FINANCE

How to Get Out of Medical Debt

EXPECTED READ TIME:3 MINUTES

Figuring out how to get out of medical debt can feel like wandering a maze. But believe it or not, you have some powerful tools at your disposal to rein it in — and you don’t have to go it alone.

What Is Medical Debt?

Medical debt is money you owe for healthcare services that you cannot pay by its due date. It’s one of the most common forms of debt in the U.S., affecting 100 million people across the nation. Most Americans with medical debt owe small amounts — only a quarter of adults with medical debt owe more than $5,000. Even so, medical debt can be hard to manage.

How Medical Debt Happens

There are many complicated factors influencing who ends up in medical debt and how much they owe, but four big factors account for much of the debt:

High cost of American healthcare

High insurance deductibles

Expensive emergency care

Chronic illnesses

Only a quarter of adults with medical debt owe more than $5,000. Even so, medical debt can be hard to manage.

How to Avoid Medical Debt

If you have a major risk factor, it may be difficult to completely avoid medical debt — but there's a lot you can do to minimize and control it.

Have insurance

Choose a plan according to your specific needs

Choose providers in your network

Ask for estimates and itemized breakdowns

Have an emergency fund

Be careful relying on credit cards

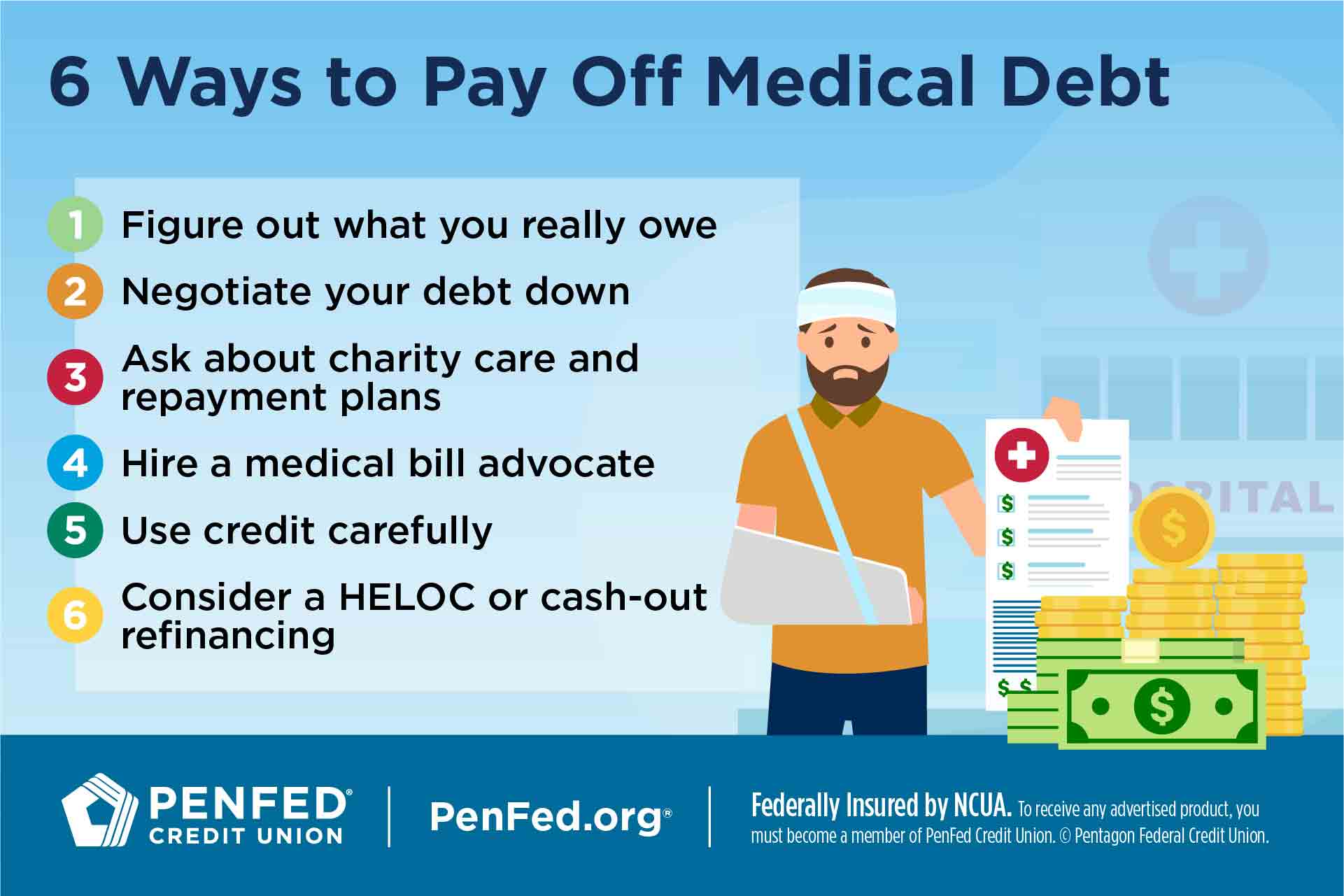

How to Pay Off Medical Debt

Paying down medical debt can be challenging, but here are some steps you can take to start regaining control.

1. Figure Out What You Really Owe

Gather your bills and check for errors like duplicate billing or unauthorized charges. If you don’t recognize charges, reach out to your insurance and healthcare providers to ensure you’re not being billed in error.

Many healthcare providers would rather negotiate than refer your debt to a collection agency.

2. Negotiate Your Debt Down

Many healthcare providers would rather negotiate than refer your debt to a collection agency because agencies cost them money. Often, they’ll set up payment plans with little or no interest if you ask.

Many medical providers have programs to help people with low incomes or high amounts of debt afford the care they need. These may get your expenses waived or reduced. You may also qualify for a repayment plan based on your monthly income.

If you don’t have insurance, ask to pay the rate your provider would offer to insurance companies or Medicare.

If you don’t have insurance, ask to pay the rate your provider would offer to insurance companies or Medicare.

3. Use Credit Carefully

Personal loans are a better option than credit cards because of their lower interest rates and installment payments. Some medical credit cards offer 0% introductory APR, but this is only a good option if you know you can pay off your debt by the time the introductory rate ends. All forms of credit will reflect on your credit score.

Balance Transfers

If you’ve already charged medical bills to your credit card but are struggling to pay them down, a balance transfer could help you pay off your debt. Know what you should look for in a balance transfer credit card before signing up.

4. Consider a HELOC or Cash-Out Refinancing

HELOCs tend to have lower interest rates than credit cards and long repayment plans. However, you could lose your home if you fall behind on payments. Cash-out refinancing is another flexible option, but you may end up with higher monthly mortgage payments.

Will Medical Debt Affect My Credit?

Many healthcare providers don’t submit medical debt to credit bureaus, and unreported debt won’t affect your credit report. As of April 2023, medical debt that is reported won’t affect your credit score unless it meets all of the following criteria:

Your original debt is $500 or more

It’s been sent to collections

It’s more than 365 days past due

If medical debt does somehow end up on your credit report, new rules going into effect July 2023 will remove the debt from your credit report once it’s paid. If left unpaid, it will remain for seven years from the date it became delinquent.

Many healthcare providers don’t submit medical debt to credit bureaus.

The Takeaway

Medical debt happens when we are at our most vulnerable. Thankfully, there are actions you can take to protect yourself from debt and pay it off.

Learn How to Prepare for and Survive a Recession

Find out what a recession is, how long they last, and how you can protect yourself financially.