Youth Finance

For Parents: Kids’ Allowance Strategies That Really Work

What you'll learn: How to strategize, award, and distribute an allowance to your child.

EXPECTED READ TIME:6 minutes

Your child excitedly rambles about the latest must-have tech or summer adventure without considering the thing that fuels those desires — money.

For them, purchases just appear, an invoice is nothing but a sheet of paper, and sales tax is nowhere on their radar. Yet, in just a few years, they’ll be navigating their first job, their own bills, and other big financial choices.

So, when is the right time to teach them sound financial decision-making, and how do you do it?

When introduced early and thoughtfully, an allowance provides vital lessons in managing money.

If you’ve decided an allowance is right for your family, this guide is your go-to for all things budgeting and allowances for kids, from savvy strategies and digital tools to the absolute don’ts.

What’s an Allowance for Kids?

You might remember a time when allowances felt simple — a few coins for completed chores, and into the piggy bank they went. Weeks later, your hard-earned money bought you a scoop from the neighborhood ice cream truck.

While mobile apps, tap-to-pay, and other digital developments have changed the way they’re paid and tracked, the goal of allowances remains the same.

An allowance, or pocket money, is a regular sum of money that you give your child, making them the CEO of their finances. Like any individual in charge, decision-making counts. When your kid sets a portion of their allowance aside, they reap the benefits later. If they squander the cash quickly, they’ll find themselves in need. Whatever they decide, it’s their first taste of financial autonomy!

When and How to Start an Allowance

Between the rising price of goods, paying down your debt, and keeping up with your child’s evolving desires, deciding when to give them their first allowance can feel like adding another layer to an already complex puzzle.

There’s no “perfect” moment to get started or “right” way to roll it out, just smart tips to help you navigate this exciting stage of your child’s development.

Let’s dive right in!

Recommended Ages to Begin an Allowance

When can a child truly grasp the concept of money? Finance researchers and educators have found that children begin forming money habits between three and seven years of age. At this stage, most children are developing basic math skills, recognizing coins and bills, and starting to express desires for specific items.

Don’t miss this window — it’s like golden hour! The best thing to do is to start small and keep it simple. You can gradually introduce more complex personal finance topics as they mature.

Finance researchers and educators have found that children begin forming money habits between three and seven years of age.

Starting With the Basics of Saving and Spending

Spending and saving are the most basic money concepts you can introduce to your young one. The goal is to get them to understand the difference between needs and wants and figure out when to enjoy money and when to save it.

Make it tangible and fun! A great way to bring these ideas to life is with clear, labeled jars.

The “Spend” Jar: This is for instant gratification — that spontaneous comic book purchase or sugar-dusted treat. It’s how they’ll learn the reality of money changing hands. Once spent, the cash is gone, and the item or experience is theirs. Use bright colors, stickers, and printout icons to distinguish this jar.

The “Save” Jar: This is how your child learns that patience and consistency pay off. At the start, they might not like the idea of waiting, but they’ll come around. Imagine their excitement as they watch this jar fill up, bringing them closer to that special outing or new Lego set. When introducing this jar, attach an image of their savings goal.

The ideal amount is as unique as your family.

How Much Allowance Should I Give?

The “how much” question is probably one of the most asked in the world of kids’ allowances, and there’s no universal answer. The ideal amount is as unique as your family.

Factors Influencing Allowance Amount

When you’re deciding on an allowance, keep the below elements in mind. They’re like the ingredients in a recipe — each one contributes to a well-balanced and nourishing outcome.

Your child’s age and needs: It makes sense to give younger children a small amount of money. That’s because their wants and comprehension levels are basic. As they age, you’ll want to increase their allowance to cover their needs (think lunch money, transportation, and sanitary products) as well as any extracurricular activities and more complex desires.

Your family’s income and financial standing: We’ve briefly discussed this, but it’s worth repeating. The allowance amount must comfortably fit in your family’s budget.

Your location: Like your pay, the local economy plays a role. What might be a reasonable allowance in a rural town could be insufficient in a major metropolitan area, where everything from movie tickets to groceries cost more.

Your money beliefs and teaching goals: Do you believe in a “lean and mean” allowance to teach the value of every dollar or do you prefer to provide your teen with a generous cushion? There’s no good or bad — just what feels right for your family.

Their responsibilities: If their allowance requires them to do chores, the amount should reflect the effort and complexity involved in those tasks.

The number of children in your household: If you have more than one kid, then you may want to adjust allowance amounts, so you’re not stretched thin. It’s about balancing fairness with your financial reality.

Average Weekly Allowances for Different Age Groups

Allowance averages give insight into other parents’ approaches. As you explore these figures, avoid an “I’m doing it wrong” mindset and lean into a “What can I learn?” attitude.

A Closer Look

- In 2022, parents gave their eight to 14-year olds an average allowance of $19.39 a week.

- Chore-based allowances averaged $35 per week in 2023.

- Greenlight app users between the ages of five and 19 received an average allowance of $12.98 a week in 2024.

- According to Till Financial, the average weekly allowance for six-year-olds in 2024 was $5, and $28 for college-bound 18-year-olds.

Young children primarily use their allowance to fund small pleasures like their favorite ice cream or a new book.

Adapting Allowance with Age and Responsibilities

Still trying to figure out that sweet spot? Here are some general guidelines to help your family navigate allowances through the years.

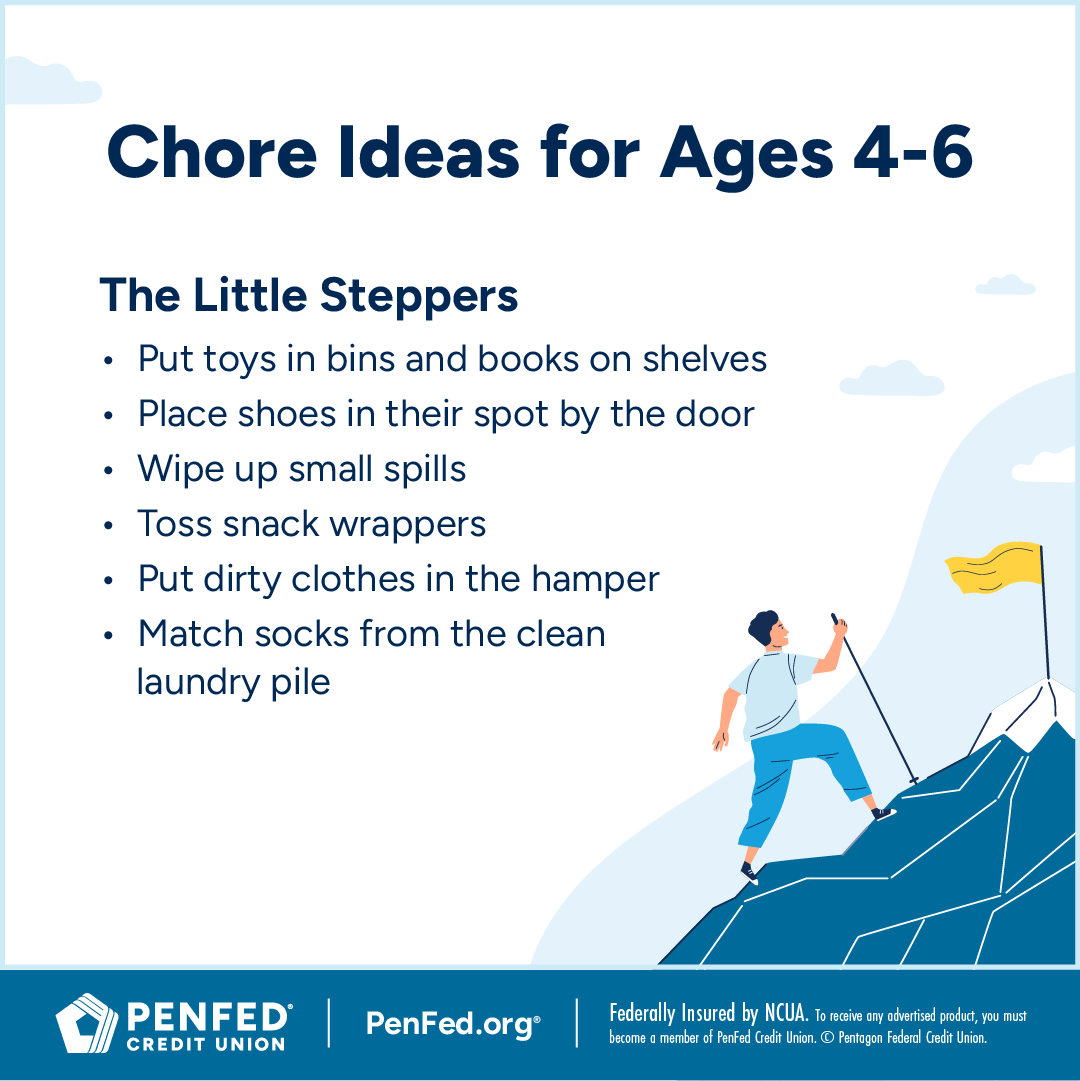

Ages 4-6: $1-$5 per week

At this point, allowances are linked to simple responsibilities like making their bed or putting away toys. Young children primarily use their allowance to fund small pleasures like their favorite ice cream or a new book.

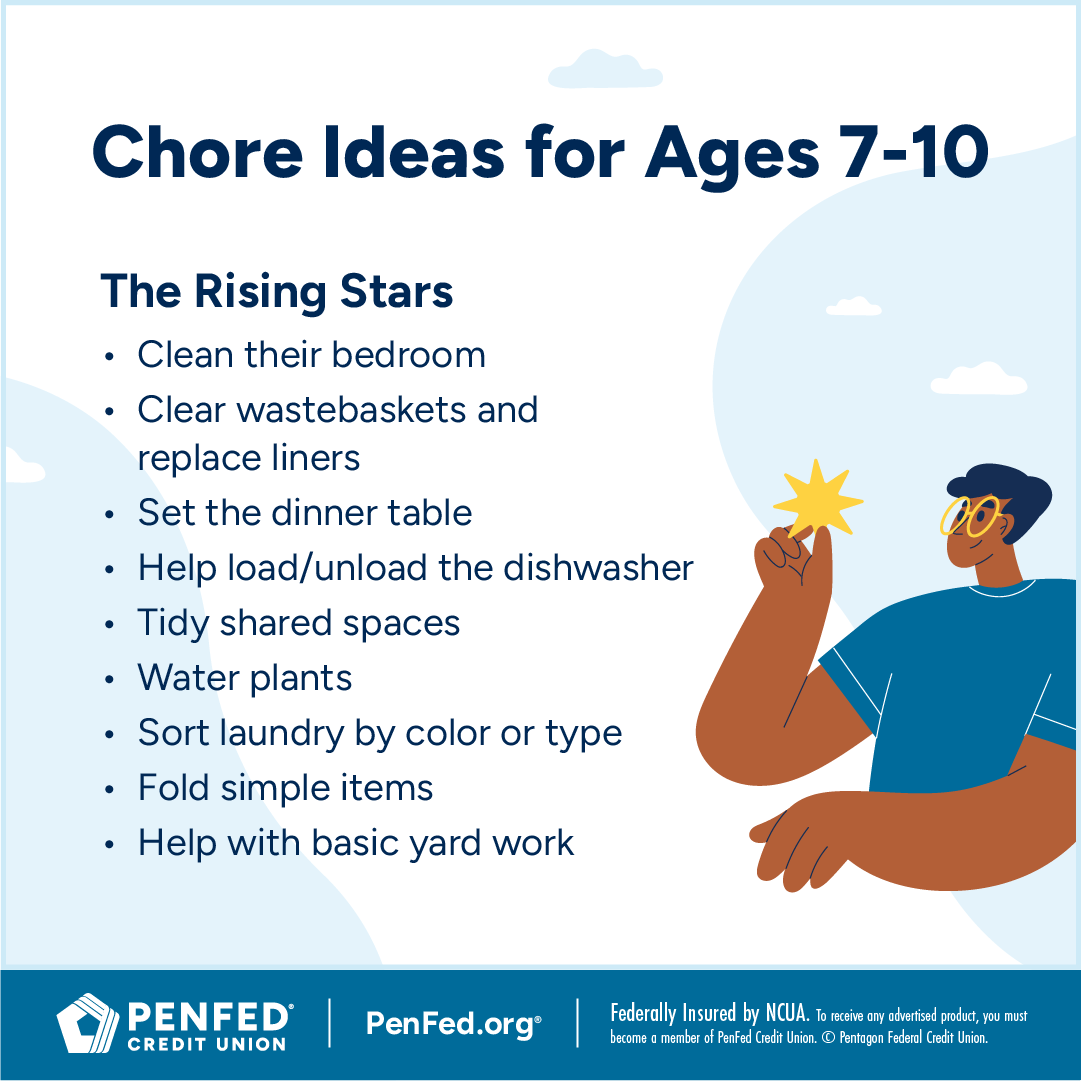

Ages 7-10: $5-$10 per week

Now, they can start to pay for small personal items like stickers or toys. This could be a good time to introduce a “give” jar.

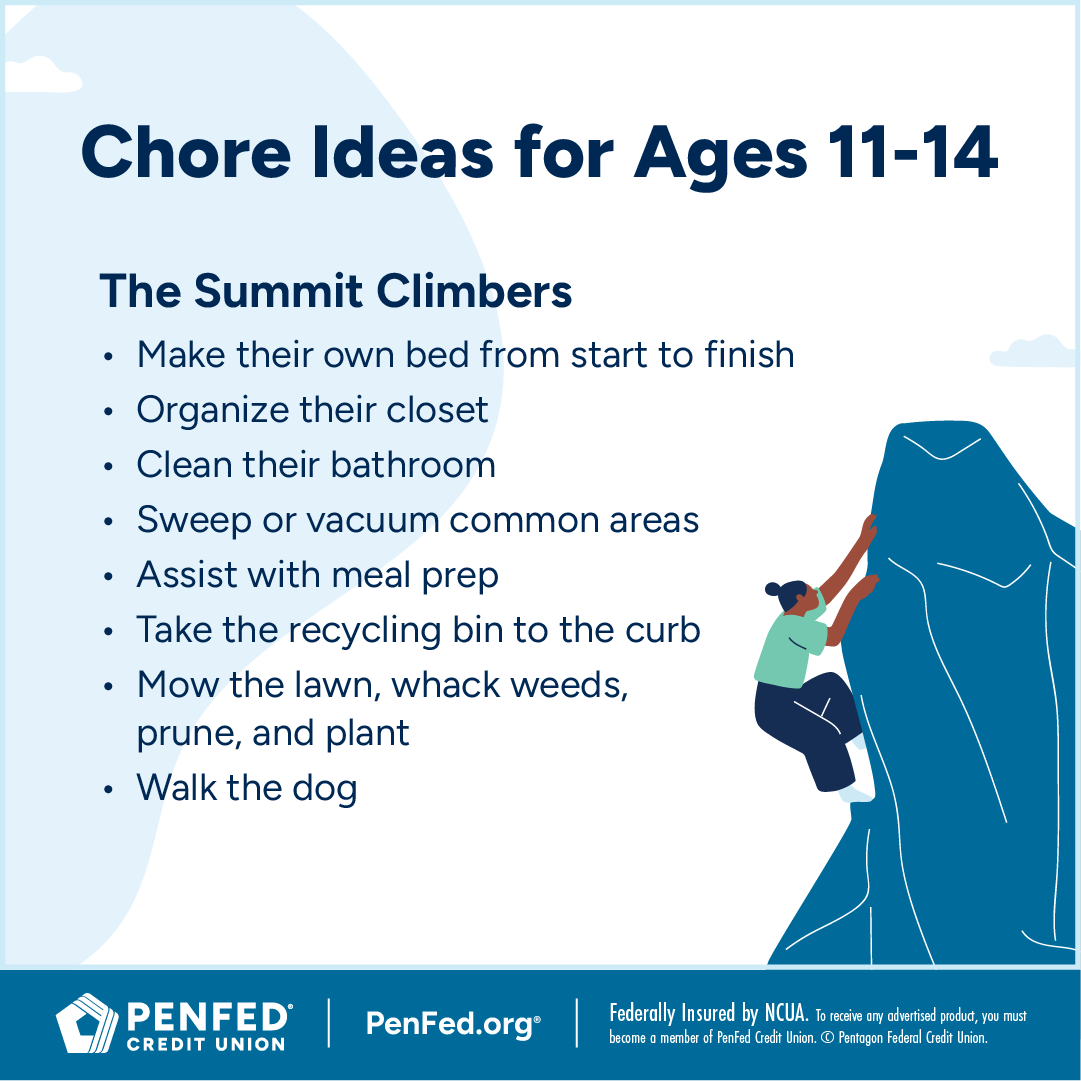

Ages 11-14: $10-$15 per week

Your tween may use some of their allowance for social outings and even clothes. Step up their money game with more complex budgeting skills!

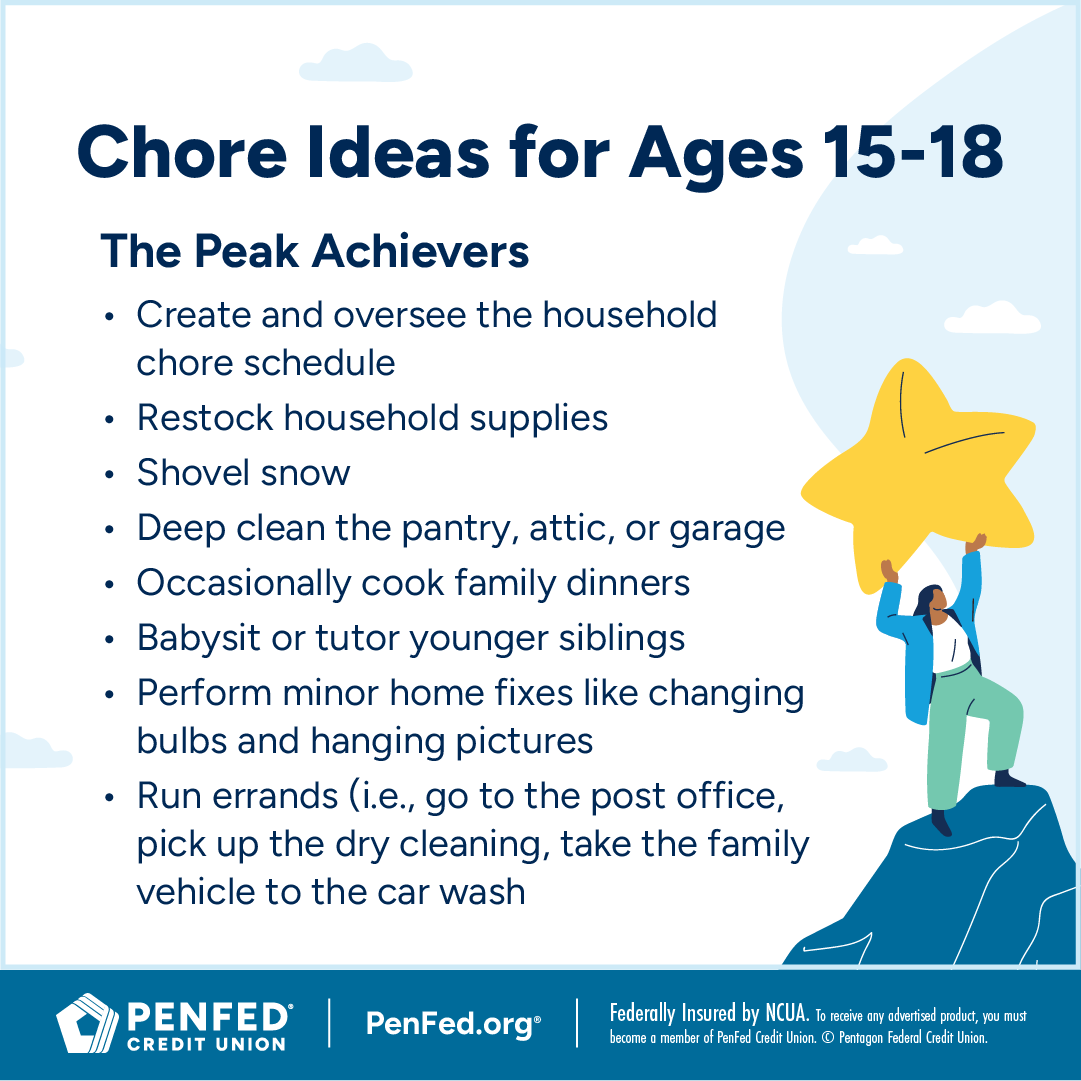

Ages 15-18: $15-$20+ per week

A higher allowance means they can afford their own entertainment, fill up their gas tank, and maybe, cover a portion of their cell phone bill. This is a great time to push part-time employment, saving for college dorm supplies, and the importance of planning for retirement.

If you’re unsure whether allowances are right for your family, consider a low-stakes trial, like this one:

A dollar per age: The premise is straightforward. Every week, you give your child the dollar amounts equal to their age. So, a six-year-old gets $6, a 14-year-old gets $14, and so on. See how your child fares over a month or two. Are they picking up crucial lessons? Do they seem like they can handle more cash? If yes, then lock in.

If you’re unsure whether allowances are right for your family, consider a low-stakes trial, like a dollar per age.

Kids Allowance Strategies That Really Work

Here are some no-fuss strategies and systems to transform the simple act of giving an allowance into powerful, lifelong money smarts.

Chore-Based Allowances

This strategy is a great antidote to entitlement concerns. Whether it’s feeding the pets or taking out the trash, they’ll learn that that money comes by doing. Be sure to use age-appropriate chores.

You can make chore-based earning more fun and flexible by creating a “marketplace.” Include a variety of services, from tech support (fixing the Wi-Fi) to personal shopper (helping mom/dad find items at the grocery store) to assistant chef (making dinner from start to finish). Assign each service a price. This will end up being your child’s allowance or bonus. Here are some helpful tips:

- Print out your list of services and place it where everyone can see it, like on the fridge. Make sure it’s nice to look at and easy to read.

- Request your child’s services in a playful and professional manner or have them come to you. If they want to get into character, let them.

- Task complete — pay up. Be open to negotiation if they went the extra mile.

One-Off Project Earnings

You can offer your kid opportunities to earn extra for large, non-routine tasks. This includes tackling a cluttered attic or basement, helping with a major garden overhaul, or supervising a younger sibling as they do their chores. This shows them that taking on more responsibilities is beneficial.

Matching Contributions

Want to boost your child’s savings? Introduce a matching program, just like a 401(k). Match every month’s savings at a certain percentage, maybe 15%. They’ll see their money grow faster, demonstrating the power of compounding.

Cost-Saving Incentives

Surely, you don’t want to turn your children into anxious mini number-crunching adults. But you do want them to be mindful of family resources. This strategy is how you make that happen. Encourage them to turn off the lights when they don’t need them, repurpose long-forgotten items, and keep their clothes in good condition for a set period. How ever much money is saved by carrying out these actions is what you’ll pay them as an allowance or bonus.

Spend, Save, Give

New to allowances? Implement a spend-save-give system, assigning a fixed percentage to each element. You might choose to mirror the widely used 50/30/20 budgeting method (baking charitable giving into wants or savings) or come up with your own. Over time, they’ll learn how to effectively manage their allowance without the guardrails.

For older children who are serious about saving, consider investing a portion of their money in a low-cost, stable exchange-traded fund (ETF). Even better — there are tools and platforms to teach them to do it.

For older children who are serious about saving, consider investing a portion of their money in a low-cost, stable exchange-traded fund (ETF).

Financial Tools to Help Children Manage Money

You’ve given your child an allowance and taught them the money basics. Now, it’s time to bring those concepts to life with age-appropriate financial tools.

Using a combination of interactive games, intuitive budgeting features, and expert tips to teach responsible spending, money management apps offer a safe and fun space to experiment with all things money.

Some even offer debit cards, investing simulations, and ways to give back to the community.

If you want to go the non-digital route, then try our printout allowance tracker.

Addressing Common Queries Regarding Kids' Allowance

Before you commit to weekly allowances, let’s explore some common questions.

Providing Allowance vs. Financial Rewards

This key distinction can make or break your allowance system. So, what’s the difference?

|

Allowances |

Financial Rewards |

|---|---|

|

|

If you decide to blend allowance and financial rewards, it should look something like this:

When your child masters a new skill, you can give them a permanent allowance bump — just like a workplace promotion. Let’s say they’ve learned a new language, perfected playing the cello, overcome their fear of public speaking, or nailed parallel parking. These milestones are worth celebrating. Define the types of achievements you’d like to honor. Don’t feel pressure to reward them all.

How Child Allowance Differs Around the Country and the World

You may be wondering, “What’s the deal with allowances in other parts of the world?”

What’s considered a standard in one household, region, or country can be way different elsewhere. A broad knowledge of allowance and money practices can help you contextualize your approach.

In addition to economic climate, which we’ve discussed, consider the following:

Cultural influence: Journey through different cultures and you’ll find that allowance isn’t just about money — it’s a reflection of history and core values (like individualism vs. collectivism and work ethic). In some societies, children are woven into family finances. They’re expected to use a portion of their allowance or paycheck to cover school supplies, some utilities, and other costs. In others, the concept of a “standalone” allowance is uncommon. Then, there are the communities that value to-the-point allowance conversations, and those that take on a more lenient approach (such as the UK, where only a third of parents and caretakers set rules around spending habits).

Education and policy: Beyond the home, there are efforts to better equip youth to handle allowances and other money matters. In the U.S., the Financial Literacy and Education Commission handles that job with several initiatives. Meanwhile, EU experts continue to push for policies that will formally integrate personal finance into school curricula. Over in Jordan, students are already benefiting from such a program. And in India, entrepreneurs are using storytelling to teach elementary students about money management.

What’s considered a standard in one household, region, or country can be way different elsewhere.

The Takeaway

Deciding to give your child an allowance is a big step that requires years of tact, consistency, and patience. But with the right tools and resources, you can absolutely nail this vital investment. Every dollar earned, choice made, and lesson learned strengthens their financial future!

Bank With Confidence

Get access to a checking account that lets you manage household finances like a pro.