FINANCE

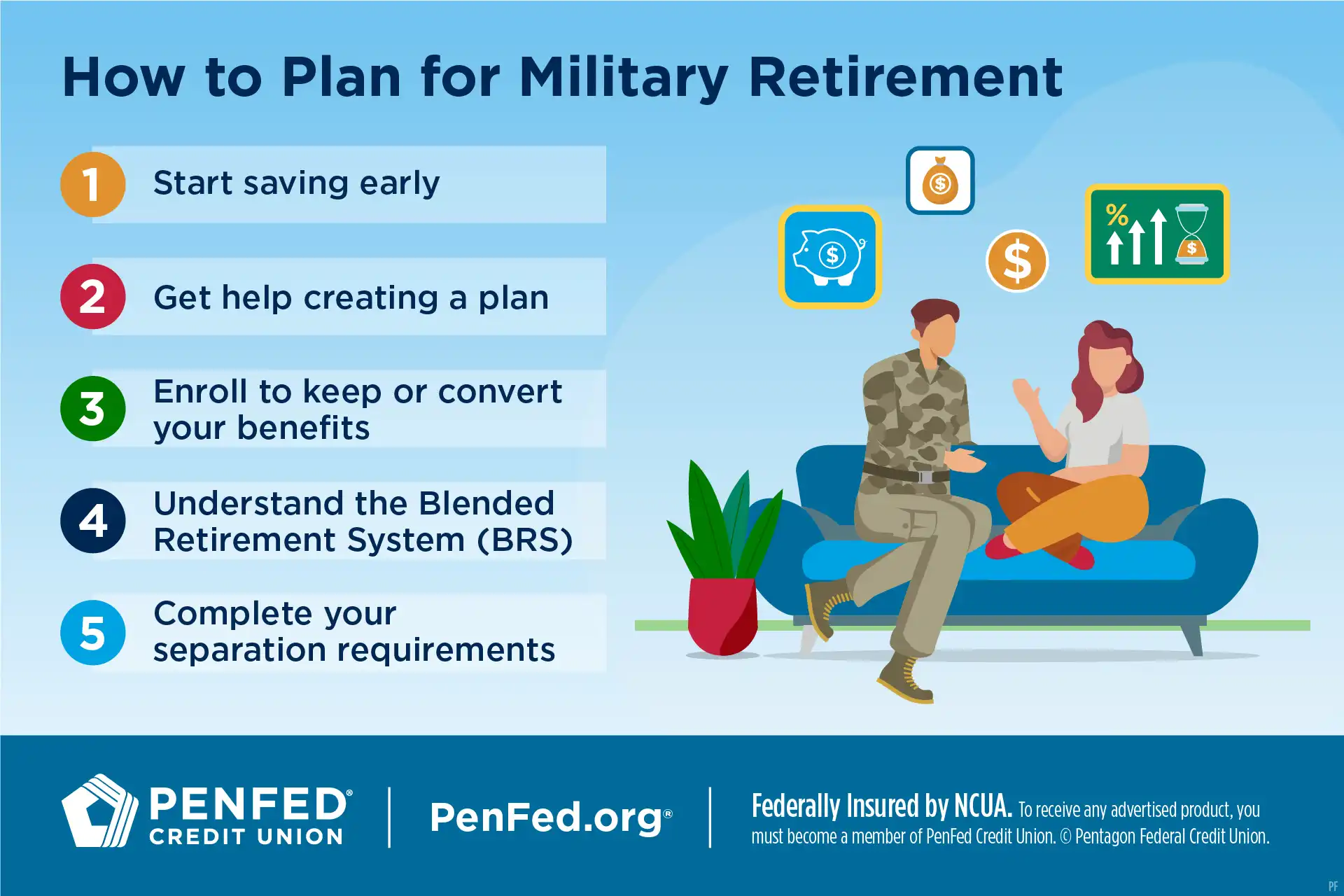

How to Plan for Military Retirement

Expected read time: 6 minutes

Transitioning from active duty to civilian life can be surprising — and one area where you don’t want surprises is in your military retirement. The military has been changing its retirement plan in recent years to offer benefits that are more appealing to younger service members and more in line with what the private sector offers. Here are tips on navigating the process so you can maximize your military retirement benefits.

Start Saving Early

Saving for retirement is easier if you start earlier. Over time, compound interest on your contributions can multiply your savings many times over. Ideally, you’ll start saving for retirement in your 20s, but there are ways to catch up if you’re starting later.

Get Help Creating a Plan

Retirement planning can get complicated, but those who create a retirement plan save five times as much as those who don’t. Take advantage of the resources available to you like:

- Retirement planning seminars

- Informational briefings

- Military retirement guides

- Retirement planning toolkits

You can also consult a financial advisor with miliary retirement experience to tailor a plan to your specific situation.

Those who create a retirement plan save five times as much as those who don’t.

Plan Your Post-Retirement Budget

Your retirement budget may look very different from your active duty budget. For example, the largest expenses for most Americans are housing, transportation, food, and healthcare.

Consider whether you have access to things like base housing and TRICARE or whether you’ll need to cover those expenses yourself (which could greatly increase your monthly expenses). As much as possible, reduce your debt before retirement to make budgeting easier.

Another consideration is whether you plan to work during retirement. Many service members start their own businesses, utilize their skills in the private sector, or take civil service positions to generate additional income.

Just be aware that taxes on your civilian income could mean your take-home pay will be less than you expected.

As for your military retirement pay, how much you receive will depend on factors like when you enlisted, how long you served, and the type of retirement you have. There are three types of non-disability pay:

Many service members start their own businesses, utilize their skills in the private sector, or take civil service positions.

Types of Non-disability Retirement Pay, Eligibility, and Multiplier

|

Type of Pay |

For those with… |

Pay Multiplier |

|---|---|---|

|

Final basic pay |

Entry dates prior to September 8, 1980 |

2.5% times your years of creditable service, times final pay |

|

High 36 |

Entry dates between September 8, 1980 and July 31, 1986 Entry dates after August 1, 1986 Entry dates before January 1, 2018 *Only those who did not elect REDUX or opt into BRS |

2.5% times number of years of service, times the average of highest 36 months of basic pay |

|

REDUX |

Entry dates after July 31, 1986, who accepted a mid-career bonus, and remained active duty for 20 years |

Before age 62: At and after age 62: |

|

BRS |

Entry date on or after January 1, 2018 |

2.0% times years of service, times highest 36 months of basic pay 1% branch match of basic or inactive duty pay Members can receive up to 4% match if contributing 5% |

Source: MilitaryPay.defense.gov

Use Additional Retirement Tools to Supplement Your Military Retirement Pay

Your military retirement pay may not be enough to support the lifestyle you want to live in retirement. That’s why it’s important to save using additional retirement tools as well. There are general benchmarks that can guide you in setting retirement savings goals, but remember that these are general guides that can’t replace more careful planning.

Take advantage of 401(k) benefits if you’re a service member working in the private sector.

401(k)

Take advantage of 401(k) benefits if you’re a service member working in the private sector. Employer contributions are an important part of reaching your retirement savings goals, plus these accounts carry special tax benefits.

TSPs

The Thrift Savings Plan is part of the Blended Retirement System (BRS) and functions like a 401(k), offering similar savings and tax benefits. TSP comes with an automatic 1% match from the Department of Defense, but service members can also contribute up to 5% to maximize their savings benefits. If you’re starting late, TSP does allow for catch-up contributions once you turn 50 years old.

IRAs

An individual retirement account (IRA) is a special account where you can save and invest for retirement independent from your employer. There are different types of IRAs that offer either tax-deferred or tax-free options.

High-yield savings accounts, certificate accounts, and money market accounts are other ways to diversify your investments while earning predictable yields.

Supplemental Savings Tools

While traditional retirement savings tools offer unique tax benefits, they’re not your only option. High-yield savings accounts, certificate accounts, and money market accounts are other ways to diversify your investments while earning predictable yields. They can also help you create better balance between your liquid and illiquid assets.

Enroll to Keep or Convert Your Benefits

You receive many benefits as an active-duty service member, some of which can follow you into retirement if you enroll to keep them. Utilizing these benefits will lower your expenses in retirement, allowing you to stretch your savings further. Here are a few benefits you should keep track of:

- TRICARE

- Dental and vision care

- Commissary and exchange privileges

- Servicemember’s Group Life Insurance plan (usually must be converted to Veterans’ Group Life Insurance upon retirement)

As a retired service member, you’re also eligible for:

Understand the Blended Retirement System (BRS)

The Blended Retirement System (BRS) took effect on January 1, 2018 and combines components of older military retirement plans with new benefits that are more similar to private-sector plans. It includes:

Monthly retirement pay for life after a minimum of 20 years of service

Matching contributions up to 5%

A mid-career continuation bonus

An option to receive a discounted, one-time lump sum payout at retirement

The Blended Retirement System (BRS) took effect on January 1, 2018 and combines components of older military retirement plans with new benefits that are more similar to private-sector plans.

BRS calculates your retirement using a 2.0% multiplier for each year of service. That means a service member who serves 20 years will receive a pension worth 40% of the retirement multiplier.

You can maximize your BRS by:

Investing 5% of your pay into your TSP. Your branch automatically starts putting 1% of your pay into TSP for you when you opt into the program. If you put in at least 5%, they’ll put in 4%.

Stay in for 20 years. Your pension can increase over time based on cost-of-living adjustments. Plus, the overall amount you receive in retirement is based on years of service completed.

Keep Growing Your TSP After Retirement

A TSP can be converted into another type of retirement account after you retire. For instance, you can reinvest it into some types of employer-backed retirement accounts if you start working in the private sector. That allows you to keep adding to your investment for years before you ever start drawing on it.

A TSP can be converted into another type of retirement account after you retire so you can keep saving.

Complete Your Separation Requirements

The Department of Defense Transition Assistance Program (DoDTAP) is designed to prepare service members for transitioning into civilian life. Although completing the program takes time, it ensures you’ll leave active duty life with the benefits you’re entitled to and a plan for your next steps. The program includes:

Initial counseling and pre-separation counseling brief

Core transition curriculum

Final medical exam

Scheduling your final move

The Takeaway

Planning for your retirement from active duty doesn’t have to be stressful. By starting early, asking questions, and using the right tools for your goals, you can set yourself up financially for this great new phase of life.

Prepare for Your Retirement Today

PenFed’s extensive IRA portfolio allows you to customize how you save for retirement.