managing all things credit. Reporting cycles typically occur once a month, near the close of a billing cycle.

- Opt for a balance transfer or debt consolidation loan: If you’re drowning in high-interest debt, balance transfers are a great solution because they often come with a low- or zero-interest rate that lasts from a couple few months to over a year, depending on the product, issuer, and requirements. You may also consider a transfer if you have a big, planned expense you can’t pay off immediately. Just be mindful of transfer fees, the impact on your credit score, and the date regular APR kicks in. Debt consolidation loans work similarly to balance transfers, allowing you to move multiple debts to a single, easy-to-manage account. Depending on the type of loan, you could end up paying less interest than with your existing card.

- Round up and overpay: Many budgeting and investing apps allow you to round up your purchases to the nearest dollar and deposit the digital change in a savings or brokerage account. To help pay off balances a little faster and chip away at interest, consider redirecting those small round-up amounts to your credit card bill. Keep this habit going while you make minimum payments. You’ll see — these little contributions add up and pay off over time.

- Negotiate like a pro: If you’re a long-time cardholder with a strong payment history, don’t be afraid to contact your credit card issuer and ask about a lower APR. While not always successful (especially with variable APR cards), it’s worth a try. (Please note, PenFed does not lower interest rates upon request.)

- Snowball or avalanche it: If you have multiple debts, consider tapping into any extra income you have and implement the snowball or avalanche methods. Both are designed to get you debt-free and make repayment a little more manageable. Either way, you’ll be chipping away at both your principal and interest.

- Keep at good old budgeting: Use your digital wallets and budgeting apps to review your spending categories. Are there areas where you’re overspending and incurring unnecessary balances (and interest)? Get that in check.

- Watch for rate changes: Keep an eye out for a 45-day advance notice from your issuer announcing rate changes. Follow the news or Federal Reserve for updates on potential interest rate hikes, especially if you’re a variable APR cardholder. If you anticipate rates going up, consider aggressively paying down your balance ahead of time to minimize the impact of future increases.

- Shop around wisely: Want to land a low interest rate right from the start? Don’t just settle for the first credit card offer you see. Take your time. Use comparison tools to size up your top contenders. Which one has the best APR?

Other Considerations

While shelling out those monthly card payments is a win, it’s just a piece of a much larger puzzle. To truly thrive in your credit-building journey, you need to zoom out and take on a holistic approach.

Before clicking submit on a credit card application, you want to make sure it’s one that you can afford. Is the annual fee worth the rewards? Can you live with those cash advance fees? What about foreign transaction fees? Are they too high? Think about it — these fees can add up and eat into your repayment progress.

And let’s not forget your credit score. It’s the star player and the reason you’re looking to manage your debt wisely. Regularly reviewing your score and credit report is like checking a scoreboard. You’ve got to make sure everything is accurate. Once you know where you stand, you can identify areas of improvement and take steps to help you qualify for the lines of credit you want. Plus, a good score can help you land low interest rates on an auto loan, insurance, and more.

When you get tempted to go on a spending spree, take a moment to think about the future you.

Remember, tackling interest and bettering your overall financial health takes time and effort. It’s completely normal to feel overwhelmed, so give yourself some grace. And don’t lose sight of the prize. Here are some useful tips to help keep you going.

- Visualize your why: Connect your debt repayment goals to your life aspirations. Do you want to travel, buy a house, or retire early? Keep visual reminders of these goals in the spaces you frequent. And when you get tempted to go on a spending spree, take a moment to think about the future you.

- Seek out personal finance resources: Look for experts and courses that offer helpful tips and success stories. Or subscribe to a trusted finance blog.

- Make a big deal of the wins: You got one debt out of the way. That’s something to celebrate!

Frequently Asked Questions

We’ve made it through the ins and outs of credit card interest and debt repayment, but you may have a few lingering questions. We’ve got you covered. Here are some final considerations to help you fully understand what it takes to crush your balances and interest.

A “good” interest rate is subjective and depends on your creditworthiness and the type of card. Generally, anything at or below the current average APR for the card type (e.g. rewards, balance transfer) can be considered good. An excellent or good credit score is your key to accessing cheaper credit! If your score is below 580 or you haven’t established a credit history yet, you may want to consider a secured credit card.

As of August 2024, the average credit card interest rate is 24.23%. This figure fluctuates based on market conditions, plus the type of credit card.

There is no set schedule. Variable rates may change when the prime rate does. But don’t worry, the credit card company will give you a heads up. However, if you have a promotional APR, the terms and conditions will tell you how long you’ve got until the regular APR kicks in.

Most credit card issuers apply a grace period only to new purchases. Cash advances and balance transfers are often exempt and accrue interest right away, no wait time.

Missing a payment can lead to significantly higher interest costs. First, you’ll get charged a late payment fee. Then, your issuer might introduce a penalty APR that raises your interest rate. This new rate can stick around for some time.

This might have happened because you didn’t clear your entire balance by the due date in the previous billing cycle. And as we’ve discussed, interest accrues daily. Even if you paid what you thought was the full amount later, you’re still responsible for the interest accumulated until that payment.

The Takeaway

Whether you’re new to the world of credit or a veteran of paying with plastic, hold onto these insights and get proactive. That’s how you pave the way to a future where credit works for you!

Do More with a PenFed Credit Card

Pay bills, grow your credit, and unlock rewards big and small.