Finance

When Does It Make Sense to Rent Instead of Buy?

What you'll learn: How to build wealth even if you can’t or don’t want to own a home.

EXPECTED READ TIME:5 minutes

Conventional wisdom has long told us that homeownership is better than renting, but how we live and work has changed dramatically in the last few decades. In fact, you might find that renting is actually a better way to meet your goals.

Renting vs. Buying a Home

Renting a home and owning a home are two different experiences. Your choice between the two affects your budget, your commute, and the way you live in your home. Here’s how:

Expenses

The most popular argument for owning a home is that a house is an investment — but a house is also a huge expense. In fact, the total cost of owning is often more expensive than renting.

Owning a home often comes with the following costs:

- Down payment (if you are not buying with cash or financing the purchase at 100%)

- Monthly mortgage payments (if you haven’t paid off your house or inherited it)

- Interest on your mortgage (if you have one)

- Property taxes

- Homeowners insurance

- Routine maintenance (think lawn care, pest control)

- Unexpected maintenance (repairs to worn out plumbing or storm damage, for example)

- HOA (homeowners association) fees (if applicable)

- Utilities

Instead of a mortgage, renters pay monthly rent in addition to a move-in deposit (unless they snag a move-in special or their credit score is high enough to waive this). Deposits can run from half a month’s rent to two months’ rent, and there are usually additional deposits for pets.

Additionally, renters need to cover:

- Renters insurance (if required)

- Utilities

- Fees (if applicable)

Renters typically avoid the expense, responsibility, and time commitment of ownership.

Home Equity vs. Convenience

When you buy a house with a mortgage, your lender actually buys it for you. As you make mortgage payments, you gain a bigger and bigger share of ownership in your house. The amount of ownership you have in your house is referred to as equity.

You won’t build equity through renting because you’re not purchasing the place you live. For that reason, some people see renting as “throwing your money away,” but really, you’re paying for convenience. Renters typically avoid the expense, responsibility, and time commitment of ownership (as long as you have a good landlord and you maintain healthy boundaries around property maintenance, of course).

As a renter, you can simply find an apartment or house that already has the amenities you want.

Control

On the flipside, owning a home offers a degree of control that renting doesn’t. If you rent, you’ll usually need to get approval for changes from your landlord. Plus, it’ll be your landlord (not you) who will see the long-term financial benefit of any improvements you make.

As a renter, you’re also subject to your rental agency’s terms. They may control whether you can have a pet (and what kind), access to amenities like laundry facilities, and — most importantly — how much you pay in rent and fees.

Amenities

Maybe you dream of building a pool in your backyard — or a covered patio with a brick oven. As a homeowner, you can make those changes, but you also have to think about:

- The cost of installation

- Time and energy spent coordinating construction/doing the work

- Increased homeowner’s insurance and property taxes

- Increased maintenance costs

As a renter, you can simply find an apartment or house that already has the amenities you want. The cost will be lower and you can downsize to a less luxurious place if you ever need to economize, while an owner is stuck with increased costs.

If your job requires you to change location frequently, you’ll probably save by renting.

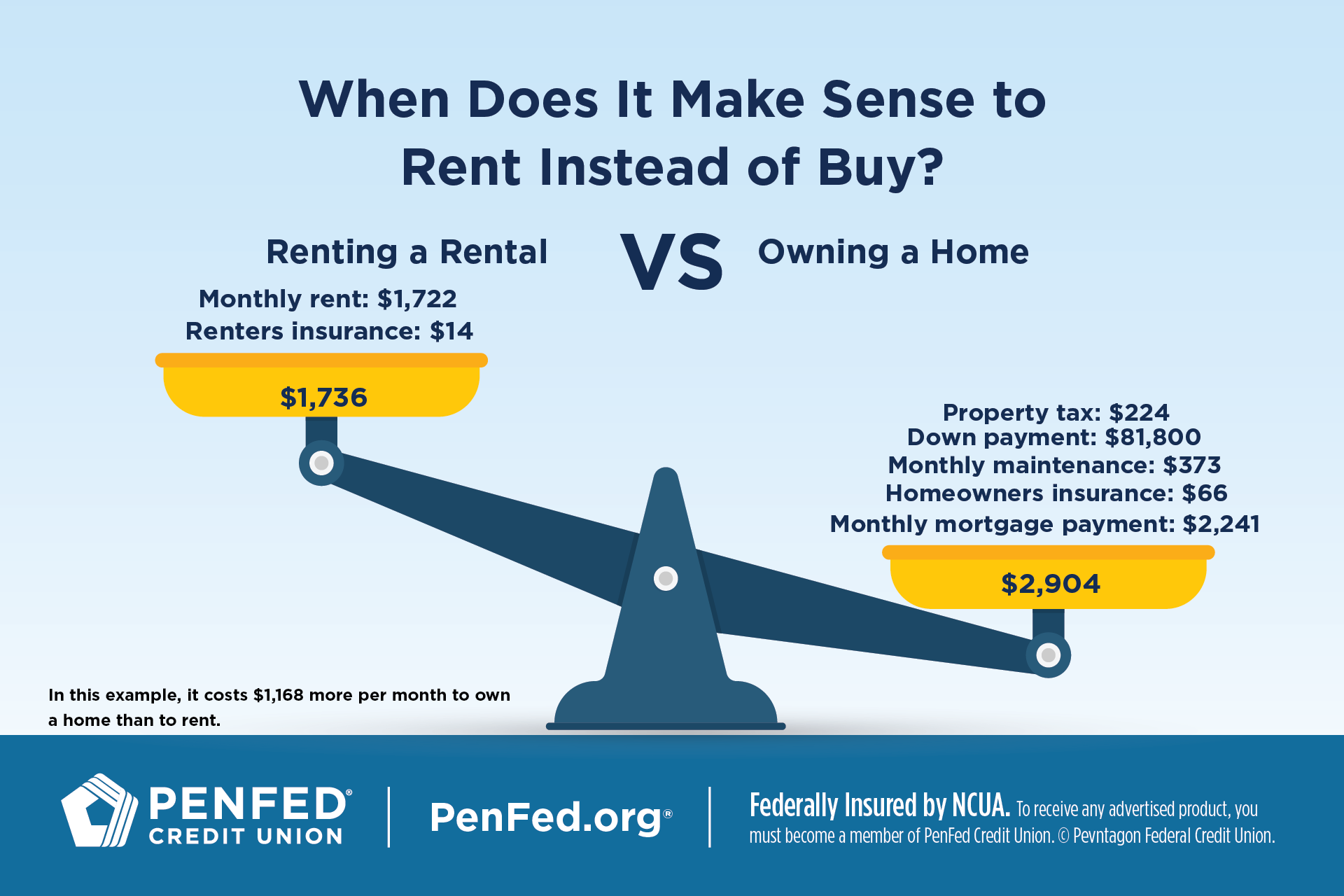

Cost of Renting vs. Owning a Home for One Year

[Owning a home involves more expenditures than renting. This table compares the cost of owning a home in Raleigh, NC vs. renting an apartment in the same area for one year.]

The median home price of $409,000 for a home in Raleigh, North Carolina is a little less than the median U.S. home price, both retrieved on April 24, 2024 from Redfin.com. All calculations assume a 20% down payment of $81,800. The monthly mortgage payment and monthly homeowner's insurance were calculated on Bankrate.com using April 24, 2024 market data. The average monthly maintenance cost is 1/12 of the annual home care cost found on Thumbtack.com for the Raleigh-Durham, N.C. market. The monthly property tax payment is 1/12 of the yearly tax based on the Wake County, NC tax rate of 67.5¢ per $100 of home value.

The average rent price in North Carolina was retrieved on April 24, 2024 from Redfin.com for the previous month. The monthly renter’s insurance is 1/12 of the average yearly renter’s insurance in North Carolina for 2024.

Reasons to Rent Instead of Buy

Deciding whether to buy or rent is a personal decision that comes down to your unique needs. Here are three signs that renting might be the right choice for you.

You’re Not Financially Ready to Buy

It’s best to wait to buy a house until you’ve established a career and built up a healthy emergency fund. After all, if you can’t make your monthly mortgage payments, you could lose your house and any equity you’ve put into it. You might even have to declare bankruptcy in that case and face diminished credit for several years. You may not be ready to buy a house yet if you’re:

- Just starting your career

- Changing jobs frequently

- Working in a career with unsteady income

- Still learning how to budget and manage your finances

Renting may also be a better choice if you want to live in a major metropolis.

Your Job Makes Buying Difficult

It generally takes 3 to 5 years for a house to increase in value enough that you can recoup your down payment and closing costs by selling. In other words, if you don’t plan to stay in your house for a few years, then you may lose money by buying a home. If your job requires you to change location frequently, you’ll probably save by renting.

You Have Other Financial Goals

Owning your own home ties up a lot of your money that you could be using for something else. A house is a long-term investment that often increases in value over time, but you won’t miss out by choosing to invest your money differently.

The Market Is Unfavorable

Housing prices fluctuate based on market factors. If the housing market’s hot, waiting for it to cool before you buy could save you thousands of dollars. Avoid buying during periods of inflation or times when interest rates are unusually high.

Buying Doesn’t Fit Your Lifestyle

Homeownership offers stability, but it also ties you to a specific place. If your goal is to move to a new place, travel extensively, or live as a digital nomad, then homeownership may not help you achieve those goals.

Renting may also be a better choice if you want to live in a major metropolis. Space comes at a premium in places like Boston or San Francisco, so the trade-off could be living in the heart of things in a place you don’t own.

If you already have an emergency fund and savings, consider investing in longer-term, less flexible accounts like a 401(k) and IRAs.

How to Build Wealth Without Home Ownership

A house is only one kind of investment. All investments have some risks, and it is possible for a home to lose value because of factors like neighborhood changes, population shifts, dips in the housing market, and even natural disasters.

It’s important to know that a house isn’t the right investment for everyone, and you won’t miss out on building wealth if you decide to rent instead. A good alternative is to take the money you would’ve used for a down payment and invest it instead. The most important factors for making this work are that you start early and invest consistently. Make investing easier by automating your saving.

Highly Liquid Investments

If home ownership isn’t for you and you don’t have much in savings yet, then investing in liquid assets could help you build wealth:

- Stocks often perform better than real estate

- ETFs offer lower returns than individual stocks but carry less risk

- REITs pay dividends and are less risky than stocks

- Certificates offer lower yields but guaranteed returns

- High-yield savings accounts grow your savings with compound interest

Illiquid Investments

If you already have an emergency fund and savings, consider investing in longer-term, less flexible accounts like:

- 401(k) accounts with employer matches

- IRAs you operate independent of an employer

- HSAs save pre-tax money

- Bonds offer steady, guaranteed returns

Value of a Home vs. Value of Alternative Investments After Five Years

[Could you come out even — or better — investing your money instead of buying a home? The table below compares both options. The first option is to purchase a home. The second option is to invest your down payment in a certificate for five years at 4.5% and also invest the difference between renting and owning in a 401(k) each month at an average rate of return.]

The projected home value increase is based on the 2024 quarter four projection from Fannie Mae. The remaining mortgage amount is from the amortization table on bankrate.com’s mortgage calculator. The certificate rate was retrieved from bankrate.com’s “Best Five-Year CD Rates” on April 24, 2024. The certificate’s future value was calculated using bankrate.com's CD calculator. The 401(k) future value was calculated on bankrate.com’s retirement return on investment calculator.

The Takeaway

Homeownership offers many benefits, but renting has its own hidden benefits as well. To buy or not to buy isn’t the question — the question is which option will help you live the life you dream of.

Invest in Your Future

Find out how much you could earn with one of our certificates.