PERSONAL FINANCE

How AI Is Reshaping Wealth Management

What you'll learn: Boost your wealth with AI tools and know when to bring in a financial advisor.

EXPECTED READ TIME: 9 MINUTES

You’ve spent the last few years building your wealth, brick by financial brick. You’ve taken personal finance courses, navigated market highs and lows, and struck the perfect balance between funds and stocks.

Now, you’re ready to do even more, and there’s a new player on the scene, promising to transform the way your money is managed. It’s artificial intelligence (AI).

So, is your financial advisor old news? Should you trust a robot with your retirement?

Let’s cut through the hype to find out how AI is shaking up wealth management and when a human touch is still your winning play.

What AI and Robo-Advisors Actually Do

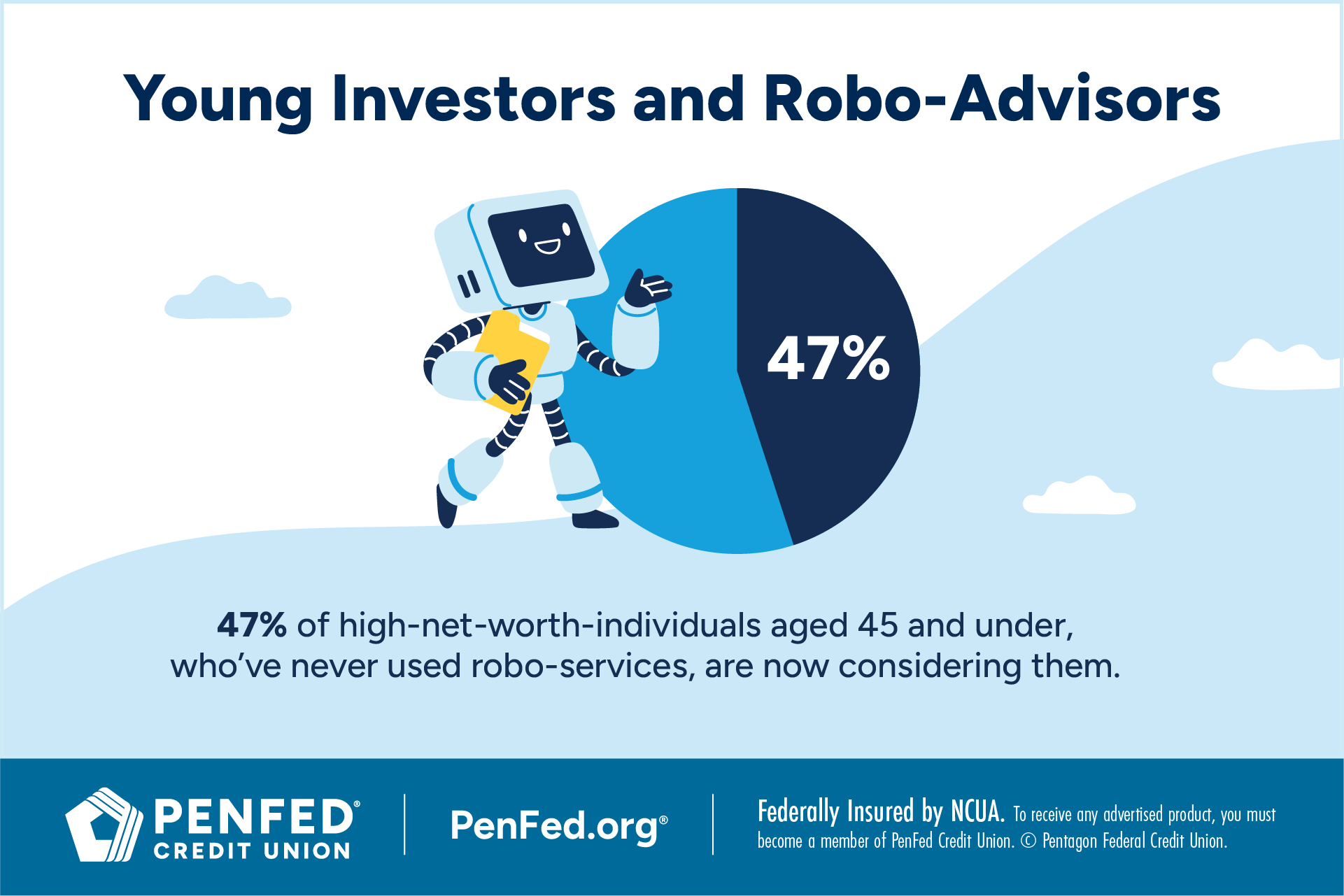

So, how does AI get down to business in wealth management? Let’s start by looking at robo-advisors. You may have heard of Betterment Premium and Vanguard Personal Advisor. These are popular robo-advisors.

Think of robo-advisors as super smart financial assistants, always on the job. Just like a stylist learns your quirks, the colors that make you tick, and the fashion boundaries you’re willing to push, a robo-advisor gets to know your financial goals, risk tolerance, and investment style. Then, it goes to work curating the perfect portfolio for you. It will make adjustments as often as required. This round-the-clock process is called portfolio rebalancing.

You can trust your robo-advisor with other tasks too. Many of them can automate your savings by setting up recurring transfers, manage your dividends, and forecast returns on that retirement account.

This can make all the difference for high-net-worth individuals (HNWIs), as managing a significant sum of money often comes with major risks and time constraints.

The bottom line? AI has become an integral part of portfolio management, making it happen quickly, seamlessly, and often for a low cost compared to a human with years in the game. In with simplicity, and out with complexity!

The Upside – Where AI Sells

Let’s dive a little deeper into the miracle that is AI in wealth management.

When it comes to number crunching power, AI is in a league of its own. It’s a master of data processing and pattern recognition, making sense of mountains of information at a superhuman speed. Just think about it — every trade, economic report, social post, and global headline sifted through in real time. It spots subtle connections, emerging trends, looming threats, and fresh opportunities that may evade the human eye.

There’s more.

When it comes to number crunching power, AI is in a league of its own.

Top 5 Advantages of Using AI in Portfolio Management

AI is here to stay. Here are five ways it can give your portfolio a competitive edge:

- Hyper-personalized insights: You know how a tailor alters a suit so it fits just right? AI does that for your money. You just have to tell it what you need and want.

- Lightning-fast rebalancing: Out of nowhere, the market takes a wild swing, throwing your portfolio way off balance. A human advisor might need hours, or even days, to analyze the impact and adjust. AI? It will get to rebalancing in milliseconds. No more drifting off course.

- Tax-loss harvesting: Managing taxes across multiple accounts and trusts might get a bit messy. AI tidies things up. It sniffs out chances for tax-loss harvesting, meaning it strategically places and sells your investments to offset capital gains.

- Bias-free decision-making: Let’s face it: we all have biases, which can cloud even the sharpest of financial minds. Plus, the markets are partially driven by feelings. AI, on the other hand, takes action based on cold, hard data and logic.

- Low barrier to entry: Not sure robo-advisors are for you? You can test them out, and the best part is, most have low account minimums compared to what a wealth management service might require. Start slow and up your contributions and investments as you get comfortable.

Keep in mind AI can’t predict unprecedented events, nor can it fully interpret complex human motivations.

The Human Edge – Why Wealth Still Needs Wisdom

While it’s designed to be secure and get it right most of the time, no AI is foolproof. Like people, it can’t predict unprecedented events, nor can it fully interpret complex human motivations.

Enter the trusted advisor!

Think of it like this — AI gives you a clear map, but a seasoned guide knows when to take a detour because of traffic or to catch the scenic views.

When a Human Advisor Becomes Essential

Here are four areas where human services shine:

- Establishing trust, empathy, and discretion: For many high-net-worth investors, relationship and soft skills are at the heart of managing their wealth. In fact, most wealth management clients agree that trustworthiness is the second most important quality in a financial advisor. When it comes to things like estate and succession planning, AI can churn out all the data you want but it may not offer the depth of understanding, comfort, and discretion that comes from working with a trained professional. Advisors use emotional smarts to facilitate personal talks about family, charity, business, retirement, and more. And when emotions run high due to the unexpected (like a job loss, health crisis, or death in the family), an advisor steps in as a critical anchor with calm. This is something AI is still learning to master.

- Addressing unspoken needs: Your financial story is constantly evolving. While AI can optimize for the goals you share with it, it may have a hard time filling in the blanks. Through active listening and questioning, a human advisor can uncover underlying motivations and adjust your portfolio accordingly.

- Assisting with philanthropic planning: What are your core values and what type of impact do you want to leave behind? A financial advisor can help you hone your vision and bring it to life in a way that no algorithm can. This includes seeking out niche or ethical investments, connecting you with like-minded investors, or setting up a donor-advised fund.

- Managing complex assets: While AI does well with monitoring and managing publicly traded securities, it has quite a way to go when it comes to managing more specialized investments like real estate, private equity, and venture capital. Financial advisors know just what to do with those types of assets since they work with several HNWIs with diverse portfolios and unique circumstances.

AI may not offer the depth of understanding, comfort, and discretion that comes from working with a trained professional.

Hybrid Models – the Best of Both Worlds?

What if you didn’t have to pick and choose? What if there was a way to build a deep bond with a person while letting the algorithm do its thing?

Hybrid model investing (or cyborg advising, as some call it) combines the power of AI with human expertise in the same way an experienced surgeon uses robotic assistants.

So, with both doing the heavy lifting, what can you expect? Let’s find out with the example below.

A Fictional Case Study

A successful tech entrepreneur is nearing retirement. He has a diverse portfolio comprising publicly traded assets and real estate.

His advisory team might use AI tools to:

- Monitor global markets 24/7: AI doesn’t stop. It constantly looks for anomalies and opportunities across asset classes, then notifies human advisors.

- Lower the client’s tax burden: AI models can simulate various tax scenarios and provide the most efficient ways to manage one’s tax bill. The entrepreneur’s advisor then steps in to review the suggestions.

- Stress-test the client’s portfolio: If inflation hits and interest rates spike, how would the business owner’s portfolio fare? Robo-advisors can give the professionals an idea, which they can then tweak.

With the tedious analysis out of the way, the client’s financial advisor can focus on:

- Interpreting insights: Data is good to have — only when it means something. The advisor takes what the AI gives them and makes it personal (bells and whistles included), ensuring their client’s growth. They might suggest investing in a new stock or doubling down on exchange-traded funds.

- Leading crucial discussions: Whether it’s about building generational wealth, adjusting the client’s risk level, or discussing an earlier-than-anticipated retirement, an advisor is there to talk it through.

- Prioritizing compliance: When a new financial regulation comes around, an advisor can help figure out what it means for the client.

Choosing the Right Strategy for Your Wealth

Both wealth management tools we’ve discussed have benefits. So, how do you decide what’s right for you?

Easy, just go through our checklist:

When to Use AI Tools

- You’re just getting started with investing: You have a great job and you’re ready to make your money work for you with a not-so-high account balance. As you plan for retirement, consider how a robo-advisor can help. Plus, you can learn a lot in the process.

- You like a hands-off approach: Looking for a low-effort solution? Then, AI it is. Let that robo-advisor take the reins.

- Your finances are straightforward: If you’re saving for retirement or planning to buy a house, a robo-advisor can help you achieve your goals. However, if you have multiple accounts and trusts, going the traditional route might be a better option.

- You’re comfortable with digital tools: You’re no stranger to using apps to manage your money.

- You want to keep costs down: Robo-advisors generally have lower management fees than wealth management professionals, who may charge thousands of dollars in a year. Boost your returns without breaking the bank!

When To Hire a Financial Advisor

- You need personalized advice: Maybe you have a large inheritance or family business to pass on. In such cases, a human’s judgement, experience and empathy are key. No more one-size-fits-all plans — advisors come up with person-specific strategies.

- You value a personal bond and trust: Nothing beats face-to-face time with an advisor who’s dedicated to your growth, year after year.

- You want to go deeper: When your goals and portfolio become more complex, an advisor can help you decipher it all.

When To Go Hybrid

- You want efficiency and human connection: Hybrid models are best suited for HNWIs who appreciate the data-driven precision of AI alongside a friendly, knowledgeable coach.

- Your financial needs are growing and changing: When life throws curveballs, the hybrid model offers balance, adjusting your portfolio to near perfection.

- You’re looking for that sweet spot between cost and service: Get the best of both worlds when you need it, as long as you can afford it.

The Takeaway

It’s your financial journey, and you get to pick the tools to enhance it.

AI is exceptional with numbers and data mining, while an advisor handles your legacy with care. You may decide to start with one, then transition to the other or combine the two. There’s no right or wrong — whatever you choose, remember that they’re equally beneficial and that your goals are the priority.

Build Your Future

Reach your biggest goals with help from a wealth management professional.