CHECKING & SAVINGS

What Is a Money Market Account?

Expected read time: 6 minutes

Money market accounts offer a unique way to grow your savings while keeping your cash liquid. If you need to balance your need to save for the future against your need to cover expenses now, a money market account is one way to ease bothersome cashflow issues. Does that make it the right account for you? Let’s find out.

What Is a Money Market Account?

You can think of a money market account as a kind of hybrid between checking and savings.

You can use a debit card, ATM, or checkbook to pay bills, make purchases, or withdraw cash from a money market account, but you won’t be able to make as many transactions as you would with a checking account.

At the same time, you’ll earn higher dividends with a money market account than with a checking account, as you would with a savings account. In fact, most money market accounts offer compound interest/dividends.

What’s a Deposit Account?

Money market accounts are a kind of deposit account. A deposit account is a type of bank or credit union account that lets you deposit and withdraw money. Other types of deposit accounts include checking, savings, and certificate accounts.

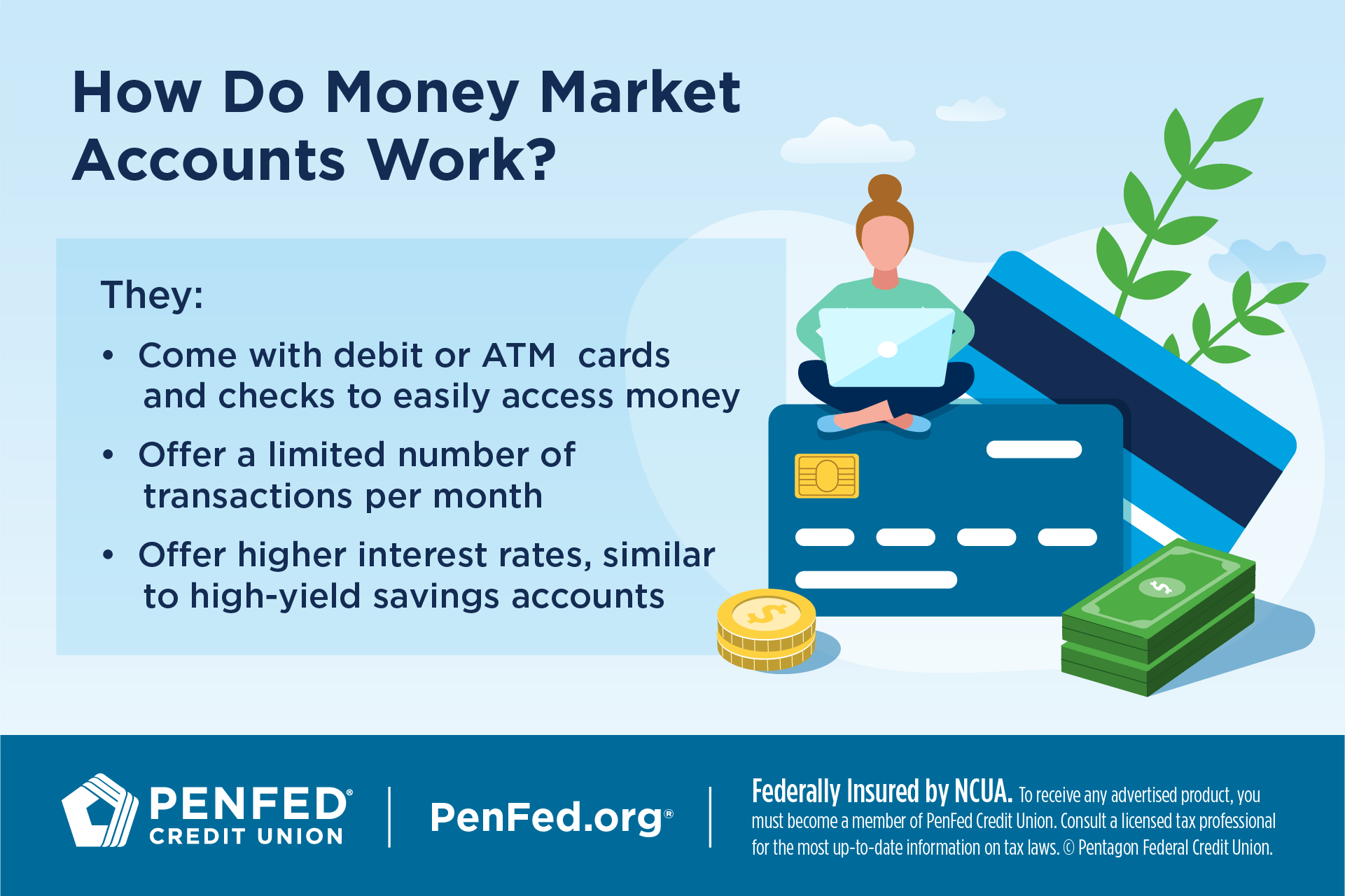

How Does a Money Market Account Work?

Money market accounts are a flexible way to save money. Unlike savings accounts, money market accounts come with debit or ATM cards and checks so you can access your money easily without having to transfer it to another account first.

A deposit account is a type of bank or credit union account that lets you deposit and withdraw money.

But there’s a catch — most banks and credit unions limit the number of monthly transactions on money market accounts. If you exceed that number of transactions, you may be charged a fee for each extra transaction.

The trade-off for that low number of transactions is a higher interest rate and higher annual percentage rate (APY) on your money market balance. This incentivizes keeping your money in your account rather than spending it, while also offering the convenience of dipping into savings quickly if you need to.

Can a Money Market Account Lose Money?

Money market account values won't fall when stock values go down, but accounts with high or frequent fees could mean less overall gain. Because they earn dividends like your savings account instead of through riskier means like the stock market, it’s unlikely you’ll lose money in a money market account as long as you understand how it works.

Fees can eat up your savings if you don’t know how to avoid them. Most money market accounts have monthly maintenance fees, and some can be high. There are also fees for exceeding the number of allowed transactions (usually six) or for falling below your minimum balance requirement.

Generally speaking, money market accounts are considered safe, low-risk investments. They’re even insured by the FDIC (at banks) and NCUA (at credit unions), just like your checking and savings accounts.

Generally speaking, money market accounts are considered safe, low-risk investments.

Money Market Accounts vs. Other Deposit Accounts

It can be tough to decide whether you need a money market account or a different type of deposit account. Here’s how they compare.

What Is the Difference Between a Money Market Account and a Checking Account?

Checking and money market accounts are similar: both come with debit cards and checkbooks, and both are insured by the FDIC or NCUA.

The difference? Money market accounts are designed to grow your savings. The transaction limits are designed to encourage you to hold more of your money in the account for longer. Checking accounts, on the other hand, are designed to handle lots of transactions.

Transaction limits are designed to encourage you to hold more of your money in the account for longer.

Money Market vs. Checking Accounts

How do money market accounts stack up against checking accounts? Let’s compare:

|

Money Market |

Checking |

|---|---|

|

Comes with debit card and checkbook — easily access funds |

Comes with debit card and checkbook — easily access funds |

|

Limited number of monthly transactions |

Unlimited number of monthly transactions |

|

Designed to grow your savings |

Designed to manage cashflow |

|

Higher dividends |

Lower or no dividends |

|

Higher fees, including monthly maintenance fees |

Monthly maintenance fees can sometimes be waived |

|

Usually requires higher minimum balance |

Minimum balance requirements vary but can be low |

|

Insured by FDIC (at banks) and NCUA (at credit unions) up to $250,000 |

Insured by FDIC (at banks) and NCUA (at credit unions) up to $250,000 |

What Is the Difference Between a Money Market Account and a Savings Account?

Both money market and savings accounts are designed to grow your savings through dividends (called interest at banks). Many money market accounts offer rates equivalent to those of high-yield savings accounts, which are higher than the rates on traditional savings accounts.

The big difference between a money market account and a savings account is that money market accounts come with debit cards and checkbooks so you can pay bills or make purchases directly from that account. Often you have to transfer money from savings to checking before you can use it.

The big difference between a money market account and a savings account is that money market accounts come with debit cards and checkbooks.

Another difference is the cost of these accounts. Money market accounts usually have a larger minimum balance requirement and higher monthly maintenance fees. They also require a larger opening deposit — often around $2,500. In contrast, savings accounts usually have low minimum balance requirements, have fewer and lower fees, and require much smaller opening deposits.

Money Market vs. Savings Accounts

Both money market and savings accounts can help you grow your savings. Which is right for you?

|

Money Market |

Savings |

|---|---|

|

Comes with debit card and checkbook — easily access funds |

Generally does not offer debit card or checkbook |

|

Limited number of monthly transactions |

May have limits on number of monthly transfers (varies by bank or credit union) |

|

Designed to grow your savings |

Designed to grow your savings |

|

Higher dividends |

Higher dividends on high-yield accounts, modest dividends on traditional accounts |

|

Higher fees, including monthly maintenance fees |

Low or no monthly fees |

|

Usually requires higher minimum balance |

Requires low minimum balance |

|

Insured by FDIC (at banks) and NCUA (at credit unions) |

Insured by FDIC (at banks) and NCUA (at credit unions) |

What’s the Difference Between a Money Market Account and Money Market Mutual Fund Account?

A money market account is a deposit account that earns dividends. A money market mutual fund account is an investment account made up securities such as Treasury bonds, certificates, and corporate bonds.

Money market accounts are designed for saving money and managing cash flow, and you can open them through a bank or credit union. You would need to go through a brokerage firm to open a money market mutual fund.

You would need to go through a brokerage firm to open a money market mutual fund.

The Takeaway

Growing your savings is an important part of achieving financial wellness. Thankfully, there are lots of tools for doing that! The key is understanding how you save and what you need from a savings product to get the most bang for your buck. Then there’s nothing stopping you from nurturing your nest egg.

Invest in Yourself

Discover the diverse offering of savings products available to our members.