CHECKING & SAVINGS

How Many Savings Accounts Do You Need?

Expected read time: 6 minutes

The right number of savings accounts for you depends on the type and number of savings goals you have. It also depends on how you like to track those goals and whether you prefer a more active or passive savings strategy. Let’s explore what you need to start meeting your biggest savings goals.

How Much Does the Average Person Keep in Savings?

As of 2019, Americans on average save 3.4% of their income. That adds up to around $41,600 spread across different financial tools like savings accounts, certificates, bonds, and retirement accounts. However, that average may be skewed by very high-income earners. Average savings vary greatly by age, education level, income, and other demographic factors, with older, college-educated, and higher-income earners saving the most.

The Federal Reserve reported in 2020 that 64% of Americans could not cover a $400 emergency. This suggests that while Americans are saving, they may not be saving enough and may not be keeping enough of their savings liquid.

How Many Savings Accounts Can I Have?

There’s no legal limit to the number of savings accounts you can open. Some banks and credit unions will limit the number of accounts you can open at their institution, but that doesn’t mean you can’t open more accounts elsewhere.

There’s no legal limit to the number of savings accounts you can open.

That being said, having too many accounts will overcomplicate your personal finances. It can be challenging to keep up with multiple accounts spread across different banks and credit unions. Spreading your savings too thin could also cost you money. Some institutions offer higher dividends on bigger balances, which you could miss out on. Others charge fees if you don’t maintain a minimum balance, which may be hard with multiple accounts.

There’s a right number of savings accounts for you — and it’s probably more than one. But exactly how many accounts you need depends on your savings goals, and that’s completely unique to you.

Pros and Cons of Having Multiple Savings Accounts

|

|

|

|---|---|

|

Discourages spending from your emergency and long-term savings accounts |

Requires more work to manage your finances |

|

Makes it easier to track multiple savings goals at the same time |

Can make it hard to meet minimum account balances |

|

Enables you to take advantage of different APYs (annual percentage yield) and bonuses from multiple financial institutions |

Might miss out on higher APYs awarded for higher balances |

|

Helps build wealth over time |

Unused accounts are vulnerable to fraud |

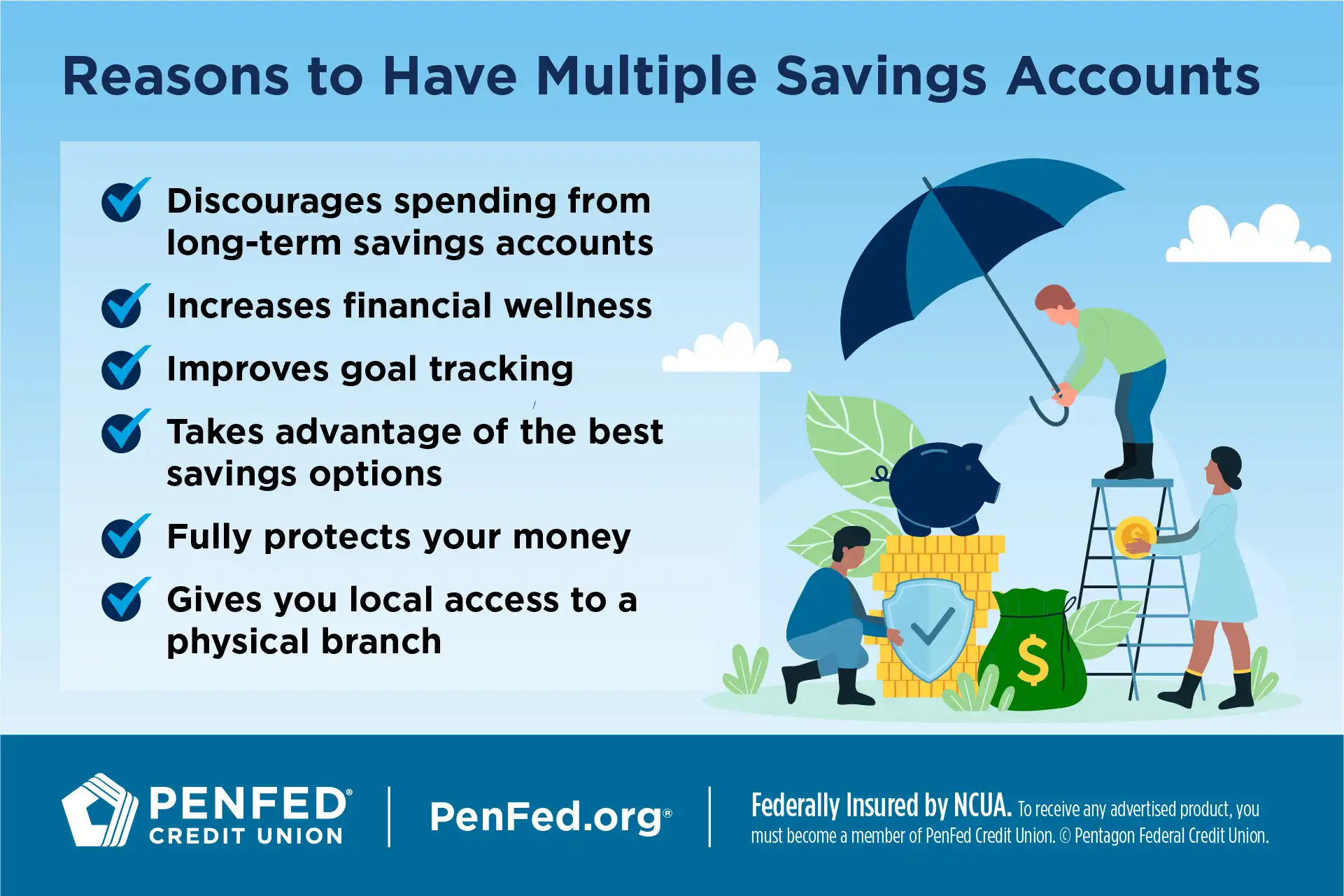

Is It Good to Have Multiple Savings Accounts?

There are clear advantages to having multiple savings accounts. Many financial experts recommend having at least three, each with a purpose:

- One for an emergency fund

- One for short-term savings goals

- One for long-term wealth building

Many financial experts recommend having at least three savings accounts, each with a purpose.

Increase Financial Wellness and Monitor Goals

Separating your savings this way increases your financial wellness and makes monitoring your financial goals easier. You can track progress on your savings goals at a glance, and you’ll be less likely to spend from savings. For example, if your emergency fund is in a separate account from your short-term savings, then you’re less likely to tap into it for that last-minute beach vacation.

If your emergency fund is in a separate account from your short-term savings, then you’re less likely to tap into it.

Take Advantage of the Best Options

Opening accounts at multiple financial institutions enables you to take advantage of the highest APYs and best perks from different financial institutions. As rates fluctuate, you can move your savings back and forth so you’re always getting the highest dividends.

Fully Protect Your Money

Your money in checking and savings accounts is insured by the NCUA (at credit unions) and FDIC (at banks). This protection covers up to $25,000 per bank, per account type. If you’ve met that limit at your current financial institution and have more to put into savings, you can better protect your money by putting it in additional accounts with other institutions.

Don’t open a savings account unless you have a plan for it.

Every Savings Account Should Have a Purpose

As a general rule, don’t open a savings account unless you have a plan for it. Money that sits in a forgotten account will earn interest but could probably be put to better use. Unused accounts are also vulnerable to fraud you may miss if you’re not interacting with them regularly. Plus, you’ll feel more motivated to keep saving if you have a clear idea what you’re saving for.

What Kinds of Savings Accounts Are Best for Me?

The traditional savings account is pretty familiar, but it’s not the only way to save — or the best way to save for every goal. Here are other savings tools to consider:

High-Yield Savings Account

High-yield savings accounts are similar to regular savings accounts, but they earn an APY that’s 10 to 20 times higher. Depending on the bank or credit union you use, your account may have restrictions on withdrawals, transfers between accounts, or minimum balance requirements that regular savings accounts don’t. But it will also build wealth quickly while keeping your money liquid.

For most Americans, “retirement account” means a 401(k) or pension, but those are only two of many options.

Certificates

Certificate accounts usually offer higher APYs than traditional savings accounts. The downside is your money is locked away until the certificate matures. That can work to your advantage, however, by removing temptation to dip into your savings and providing a lump sum at maturity to cover a big purchase like a car or vacation.

Retirement Accounts

For most Americans, “retirement account” means a 401(k) or pension, but those are only two of many options. And even if you have a retirement account already, you can go beyond traditional accounts and create supplemental retirement funds to save even more.

Money market accounts offer some features usually reserved for checking accounts such as checks and debit cards.

Money Market Accounts

Money market accounts offer higher APYs than traditional savings accounts, but lower than high yield savings and CDs. Often, they have a higher minimum balance requirement, too. But on the plus side, they offer some features usually reserved for checking accounts such as checks and debit cards that make your money more accessible.

Managing Multiple Savings Accounts Effectively

Keeping up with multiple savings accounts might sound confusing if you’re used to just having one. Here are some tips to make managing multiple savings accounts easier:

- Label your accounts

- Use a third-party budgeting app

- Automate your savings

Label Your Accounts

Many financial institutions let you add a nickname to your accounts through their website or mobile app. Label each of your accounts by their purpose or goal. It’ll help you keep them straight without having to memorize account numbers, and you’ll feel motivated each time you see them.

Use a Third-Party Budgeting App

Most people benefit from being able to see all of their accounts in one place at the same time. Your current bank or credit union might have a mobile banking app that allows you to add accounts from other institutions so you to see everything in one place. If not, consider turning to a trusted third-party budgeting app where you can manage all your accounts together.

If apps aren’t your thing or you’re worried about security, you can also go old school and create a spreadsheet tracking your savings over time. Update it weekly, monthly, or as often as works for you to stay on track.

If apps aren’t your thing or you’re worried about security, you can also go old school and create a spreadsheet.

Automate Your Savings

Make saving simple by automating it. You’re more likely to stick with a savings habit if you make it easy, and you’ll get used to not seeing that money in your checking account, reducing the urge to spend it.

You’re more likely to stick with a savings habit if you make it easy.

The Takeaway

Savings accounts aren’t just places to squirrel away money. They can be powerful tools for organizing your finances and building personal wealth. And now you know how to leverage that power for you and your family.

Explore Your Savings Options

Discover the diverse offering of products, services, and support available to our members.