AUTO

How to Determine if Your Auto Lender Is Reliable

EXPECTED READ TIME: 5 MINUTES

A car loan is a big deal, which is why lender reliability is so important. No one wants to play phone tag when they have questions, have their payments go missing — or worse. But you can set those worries aside. We have a strategy to help you vet lenders so you can feel confident when signing on the dotted line.

Common Indicators of Auto Loan Scams

Auto loan scams exist. In fact, they’ve been increasing since 2020 along with scam mortgage and student loan lenders. Some experts attribute this to COVID-19 and the economic uncertainty it caused, although scam lenders have always been around to some degree.

Thankfully, auto lender scams follow a few common patterns. Understanding those patterns can help you quickly spot problematic lenders and move on to more reputable options. The most basic red flags include:

- Pressuring you to commit to a loan before you are ready

- Refusing to outline explicit terms or changing terms with no explanation

- Pushing you to sign forms before you’ve read them or before they’re complete

- Encouraging you to include misleading or inaccurate information on forms

- Encouraging you to borrow more than necessary

- Charging fees upfront

You want to watch for bad lenders who may not be frauds but do offer really bad loan terms.

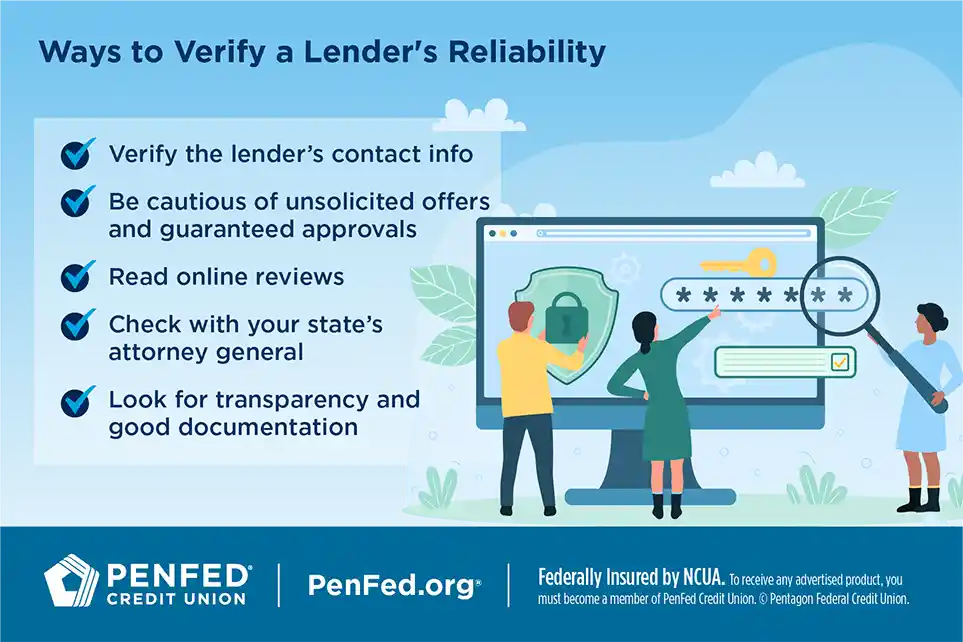

5 Ways to Vet an Auto Lender

While auto loan scams are a legitimate worry, you also want to watch for bad lenders who may not be frauds but do offer really bad loan terms that could cost you thousands of dollars. You can largely sort the good lenders from the bad with five quick steps.

1. Verify the Lender’s Contact Info

Just because a company lists a phone number or address on their website doesn’t mean that contact information is active or accurate.

Call the number on their website to see who answers. Check the address using your favorite GPS app to make sure it’s really a business and not a random house or vacant lot.

Call the number on their website to see who answers. Check the address using your favorite GPS app.

Even fully online lenders will have a working phone number, email address, and physical address they’re based out of. A good lender will be responsive, either answering your call or returning it promptly.

2. Be Cautious of Unsolicited Offers

In the U.S., it’s illegal for lenders to initiate loan offers over the phone and ask you to pay an advanced fee for it. Even so, you may just want to stay cautious of any unsolicited offers. Remember, scammers commonly contact victims through phone, email, or text message pretending to be someone else.

In the U.S., it’s illegal for lenders to initiate loan offers over the phone and ask you to pay an advanced fee for it.

Reputable lenders don’t want to make bad loans. That’s why they’ll look at your credit report and existing finances through a process known as loan underwriting before making any offers.

Even lenders offering bad credit loans will evaluate your income, credit, and existing debt before making promises. You can get an auto loan with bad credit from a reputable lender, but you’ll need to reach out to them to start the process.

3. Read Online Reviews

Online reviews are incredibly helpful when you’re looking for a reliable auto loan lender. They’ll help you vet both fraudulent lenders and lenders with poor customer service, hidden fees, or other problems. A lack of reviews and online presence (website, social media accounts) is a warning sign a company may not exist.

A lack of reviews and online presence (website, social media accounts) is a warning sign a company may not exist.

As for reviews, be sure you’re reading more than the cherry-picked testimonials they include on their website. Instead, use websites that aggregate reviews, such as the Consumer Finance Protection Bureau and the Better Business Bureau, that will reveal the good and the bad.

4. Check With Your State’s Attorney General

In most states, lenders and loan brokers are required to register with state agencies. A state’s attorney general’s office will be able to tell you whether a lender is registered with them or not.

Be sure to contact the attorney general for the state where the business is located, not your home state (if they differ). For instance, if you’re in California and using a lender based in Colorado, contact the Colorado attorney general to see if the lender is registered there.

If you’re in California and using a lender based in Colorado, contact the Colorado attorney general.

5. Look for Transparency and Good Documentation

Reputable lenders want you to understand what you’re getting into when you borrow from them. Unfortunately, predatory lenders do exist, and often they hide behind vague phrasing and confusing financial terms.

Avoid lenders who can’t explain the terms of their loans in simple language, or who won’t disclose important information like your loan’s APY, fees, or payment due dates.

Avoid lenders who can’t explain the terms of their loans in simple language.

Common lender scams around transparency include things like yo-yo financing or loan packing. With yo-yo financing, a lender offers you certain financing terms and then sells your loan to a third party. If they can’t sell your loan profitably, they’ll require you to put up more money.

Loan packing is similar, misleading you about the price of your loan. In this case, a dealer will add extra services and upgrades to your loan and have you finance these costs to boost the dealer’s profit. Tactics like this are why it’s important that you understand your loan agreement before signing it.

Choose a Lender You Already Know

We can’t stress this one enough — the best way to pick a reliable lender is to go with a tried-and-true lender, one you already trust. Your current bank or credit union likely offers the best financing available, and you’ll even increase your negotiating power at the dealership if you walk in with pre-approval.

You’ll even increase your negotiating power at the dealership if you walk in with pre-approval.

How to Report Auto Loan Scams

If you or a loved one have been scammed, there are steps you can take:

- Call your bank or credit union. If you recognize fraud soon enough, you may be able to stop or reverse payments you’ve made.

- Collect documentation. This includes any texts, emails, mail flyers, letters, or other correspondence you’ve had with the scammers.

- Report fraud to the proper authorities. Start by filing a report with your local police. Then contact your state’s attorney general, the FBI, the FTC, the CFPB, and the Better Business Bureau. Doing so can prevent other people from becoming victims, and in some cases, you may be able to recover your money.

- Contact the major credit bureaus — Experian, Equifax, and TransUnion. You can set up fraud alerts on your account or freeze your credit to protect yourself from further fraudulent activity.

- Prevent identity theft. Adopt a mix of physical and digital security practices like canceling and requesting new bank cards and updating existing passwords for online accounts. It’s important to act quickly to prevent further loss.

The Takeaway

Buying a car should be an exciting experience, but sometimes worries dampen the fun. By vetting your auto lender, you can cut your worries in half — leaving more time for planning a great vacation, prepping for road trips, and cruising in your long-awaited dream car.

Find Out More About Car Loan Options Through PenFed

Discover the diverse offering of products, services, and support available to our members.