Student Loans

How to Get a Student Loan With Bad Credit

EXPECTED READ TIME:4 minutes

Just because you have bad credit (or no credit) doesn’t mean you can’t qualify for student loans. Federal student loans don’t consider your credit score as a factor for approval. If you don’t qualify for federal loans or need to borrow more than they offer, private student loans are still an option even if your credit isn’t great.

What Credit Score Do You Need to Get a Student Loan?

It’s best to take out federal student loans if you need help paying for college. Federal loans have many advantages over private loans, one of which is that your credit score isn’t a factor in whether you qualify.

Private student loans are different. They’re made by private lenders, not the federal government, and each private lender can set their own standards for who they lend to. Most private lenders require you to have a FICO credit score of 670 or higher. (For reference, FICO scores range from 300 to 850. “Good” credit is anything between 670 and 739.) Check with individual lenders for their eligibility requirements.

Can You Get a Student Loan With Bad Credit?

You can get a student loan with bad credit. As long as you haven’t defaulted on an existing federal student loan — or become disqualified in another way — you can take out federal student loans even if you have bad credit. And managing those loans wisely can help you rebuild bad credit.

Bad credit doesn’t disqualify you from getting private student loans either, but you may have to take some extra steps to get approved.

Bad credit doesn’t disqualify you from getting private student loans either, but you may have to take some extra steps to get approved.

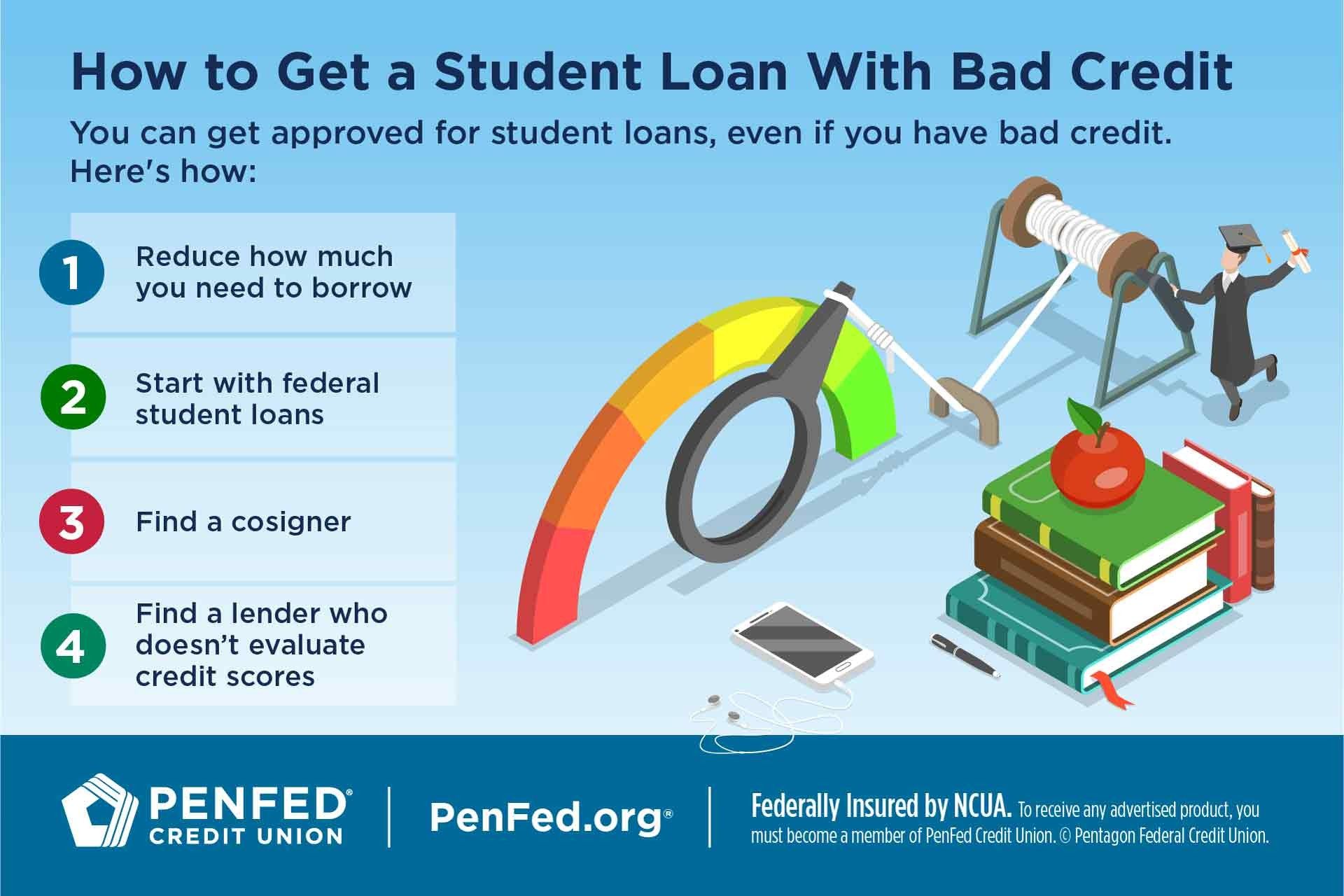

Ways to Get a Student Loan With Bad Credit

There are ways to get student loans with bad credit. When lenders see a low credit score, they see someone who has had trouble repaying debt before. You need to show lenders that you’re not a lending risk for them.

Reduce How Much You Need to Borrow

The average college student graduates with around $30,000 in debt. That’s a lot of money to borrow, especially for someone with bad credit. Applying for scholarships and grants can increase your chances of approval because they reduce the amount you need to borrow.

Unlike loans, you don’t have to repay scholarships and grants, and your credit score won’t be a factor in whether you receive them or not. You can apply for many federal grants by completing the Free Application for Federal Student Aid (FAFSA).

You don’t have to repay scholarships and grants, and your credit score won’t be a factor in whether you receive them or not.

Another way to reduce the amount you borrow is to participate in work-study programs that let you earn money working part-time for your school. When possible, you’ll be placed in jobs related to your major so you gain valuable experience along the way.

Start With Federal Student Loans

Start by borrowing federal student loans. You’ll have to report your financial situation to the office of Federal Student Aid using the FAFSA, but your credit score won’t be a factor in whether you qualify. Instead, the kinds of loans you qualify for are based on your family’s income and expected contribution to your school costs.

Find a Cosigner

One way to get a student loan with bad credit is to find a cosigner — a family member or friend with good credit (usually in the high 600s or better) who agrees to repay your loan if you become unable to. Having a cosigner doesn’t mean you don’t have to repay your loan. Your cosigner only has to pay if you cannot. That might happen if you lose your job, become unable to work, or die before fully repaying your loan.

Find a Lender Who Doesn’t Use Credit Scores

There are some private lenders who don’t use your credit score to determine eligibility. Instead, they may consider your current income or income potential (what you could make in the future with your degree). The downside is these lenders often charge higher interest.

Wait and Build Your Credit Score

Another option is to wait and build your credit before applying for student loans. You can do this by paying down existing debt, catching up on accounts you’re behind on, and paying your bills on time. If you have a credit card, using it wisely can help improve your credit score. There are also simple ways you can raise your score without a credit card.

Having bad credit doesn’t have to stop you from getting a student loan.

The Takeaway

Sometimes it can feel like bad credit is an anchor holding you back. But having bad credit doesn’t have to stop you from getting a student loan. With a few extra steps, you can get approved and put yourself on a better path.

Ready to Finance the School of Your Dreams?

Discover the diverse offering of products, services, and support available to our members.