CHECKING & SAVINGS

How to Use Direct Deposit to Save Time and Money

What you'll learn: How to set up and leverage direct deposit to make budgeting easier..

EXPECTED READ TIME:8 minutes

Direct deposit has become a part of everyday life for many Americans. Whether you’re working or retired, you’ve likely been asked by an employer or government agency whether you’d like to have funds deposited directly into your account instead of getting paid via mailed check. Here’s what you should know about direct deposit, if you haven’t taken advantage of it yet.

What Is Direct Deposit?

Direct deposit is a way of moving money into a checking or savings account through an electronic network instead of via physical cash or a paper check. It uses a network called the automated clearing house that enables banks and credit unions to transfer money back and forth. Direct deposit is considered a safe way to move money, and it’s commonly used to:

Pay employees

Issue tax refunds

Pay government benefits such as Social Security

How Do I Set Up Direct Deposit?

To set up direct deposit, you’ll need to give the person or company paying you a voided check or the following information:

The name of your bank

Your bank’s routing number

Your account number

Some employers also require you to complete a form authorizing direct deposit. It can take between a few days and a few weeks for your information to be entered into the right systems and for your direct deposit to kick in. But once it’s set up, your funds will be available for use as soon as you are paid.

It can take between a few days and a few weeks for you to start receiving your direct deposit.

Tips for Using Direct Deposit to Level Up Your Finances

Banks and credit unions often go the extra mile to offer perks associated with direct deposit. These perks probably won’t make or break your day-to-day, but if you’re looking to get the most out of every money move you make, direct deposit incentives are worth it. You can:

Use direct deposit to waive monthly fees

Avoid bill pay and transfer delays (if you get paid early)

Hyper-organize and automate your monthly budget to stay on track

Use Direct Deposit to Waive Monthly Fees

Monthly fees are annoying. The good news is that you can often get maintenance fees waived if you meet certain criteria.

One easy way is to deposit a minimum dollar amount every month using direct deposit. These minimums are usually reasonably lower than the typical monthly income. It’s likely you’ll qualify!

If you sign up for direct deposit, some institutions will make your pay available on Wednesday or Thursday instead of Friday.

Avoid Bill Pay and Transfer Delays With Early Paychecks

If you sign up for direct deposit, some institutions will make your pay available on Wednesday or Thursday instead of Friday.

Keep in mind, this won’t change the frequency of your paychecks. For instance, you’ll still go two weeks between paychecks if that’s your current pay schedule. But with early paychecks, you can pay bills or make transfers on payday with a better chance they’ll land before the weekend.

Why does that matter? Well, if a transfer takes two business days and you initiate on a Friday, it will take four days total to complete, but if you initiate on a Wednesday, it will take two days total. If your due date for a particular bill is on a Monday, sending that payment on Wednesday makes a difference.

How to Direct Deposit Into Multiple Accounts

Most employers allow you to allocate paycheck funds to multiple accounts, including a mixture of savings and checking. Here’s how to set this up:

- If your employer has an online portal, navigate to the direct deposit window.

- Enter the account numbers and portion of your pay to be sent to each.

- Submit the changes.

- Wait for the changes to take effect before changing how you spend.

You’re much more likely to meet your savings goals or build your emergency fund if you automate those actions.

Keep in mind, different employers offer different options, and you may not see the changes on the very next paycheck. Now that you know where to go to line up your accounts, here are some strategies for allocating your direct deposit funds:

Out of Wallet, Out of Mind: Send It to Savings

You’re much more likely to meet your savings goals or build your emergency fund if you automate those actions.

Here’s an idea that can help boost your savings: Open an online savings account (or accounts) at a different institution than the one you use for your daily checking and savings. Then send a portion of your pay to that account using direct deposit. Bonus if it’s a high-yield savings account.

And don’t link this savings account to anything other than direct deposit. This keeps your money liquid but places a few barriers between you and your savings because:

- You never see that money to begin with

- You can’t get to it as easily as money in your checking or linked accounts

After a few paychecks, you won’t even notice the diminished sum. After a few months (or years), you’ll be pleasantly surprised at your sizeable stash. These types of accounts are great for travel funds, periodic luxury purchases, or just adding to your overall savings.

Streamline Your Monthly Budget With Multiple Checking Accounts

While you’re at it, add another checking account or two to your bi-weekly allocations. Avoid having to nag yourself — or be nagged — about making that monthly transfer to the joint account. Automate your digital envelope budget by having the ACH stuff those accounts for you.

Whatever your account matrix looks like, direct depositing saves you the tedious step of transferring money..

That means less screen time, less chance you’ll tap the wrong account when you’re frantically transferring funds at 11:52 PM after a long day, and more freedom to organize other things — like bike trips, barbecues, or book club meetings — or to just have more time to yourself.

Whatever your account matrix looks like, direct depositing saves you the tedious step of transferring money.

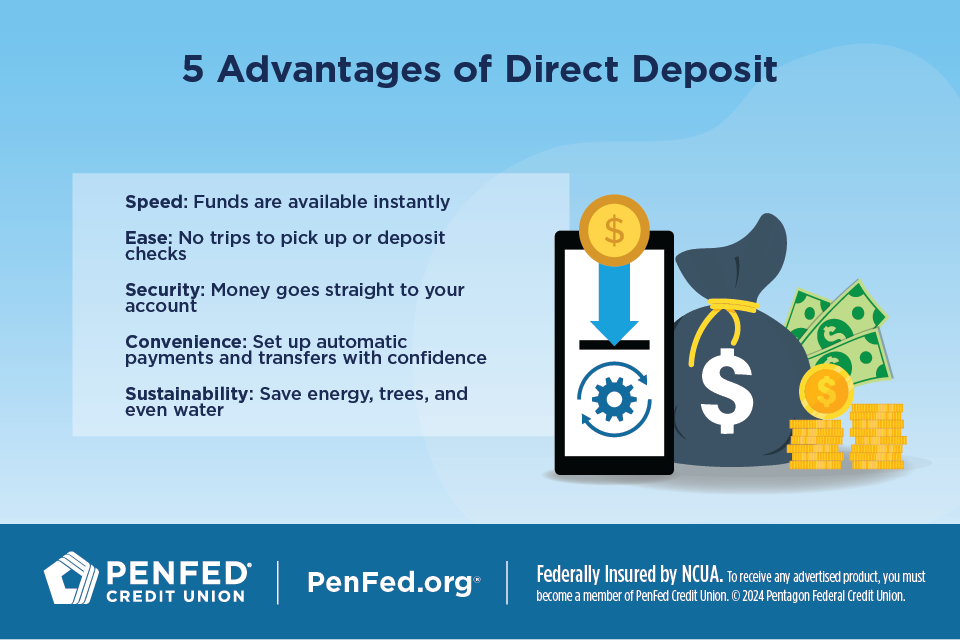

Overall Advantages of Direct Deposit

Direct deposit has become standard practice because of its many benefits for employers and employees alike. These benefits include:

- Speed: Direct deposits are automated to send at midnight on payday. Unlike checks that can take time to clear, direct deposits are available for use right away.

- Ease: Once a direct deposit is set up, you’re set. You’ll wake up to your money sitting in your account instead of going to pick up a check and taking it to the bank.

- Security: Cash and checks can be easily lost or stolen. Checks can also be damaged. But direct deposit goes straight from your employer to your bank.

- Convenience: Because your pay goes straight into your account at the same time every pay period, you can set your bills to pay automatically without risking an overdraft. You can also make saving easier by setting a portion of your direct deposit to go to your checking account and the rest to automatically go to savings.

- Sustainability: Less energy and fewer natural resources are expended through electronic transfers than through producing, mailing, and processing paper checks.

Are There Any Cons of Direct Deposit?

Direct deposit does carry some cybersecurity risks. Anyone paying you by direct deposit will have to store your sensitive financial information electronically. If their network is hacked, your data could be exposed.

However, direct deposit does not present a greater risk than online purchases or peer-to-peer transfers. It’s generally considered safer than other payment methods.

Can I Receive Direct Deposit Without a Bank Account?

The simplest way to receive your direct deposit without a checking account is by using a prepaid card or gift card. These cards are available at most retailers, are easy to set up, and can be used like a debit card.

The main drawback is that using prepaid cards is often expensive, usually incurring high fees for their original purchase, monthly usage, and features like ATM withdrawals.

Another option is receiving your funds via a peer-to-peer payment app. While generally cheaper than prepaid cards, such apps may or may not offer ATM access or debit cards — you’ll have to read the fine print to check. Some may also set limits on the number of transactions you can make per week or per month, and you’ll only be able to pay people or businesses who use that same app.

The simplest way to receive your direct deposit without a checking account is by using a prepaid card.

The biggest concern with these methods is they’re less secure than using a bank or credit union.

In comparison, checking accounts offer:

Better protection against theft

Better protection against fraud

Additionally, traditional checking accounts carry other benefits that prepaid cards and peer-to-peer apps don’t, such as:

Earning interest on your balance (for interest-bearing accounts)

Debit card and ATM access as a standard feature

Free accounts or fees that can be easily waived

Automatic payments and transfers, often at no charge

Traditional Checking Accounts vs. Alternatives for Direct Deposit

Where should you have your direct deposit sent? Let’s compare your options:

|

Type of Account |

Pros |

Cons |

|---|---|---|

|

Prepaid cards |

Widely available |

Expensive |

|

|

Easy setup |

May charge for ATM access |

|

|

Works like a debit card |

Limited theft or fraud protection |

|

|

|

Not insured |

|

|

|

|

|

Peer-to-peer payment apps |

Easy setup |

Limited weekly/monthly transactions |

|

|

Instant transfers |

Only works with other app users |

|

|

|

Limited theft or fraud protection |

|

|

|

Not insured |

|

|

|

|

|

Bank or credit union checking account |

Earned interest |

May charge fees |

|

|

Opened online or in person |

May limit the number of account transfers |

|

|

Debit card and ATM access |

|

|

|

Free or fees can be waived |

|

|

|

Automatic payments and transfers |

|

|

|

Stronger fraud protections |

|

|

|

FDIC- or NCUA-insured up to $250,000 |

|

The Takeaway

Direct deposit is one more way to take the headache out of managing your money. With lots of benefits and few downsides, it could be just the thing you need to whip your finances into shape.

Direct Deposit FAQs

Most employees sign up when they start working with a new company, but you can sign up at any time by contacting your payroll or HR department.

Most states require your employer to provide you with a wage statement for each pay period, regardless of how you are paid. That statement may be paper or digital.

Yes! As we outlined above, direct deposits can often be divided into multiple accounts. You’ll need to complete a form for your employer to give them information for each account you want to have money sent to and the amount of money you want deposited in each account. Some employers have you designate a specific dollar amount for each account, while others use a percentage.

Some states require that employees be paid the day before a federal holiday. It’s best to contact your employer if you’re unsure about their policy and the rules in your state.

The Electronic Fund Transfer Act (EFTA) states that employers can make direct deposit mandatory as long as employees can choose the bank or credit union where their money will be deposited.

An employer can also choose the bank or credit union employees must use to receive their direct deposit, but then the employer must also offer alternative payment methods for employees.

Financial institutions are likely to flag direct deposits issued to one name that are going into an account with a different name as possible cases of error or fraud. In such a case, you also won’t be able to access your money unless you are an authorized user on the other person’s account.

If you need to give money to a relative, you’d be better off setting up automatic transfers between your account and theirs or using a peer-to-peer payment app like Zelle. If you need to receive direct deposits but don’t have an account, consider opening a free checking account or receiving your deposits on a prepaid card.

Ready to Get Paid Early?

Discover all the benefits of direct deposit and more with PenFed's feature-rich Access America Checking Account.