FINANCE

Your Month-by-Month Financial Roadmap: A Year of Smart Money Moves

What you'll learn: How to achieve financial balance with our monthly money management tips.

EXPECTED READ TIME: 13 MINUTES

The world around you is buzzing, but you’re lost in thought. First come the dreams, then the questions.

Am I saving enough for my kid’s college education? What about retirement? Can I finally go on my dream vacation? Should I pay off my car early?

Balancing your long-term goals with current desires isn’t always easy. But what if you had a roadmap — meaning, no second-guessing? We’re breaking down the year into simple month-by-month steps to help you take control of your finances.

Tips for Using this Guide

You’re about to walk through a year’s worth of smart money moves. By the end, we hope you’ll be feeling confident enough to take on all things money. As you embark on the journey, remember these ten things.

- Review the whole guide before starting so you can see how it all ties together.

- Reading this article in July? Not to worry — just scroll to where you are in the year.

- Consider your personality — are you a seasonal spender? Cautious investor? Use this guide with your personal money tendencies in mind.

- Enlist a family member or small group of friends to walk this path with you. Together, practice loud budgeting.

- Visualize your success. A vison board with your financial goals can be a great motivator.

- Research the things you don’t know, or take a personal finance course.

- It’s important to get your finances right, but take a break if you feel a spiral coming on.

- Be patient — the time to celebrate your wins will come.

- Big goals are nice, but don’t discount the small, consistent, measurable steps.

- Keep a monthly finance journal where you can reflect on your feelings and observations about all this. (Even if you don’t go back and read it, the physical act of writing helps your brain process information.)

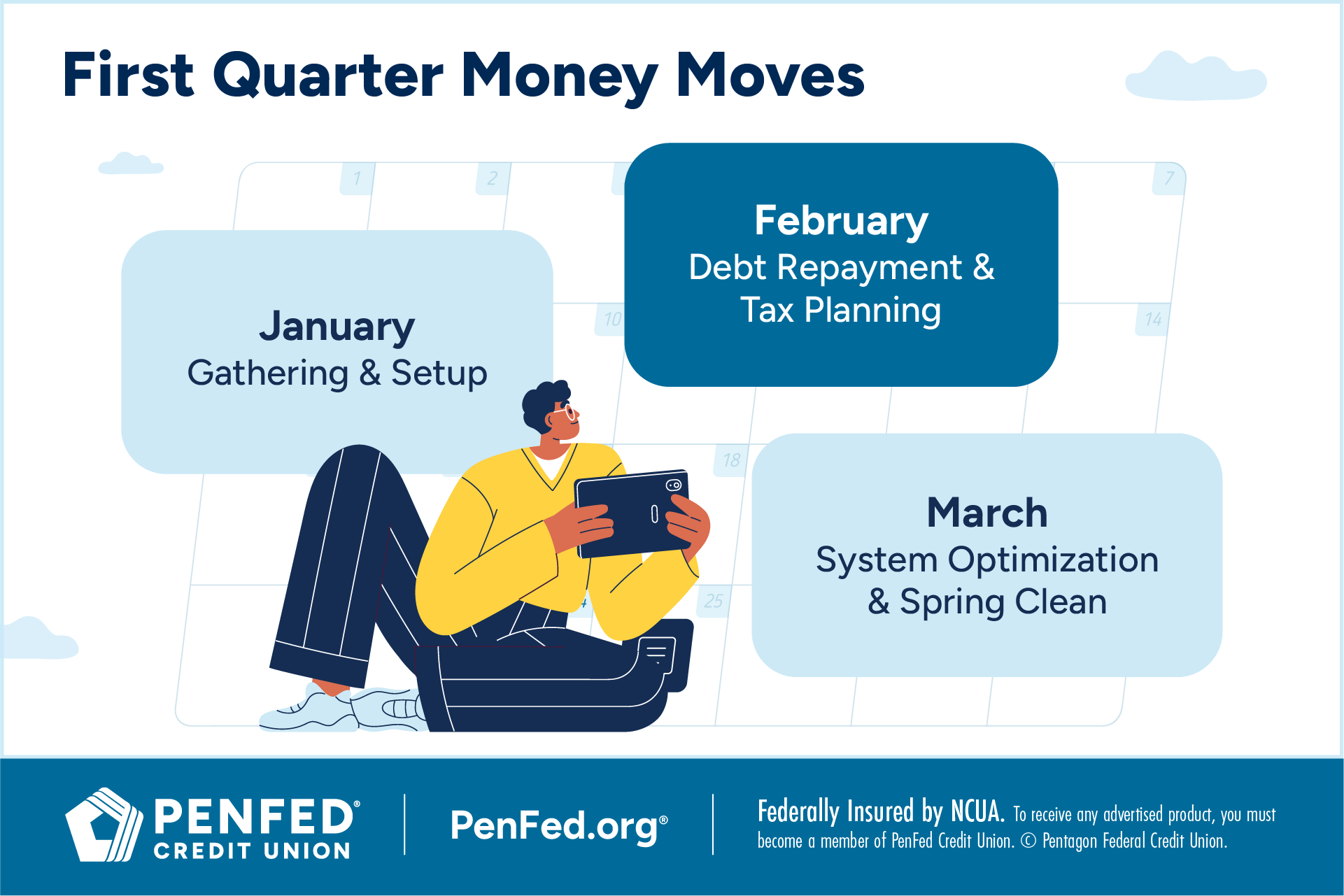

January: Reset and Re-Imagine

Welcome to month 1 of 12. The new year is like a fresh canvas — it’s the perfect time to etch bigger and better goals and habits.

But first, check in with yourself.

Look back at the past year. What truly worked for your personal or family finances? Perhaps that automated monthly savings transfer added up to a lot, or your new budgeting app made tracking easy — even fun. On the flip side, what felt too tight, chaotic, or draining? Maybe you gave in to too many impulse buys or there was a huge, unexpected expense, or you ignored a certain debt all year long.

Now that you know where you stand, it’s time to bounce back!

Revisit and Practice Your Money Mantras

Making smart money moves starts with a mindset shift. Think about the positive messages you want to live by — perhaps, the ones that got you over a financial trauma. You might even recall money mantras you heard growing up.

Instead of “Money doesn’t grow on trees,” or “I’m failing if I haven’t made X amount by the time I’m X years old,” try “Money is a tool, not the goal.”

The key is to get motivated, not to pile on unhealthy pressure.

An emergency fund is how you bat away the curveballs.

Prioritize Saving

Job changes, medical bills, and car repairs — life is full of surprises. An emergency fund is how you bat away the curveballs. Aim to have three to six months of essential living costs saved. A little more, if possible, is nice.

Use this month to map out your savings plans. Maybe you want to have your emergency fund ready to go by March or June, so you can switch to other priorities like buying a new car, moving to a bigger home, getting a furry friend, or paying off your credit card. Whatever the goal, a sinking fund is your answer. Automate your contributions and watch your balance grow.

Bonus tip: Find out if your bank or credit union offers high-yield savings accounts, regular savings accounts with no monthly maintenance fees, or interest-bearing checking accounts. This is how you’ll maximize your savings.

Consider Investing

To some, investing is synonymous with Wall Street titans and busy charts. But it’s not as specialized as you might think — and it’s something anyone can do. About 35% of Americans invest a portion of their earnings through a work-sponsored 401(k) plan. If you have the option to set one up, go for it.

Already have a 401(k)? Ask yourself if you’re contributing enough to meet your employer’s match. Don’t leave free money on the table. Next, check your investment mix to make sure it fits your goals and risk tolerance. Finally, know your matching schedule so you have the most accurate understanding. Matched payments are often added to your account around the same time your paycheck processes, but some employers issue a lump sum contribution at the end of the year. That can change how these accounts earn interest.

Whatever investing looks like for you, remember this — small, consistent contributions make all the difference.

Ready to step beyond retirement accounts? Consider an individual brokerage account. This investing option may offer a wider range of stocks, bonds, and exchange-traded funds (ETFs), plus no contribution limits. There are even AI-powered versions, designed with novices in mind. They provide personal recommendations.

If you’re seeking a more conservative approach, then a federally-insured certificate account may be best for you. Set it up and enjoy fixed, guaranteed returns for a set period, on top of the potentially higher rate of return (compared to that of traditional savings accounts).

Whatever investing looks like for you, remember this — small, consistent contributions make all the difference.

Decide what matters to you and/or your family and make those things your priorities.

Win at Spending

Taking control of your spending doesn’t mean cutting out fun. Come up with a realistic monthly household budget using proven strategies like the 50/30/20 rule (that’s 50% of your income for needs, 30% wants, and 20% for savings, investments, and debt repayment). Use your banking app or a plain old spreadsheet to track your expenses for a few weeks. You might be surprised where your money goes. Then, look for areas where you can make small adjustments like getting rid of unused subscriptions, finding free local entertainment, using coupons when grocery shopping, and leveraging credit card cash back.

These measures will help you figure out the right amount of cash to keep in your checking.

Set One or Two Family Priorities for the Year

Decide what matters to you and your family and make those things your priorities. Do you want to take a big family trip, save for a home renovation, or grow your charity giving fund? When your financial decisions are tied to values-based goals, managing money feels like less of a chore.

February: Create Calm Around Debt and Taxes

It’s February 1st. The days are short and your tolerance for wealth management might be even shorter. Maybe you’re starting to think about tax season and you’re realizing that refund is only going to go so far. Maybe your credit card bill due date is coming up, and you know it still carries the bulk of last year’s holiday shopping. You can’t bear to look!

Do a Mental-Health-Around-Money Check In

To start, be honest with yourself. Are you carrying guilt or shame around that high credit card balance or feeling more than uncertain about the ins and outs of taxes? Clear the air with yourself and you’ll be on your way to achieving sustainable financial growth that lasts longer than a week. Here’s a step-by-step mini guide that takes you from self-reflection to actionable results in about 30 minutes:

First, reflect:

- Take time to analyze these feelings in writing or in a thought experiment, the way you might analyze any situation.

- In doing so, name the feeling, consider the first time you ever felt that way (about finances or otherwise), and let some self-knowledge unfold without putting too much pressure.

- Take a breath and remind yourself that you’re human and your feelings are reasonable given the situation. If you think your feelings are disproportionate, consider what bigger picture fears might be driving them. Understanding a broad fear can help you zero in on bigger long-term goals!

- Don’t dwell. Release the negative feeling best you can. You can imagine them rolling off your back or even do a physical wave or gesture to symbolize release — physical actions can help your brain retain understanding.

Now get practical:

- Shift your observations to recent events. No shame — just focus and consider. What led you to charge all those gifts to credit? Did you feel like you needed to show up with gifts because you hadn’t spent much time with family all year? And how did you end up owing on taxes last year? Did you underpay your quarterly taxes or underestimate additional income?

- Now write down some simple things you can do — even if they seem hard to execute — to work toward resolution.

Finally, take action:

- Watch some online videos about tax prep to see what real people are doing in similar circumstances.

- Consider spending more time with people or dividing up your holiday budget in detail down to the dollar per person before you start out. Keep it simple to keep it calm.

Don’t avoid your negative feelings around money. Use them to help you zero in on bigger long-term goals.

Automate Saving

This month, look at how you distribute your savings. Do you wait until you get paid to figure it out? Now’s a good time to consider automating your savings plan. Set it up now and watch the buckets fill up all year! You can set up recurring transfers from your checking account or, if you have a regular paycheck, have funds directly deposited from your paycheck to your various accounts so you never have to think about it.

Investing

Own an IRA? If you haven’t hit the maximum contribution limit for the previous tax year, February is a good time to make it happen as the deadline is typically in April. Doing so will boost your retirement money, plus there are potential tax benefits.

If you’re wondering whether or not to invest because of a debt you carry, the answer is you can. Just be strategic. Start small and bet on compounding.

Spending

Use windfalls such as work bonuses, side gig income, and refunds wisely. Choose one credit card or loan — perhaps the one with the highest interest rate (debt avalanche method) or the smallest balance (debt snowball method) — and pay a little more than you usually would each month. In the meantime, hit the pause button on swiping those cards or applying for new lines of credit.

If your debt feels like it’s way beyond what you can handle, you could consider debt consolidation by way of a balance transfer. This option lets you move your outstanding balances to a single, new credit card with a zero to low APR. As with any credit card, know your repayment schedule and look out for credit card fees.

Leverage Your Tax Refund

Don’t wait till the last minute to file your taxes. Try to do it once you receive your W-2 forms, so you can get your hard-earned refund as soon as possible. Direct the refund money to your emergency fund or get the family together for an unforgettable camping trip.

Don’t wait till the last minute to file your taxes. Try to do it once you receive your W-2 forms.

March: Optimize Tax Refunds and Spring Clean Your Financial Systems

The days are getting longer.

March is the perfect time to further optimize your tax refund and spring clean your financial systems. So, where do you start? Pinpoint the financial habits that you want to let go of. Maybe it’s the mindless online shopping, avoiding money conversations, or inconsistent expense tracking. Swap out old habits for these healthy wealth-building actions.

Saving

Resist the urge to let your refund disappear into everyday spending. Instead, give it a purpose. Have you been dreaming of a new mattress? Finally ready to fix that dented bumper? Or maybe you’ve been holding off on some new audio equipment. Whatever the spend, set up an account now and get it ready to receive your refund. When the money goes in, pretend it doesn’t exist until you’re ready to use it for the intended purpose. Or consider opening a certificate with your refund so you can earn a little extra and keep your hands off till the time comes to spend it.

Investing

With personal investments out of the way, make March the month you start a 529 plan for your kids (if you have any) or increase education contributions. A 529 plan is a tax-advantaged savings plan for people who want to save for future education expenses. You can also use a 529 for your own education expenses if you don’t have kids.

Spending

Shop intentionally. Don’t go buying clothes just because it’s spring or jumping at every homeware sale. Make a list of what you need, set a spending limit, and look for vintage and classic resale options.

Bonus: Teach Your Kids About Money

Whether you have a toddler on your hands or you’re a single parent, it’s never too early to sow the seeds of financial literacy. This month, choose one money habit to model or teach your children. It could be as simple as saving a portion of their birthday money or involving them in a family budgeting discussion.

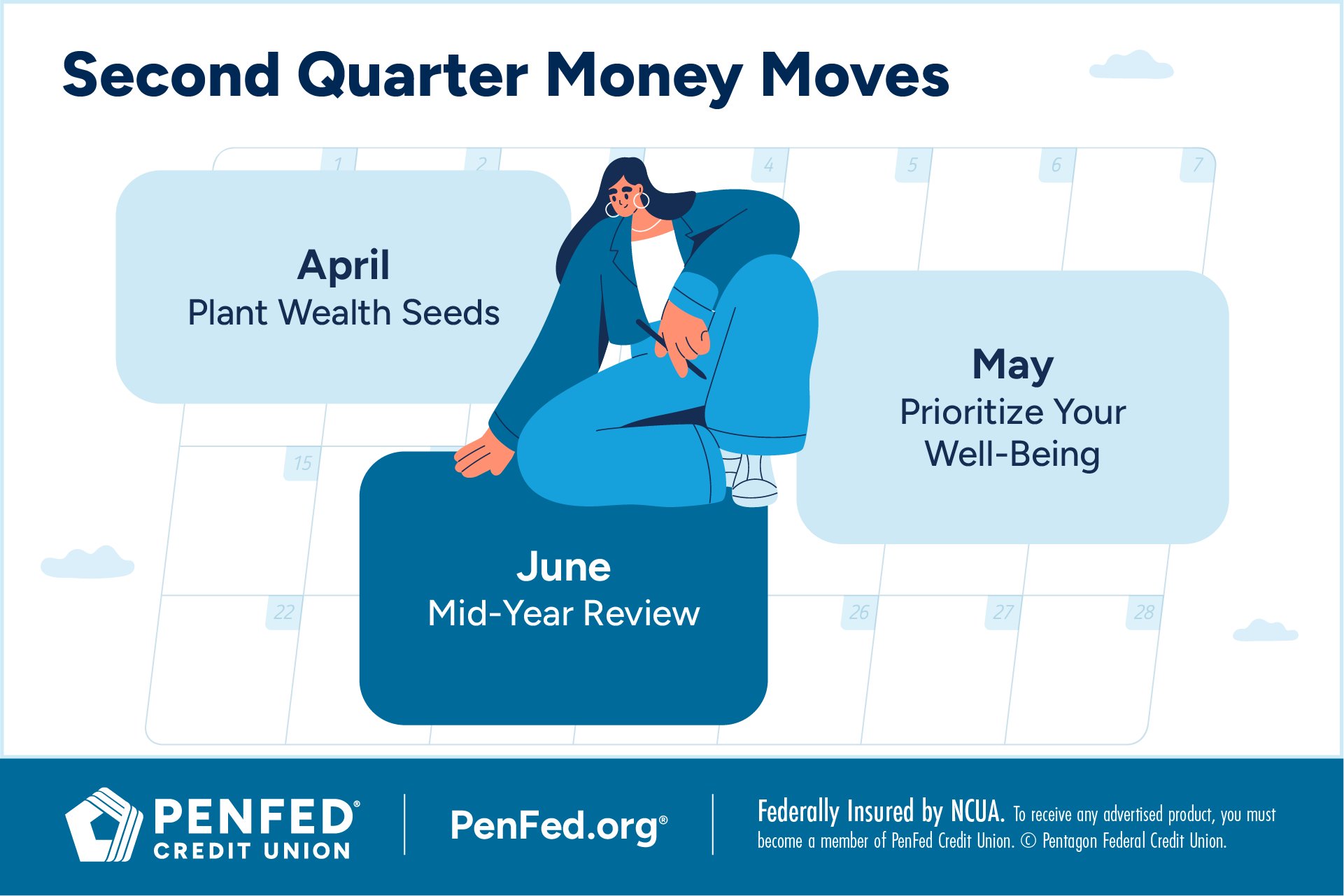

April: Plant Financial Seeds for the Future

Spring continues. If you haven’t already, start planting financial seeds for the near future. Think of one or two financial wins and go full steam ahead. Be sure to celebrate your victories along the way.

Here’s your checklist for April.

Saving

How are your sinking funds doing? This month, your goal is to track progress. Take stock of your needs for the upcoming months. Think day trips to the beach (or dream trips overseas), kids’ camps, and all those spring and summer birthdays. Check to see how close you are to your target for each one. Keep adding money until it’s fully funded, so you can enjoy those special moments hassle-free.

Investing

Q2 is upon us. It’s a good time to review your retirement account(s) again. Consider upping your 401(k) contributions. If you’re not eligible for a 401(k) — or even if you have one — consider an individual retirement account (IRA), an equally popular and powerful investing vehicle. Depending on the account type, your money grows tax-free or deferred. For example, a Roth IRA comes with tax-free withdrawals in retirement.

Spending

It’s easy to get caught up in your daily responsibilities, especially if you’re caring for a growing family or aging parents. This month, make it your goal to invest in yourself. Budget for things like:

- Professional development courses

- Tools that make home life more efficient

- Self-care resources like a subscription to a meditation app, a productivity workbook, or a self-help bestseller

These investments can really make a difference when it comes to your well-being and earning potential.

May: Budgeting for Joy and Rest

Spring is in full bloom. May invites us to make space in the budget for fun, one-of-a-kind experiences, and moments of unwinding.

Savings

As the weather in most locations warms up, you might be ready to stretch your wings a bit. Go ahead and start tapping into those “reward” or “fun” funds you’ve been working so hard to fill. Take a break from your busy life to engage with the people and things that make you happy. Plan a family pizza night, enjoy a kid-free night on the town, or carve out time for a new hobby like learning to play tennis. Living a little helps motivate you to keep saving. Now’s also a great time to map out your saving strategy for fall activities. Keep up the good work!

Investing

Investing doesn’t require a large lump sum. If funds are tight, consider adding fractional shares to your investment portfolio. Many investment platforms allow you to buy a portion of a stock or ETF for a few dollars.

Spending

Holidays and special occasions call for gift shopping. Take the stress out of these celebrations with proper planning. If these holidays are applicable to you, look at your gift-giving sinking funds for Mother’s Day and Father’s Day to ensure they are where you want them to be. If not, consider low-cost presents like a DIY card, a scrapbook, or a free outing. You could also use coupons to help cover the cost of shopping.

The key to achieving your goals in the second half of the year is to be flexible, patient, and consistent.

June: Mid-Year Review and Reset

Time flies — you’re halfway through the year. Pause to acknowledge your financial progress, no matter how small. Identify what’s not working. Did a job change or family need arise that derailed your plans? Are rising grocery prices getting to you? Make small adjustments to the budget where needed.

Prioritize Saving

Revisit the savings goals you set in January. Hopefully, you’re on track. If not, don’t panic. Decide whether you need to make higher contributions through the rest of the year or modify your goals slightly. The key to achieving your goals in the second half of the year is to be flexible, patient, and consistent. If you hit your savings goals, think of bigger and better ways to make your money work for you.

Consider Investing

Maybe you have a health savings account (HSA) or flexible spending account (FSA). These accounts are there to make life a little easier for you. Evaluate your balances and contributions, so you know exactly how to maximize these accounts. An HSA comes with a high-deductible health plan, and it offers triple tax advantages — tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. FSAs are use-it-or lose-it accounts, so knowing your balance is crucial.

Win at Spending

Need a new grill, patio furniture set, or smart watch? Schedule big purchases strategically. Keep an eye out for mid-year sales from now through August. Research prices, compare models, and set a budget. When you can, shop secondhand. Do this and you’ll get the best bang for your buck and escape the overspending trap.

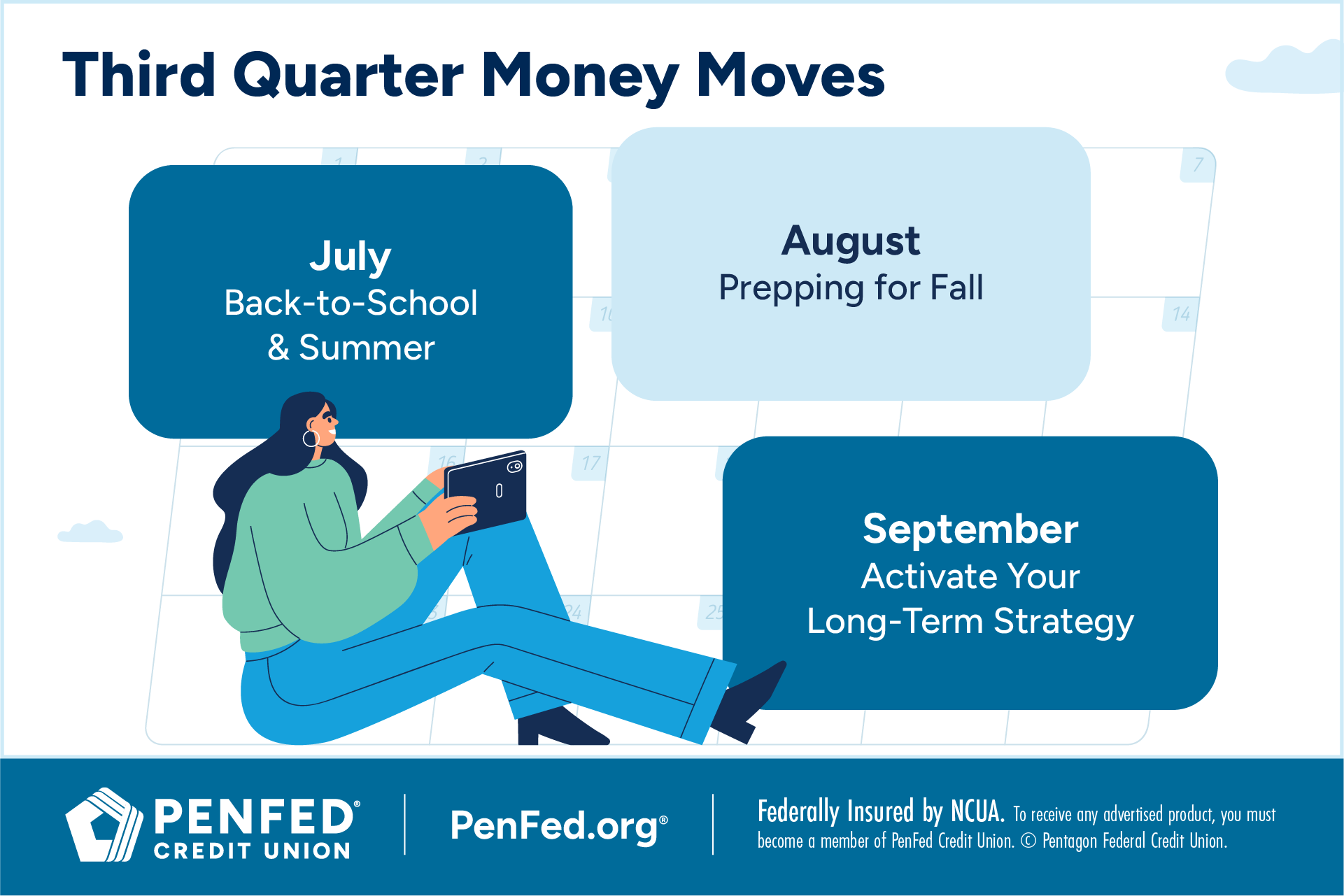

July: Family Fun and Looking Ahead

The sun-soaked days are finally here. This month is about finding the sweet spot between back-to-school planning and family fun.

As you get into spending, think of age-appropriate ways to show your children why balancing needs and wants is important. Reflect on your money story, be transparent, and have fun with it. They’re your co-creators in shaping your family’s money culture.

If you don’t have kids, money conversations might look a little different for your household, but budgeting basics still apply. You can still:

- Talk household finances with your roommate or partner

- Do a needs vs wants exercise for yourself to help bring spending into focus

- Make a “back-to-school” budget for yourself to update your home office and fall wardrobe (then go “back-to-school” shopping for yourself for a bit of nostalgia)

Here’s what else to focus on in July:

Saving

The cost of school supplies and new clothes can quickly add up. Get ahead with a short-term savings plan. Even setting aside $20-$40 a week can make a difference when the August and September bills roll in.

Investing

Schedule your review of investment milestones, just as you’ve been doing for your sinking funds. A look back at the last quarter will help you figure out your next move. It’s also a great idea to grow your understanding of investments.

Ask yourself what you’re invested in and why. Do you own stocks from big companies or are you tapping into a mix of industries? Do these choices still align with your core values and what do they mean for your long-term goals? What about associated fees — are they on the lower side? Your answers might reveal that you need to make some adjustments.

Spending

Summer memories don’t have to come with a hefty price tag. Opt for budget-conscious experiences like free museum visits, a day out at a local park, and community festivals. Does your town have a cool river or great hiking nearby? A free or low-cost tourist destination you’ve never checked out?

Craving some social time that doesn’t involve a screen but tired of spending $100 every time you step in a restaurant? Throw an easy potluck or BYO barbeque on a nice day or evening for your neighbors and/or a few friends.

In August, create or update the upcoming budget for lunches, transportation, extracurricular activities, and more.

August: Prepare for the Fall With Intention

What’s next on your list of financial to-dos? Map out upcoming expenses and spread them out, then check in with yourself — what’s one thing you can do this month to make your fall routine feel more financially organized?

Here are some suggestions.

Saving

In July, you worked on stashing cash for “back-to-school” supplies. Now, zoom out and look at the bigger picture. Create or update the budget for school lunches, transportation, extracurricular activities, and more.

You can do this for your kids, if you have them, or for yourself. If you don’t have kids, this is just the month you think about costs related to the same things, only the adult versions — work lunches (and coffees, probably), commuting costs, sports clubs or memberships.

Investing

How’s your 529 plan doing? Is it growing as planned or could it use a boost? Now is the time to decide. Also, make sure you know the guidelines. Many people only think of college when 529 accounts come up in conversation. However, you can use up to $10,000 of the money in your child’s account on K-12 tuition expenses. And remember, 529s aren’t just for kids. If you want to go back to school one day, now’s a great time to start saving.

Spending

Get even smarter with back-to-school shopping. Sales are great, but what if you could save even more? Some states, like Virginia, let you do that with tax-free holidays around this time of year. Make the most of it!

Check if your state has a tax-free retail day so you can save even more on back-to-school supplies.

September: Prepare for Fall With Intention

September is here — shift your gaze and focus on the long-term.

What does that look like? A good starting point is to re-align your spending with your routine. What do you find yourself gravitating toward most days? What do you actually spend time on versus what you thought you would? Do you have a gym membership, but can’t tear yourself away from the garden most days? Check in with yourself and pick a long-term goal based on your day-to-day that gets you excited. This will be one of your main money projects from now through the end of the year.

Saving

Your emergency fund is back in the picture. Maybe you’ve used a portion of it. That’s just fine, but if you’re below target, build it back up. A fully funded emergency fund is one of the most powerful financial tools.

Investing

In the fall, many employers offer open enrollment for benefits like a 401(k) plan. Sign up for any wealth-building benefits you don’t have. Just make sure they work for your needs and goals.

If you get a pay raise at this point, say “no” to lifestyle creep and “yes” to increasing contributions to your investment accounts. For example, if you now receive an extra $200 in your paycheck, consider automatically directing the full amount to your 401(k), or split this amount between your 401(k) and Roth IRA. If dedicating the entire raise isn’t feasible, aim to contribute at least half to one investment account.

Start to prep for fall birthdays and holidays by shopping sales now.

Spending

The end of the year comes with more gift-giving. Start to prep for fall birthdays and holidays by shopping sales. If you’re not ready, give some thought to how much you’d like to spend and space out your purchases. Maybe you can grab your partner’s gifts now, your kids’ gifts the following month, and something for your parents or co-workers after Thanksgiving.

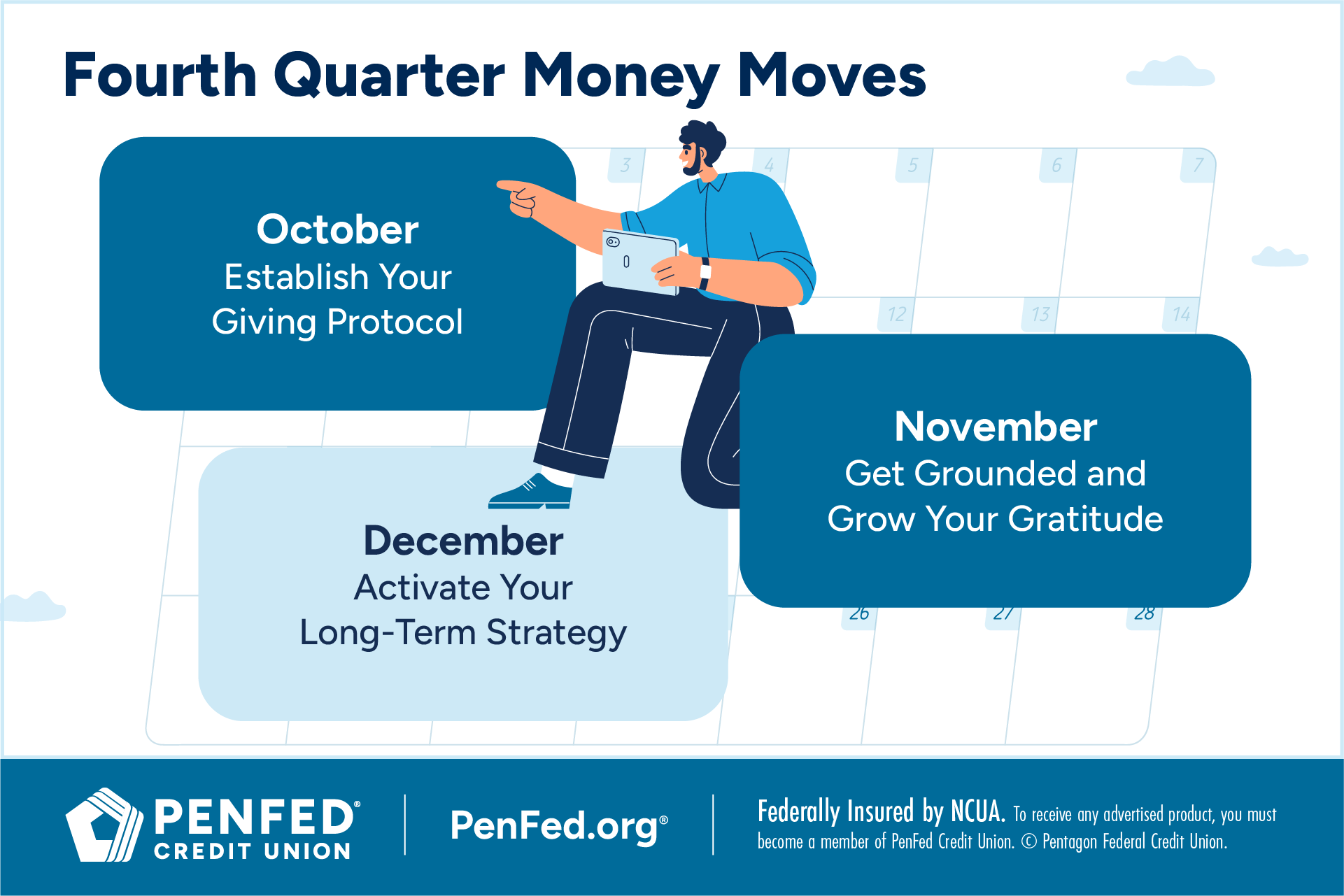

October: Give Thoughtfully, Not Stressfully

In October, start thinking ahead to giving. Check in with yourself. What does thoughtful giving look like to you beyond the price tag? Does it mean homemade gifts, shared experiences, or contributing to a cause you care about? It might seem early to think about the holidays, but the more time you give yourself to reflect, the more time you have to plan a strategy that actually lines up with your goals. Waiting till the last minute will almost always end with overspending.

Here’s this month’s financial checklist.

Saving

At this point in the year, you’re coasting on savings. Take a little break from opening accounts and mapping things out to enjoy the foliage. Let the hard work you did earlier in the year work in the background.

Investing

Think outside the box. Instead of toys, consumables, or one-time use items, consider gifting investments to your children or loved ones. This could be fractional shares of your favorite stocks or a contribution to existing investment or education accounts. It’s the gift that keeps on giving, and they’ll thank you for it.

Spending

In addition to gifting, budget for end-of-year travel and events you plan to host. Think of food you’ll have to buy, the decorations you’ve been eyeing, and affordable flights and accommodations. Get these costs out of the way if there’s room in your budget. Go into the festive season and come out debt-free.

Instead of toys, consumables, or one-time use items, consider gifting investments to your children or loved ones.

November: Gratitude and Grounding

Reflect on what you’ve built this year. Write down your family’s financial wins and learnings. Be grateful for every lesson and experience.

Now, what’s one final thing you want to accomplish before the year ends? Make space in your schedule — and budget for it.

Saving

The saving doesn’t stop. Start setting aside money for next year’s goals and big buys. Think of it as getting a head start on your new year money resolutions — whether that means going back to school or upgrading to an EV.

Investing

Make final pushes on annual retirement contributions and check beneficiaries. Life happens, and you want to make sure your money goes to the right people if there’s a crisis.

Spending

Don’t let peer pressure, flashy ads, or buy now and pay later offers set you back. Practice mindful spending on Black Friday and Cyber Monday. Draft a modest list of needs and throw in one or two nice-to-haves if you can afford them.

December: Close the Year With Intention

You made it — the holidays are here, and you stuck to your budget, paid down your debt, and said yes to the things that bring you joy. Next year looks bright. If you didn’t do any of those things, that’s okay. A new year is right around the corner.

Now, close out with intention. Dig deep and reflect on at least one financial lesson you learned during the year and plan to carry into the next.

If you can find a lull in the holidays, it’s a good time to prep a new spreadsheet, get a blank notebook (maybe you’ll get one as a gift), or make any appointments with advisors you’ll want in January.

Here’s what to focus on this month:

Saving

As part of your year-end review, ask yourself these questions. One: how many savings accounts do I have? Two: would it make saving and expense tracking easier if I consolidated them? Three: would a single account allow me to meet the minimum balance requirement for better interest rates?

If you answered yes to all three, then make the move to consolidate. If you tried multiple accounts this year and it worked, keep at it. This month is all about asking what worked and what didn’t, then adjusting.

Investing

As you make the last of your contributions to your retirement accounts, don’t forget your HSA. While you’re not barred from making contributions after the clock strikes midnight on December 31st, it might make your life easier to fully fund your account in the current calendar year.

Spending

Celebrate within your means this holiday season. Make holiday-themed drinks at home, revamp old decorations, or gift yourself a Groupon experience — you deserve it. Simultaneously plan a no-spend reset for January. Pick a day each week to carry out this challenge or commit to a full seven days. This is a great way to give your budget a breather at the top of the year and mentally prepare for what’s ahead.

The Takeaway

Look how far you’ve come! Now, you’re a money management pro or you’re gradually making your way to that. In any case, celebrate progress, not perfection. The more you practice good saving, spending, and investing habits, the better you’ll get.

The Checking Account for Wealth Builders

Smart finances start with smart banking. Discover PenFed Checking.