Finance

What Is Opportunity Cost?

EXPECTED READ TIME:7 minutes

Every choice you make in life has an upside and a downside. For example, if you decide to walk to school then you can’t reap the benefits of sitting back and relaxing like you could if you had taken the bus or ridden in a car.

Did you know, though, that there’s actually a way to keep track of those pros and cons? In the case of your morning commute, sitting down would be considered an opportunity cost. The term “opportunity cost” refers to the missed opportunities you’ll face when you make a choice in one direction over another.

Businesses consider opportunity cost all the time when making important decisions, but it can be just as useful when you’re making decisions about personal finances.

Limited Resources Force Us to Choose

Opportunity costs happen because we all have limited resources. In other words, we only have a certain amount of time, money, and energy to use for things each day. Because our resources are limited, we have to make choices about how we spend them. Considering the opportunity cost of choices can help us make better decisions.

Evaluating opportunity costs doesn’t come naturally to everyone, but you can learn to get better at it.

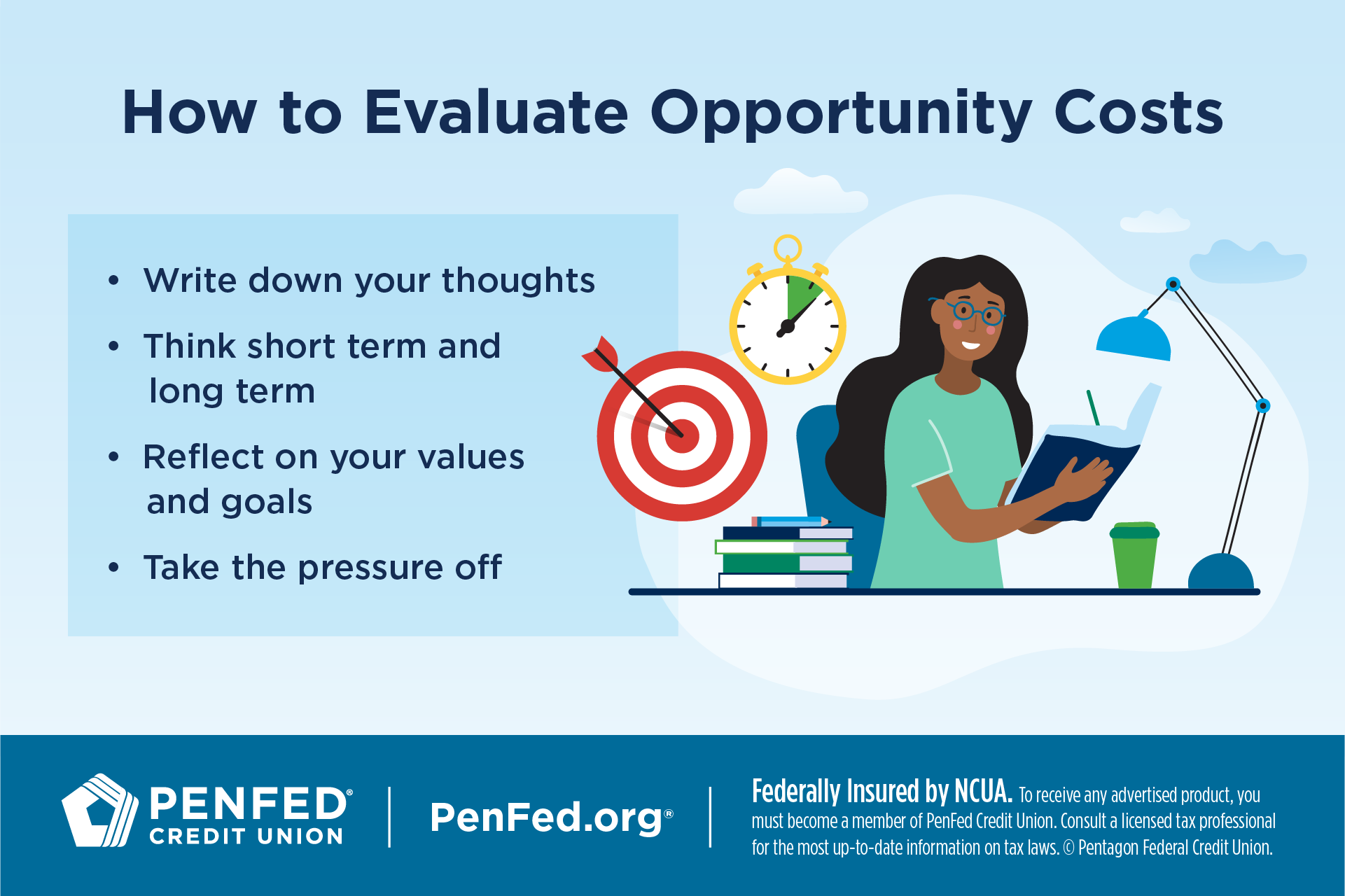

How to Evaluate Opportunity Costs

Evaluating opportunity costs doesn’t come naturally to everyone, but you can learn to get better at it. Here are some tips to get you started.

Write Down Your Thoughts

Opportunity costs aren’t always obvious, so writing down your thoughts can help you work through the benefits of each choice and weigh those benefits against each other. Consider using a graphic organizer such as a:

Simple pro-con list where you write out all the benefits and consequences of each choice

Weighted pro-con list where you write out pros and cons of a choice and then assign them points based on how important they are to you

Goal chart that considers how much each option helps you reach your goals

See It in Action! Pro-Con List for Choosing an After School Activity

Isabel is choosing between two after-school activities, soccer and robotics club. Both are great options, but she only has time for one, and the activities sometimes overlap. She decides to use a graphic organizer to help her figure out which activity is a better fit.

Is soccer or robotics club the better activity for Isabel? Let’s compare them:

|

|

Soccer |

Robotics Club |

|---|---|---|

|

Pros |

Make new friends |

Make new friends |

|

|

Stay active |

Play with robots! |

|

|

Take a break from academics |

Learn skills to help me in school |

|

|

Increase fitness level and coordination |

Learn skills that could help me get a job |

|

|

Improve teamwork skills |

Improve teamwork skills |

|

|

Soccer |

Robotics Club |

|

Cons |

Chance of injury |

Expensive |

|

|

Weekends spent traveling |

Some travel for competitions |

|

|

Less time for school and friends |

Could be hard to focus after being in school all day |

Think Short Term and Long Term

Instant gratification feels pretty good, and it’s easier to think about short-term consequences. But thinking long term helps us make choices we’ll be happy with long after we’ve made them. Plus, some choices (like saving money or working out) offer little immediate benefit but pay off big time later.

Ask yourself this: What am I giving up if I spend my money this way?

Reflect on Your Values and Goals

Keep your values and goals in mind while you make big decisions. That way you’ll make choices that feel true to you and help you achieve big things. You also won’t be distracted by popular trends or other pressures that try to influence you.

Take the Pressure Off

We often think about choices in terms of “good” or “bad,” but many choices aren’t about right or wrong. The results of each choice are just different. If you’re stressing over a choice because you’re afraid to make the wrong one, try to change the words you’re using. Instead of asking, “Am I making a bad choice?” try asking, “Am I making a choice that works for me?”

Even if you’re not paying your own bills yet, every choice you make around money has pros and cons.

Opportunity Costs in Personal Finance

Opportunity cost is an important part of managing money. Even if you’re not paying your own bills yet, every choice you make around money has pros and cons. Here are things to think about when evaluating those opportunity costs.

The Opportunity Cost of Spending

Every time you spend money, there’s an opportunity cost — once your money is spent, it’s gone, and you can’t spend it on anything else. That’s why it’s important to ask yourself some questions before you pull out your wallet:

Can I afford this on top of other essential expenses?

Is this something I need, or is it something I want?

Is this something I really want, or is it a passing trend?

What am I giving up if I spend my money this way?

How will I feel about this purchase two weeks from now?

See It in Action! Opportunity Cost of Spending or Not Spending $20

Every Friday after school, Jesse goes to a local arcade for a few hours where they spend around $20. Lately they’ve been wondering if this is the best use of their money, so they use a graphic organizer to find the opportunity cost of spending money at the arcade.

Is it worth it to spend $20 at the arcade every week? Let’s think about the opportunity cost:

|

Spending $20 at the Arcade |

Not Spending $20 at the Arcade |

|---|---|

|

Hanging out with friends |

Having more money to spend on other things |

|

Playing games I don’t have at home |

Could save up to buy my own gaming system |

|

Spending time in a cool place I like |

Could spend my time on other hobbies |

As you can see from their work, the main opportunity cost of spending money at the arcade every week is that Jesse has less money to use for other things. Jesse may decide they’d be better off saving $20 a week and doing something cheaper with friends — or they may decide that time with their friends is important and worth the money. Only Jesse can decide if spending money this way is the right choice.

Either way, now they understand what they’re missing out on and can make a more informed decision based on values and long-term goals.

When you put money in a savings account, your bank or credit union borrows that money to operate.

Opportunity Cost and Earning Dividends

When you put money in a savings account, your bank or credit union borrows that money to operate. In exchange, it pays you dividends for loaning it your money. (Banks use the term “interest” instead of “dividends.”)

Many savings accounts earn compound interest, which means they earn (more money for you) on the amount of money you put into them (called the principle) and on the money your account has earned. Savings accounts don’t earn a lot of dividends right away, but they’re worthwhile because over time compound interest can grow your money quite a bit.

Over time compound interest can grow your money quite a bit.

See It in Action! Compound Interest on Savings in a Savings Account

Hao earns $50 a month doing yard work for his neighbors. Usually, he spends most of it going to the movies, but lately he’s been thinking about saving part of it instead. He decides to investigate the opportunity cost of spending all of his money.

Hao does some research and learns he can open a savings account earning 3.00% annual percentage yield at his local credit union. This is what he could earn with compound interest if he saves half of his money ($25) every month.

|

Months of Saving |

Savings Account Balance |

|---|---|

|

1 |

$25.00 |

|

2 |

$50.06 |

|

3 |

$75.18 |

|

4 |

$100.36 |

|

5 |

$125.60 |

|

6 |

$150.91 |

Opportunity Cost and Debt

If you take out a student loan to pay for college or if you pay for things using a credit card, you will actually be charged interest instead of earning it. In that case, one opportunity cost of borrowing is: the interest you won’t have to pay if you use debit or cash. So, if you can afford not to borrow, you may want to avoid it.

Knowing how to identify and weigh opportunity cost can help you make better decisions.

The Takeaway

Making big decisions can be tough, especially when the decision involves money. Knowing how to identify and weigh opportunity cost can help you make better decisions that you feel proud of.

Checking Accounts for Your Bright Future

Discover the diverse offering of products, services, and support available to our members.