Finance

What Is the Difference Between Liquid and Illiquid Assets?

EXPECTED READ TIME:5 minutes

There are a lot of ways to evaluate potential investments. One of the easiest is to determine whether the investment is liquid or not. Understanding this concept will help you see how an investment could fit into your portfolio, and the potential benefits and consequences of investing in it.

What Is an Asset?

In financial terms, assets are things of value that can be traded for cash or other things of value. These could include stocks and bonds or physical objects like houses and cars. People (or businesses) purchase assets as investments, hoping they increase in value over time.

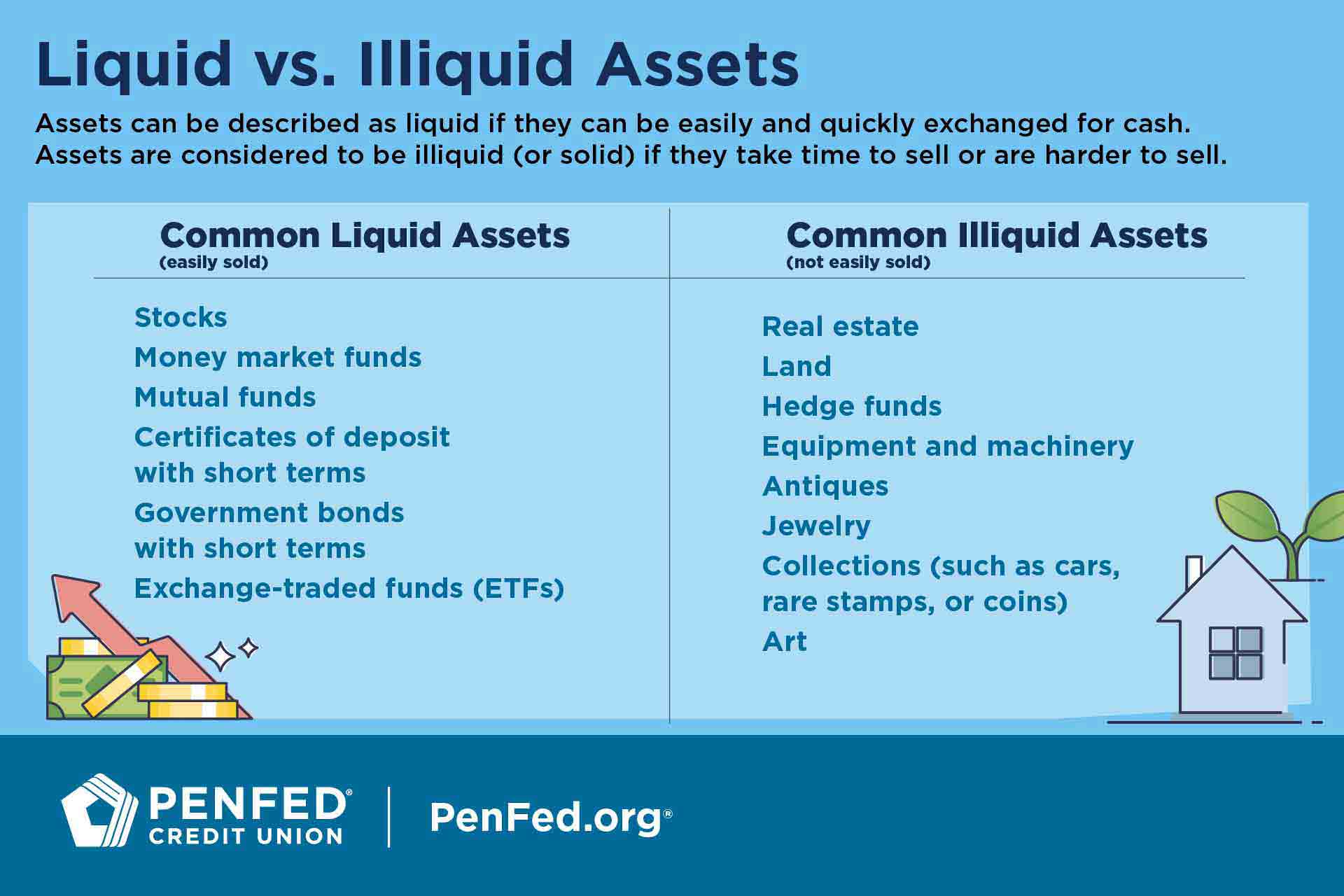

Assets can be described as liquid or illiquid (some people use the term “solid”). The value of liquid assets increases more quickly, and they can be sold or traded easily. The value of illiquid assets increases more slowly. Selling illiquid assets or trading them takes more effort.

Liquid Assets

Liquid assets are versatile and help protect you against unwanted (and unexpected debt). It’s a good idea to maintain liquid assets. Here’s why:

Liquid Asset Definition

Liquid assets are assets that are easy to sell for cash and won’t lose value when converted. They tend to reach maturity (meaning their value increases enough that you can sell them for a profit) quickly. Assets are more likely to be liquid if:

- Their value can be agreed on

- Selling them is easy and takes little time and effort

- There’s a large market of people interested in owning them

- Interest in that type of asset is on the up and up

Liquid assets are flexible, meaning you can convert them to cash easily.

Examples of Liquid Assets

Some common examples of liquid assets include:

Stocks

Mutual funds

Certificates with short terms

Government bonds with short terms

Exchange-traded funds (ETFs)

Pros and Cons of Liquid Assets

Liquid assets are flexible, meaning you can convert them to cash easily. That can help you avoid debt, manage a financial hardship, or free up money to invest in new opportunities without a lot of hassle or planning. Keeping liquid assets on hand helps you maintain financial security. Because liquid assets tend to mature quickly, you can constantly reinvest, taking advantage of new opportunities as you find them.

On the other hand, liquid assets usually have a smaller return than illiquid assets. They’re more reactive to economic changes, too, meaning they can jump up or plummet in value very quickly. Overall, liquid assets are less certain investments.

| Pros and Cons of Liquid Assets | |

|---|---|

| Pros | Cons |

| Flexible – easily converted to cash | Returns are usually smaller |

| Can be cashed out during financial emergencies | Vulnerable to economic downturns |

| Mature quickly and enable reinvestment | Less certain |

Illiquid Assets

Illiquid assets help build your wealth over time. They can also help preserve your wealth during economic downturns. Here’s how they work.

Illiquid Asset Definition

Illiquid assets are assets that are harder to sell or trade. They usually reach maturity slowly. An asset might be illiquid for a few reasons:

The asset is hard to value

Selling the asset is complicated or time-consuming

The asset only appeals to a small market

Interest in that asset (or type of asset) has diminished

Examples of Illiquid Assets

Some common examples of illiquid assets include:

Real estate

Land

Hedge funds

Equipment and machinery

Antiques

Jewelry

Collections (such as cars, rare stamps, or coin collections)

Art

Pros and Cons of Illiquid Assets

Illiquid assets usually offer bigger returns than liquid assets. Their growth is slow and steady, so while they’re not guaranteed, they are more likely to have a net gain if you hold them long enough. They’re also less reactive to economic changes. Holding illiquid assets during market downturns can help you minimize your financial losses.

Illiquid assets usually offer bigger returns than liquid assets.

However, illiquid assets are also inflexible. Selling illiquid assets takes time and selling too early could mean selling at a loss. They keep your money tied up, which can limit your options when you face financial hardship. Because of this, it can be more difficult for investors with less cash to break into illiquid assets.

| Pros and Cons of Illiquid Assets | |

|---|---|

| Pros | Cons |

| Returns are usually bigger | Inflexible |

| More certain | Assets gain value more slowly and tie up money |

| Less vulnerable to economic downturns | Harder to afford for investors with less money |

Liquidity Isn’t Fixed

Assets aren’t either liquid or illiquid. We use the term “liquidity” to describe where an asset falls on a spectrum ranging from cash (the most liquid asset because you can use it to buy anything) to items like art, jewelry, and collectibles that are characteristically illiquid.

The liquidity of an asset can change depending on trends or economic factors. For instance, you might get a good price for your used car if the cost of new cars increases drastically. Fewer people will be able to afford expensive new cars, generating more demand for your used car (and making it more liquid). But if the price of new cars falls — or buyers have great financing options for new vehicles — then you won’t be able to make as much selling your car (making it more illiquid).

The liquidity of an asset can change depending on trends or economic factors

Which Type of Asset Is Right for Me?

If you’re just starting out, you probably want to maintain more liquid assets. Liquid assets can help you weather financial challenges and avoid accumulating debt. You can invest in financial tools like savings accounts, short-term certificates, and money market accounts that will increase your total capital (a fancy financial term for “cash you can invest”).

As your capital increases, you can start investing more money in illiquid assets. That could mean opening a retirement account or buying a house. You’ll still want to maintain some liquidity for an emergency fund, additional investment opportunities, or fun things like vacations.

As you refine your personal budget and build wealth, you can continue investing more in illiquid assets — while continuing to maintain some liquid ones — until you find the right balance.

The Takeaway

Both liquid and illiquid assets have their strengths and limitations, and a good investment portfolio usually has some of each. Understanding the types of assets you have can help you invest more wisely and use them to their full advantage.

Wealth Management Strategies for Each Stage of Your Life

Discover the diverse offering of products, services, and support available to our members.