CHECKING & SAVINGS

Understanding Health Savings Accounts

What you'll learn: How an HSA can help you cover medical costs and build a financial safety net.

Expected Read Time: 8 minutes

Understanding Health Savings Accounts (HSAs)

Picture this — you’re juggling a new side business and growing family, and then life takes an unexpected turn. An emergency room visit and a couple of prescriptions later, and you’re facing a stack of bills.

Or maybe, you’re thinking ahead to retirement and wondering how you’ll afford specialty care. From unplanned hospital bills to daily and future medical needs, the cost of maintaining your health could leave your finances ailing.

Thankfully, there are health savings accounts (HSAs). Learning how these triple-tax-benefit accounts work can help you maximize their advantages and remedy the stress of managing healthcare expenses.

What Is a Health Savings Account?

A health savings account (HSA) is a tax-advantaged savings account for people with high-deductible health plans (HDHPs), a type of health insurance plan with a high annual deductible and premiums that are lower than those of traditional health plans.

HSAs are a way to set aside money for qualified medical expenses. Think of it as a medical piggy bank — one that Uncle Sam helps you fill using these three benefits:

- Contributions are tax-deductible.

- Earnings grow tax-free.

- Withdrawals for qualified medical expenses are tax-free.

More than 70 million Americans own an HSA, and account balances are growing steadily. End-of-year balances in 2022 averaged $4,607.

Who Is Eligible for an HSA?

Wondering if you can open an HSA? To be eligible, you must meet the following requirements:

- You must be enrolled in a high-deductible health plan.

- You can’t have any other health insurance plans.

- You can’t be claimed as a dependent on someone else’s tax return.

- You can’t be enrolled in Medicare.

While having other health insurance is not permitted, you may hold disability, dental, vision, and long-term care insurance policies alongside your HSA.

More than 70 million Americans own an HSA, and account balances are growing steadily. End-of-year balances in 2022 averaged $4,607.

HSA-Qualified HDHPs

Not all health plans are the same. If you’ve got your sights set on an HSA, you’ll need to look out for specific features when considering HDHPs.

- HSA-qualified HDHPs have a deductible above a certain minimum threshold.

- HSA-qualified HDHPs have a limit on the total amount you’ll pay out of pocket each year for covered benefits.

- HSA-qualified HDHPs typically only cover preventive care and certain insulin products (and sometimes telehealth services) before you meet your deductible.

If you’re interested in other tax-favored health plans, review IRS Publication 969.

Differences between HSAs and FSAs

A flexible spending Account (FSA) is a pre-tax savings account that employers offer. Like an HSA, it allows you to set aside money for qualified medical expenses such as doctor visits, over-the-counter medicine, and prescriptions. While both an HSA and an FSA help you save, there are some important differences.

HSA vs FSA Comparison

|

Feature |

Health Savings Account (HSA) |

Flexible Spending Account (FSA) |

|---|---|---|

|

Contributions |

You and/or your employer can contribute |

You don’t typically contribute, your employer does |

|

Rollover |

Your funds roll over year to year |

Your funds expire, so you’ll lose them if you don’t use them |

|

Portability |

You keep the account even if you change plans, jobs, or retire |

You lose ownership of the account when you change jobs |

|

Required Health Plan |

You need to have an HDHP |

You don’t need to have an HDHP |

How Health Savings Accounts Work

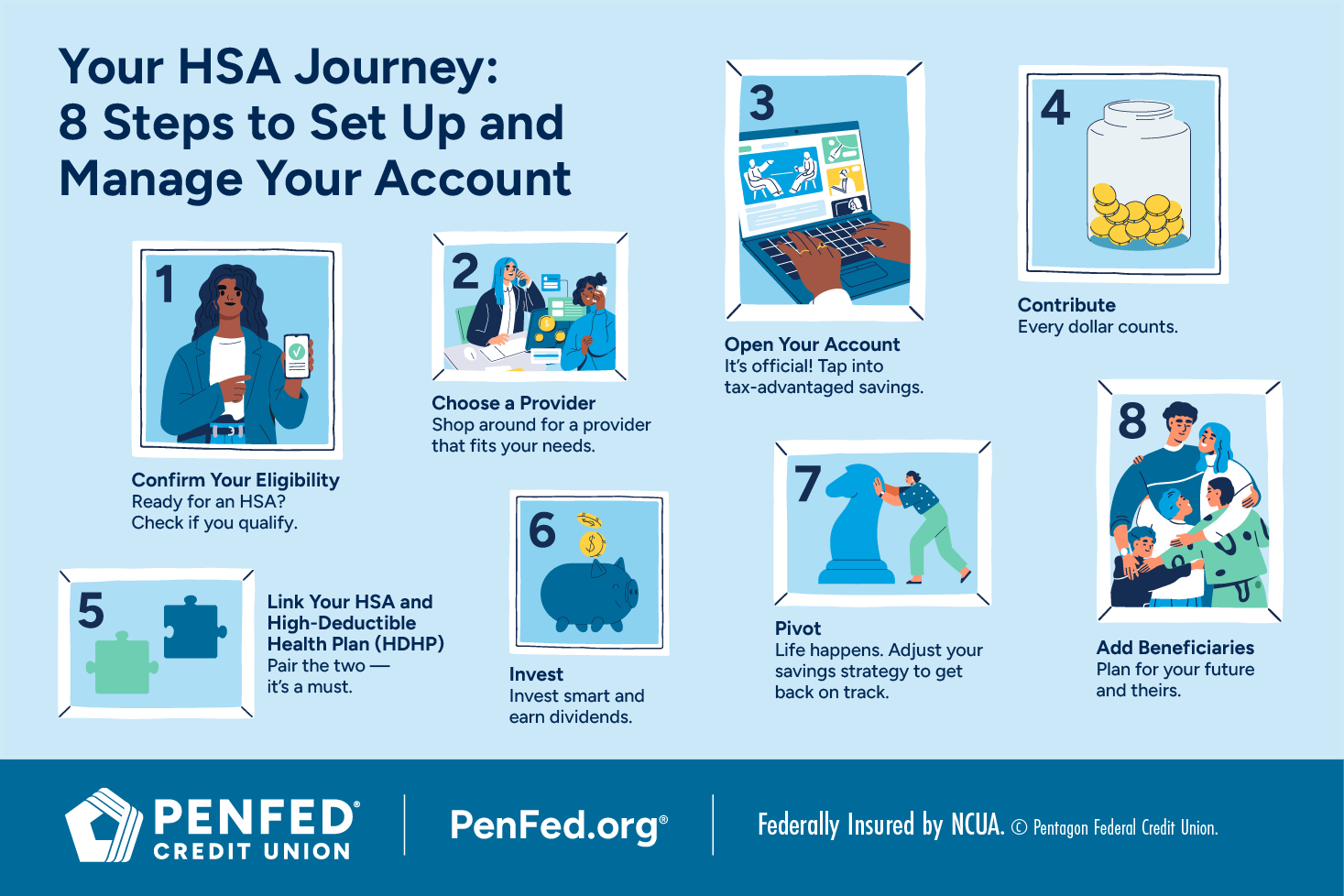

Now, we’ll show you how to set up, manage, and contribute to your HSA.

Contribution Limits and Regulations

The Internal Revenue Service (IRS) sets the annual contribution limits for HSAs. The 2025 contribution limit is $4,300 for individuals and $8,550 for families. However, account owners aged 55 and older can boost their HSA savings with catch-up contributions of up to $1,000 per year.

How You’ll Use HSA Funds for Medical Expenses

Your HSA dollars can be used for a wide range of eligible health expenses within these categories:

- Coinsurance

- Copayments

- Deductibles

- Qualified medical expenses

Think doctor visits (including primary care and specialists), prescriptions, hospital stays, menstrual products, some dental and vision treatments, and more. You decide how to allocate those savings and who benefits. With your HSA, you can cover eligible expenses for your spouse and/or dependent regardless of whether your plan offers individual or family coverage.

Your health plan provider or tax advisor can provide more information on eligible expenses.

Contribution Methods

There are two main ways to contribute to your HSA: through payroll deductions or direct contributions.

With the first option, a predetermined amount of pre-tax dollars comes out of your paycheck. With the second option, you make contributions using after-tax dollars. Each method has unique tax implications. The good news is there’s no federal income tax tied to either one. Depending on where you live, there may be no state taxes, either.

Why Should You Choose Payroll Deductions?

Payroll deductions are a convenient, low-effort way to grow your HSA because your employer does the work each pay cycle. Upon HSA setup, you let them know the amount or percentage of your check that should go to your HSA. It’s like automating payments. All you have to do is keep an eye on your account balance to make sure you’re not exceeding the maximum contribution limit for HSAs.

So, what can you expect come tax season if you opt for payroll deductions? A lower taxable income.

Your federal taxable income is your total annual gross income without deductions. Take a look at your W-2. Gross income is often labeled as “wages, tips, and other compensation.” This covers your salary and all commissions and bonuses your employer paid out to you that tax year.

However, gross income extends beyond the W-2. Payments for freelance gigs, dividends from investing, checks made out to your side business, casino or lottery ticket winnings, and severance pay all count as gross income.

A lower taxable income can potentially reduce the amount of taxes you owe and even increase your refund.

Automate contributions — even small ones — and watch your savings grow.

Why Should You Choose Direct HSA Contributions?

Direct contributions generally require more of your involvement than employer-facilitated payroll deductions. This is the method for you if you’re enrolling in an HDHP through the Health Insurance Marketplace, and not an employer. You call the shots — which financial institution administers your HSA, how much goes into it, how often you contribute, and whether you choose to invest some of your HSA money. However, going solo doesn’t mean that you’re stuck with tedious work. Many financial institutions offer user-friendly apps and web interfaces that allow you to automate recurring transfers and transactions.

Direct, after-tax HSA contributions can also save you money during tax season because you get to deduct them when filing. This lowers your tax bill.

Understanding HSA Employer Contributions

Employer contributions can help you hit the maximum HSA contribution limit, but not all employers offer this perk. Those that do usually disclose this information during open enrollment along with their contribution amounts and rules.

As with HSA payroll deductions, employer contributions to your HSA are not taxed, which means more money for you.

Keep in mind that contributions between you and your employers should not go over the contribution limit set for that year.

There are two ways to contribute to your HSA: through payroll deductions or direct contributions.

Benefits of Health Savings Accounts

Here’s where things get interesting. What does the triple tax benefit mean for you? Let’s break it down.

Positive Impact on Taxable Income

First, when you choose the payroll deduction route, your employer subtracts your contributions from your income before the government figures out how much you owe in taxes. This means you can lower your taxable income. It’s like getting a discount on your taxes just because you saved for your healthcare. After-tax HSA contributions also come with a benefit. You can deduct them when filing your tax return, which also lowers your taxable income.

Both types of contributions are tax advantaged. The more you contribute, the more you can potentially reduce your tax burden. It’s a win-win!

Two Other Tax Advantages of HSAs

Number two on the list of HSA tax advantages is tax-free growth. Here’s an example of how it works: if you invest $1,000 in your HSA and it earns $45 in dividends or interest, that money is yours to keep — no taxes owed.

Finally, there are tax-free withdrawals. Maybe you need a new prescription. You can use your HSA funds to pay for it if prescriptions are a qualified medical expense. Again, no taxes owed.

The more you contribute, the more you can potentially reduce your tax burden. It’s a win-win!

Long-Term Savings and Investment Opportunities

Beyond the three-for-one deal, HSAs can be a big help in retirement. As you get older, you may need more frequent checkups, specialist visits, or long-term care, as well as the money to cover these services. To avoid dipping into your dedicated retirement funds, you can invest a portion of your HSA contributions in a mix of index funds. Through compounding and tax-free growth, your investments could grow significantly over the next 20 to 30 years.

You can also invest the money you save from HSA tax breaks — for any purpose and length of time. However, be aware that these investments may have unique tax implications. Check with your tax advisor for specific details.

Comparison With Other Savings Options like 401(k)

Both HSAs and 401(k)s are tax advantaged, but they have different purposes and rules.

A 401(k) account is designed to help you save for retirement. As with an HSA, you can contribute a portion of your pre-tax paycheck, and often your employer matches a certain percentage of your contributions. Then, you invest that money. Your investments grow tax deferred, meaning you won’t have to pay taxes until you withdraw the money in retirement. This means the money you take out will be subject to federal and potentially state income taxes — just like your regular paycheck.

Let’s explore this unique feature and others in more detail to determine if an HSA or 401(k) is right for you.

HSAs vs Other Savings Options Comparison

|

Feature |

401(k) |

Health Savings Account (HSA) |

|---|---|---|

|

Contributions |

You and/or your employer can contribute |

You and/or your employer can contribute |

|

Tax Advantages |

You benefit from tax-deferred growth |

You benefit from tax-free growth |

|

Withdrawals |

You can withdraw at age 59½ without early withdrawal penalties |

You can withdraw at any time for qualified medical expenses |

|

Portability |

You can transfer the account when you change jobs |

You keep the account even if you change plans, jobs, or retire |

Setting Up a Health Savings Account

Setting up an HSA is a relatively straightforward process, but you’ll want to make sure you’re taking the correct steps right from the beginning to save time.

Steps to Open an HSA

Get your HSA up and running in these few steps!

- Confirm Your Eligibility: Make sure you meet all the requirements, including being enrolled in a qualified HDHP.

- Choose a Provider: Choose a trusted financial institution like a credit union that offers HSAs.

- Open the Account: Fill out all the necessary paperwork and make your first contribution!

- Link Your HSA to Your HDHP: Work with your providers to link your HSA to your HDHP, if that wasn’t done in the previous step. Your provider(s) may request specific information. When this process is complete, you can log into your HSA online account to verify the linking was successful.

Ask yourself how each investment option aligns with your risk tolerance and overall financial goals.

Choosing the Right Bank or Provider

Finding the right bank or provider for your HSA is like finding the right bank when you’re ready to open a checking account — you want a good fit. Not all HSA providers are the same, so doing your research can help you narrow down your choices. Here are some factors to consider:

- Fees: Research any fees associated with the HSA, such as maintenance or investment fees. Consider how different fee structures might impact your savings overtime.

- Investment Options: Study the various investment options available to you. Ask yourself how each one aligns with your risk tolerance and overall financial goals.

- Customer Service: Examine the quality of customer service, focusing on the factors that matter most to you, like response time.

- Online Access and Tools: Explore website and mobile app functionality to ensure easy account management.

- Spending Options: Aside from reimbursement and bill pay options, many HSAs offer a debit card that you can use for qualified medical expenses at the point of sale or online.

- Reputation: Pay attention to the provider’s track record of securing funds and prioritizing its customers or members.

Maximizing Your Health Savings Account

Your HSA is ready to go — now what? We’ve put together some general tips to help you manage your funds and maximize your HSA’s potential.

- Contribute Regularly: Automate contributions — even small ones — and watch your savings grow.

- Keep Detailed Records: Maintain thorough records of all your qualified medical expenses so you can track your spending and make sure you’re complying with the law. Use a spreadsheet or budgeting app or keep a folder of receipts.

- Balance Short- and Long-Term Needs: Tailor your strategy for healthcare cost planning in three simple steps — address immediate healthcare needs, estimate future costs, and invest. Compare all investing options available to you like target date, mutual, exchange-traded and low-cost index funds.

- Review and Adjust Regularly: Assess your healthcare needs and finances quarterly or annually, so you can adjust your HSA strategy.

- Stay Informed: Keep up with any changes to HSA regulations.

Assess your healthcare needs and finances quarterly or annually, so you can adjust your HSA strategy.

Assigning Beneficiaries and Account Updates

Assigning beneficiaries to your HSA account is like a final act of care.

A beneficiary is the person who inherits the money in your HSA if you’re no longer around. It could be your spouse, children, a parent with a chronic condition, a close cousin, or even your favorite charity. Here are some steps to guide you through the process of selecting beneficiaries:

- Contact Your HSA Provider: Your bank, credit union, or investment firm provides the forms you’ll need to assign your beneficiaries.

- Fill Out the Paperwork: In addition to providing your beneficiaries’ basic information, you can specify how your funds should be allocated.

- Update as Necessary: You can update your list of beneficiaries if there are new additions to the family, a divorce, or any other big life changes.

Common Questions about HSAs

Still wondering if an HSA is for you? Here are some HSA FAQs to help you decide.

The Takeaway

An HSA allows you to take control of your healthcare spending today and prepare for a healthier tomorrow. With the right guidance, you can easily open and manage an HSA. A trusted financial institution can help you explore your options.

Your Life, Your Plan, Your Wealth

Discover wealth management solutions to grow your savings at every age.