FINANCE

Budgeting for Newlyweds

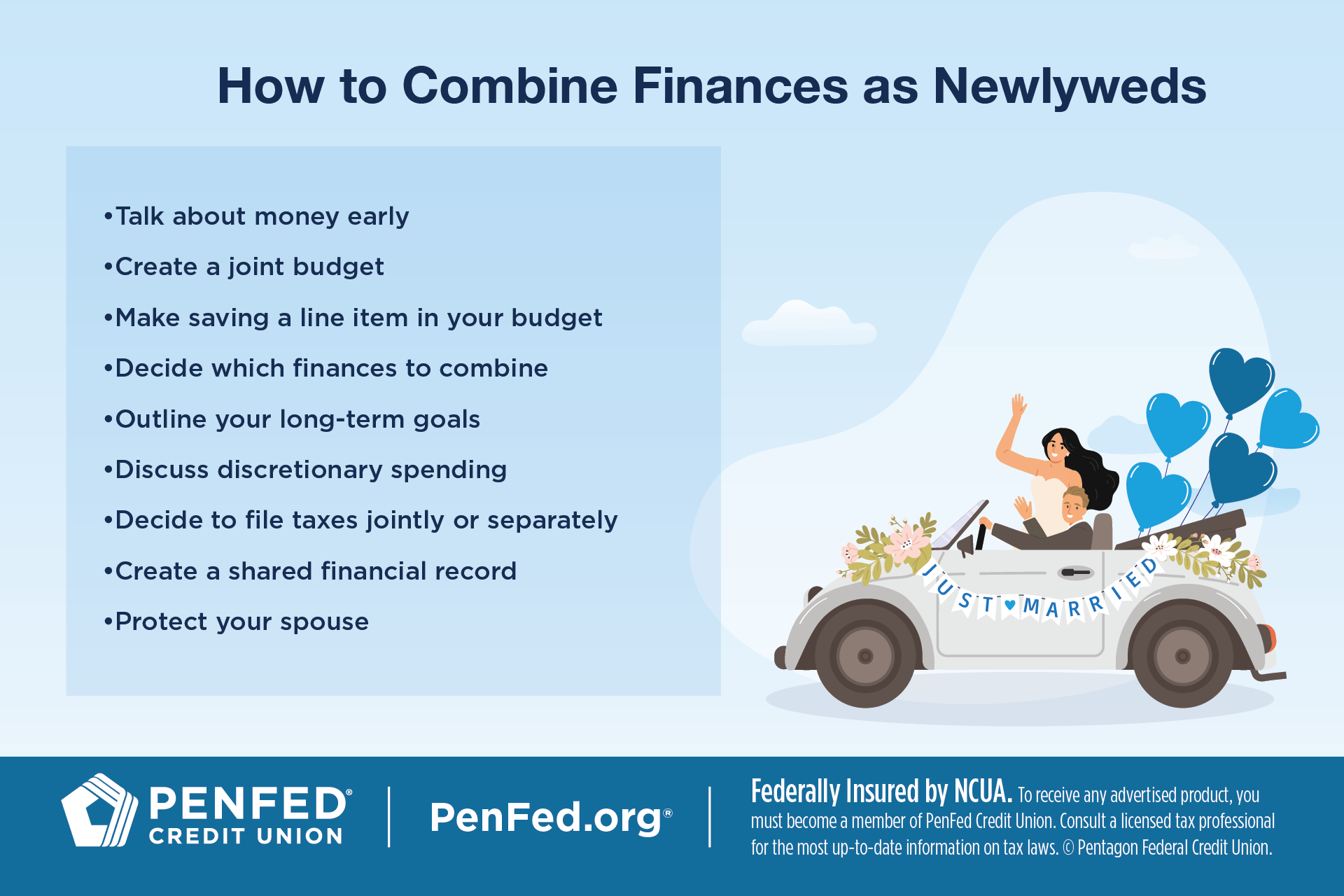

What you'll learn: A step-by-step to combining finances with your spouse.

EXPECTED READ TIME: 6 MINUTES

Getting married is a huge, exciting milestone, but combining two lives can take some planning. You can make that transition easier by budgeting with your spouse from the very beginning.

Unsure what you need to discuss? Use our step-by-step guide to setting up your life together.

Start Talking About Money Early

Money is an emotional topic. Even if you're not materialistic, money is tied to our sense of security. That makes it an uncomfortable — and unromantic — topic.

According to a 2024 Bankrate study, 43% of American couples have only joint accounts, while the majority (57%) have at least some separate financial accounts.

But it's also one of the biggest sources of conflict in marriage. That's why it's important to be open and honest from the beginning. Start by:

- Establishing where you each are financially — sharing your salaries and sources of income, listing out any debts you have, how much you owe, your credit scores, and savings.

- Stating your financial goals. Don't panic if you have different goals for your money, but do think about if and how those goals are compatible — and what goals you want to work toward together.

- Verbalizing your values around money. You and your partner may not think about money the same way. Understanding how you differ will help you compromise on saving, spending, and budgeting.

It's good to practice discussing money early on since it will be an ongoing conversation throughout your marriage. Set aside time — once a week, month, or quarter — to check in and reevaluate your budget. Your conversations will get easier with practice.

Create a Joint Budget

Creating a shared budget is similar to creating a personal budget. Even if you decide to keep your finances separate, you'll share some expenses as a couple. Start by listing these out by categories, including:

- Home: rent or mortgage payments, insurance, property taxes, and any fees for things like trash, parking, or an HOA

- Utilities: water, power, and internet

- Groceries: food, household essentials like cleaning supplies

- Maintenance: any costs related to your home (such as yard maintenance or pest control) or car (like gas/EV charging or tune-ups)

- Shared debt: mortgages, car loans, personal loans, or other debt you've cosigned on

You may have additional shared costs like childcare expenses, subscriptions, weekend entertainment, or hobbies. Customize your budget according to your needs.

The next step is to add up your shared income. Consider all sources of income (such as investments, retirement accounts, and side jobs) as well as your main salary.

Practice discussing money early on since it will be an ongoing conversation throughout your marriage.

Make Saving a Line Item in Your Budget

You're significantly more likely to save money if you treat it like an expense instead of an afterthought. Budget for saving and find effective ways to grow that money, such as:

- High-yield savings accounts

- Certificates

- Retirement accounts and HSAs

- Brokerage accounts

If you have specific goals or hobbies that you spend money on, then you may find it easier to manage your savings with multiple accounts for long-term and short-term savings goals.

Decide Which Finances to Combine

Traditionally, couples combined all their finances when they got married, but that's not always the case today. According to a 2024 Bankrate study, 43% of American couples have only joint accounts, while the majority (57%) have at least some separate financial accounts:

- 34% have a mix of joint and separate accounts

- 23% keep their accounts completely separate

Whether it makes sense to combine finances depends on your situation. You may decide to open a joint checking account to pay your shared expenses from and keep the rest of your money separate. If you decide not to combine finances at all, then you'll need to decide who pays which bills.

Budget for saving and find effective ways to grow that money.

Outline Your Long-Term Goals

Whether you're paying off debt, investing for retirement, or saving for a dream vacation, you've likely got some long-term goals. Flesh them out, make a plan for reaching them, and incorporate that plan into your shared budget. You'll be more likely to actually achieve those goals.

If you have more than one goal, rank them in order of priority. That way, if your financial situation changes, you'll be able to adapt your budget quickly without losing progress.

If you have more than one goal, rank them in order of priority.

Discuss Discretionary Spending

Discretionary spending is money you spend on wants. How you like to spend leftover money is tied to your values, so it's worth discussing with your partner. If you combine finances, you'll need to decide on how much total discretionary income you have each month and how you want to use it.

Decide to File Taxes Jointly or Separately

There are tax credits and deductions you can take advantage of if you file your taxes jointly, but there are times when it makes more sense to file separately. Your tax situation is unique to your relationship. If you're unsure what makes the most sense, contact a tax professional.

Protect Your Spouse

You don't know what's around the corner, but that doesn't mean you can't prepare for bumps in the road. Make sure your partner is prepared to handle things on their own if necessary.

How ever you do it, make sure you both have access to your budget and goals.

Organize Important Documents

Gather your important financial paperwork and store it all in one place that's easily accessible. This paperwork should include:

- A list of all your bank accounts with institution names, account numbers, balances, and login information

- A list of any other assets like property or investment accounts

- Property deeds, vehicle titles, and insurance information

- A list of outstanding debts with balances

If you haven't already, now is a great time to make your new spouse your beneficiary on any insurance policies.

Start an Emergency Fund

An emergency fund is money set aside to cover your essential expenses for 3 to 6 months in the case of an emergency like a job loss or illness. It's easy to start one using a high-yield savings account and putting aside a little at a time each month. If you already have a healthy emergency fund, decide whether it's big enough for you and your partner or if you need to grow it more now that you're married.

Update Your Beneficiary and Insurance

If you haven't already, now is a great time to make your new spouse your beneficiary on any insurance policies or retirement accounts you have. You may also need to adjust your health insurance to make sure everyone has the coverage they need. It's possible you could save money by combining your policies.

The Takeaway

Budgeting as a married couple isn't easy. But a little legwork at the start of your marriage will make money management easier down the road when you and your partner face big financial choices together.

Grow a Brighter Future Together

Discover the perfect savings account for your goals.