CHECKING & SAVINGS

How Many Checking Accounts Should You Have?

Expected read time: 6 minutes

The number checking accounts you should have depends on how you prefer to organize your finances. Having one account keeps things simple, since everything is in one place. At the same time, having multiple checking accounts can help you divide up your money and simplify budgeting. Here’s how to decide the magic number that’s right for you.

Do Most People Have Multiple Checking Accounts?

According to a 2019 study, the average American has 5 different bank accounts at 3 different banks or credit unions. That includes both checking and savings accounts spread across traditional banks, online banks, and credit unions. When asked, many people claimed they opened new bank accounts to:

- Increase flexibility

- Improve convenience

- Avoid high fees

- Separate their finances

How Many Checking Accounts Can I Have?

There’s no legal limit to the number of checking accounts you can open. Some banks and credit unions will limit the number of accounts you can open with them, but you can always open a new account at another institution.

There’s no legal limit to the number of checking accounts you can open.

Keep in mind there may be a limit to the number of accounts you can manage successfully. More accounts mean more account numbers and passwords, fees, minimum balances, and account-to-account transfers. Too many accounts will make your personal finances overly complicated, particularly if they’re spread across multiple financial institutions.

Pros and Cons of Having Multiple Checking Accounts

|

Pros |

Cons |

|---|---|

|

Simplifies budgeting and avoid overspending |

Requires more work to manage your finances |

|

Keep personal and business expenses separate |

Can result in paying more fees |

|

Easily track specific spending categories by paying them from dedicated accounts |

Could lock up your money with high minimum balance requirements across multiple accounts |

|

Share finances with a partner while retaining control of your personal account |

Could result in lots of account-to-account transfers back and forth |

|

Take advantage of offers from different banks and credit unions |

Unused accounts are vulnerable to fraud |

Does It Hurt My Credit Score to Have Too Many Checking Accounts?

Having multiple credit cards (or other lines of credit) can hurt your credit score, especially if your debt-to-income ratio or credit utilization rate is high. Unlike credit cards, however, checking accounts don’t affect your credit score unless you routinely overdraw them.

Checking accounts don’t affect your credit score unless you routinely overdraw them.

Every Checking Account Should Have a Purpose

As a rule of thumb, don’t open a new checking account unless you have a purpose for that account. Unused accounts are vulnerable to fraud, and many accounts require a minimum balance to avoid monthly maintenance fees. If your account falls below that threshold, your funds will be eaten up quickly.

Use your financial goals to find your sweet spot. You should have enough accounts to reach your financial goals and few enough accounts to manage your finances easily.

Unused accounts are vulnerable to fraud.

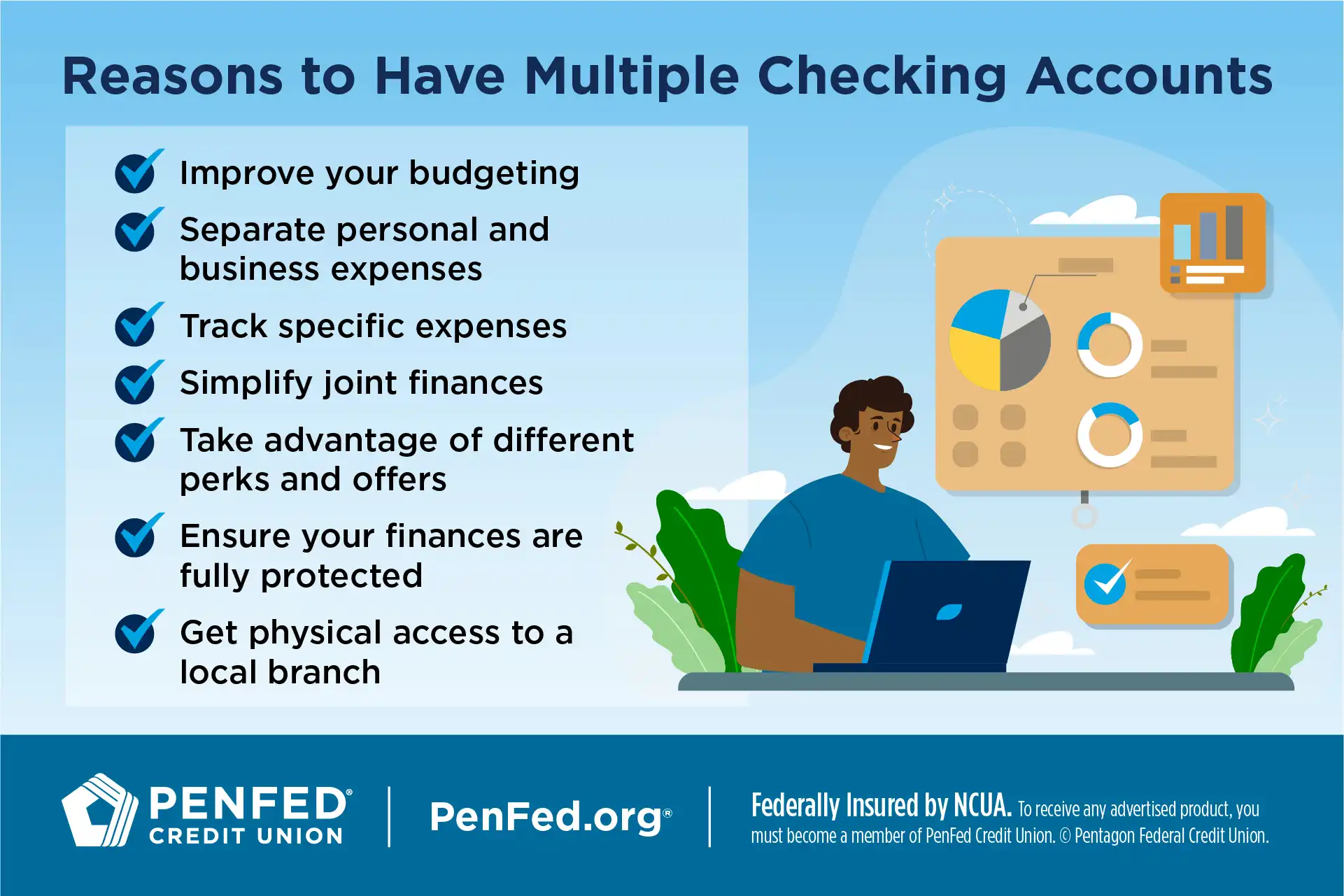

Reasons to Have Multiple Checking Accounts

While having a single checking account keeps things simple, there are good reasons some people prefer to have multiple checking accounts. Whether or not that works for you comes down to your style of money management. Here are a few reasons you might want to consider opening a second (or third!) checking account:

- Improve your budgeting

- Separate personal and business expenses

- Track specific spending categories

- Simplify joint finances

- Take advantage of different perks and offers

- Ensure your finances are fully protected

- Get access to a local branch

Improve Your Budgeting

Maybe you’ve heard of the envelop budget method. You can do the same thing by dividing your money across different accounts, each with its own use. For instance, you might pay your bills out of one account, pay off debt from another, and use a third for miscellaneous spending.

You might pay your bills out of one account, pay off debt from another, and use a third for miscellaneous spending.

Separate Personal and Business Expenses

If you’re self-employed or run a small business or side hustle, you can use multiple checking accounts to separate your personal and business expenses. This simplifies management of your taxes and makes it easier to see how your business is performing.

Track Specific Spending Categories

You can use a checking account to track specific expenses. For instance, you might use a separate checking account to pay for home repairs and improvements so you’re clear on how much you’re spending.

Thirty-four percent of couples use a mix of joint and separate accounts to manage their finances.

Simplify Joint Finances

You and your partner may love sharing one joint checking account. According to a 2019 study, that works for around 43% of married or cohabitating couples. But 34% of couples use a mix of joint and separate accounts to manage their finances, while 23% keep their accounts completely separate.

There isn’t a right or wrong here. Different factors influence whether joint or separate accounts work for your situation. But in some cases, having multiple accounts offers couples greater flexibility and freedom — and helps keep the peace.

Take Advantage of Different Perks and Offers

Different banks and credit unions offer different perks. Opening a new checking account could:

- Give you access to better rates on high-yield savings or certificate accounts

- Help you land a great credit card offer

- Make you eligible for lower-cost auto loans or mortgages

- Score you rewards for having multiple accounts, including waived fees, automatic transfers, or higher interest rates

Some savvy folks prefer to spread their accounts across multiple financial institutions to take advantage of all the best offers they find. This takes a little planning but could be the key to reaching important financial goals.

Some savvy folks prefer to spread their accounts across multiple financial institutions.

Ensure Your Finances are Fully Protected

Money you store in checking and savings accounts is insured by the FDIC (at banks) or NCUA (for credit unions) up to $250,000 dollars per bank, per account type. If you’ve reached that threshold at one financial institution and have more money you want to deposit, you can make sure it’s protected by depositing it at a second financial institution.

Get Local Access to a Physical Branch

If you’ve recently moved to another state or region, or you currently only have an online checking account, you may not have local access to a physical branch of your financial institution.

Opening up an additional account at a local or regional credit union or bank can give you better access to your money.

Opening up an additional account at a local or regional credit union or bank can give you better access to your money.

Even though a lot of national and online banks offer free access to various ATM networks, their locations may not be convenient — or you may be charged non-reimbursable fees by third party operators.

You may also need access to a branch for large cash withdrawals, same-day money orders or checks, or in-person services with a loan officer or account specialist.

The Takeaway

Personal finance isn’t one-size-fits-all. You might be doing just fine with a single checking account. But if you’re looking for a way to stick to your budget, visualize your budget better, track expenses more efficiently, or get better access funds and financial services, it might be time to consider another checking account.

Checking Accounts for the Way You Spend

Discover the diverse offering of products, services, and support available to our members.