YOUTH FINANCE

For Parents: Pros and Cons of Giving Your Child an Allowance

What you'll learn:How to decide if an allowance is right for your child.

EXPECTED READ TIME: 5 MINUTES

Will an allowance teach your child responsibility and set them on the path to a high-net-worth future, or are you handing them a one-way ticket to impulse town? Will it spark a love for saving like it did for you, or will you end up with tiny spendthrifts who get upset when they don’t get their fix?

This article explores both sides of the allowance coin, helping you to make the best choice for your family.

What We'll Cover

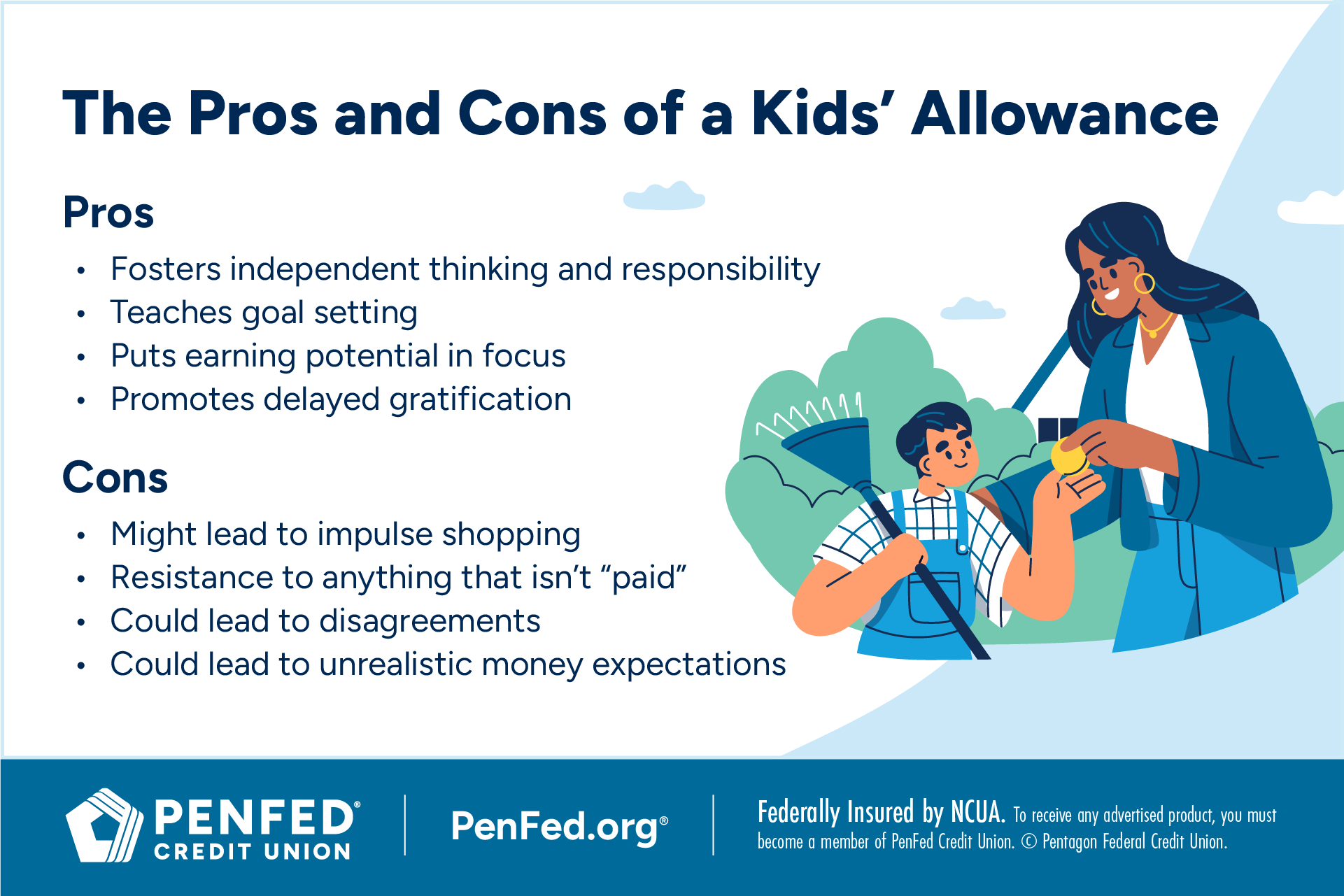

The Pros and Cons of Giving an Allowance

The allowance debate is a classic, right up there with “early bedtime or extra story,” “screen time or day at the park,” and “homemade lasagna or fast food run.” Here’s the thing — an allowance isn’t a magic wand. It’s a tool. And like any tool, its effectiveness depends on how you (and your child) wield it.

Let’s start with the pros.

Pro: Fosters Independent Thinking and Responsibility

Your child needs to decide between two action figures — one they can afford and another that requires borrowing. Choices like these serve as a real-world masterclass in decision-making and understanding trade-offs.

Pro: Teaches Goal Setting

Kids are natural dreamers. An allowance gives concrete shape to those dreams. Skateboard or video game — they learn to set a target, track their progress, and make it happen. This is a crucial skill even for nonfinancial areas of adult life.

An allowance teaches your child to wait and save for something bigger.

Pro: Puts Earning Potential in Focus

When an allowance is tied to responsibilities — even simple ones like helping with dinner — kids start to connect effort to reward. They learn that money isn’t infinite: it’s earned.

Promotes Delayed Gratification

In a world of instant downloads and next-day delivery, patience doesn’t always come easy. An allowance teaches your child to wait and save for something bigger.

Pro: Sparks Entrepreneurship and Initiative

With their own funds, your kid might start to think, “How can I earn more?” Washing the car, walking the neighbor’s dog, or even crafting small items to sell could be the solution.

Pro: Builds the Foundation for Giving Back

An allowance isn’t just about personal gain. Kids can learn the importance and joy of charitable giving by allocating a portion of their earnings to the causes they care about.

Now, for the cons.

Con: Leads to Impulse Shopping

With cash in hand (or in their account), children might struggle with the concept of waiting and end up indulging. The key is to establish clear rules — that’s how you steer them away from the instant gratification trap.

Con: Creates Resistance to Unpaid Tasks

If most chores come with cash, kids might start to believe all household tasks require compensation. This blurs the line between earning and plain old family contributions. A clear distinction between the two is how you get on the same page.

When allowances are tied to a long list of chores, you may find yourself constantly negotiating, reminding, and inspecting.

Con: Makes Room for Disagreements

When allowances are tied to a long list of chores, you may find yourself constantly negotiating, reminding, and inspecting. This can cause friction between parent and child, instead of a smooth learning experience.

Con: Could Result in Unrealistic Expectations

Allowances that are too generous or aren’t tied to real-world responsibilities could cause your child to develop feelings of entitlement and unrealistic expectations of how money is acquired. Drive home the concept of earning.

If you run into any of these dilemmas, don’t get discouraged. Instead, stay the course and be prepared to adapt your strategy as your child grows and learns. Remember, the benefits of teaching money management early are clear — more years of practice, more lessons learned, and a strong financial foundation. Here’s some data to back it up:

- 72% of adult participants in a 2025 American Bankers Association Foundation survey believe they would be further along had they learned money basics as a kid.

- Thanks to early exposure to financial education, 66% of adults confirmed that they have successfully negotiated a pay raise at least once every five to 10 years, compared to the 39% who learned about money later in life.

- 95% of high school students said learning about personal finance in class has been helpful.

- On average, American adults lost $1,015 in 2024 as a result of financial illiteracy. The more you know (and earlier you know it), the less it costs you.

8 Common Allowance Pitfalls to Avoid

Even with the best intentions, there may be times when you miss the mark. That’s parenting, after all. Pause and regroup.

Here are eight common allowance mistakes and tips to help you sidestep them.

- Being inconsistent

- Using allowance as a punishment or reward

- Micromanaging every penny

- Skipping key conversations

- Neglecting age-appropriate methods

- Making it too complicated too soon

- Comparing your capacity

- Forgetting to model good habits

1. Being Inconsistent

Giving an allowance sporadically or forgetting to pay on time is like trying to teach your child to ride a bike with wobbly wheels. Consistency is paramount. It allows them to establish a routine with their money. Pay on the same day, every week or month.

2. Using Allowance as a Punishment or Reward

It’s tempting, but docking allowances for poor behavior unrelated to money (like staying out late) can send the wrong message. Similarly, paying for every good grade or kind act blurs the lines between academic achievement, civic duty, and earning money. Seek alternative disciplinary actions when your child doesn’t behave as they should. When they make an allowance-related mistake, go over your family’s money values together. And when they’re performing well, acknowledge their efforts with a balance of verbal affirmations and monetary gifts.

3. Micromanaging Every Penny

While guidance is crucial, avoid hovering over every purchase. Let them make small spending mistakes. This is where some of the most valuable learning happens.

On the other hand, it can be tough to watch your child go without something they need because they mismanaged their allowance. However, bailing them out can send mixed signals. The whole point of trusting them with an allowance is so they can learn from their spending decisions. When possible, resist the urge to get them out of the spending hole.

4. Skipping Key Conversations

Handing over the money and walking away is a big mistake. The allowance is just a vehicle, while regular conversations about money are the fuel. Ask them what they’re saving for. Go over helpful money mantras as a unit. That’s how you cultivate true financial literacy.

Docking allowances for poor behavior unrelated to money (like staying out late) can send the wrong message.

5. Neglecting Age-Appropriate Methods

When it comes to age and allowances, a common pitfall is sticking to one system for too long, such as expecting spend and save jars to captivate your tween. Be ready to evolve your allowance system as your child grows, matching its complexity to their maturity level. Think finance apps and hands-on activities.

6. Making It Too Complicated Too Soon

Introducing too many rules, categories, or complex calculations at the start can overwhelm a young child, as well as you, the parent. Keep the initial setup super simple.

7. Comparing Your Capacity

Every family’s financial situation is different. Comparing your allowance practices to what other families are doing can create unnecessary pressure or feelings of inadequacy. Focus on what is viable for you, and more importantly, what your children need.

8. Forgetting to Model Good Habits

Kids are master observers. If you are stressed about money, make impulsive buys, or rarely discuss family finances, your allowance system — no matter how well-structured — might feel less authentic to them. Model the behaviors you want to see.

The Takeaway

As you can see, the question of giving your child an allowance is less about being right or wrong and more about tact. Keep the lines of communication open, celebrate their financial wins (big and small), and remember: every dollar managed or mismanaged is a lesson learned.

Now, watch them grow into confident money handlers!

Bank With Confidence

Get access to a checking account that lets you manage household finances like a pro.