MONEY MOVEMENT

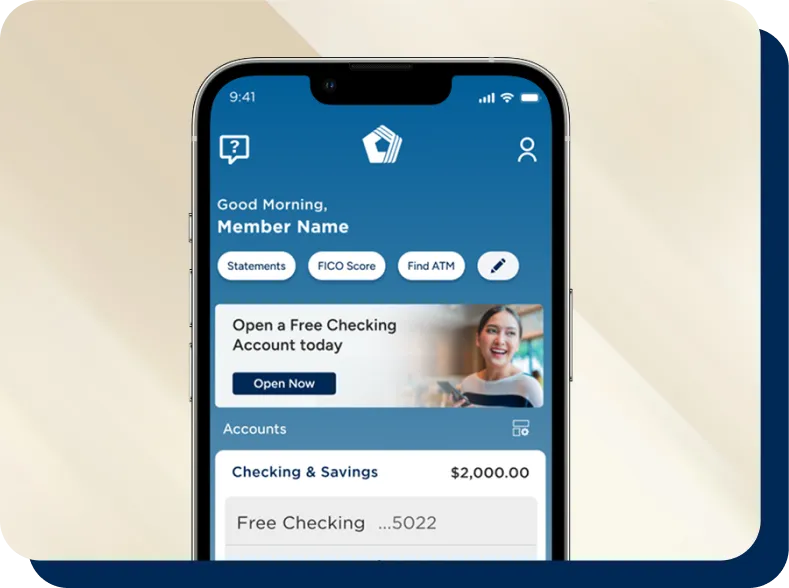

Money moves made simple

Send, receive, and manage funds your way. Our secure tools make it easy to stay in control, wherever you are.

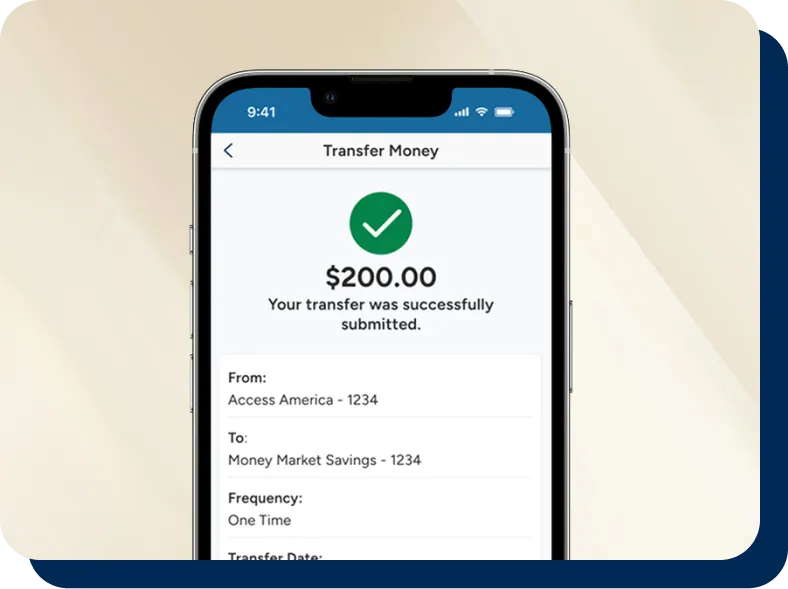

Transfer your way

Mobile App

Log in and tap "Pay & Transfer."

Select "Transfer Money."

Choose your accounts and enter the amount, frequency, and transfer date.

Confirm the details. You'll receive an email confirmation.

PenFed Online

Log in and click "Transfers."

Select "PenFed Transfers."

Choose your accounts and enter the amount, frequency, and transfer date. You can even set up recurring transfers!

Confirm the details. You'll receive an email confirmation.

Other Options

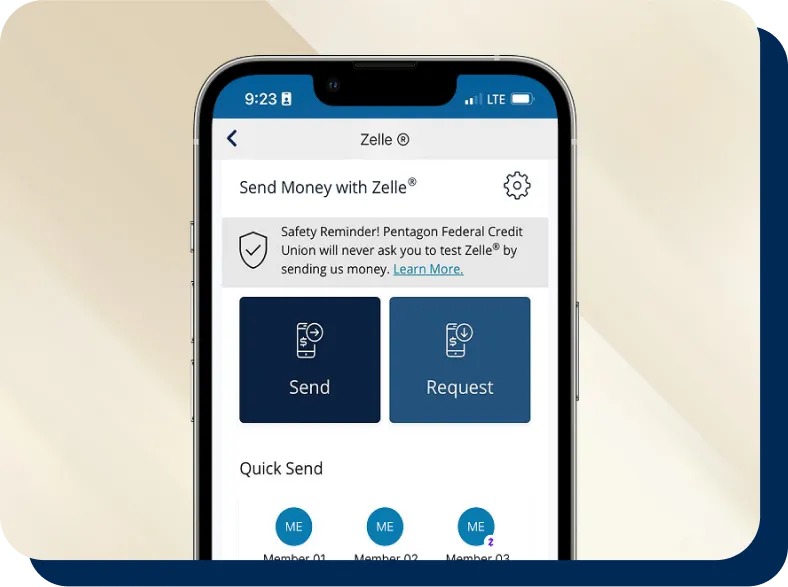

Zelle: Send money directly to friends or family with a PenFed checking or savings account.

Wire Transfers: A quick and secure way to send money, especially for international transfers.

Transfer by Phone: Call us at 1-800-247-5626, or if you're overseas, 1-703-838-5100. Be sure to have your account numbers ready!

Sending and receiving a wire transfer

Gather your information

- Your recipient's name and address.

- The receiving account number.

- The receiving financial institution's routing (ABA) number (for domestic wires) or SWIFT/BIC code. (for international wires).

Sending a wire transfer

- Call Us: Reach out to us at 1-800-247-5626 (or 1-703-838-5100 internationally) to speak with a representative.

Receiving a wire transfer

- If someone is sending you a wire, they'll need your complete account number and PenFed's routing number (256078446).

For international wires, they'll also need your PenFed address: 2930 Eisenhower Ave, Alexandria, VA 22314.

Gather your information

- Your recipient's name and address.

- The receiving account number.

- The receiving financial institution's routing (ABA) number (for domestic wires) or SWIFT/BIC code. (for international wires).

Sending a wire transfer

- Call Us: Reach out to us at 1-800-247-5626 (or 1-703-838-5100 internationally) to speak with a representative.

Receiving a wire transfer

- If someone is sending you a wire, they'll need your complete account number and PenFed's routing number (256078446).

For international wires, they'll also need your PenFed address: 2930 Eisenhower Ave, Alexandria, VA 22314.

Wire transfer guidelines

Key wire transfer information

- PenFed can receive international wires that do not require a SWIFT code.

- There's no fee to receive a wire transfer.

Modify or cancel a Wire Transfer

To change or cancel a pending wire transfer, please contact us immediately.

Recalling wires

- Domestic: You typically have up to 30 minutes from the time the wire is sent to initiate a recall.

- International: Recalls are processed on a best-effort basis and can take longer.

Daily cut-off times

Keep in mind that requests received after the cut-off times will be processed the next business day.

- Domestic: 3:00 PM EST

- International: 3:00 PM EST (Canada: 12:00 PM EST)

Key wire transfer information

- PenFed can receive international wires that do not require a SWIFT code.

- There's no fee to receive a wire transfer.

Modify or cancel a Wire Transfer

To change or cancel a pending wire transfer, please contact us immediately.

Recalling wires

- Domestic: You typically have up to 30 minutes from the time the wire is sent to initiate a recall.

- International: Recalls are processed on a best-effort basis and can take longer.

Daily cut-off times

Keep in mind that requests received after the cut-off times will be processed the next business day.

- Domestic: 3:00 PM EST

- International: 3:00 PM EST (Canada: 12:00 PM EST)