CHECKING & SAVINGS

How to Deposit Cash Without Going to the Bank: 3 Easy Alternatives

What you'll learn: Discover three safe, fast, and easy ways to deposit cash outside the bank.

EXPECTED READ TIME: 7 MINUTES

Your calendar is packed. The last thing you need is another to-do, especially one that has you rushing to the bank before closing time only to end up in a long queue. So, what’s the plan when you have cash in hand — perhaps from a recent birthday celebration or yard sale — and you need it in your account pronto?

Well, it’s actually possible to turn your banknotes into digital funds without stepping foot in a branch. Read on to learn how.

1. Deposit Cash Through a Retail Partner Network

First on the list — retail partner deposits, which are rising in popularity. This type of deposit is made possible when your bank or credit union teams up with well-known retailers.

How It Works

The process for a retail partner deposit is pretty simple and generally looks something like this:

- Power up your app: First, open your bank or credit union’s mobile banking app — your go-to for secure, on-the-spot money management. It’s connected to your checking and savings accounts. Look for the “Deposit Cash” button or equivalent.

- Generate your unique barcode: With a few taps, get the one-time barcode or numeric code that makes the magic happen. It’s often timed.

- Find your closest deposit site: No need to guess! Enable your phone’s location services to see the nearest participating retailers and their hours of operation. Choose from major pharmacies, grocery chains, or convenience stores. Swing by on your lunch break or on your way home from the gym.

- Present your barcode and the cash: Once you’re at your chosen retail spot, show the barcode to the cashier, then hand over the cash. They will scan your barcode and confirm the amount of money (and possibly, a few other details). In moments, the transaction is underway. It’s as easy as 1, 2, 3!

- Confirm the transaction was successful: You’ll typically receive a digital confirmation and/or a physical receipt. Just like that, your funds are ready. Go on and conquer your day!

The Benefits

Why use this deposit method?

- Convenience at almost every corner: These networks have thousands of locations. Whether you’re in a bustling city or quiet town hours away from a bank branch, cash deposits are possible.

- Instantaneous: The drive or stroll to your chosen retailer might take a few minutes, but the transaction itself is instant. Use your day-of funds to pay bills, grab your morning coffee, or put it toward your dream vacation.

- Safe and secure: Worried something might go wrong like your barcode ending up in the wrong hands? Rest assured. Measures like geotagging, screenshot-proof settings, timed barcodes, and two-factor authentication are built in to give you peace of mind.

- Free to low cost: There may be a small flat fee or none at all. This is usually determined by the retail network. Always confirm any associated costs before completing your transaction. And remember, paying a small price for big convenience isn’t a bad idea.

- One-stop shop: Complete your deposit at your favorite grocery store while restocking on snacks and household supplies. And easily manage all aspects of your finances — from deposits to account transfers — right from your banking app.

Complete your deposit at your favorite grocery store while restocking on snacks and household supplies.

Other Considerations

If it’s your first time hearing about retail partner deposits, then you may have questions beyond the how-to and perks. Here are two important points to keep in mind:

- Deposit amount limits and frequency: While convenient, these services often have daily, weekly, or monthly limits on how much cash you can deposit. For example, you might be able to deposit up to $500 or $1,000 per day, or a higher amount per week. Make it a point to check with your financial institution or the service provider, especially if you plan to regularly put away large chunks of change.

- Know who to contact for support: Maybe the cashier is having trouble scanning your barcode due to a system outage or you have a question about a recent transaction. Who do you call if these things happen? Most issues can be quickly resolved by contacting your bank or credit union’s member services team. Or try the retail network partner support line — keep that number handy.

2. Use an ATM

There are more than a million ATMs currently in use across the country, making this deposit option a familiar one. You can find them in stores, bank branches, and gas stations. There are even drive-thru ATMs.

How It Works

ATM deposits work similarly to withdrawals. Just follow the on-screen or audio instructions, which typically include these steps:

- Insert your debit card, enter your PIN, and select the “Deposit” option.

- Feed your bills to the cash dispenser.

- Confirm your deposit total.

- Print or email yourself a receipt.

Depending on your financial institution’s policy, the funds will be available right away or in a few business days.

Depending on your financial institution’s policy, the funds will be available right away or in a few business days.

Factors to Consider

ATM cash deposits blend traditional banking with modern-day convenience. It’s like dealing with a virtual teller — it’s intuitive and available 24/7.

However, there are a few key points to remember:

- Feature availability: Not all ATMs are created equal. You’ll need to find one that supports cash deposits. You can usually find this information online or by contacting the establishment where the ATM is located.

- Bank-specific deposits: Some ATMs only allow you to deposit cash if your account is held at the bank or credit union that owns the machine. Try using your institution’s online ATM locator tool to help you decide where to go.

- Fees: While your bank or credit union might offer fee-free ATM transactions, using standalone, out-of-network machines can come with a cost.

- Safety: Ever heard of an ATM skimmer? These are devices that thieves sneak onto ATMs to steal your card information. Stay safe by using a machine with round-the-clock surveillance and look for signs of tampering like a loose PIN pad or unusual logo and design.

3. Deposit Cash Using a Prepaid Debit Card

Imagine the convenience of a debit card without a traditional bank account. Shop your wish list and opt for bill pay — that’s exactly what a prepaid debit card lets you do. Unlike a regular debit card, a prepaid card works like a pay-as-you-go phone plan. Load it with your own money, swipe, and repeat.

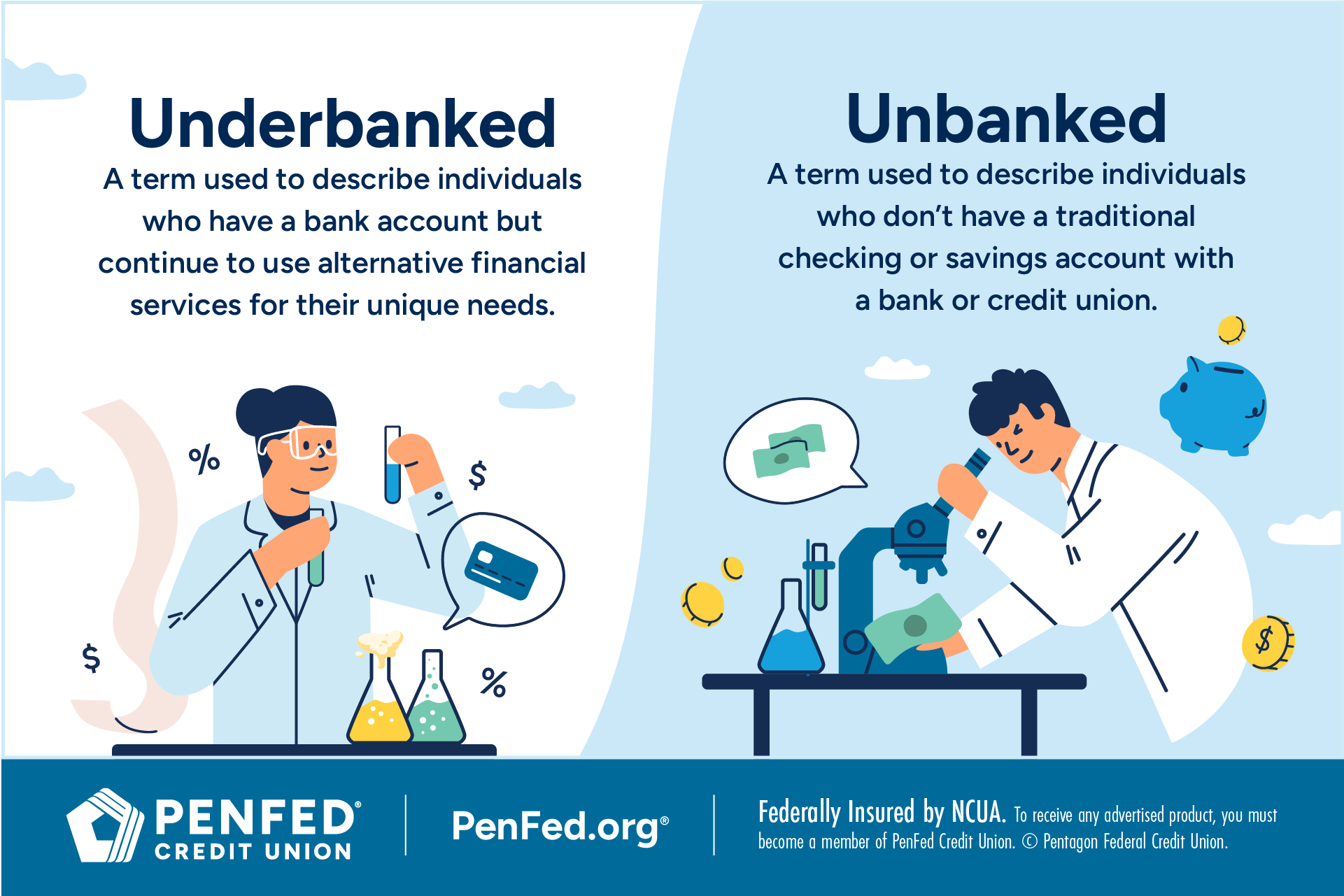

So, who’s using these cards? Think of the independent contractor who gets paid in cash but wants to go digital or the college student learning to budget. They’re also helpful to unbanked and underbanked individuals who rely on alternative tools to navigate their finances.

Unlike a regular debit card, a prepaid card works like a pay-as-you-go phone plan. Load it with your own money, swipe, and repeat.

How It Works

Here’s how to load up for life’s demands:

- Get your card: Your journey starts with obtaining your prepaid card. You can purchase yours at major retailers, grocery stores, pharmacies, or online through various providers. Once activated, it’s time for your first deposit.

- Visit a brick-and-mortar retailer: Take your prepaid card and the cash you want to deposit to a participating retail location. Similar to when you make a retail network deposit, you’ll hand over your cash at the register, plus your card. The cashier will swipe it or manually enter the details to load the funds. Start using your hard-earned, now-digital money once you get your receipt and card back. Many stores also have self-service kiosks that allow you to carry out cash reloads even quicker.

Advantages and Disadvantages

Interested in the advantages of a prepaid debit card? Check out this list:

- Stay on top of your budget: Since you can only spend what’s on the card, you’re more likely to stay within your limit.

- Secure spending: Good news — many of these cards come with FDIC insurance, protecting your loaded balance up to the legal limits. Treat your prepaid card information like you would your debit or credit card details.

- Widely accepted: Many prepaid cards are accepted where standard debit cards are. Use them online and offline.

- Enjoy the digital experience: Can’t make it to the store? Find out if your card provider allows transfers from other bank accounts. Alternatively, look into setting up direct deposit for your side gig checks or government benefits. Another plus — you might be able to add your card to your digital wallet.

While great for one-off cash-to-digital transactions, consider the full picture of owning a prepaid card:

- Potential fees: From activation fees and monthly maintenance fees to ATM withdrawal fees, there’s a price to pay for most cards — and it can add up fast. Review the card’s fee schedule before committing.

- Deposit limits: As with retail partner networks, you may be subject to loading limits. If you usually handle large sums of cash, this could be a hurdle.

For some people, being able to skip the teller line is the selling point. For others, it’s all about freeing up a stuffed wallet.

Why Cash-to-Digital Tools Are Gaining Popularity

Cash-to-digital tools are quickly becoming the norm. For some people, being able to skip the teller line is the selling point. For others, it’s all about freeing up a stuffed wallet.

Here’s what makes them special.

When to Use Branch Services

You can use these deposit alternatives as often as you’d like. However, there may be times when you have to make the trip to your bank or credit union, as with the following:

- You’re approaching a major milestone and want to sit down with a wealth management professional.

- You have a complex question about a loan application or the mortgage process.

- You need to discuss a unique account issue or dispute that requires human review.

- You would like to sign up for a certificate account.

- You’re ready to explore business banking offerings.

- You need to exchange foreign currency.

The Takeaway

Efficiency, ease, security, and speed are the names of the game — and the trio of solutions we’ve discussed were designed to provide that. If it fits your lifestyle and everyday cash-to-digital needs, then make use of it. Take control of your money!

A Checking Account Just for You

Enjoy peace of mind with secure features and effortless ways to deposit cash.