AUTO

When to Choose GAP Coverage for Your Vehicle

EXPECTED READ TIME: 10 MINUTES

Buying a car or truck can make a big dent in your budget.

To keep yourself on firm financial ground in case of the unexpected, you may want to consider Guaranteed Asset Protection (GAP) coverage and a vehicle protection plan.

Let's take a look at these optional protection plans and how they can help you save money.

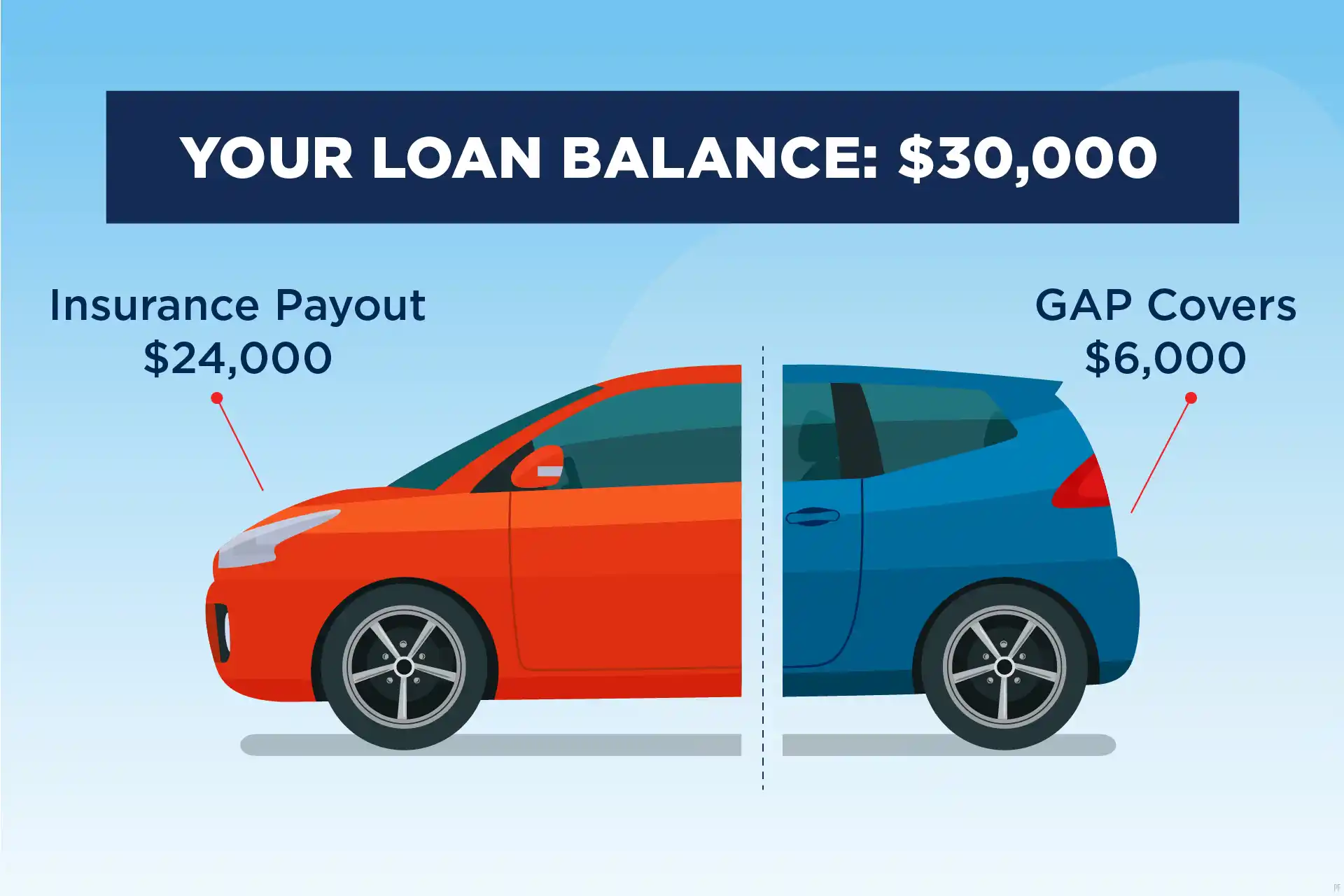

Would your insurance pay off your auto loan if your vehicle was totaled or stolen? If not, Guaranteed Asset Protection (GAP) might be right for you. GAP insurance is supplemental coverage that will pay off the gap between what you owe on your car and what it’s worth in the event your car is totaled or stolen.

What Is GAP Coverage?

GAP coverage (sometimes also referred to as GAP insurance) is supplemental car insurance that bridges the “gap” between the amount your standard comprehensive and collision insurance will cover if your vehicle is stolen or totaled in an accident and the balance you have remaining on your auto loan or lease.

Optional GAP coverage may be purchased at the same time you buy or lease a new car at the dealership or through a finance company. If you did not elect coverage at the time of purchase, some finance companies will allow the coverage to be added for a period time after the loan is established.

How Does GAP Coverage Work?

If your car is stolen or deemed a total loss following a wreck, your insurance plan will typically pay actual cash value (ACV), minus your deductible, to replace it. ACV is the amount the insurance company determines someone would reasonably pay for your car if the theft or accident had never occurred. Actual cash value takes into account:

- Depreciation

- Mileage

- Wear and tear

- Mechanical problems

- Cosmetic condition

- Supply and demand

How Much Does GAP Coverage Cost?

The settlement you receive from your insurer might not be enough to replace your car with an equivalent vehicle and pay off the remainder of your original loan or lease. This could leave you stuck making payments on a vehicle that you don’t have or can no longer drive. That’s where GAP coverage comes in.

Everything seems fine until you receive a check for $19,500 — the amount of the settlement minus your $500 deductible. That’s when you realize you’ll have to shell out $5,500 of your own money to pay off your loan balance. And you’ll still be without a car to drive.

Once you’ve paid down the loan to the point where the car is worth more than you owe, you should remove the GAP coverage.

If you had been carrying GAP coverage on the vehicle, it would have given you an additional $5,000 more. (Many GAP policies do not cover your insurance deductible but GAP coverage through PenFed comes with a deductible reimbursement up to $500.) You’d still have to make arrangements to buy a new ride to get back on the road, but at least you wouldn’t be paying off a totaled car.

Keep in mind that most GAP coverages have a loan-to-value (LTV) maximum and will only cover to the LTV maximum limit of their coverage.

According to the Consumer Financial Protection Bureau, “loan-to-value ratio (LTV) is the total dollar value of your loan divided by the actual cash value (ACV) of your vehicle.” To put this in perspective, typically, when you make a down payment, you’re bringing down the LTV. That’s a good thing when it comes to GAP coverage — the lower your LTV, the better chance you have for full coverage.

Maximum LTV limits can vary, so you’ll have to check with your specific provider.

What Does GAP Coverage Actually Cover?

Cars depreciate quickly, with new cars losing up to 40% of their value in the first year. This depreciation means the actual cash value of your car could be less than what you owe on it.

If your car is totaled or stolen, your insurance company will give you the car’s ACV, or actual cash value. That’s what the car is worth after depreciation. But the ACV may not be enough to finish paying off your auto loan. GAP coverage covers the amount you lost through depreciation.

Cars depreciate quickly, with new cars losing up to 40% of their value in the first year.

PenFed members qualify for GAP advantage — an additional $1,000 toward a new vehicle when you finance that vehicle through PenFed..

What Does GAP Coverage Not Include?

GAP coverage is not the same as regular car insurance. It pays out a specific amount in a few, limited circumstances. It does not cover:

Interest that accrues on your car loan after the date you lost your vehicle

Costs that were added to your loan balance after you purchased your GAP policy, such as Vehicle Protection or other vehicle add-ons

Routine vehicle maintenance or repairs

Balances you rolled into your auto loan, such as the balance on your previous car

Upgrades you made to the car since purchasing it

Security deposits on leases

Financial penalties for violating your lease agreement (like overuse or excessive mileage penalties)

Difficulty making payments on your auto loan or lease agreement

Vehicles with titles such as salvage, rebuilt, lemon, or buyback

Keep in mind, most GAP coverage policies do not cover your auto insurance deductible.

GAP insurance only provides the difference between what you paid for your car and its value at the time of loss.

When Does GAP Coverage Not Pay?

There are cases when GAP coverage will not pay out, including when:

A car is damaged but not totaled (meaning the cost of repairs are less than the value of the car)

A car needs routine maintenance or repairs

A vehicle is used for commercial purposes

GAP coverage also doesn’t cover:

A rental car after an accident

Damage caused to other people’s property

Lost wages or medical expenses resulting from an accident

Missed car payments

It’s important to understand that GAP coverage alone will not fully cover the cost of a new car. GAP coverage only provides the difference between what you paid for your car and its value at the time of loss. You’ll need to file a claim with your regular car insurance company as well to receive enough money to full replace your car.

How Much Does GAP Coverage Cost?

GAP coverage is usually sold at a one-time cost. Typical GAP policies cost between $400 and $700 when wrapped into your loan by the dealer, and between $20 and $40 per year if you add it to your auto insurance policy. For instance, you can purchase GAP coverage from PenFed for $599 by adding it to your auto loan if you finance (or refinance) your vehicle with a PenFed auto loan. The cost of GAP coverage will vary some based on four main factors:

Your vehicle’s actual cash value (ACV)

The age of your vehicle

Your auto insurance claims history

Your location

Is GAP Coverage Worth the Money?

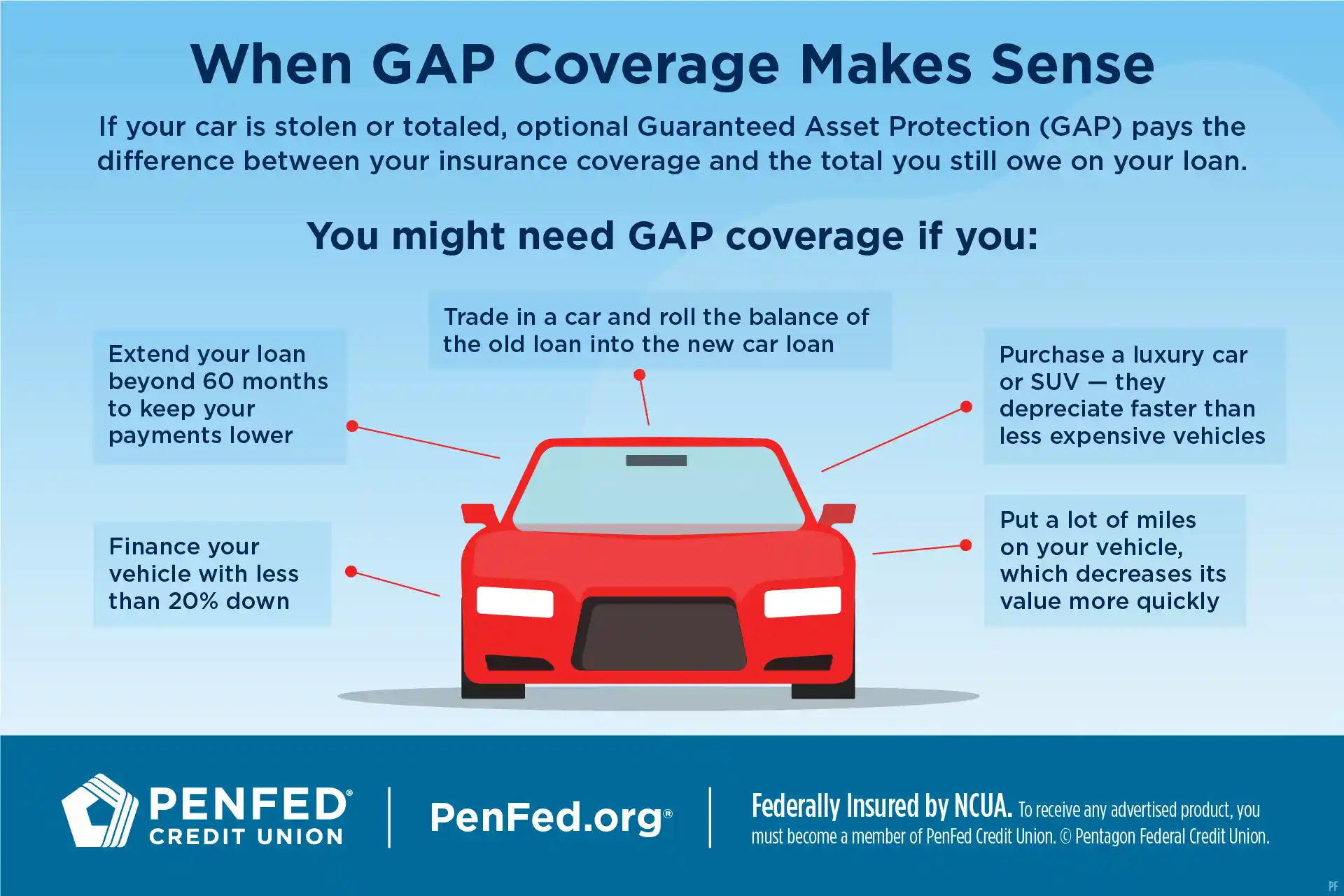

GAP coverage generally makes a lot of sense if you:

Finance your vehicle with less than 20% down

Put a lot of miles on your vehicle, which decreases its value more quickly

Purchase a luxury car or SUV — they depreciate faster than less expensive vehicles

Extend your loan beyond 60 months to keep your payments lower

Trade in a car and roll the balance of the old loan into the new auto loan

GAP coverage is also a good idea — in some instances, even a requirement — if you lease rather than buy a car or truck. That’s because the market value of the vehicle would likely be lower than the amount still owed on the contract if the car was stolen or totaled during the lease period.

If you opt for GAP insurance, you probably don’t need to carry it the entire time you have the vehicle.

If you opt for GAP coverage, you probably don’t need to carry it the entire time you have the vehicle. Ideally, once you’ve paid down the loan to the point where the car is worth more than you owe, you should remove the GAP coverage. GAP coverage wouldn’t pay any additional reimbursement if the car was stolen or totaled.

Keep in mind, some GAP coverages are not refundable. For example, some plans will not allow you to remove the coverage after 60 days. That said, many providers offer a “free look” period during which you can add GAP and cancel before the end of the period for a full refund.

Pros and Cons of GAP Coverage

As with most optional items you can select for a new car or truck, there are a number of pros and cons to carrying GAP coverage on your vehicle.

| Pros of GAP Coverage | Cons of GAP Coverage |

|---|---|

| Pays what your standard insurance doesn’t (some limits do apply) | Useless if vehicle was bought with cash or had a large down payment |

| Can be purchased from dealer, lender, or insurance company | Adds to overall cost of ownership |

| Relatively inexpensive if added to an auto policy | Often goes unused |

Getting GAP Coverage

How to Buy GAP Coverage

You can add coverage to an existing auto insurance policy, but you can also purchase it separately through a different provider such as a bank or credit union. Most dealerships will offer you GAP coverage while you’re negotiating financing, but they must wait two days before actually selling you the policy. This is to keep buyers from feeling pressured into policies before they can research alternatives.

When to Buy GAP Coverage

Most insurance companies won’t sell GAP coverage for a car that’s more than two or three years old. They may also set limitations on mileage if you’re purchasing a used car.

You’ll be eligible for the most coverage if you purchase GAP coverage sooner rather than later. For instance, most companies require you to purchase your policy within 180 days of purchasing your car to qualify for Return to Invoice or Vehicle Replacement insurance. (Return to Invoice gives you the value of your vehicle listed on your invoice, while Vehicle Replacement gives you the amount it would cost to buy a brand-new version of your vehicle.)

Optional GAP coverage must be purchased at the same time as you buy or lease a new car, and you must be the vehicle’s first owner or leaseholder.

Where to Buy GAP Coverage

You can buy gap coverage from banks, credit unions, or any company that sells auto insurance. These are usually the cheapest options, costing between 5% and 7% of the comprehensive and collision premiums on average.

Car dealerships sell GAP coverage, too, but their policies are usually more expensive, running between $400 and $900. Policies usually get rolled into your financing, which means you’re paying interest on your policy as well as monthly premiums.

FAQs About GAP

Is GAP Coverage Required?

GAP coverage is not required when you buy a car but is often required when you lease one. Many dealers include GAP coverage in your lease or financing agreement, and you may see a fee for it included with your other fees.

How Do I Know I Have GAP Coverage?

You can check your current car insurance policy or the terms of your lease or loan to see if you have GAP coverage.

Do I Need GAP Coverage if I Have Full Coverage?

Most companies require that you have comprehensive and collision coverage to qualify for GAP coverage.

GAP coverage is important if you still owe money on your car lease or loan. Full coverage will only cover the value of your car at the time you lost it, which may not be enough to replace your car. GAP coverage will cover the depreciation from the time you purchased your car to the time you lost your car.

Can I Get GAP Coverage on a Used Car

It’s possible to get GAP coverage on a used car although some insurers require a car to be under three years old to qualify. If your car is too old to qualify, you might consider loan and lease payoff or new car replacement plans.

Is GAP Coverage Refundable?

Whether your GAP coverage is refundable or not depends on the company providing your GAP coverage. Many companies will offer you a partial refund if you cancel your policy within a certain time frame, but that timeframe varies from company to company. GAP coverage from PenFed is nonrefundable after 60 days.

Does PenFed Offer GAP Coverage?

Yes! PenFed auto loans — financed or refinanced — are eligible for GAP protection (outside loans are not eligible). Our plan includes:

- Competitive cost at $599

- Coverage for loans up to $100,000 for new or used vehicles

- An additional $1,000 toward the purchase price of a replacement vehicle if financed through PenFed

- Auto deductible reimbursement at no extra charge

Additionally, we offer vehicle protection and debt protection plans for members who finance their vehicles through PenFed.

The Takeaway

GAP coverage is designed to cover expensive car repair costs and ultimately save you money, but it isn’t for everyone and every situation.

Before purchasing any type of insurance take an honest look at your financial situation and consider how much risk you’re willing to take. Then, you can decide and ride with confidence, knowing that you’ve done all you can to protect yourself and your auto investment for years to come.

Find Out More About Car Loan and Protection Options Through PenFed

Discover the diverse offering of products, services, and support available to our members.