Personal Finance

How to Create a Holiday Budget

What You’ll Learn: How to create a budget for the holidays

EXPECTED READ TIME: 6 MINUTES

Holidays can be stressful, and a large part of that stress comes from extra expenses we’re managing on top of our usual bills. Creating a budget for the holidays eliminates the pressure to “find” money or dip into regular savings.

Creating — and sticking to — a holiday budget is simpler than you might expect. Here are a few tips to get you started.

1. Write Out Your Budget

The best way to control holiday spending is to figure out how much you can afford to spend before you start shopping. Creating a holiday budget is similar to creating a personal budget, but you’ll use it just for the months leading up to and during the holidays. Once you’ve created your holiday budget, you can modify and reuse it year after year.

Once you’ve created your holiday budget, you can modify and reuse it year after year.

List Out Your Expenses

Write down (or type up) a list of your holiday expenses. Keep your budget handy — on the fridge, saved to your phone, or on the desktop of your computer. Putting it on paper (or screen) will help you commit to your budget, and seeing it frequently will keep it top-of-mind during a busy season.

You might find it helpful to list expenses by categories, such as food, travel, entertainment, gifts, decorations, and postage. Get input from family and friends so you don’t overlook anything important.

Calculate Costs

Once you know what you plan to spend on, start calculating your costs. Don’t worry if you don’t know the exact price of things — you can revise your budget as you work. And while it’s ok to guestimate at first, remember that it’s better to overestimate costs than to underestimate.

Looking back at last year’s spending can also give you a starting point for costs, as well as a sense of how much you spend in different categories. Another great option is using online price checking tools to see how prices are trending this year.

It’s better to overestimate costs than underestimate.

Find Ways to Cut Expenses

Once you know your ideal budget, look for ways to cut back. Here are some suggestions for how to reduce your holiday spending:

- Scale down. If you have a smaller family, consider buying a turkey breast rather than a whole turkey.

- Recycle and re-use. Invest in a reusable holiday tree rather than buying a fresh-cut tree every year.

- Favor your priorities. If you’d rather have big gifts than travel somewhere exotic, consider cutting back your travel budget.

Think about what really matters to you and your family during the holidays and cut back on the rest. These may be small savings, but they can add up.

By focusing on what matters to you and your family (instead of what your neighbors are doing or what you see on TV), you’ll get more value out of your purchases. You might even have enough to start saving for next year.

Think about what really matters to you and your family during the holidays and cut back on the rest.

2. Refer to Your Budget Sheet Often

A budget will only work if you check in and adjust it regularly, so have your budget with you — in either paper or electronic form — when you shop, whether online or in store.

Review it after every few purchases to ensure you’re staying on track. You can also budget better by:

Breaking Up Your Budget

Divide your budget by spending categories, such as food and travel, and set clear spending limits per category. This way you’ll ensure you’re not overspending in one area at the expense of another. Prioritize the things that matter most to you and your family, making cuts to things that don’t mean as much.

Recording Expenditures Right Away

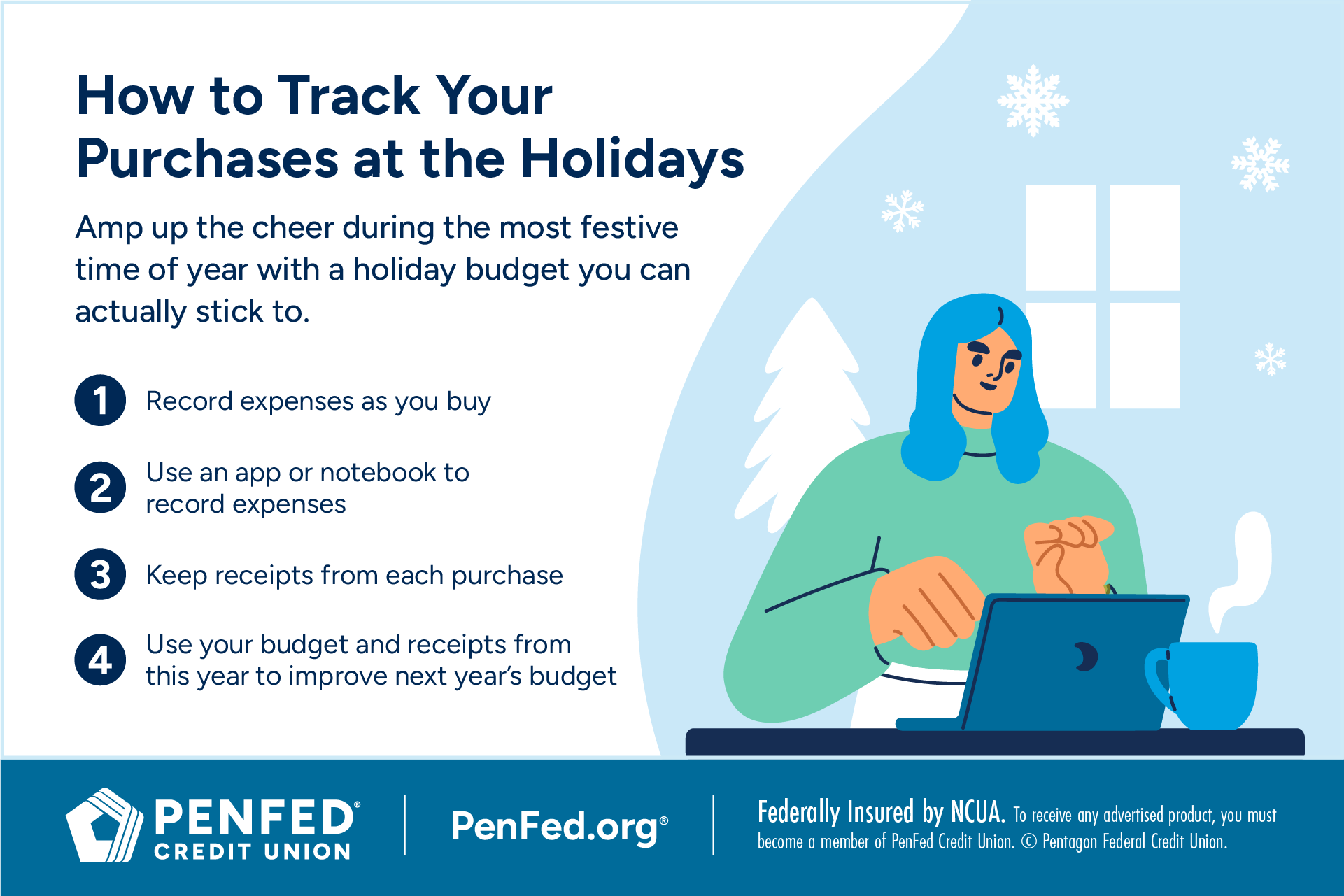

The biggest mistake people make with holiday budgets is recording purchases well after they’re made. Logging expenses later is less effective and less accurate, so track as you go. You can do this using:

- Mobile banking apps

- Holiday shopping apps

- A small notebook and pen

- A checkbook ledger

- Spreadsheets

When the holidays are over, keep your budget (including receipts) so you can refine it next year.

Using the Envelope Budget Method

Many people find the envelope budgeting method helps them stick to a budget more successfully. Withdraw your holiday budget from an ATM, divide the cash up according to your budget, and put it envelopes labeled with the appropriate spending category. Then limit yourself to only spending what’s in that envelope.

If you don’t want to carry around gobs of cash, you can also use the envelope budget method without cash.

Logging expenses later is less effective and less accurate, so track as you go.

Get the Most From Your Money

Smart spending habits can help you maximize your budget. Here are some strategies to get you started:

Comparison Shop and Buy Online

It can be tempting to buy everything at the nearest big box retailer in your area and be done, but you could actually be paying a lot more that way. Do some comparison shopping to see if you can grab deals on gifts, food, or travel expenses. You can find savings using:

- Online research to compare prices at different retailers

- Price tracker websites that show the best time to buy

- Special holiday sales like Black Friday and Cyber Monday

Buy Local

Another way to save is to buy local. Not only will you be supporting your community, but you’ll find unique gifts at great prices. You’ll also save on shipping and avoid massive holiday crowds.

Use Credit Card Rewards Programs

Using rewards cards for holiday shopping can be a great way to earn cash back or sky miles. Here’s the smart way to maximize rewards points at the holidays:

- Save money ahead of time to cover holiday costs.

- Pay with your credit card.

- Wait for your reward points to come in.

- Pay off your holiday expenses from your savings.

- Use leftover rewards points to buy discounted gift cards from favorite retailers.

This way you can earn those rewards without paying for them in extra interest charges and fees. And remember: Never put more holiday expenses on your credit card than you can afford to pay down from savings.

Using rewards cards for holiday shopping can be a great way to earn cash back or sky miles.

Start Saving Early

Another benefit of creating a holiday budget is it can help you start saving for the holidays earlier. Take your total holiday cost and divide it by how much you need to save each week or month to have that amount in time for next year’s holidays. You’ll thank yourself next year when you can skip the credit card interest and pay straight from savings.

Use Layaway

Although you don't see layaway plans advertised as much these days, many stores still offer this option. The program is simple: you make a deposit on an item and the store holds it for you until you can pay the remaining cost, often through a series of payments.

The nice thing about layaway is that it doesn't require good credit, and you won't be charged Interest or fees. If you default on your purchase, you will lose your deposit, but it won't be reflected on your credit report.

Buy Now, Pay Later (BNPL)

“Buy now, pay later”, or simply "pay later," plans have exploded in popularity over the last few years. These plans do have some advantages like helping spread out the cost of purchases, using a soft credit check for approval, and clear installment plans to pay off. If you have good credit, you may end up paying 0% Interest and no fees.

However, there are downsides as well, the biggest being that you're taking on unnecessary debt. You may also be subject to high Interest rates and fees if you miss payments. These plans also don't have the same consumer protections as credit cards.

If you decide to use buy now pay later plans, be sure you understand the terms and conditions and can easily pay off the debt you're taking on. You don't want your holidays soured by a bad payment plan.

Pad Your Budget

Holidays bring excitement, but also unexpected surprises. Whether you actively set aside money for extra expenses or simply over-estimate and under-spend, having a small cushion can help you avoid overspending.

Your kids won’t remember every gift under the tree, but they will remember the time you spend with them.

4. Stop When You Hit Zero

It’s easy to get caught up in the excitement of the holidays and overspend. We want to make all of our loved ones’ holiday dreams come true! But managing your money well is an important way to take care of them and yourself. Keep these things in mind when you hit the end of your budget:

What Really Matters

Your kids won’t remember every gift under the tree, but they will remember the time you spend with them. The same goes for adult family members and friends. Staying in control of your finances around the holidays will reduce your stress and help you be more present with the people who matter, and that’s the best gift you can give anyone.

Long-Term Financial Goals

You have long-term financial goals, whether that’s building a legacy for your family, paying off debt, saving for college, or saving for retirement. Those goals have huge effects on you and your family, and it’s important to prioritize them for the overall well-being of your family. They’ll be grateful you did in years to come.

Give Alternative Gifts

If you’ve hit the end of your budget and still need to scrounge a few gifts, don’t overspend. Instead, find alternative gifts. These could include:

- Regifting unused items like candles or coffee mugs

- Making homemade gifts

- Creating customized “coupons” for things like coffee dates, lunch out, or free babysitting

Gifts like these are enough to let someone know you thought of them, and sometimes they can be incredibly meaningful. After all, the most precious gift you can give someone is the one thing you can never get more of — time.

The Takeaway

Creating a holiday budget may be the best gift you give yourself this year. It reduces the stress of the holidays, helps you spend wisely, and frees you to focus on all the things that bring you and your loved ones joy during this season.

Explore Your Holiday Savings Options

Discover the diverse offering of products, services, and support available to our members.